- An Ethereum whale that has been holding ETH for a long period of time sells its holdings.

- Price of ETH remains unaffected, however, activity on Ethereum’s ecosystem poses concerns.

After seeing a massive rally over the last week, the price of Ethereum[ETH] started to get stagnant around the $3500 price level. Due to this stagnancy, many holders decided to indulge in profit-taking.

Whale takes profit

According to recent data, an initial holder of ETH exchanged 17,770 ETH for 62.24 million DAI at a rate of $3,503 per ETH.

This individual amassed 14,280 ETH, valued at approximately $2.6 million, at an average price of only around $182, spanning purchases made from Gemini and Bittrex between March 2017 and April 2021.

With a staggering gain of 23 times their initial investment, the profit amounts to $59 million.

This whale’s sale of 17,770 ETH injects a large amount of the currency into the market. This can cause downward pressure on the price in the short term, especially if there aren’t enough buyers to absorb all the ETH being sold.

However, the overall impact depends on market sentiment. If the sale triggers panic selling, the price could drop further. But, if the market views it as a healthy correction or the whale is simply taking profits, the price could stabilize or even rebound as others see a buying opportunity.

ETH remains resilient

At press time, ETH was trading at $3,571.59, marking a 27% difference from its all-time high. The price of ETH had tested the $3674.23 levels twice over the last few weeks.

If ETH manages to break past this level, it will put an end to the bearish trend that was observed after its price fell from $4081.55. ETH could also possibly head in the direction of the $4081.55 resistance yet again.

However, the coin’s CMF (Chaikin Money Flow) declined in the last few days, indicating that the money flow for ETH had fallen. This suggests that the price of ETH could see a period of sideways or downward movement before it starts to rally.

Source: Trading View

Is your portfolio green? Check out the ETH Profit Calculator

State of the Ethereum network

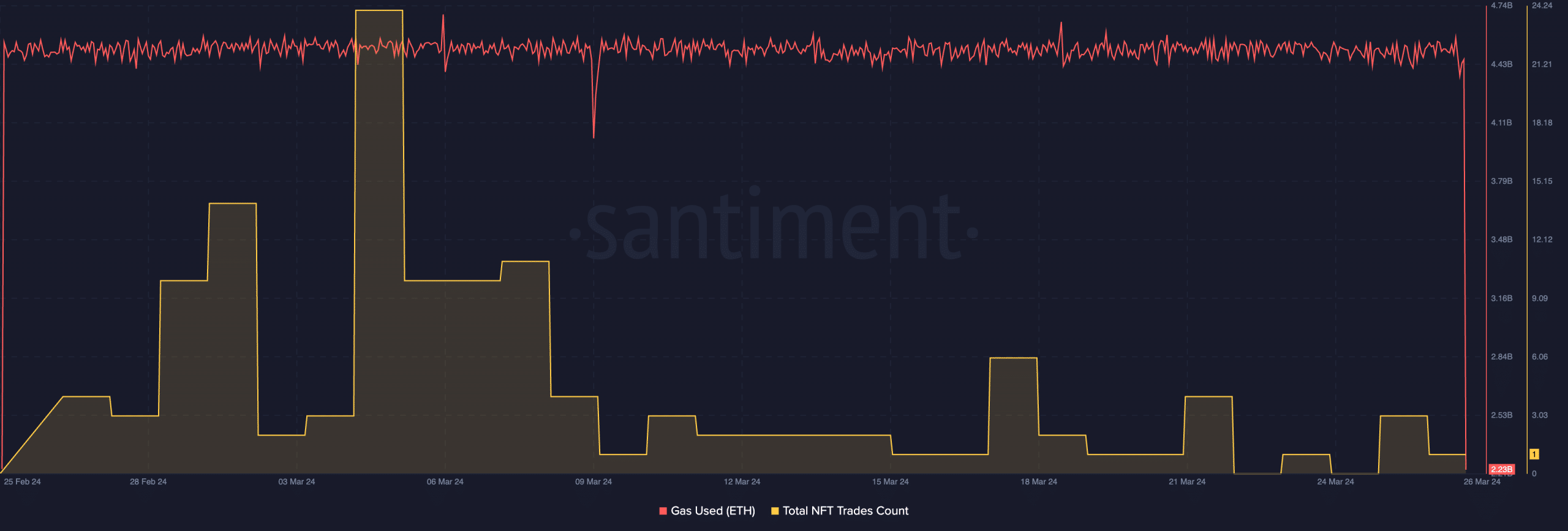

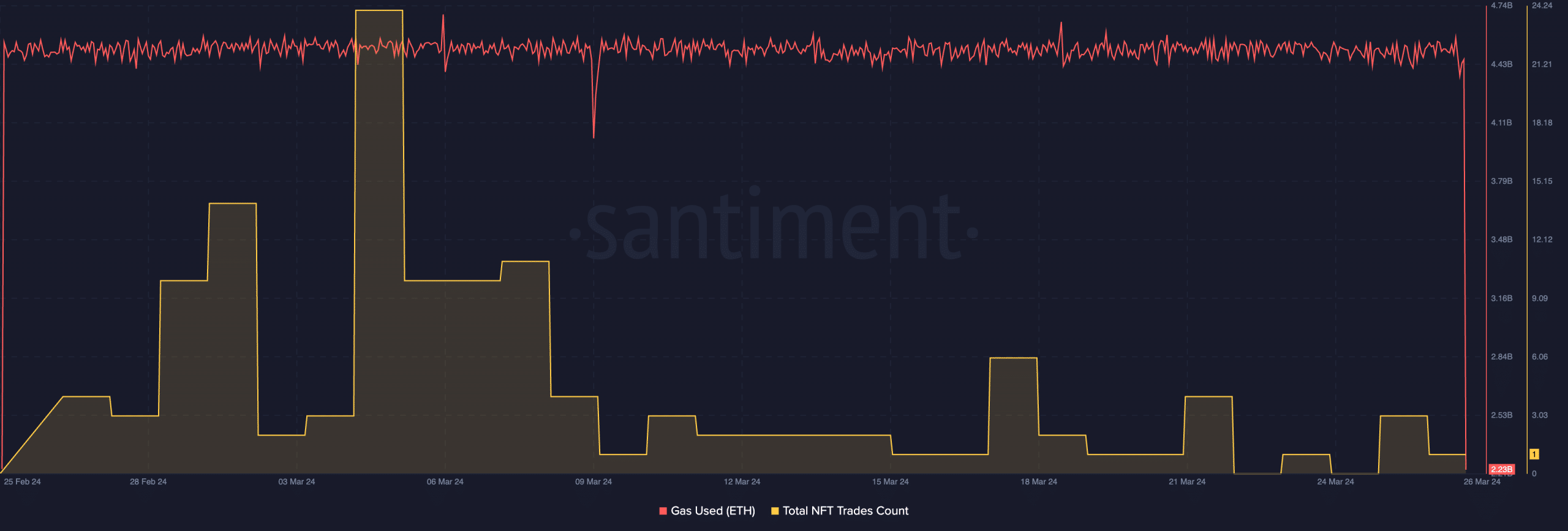

The popularity of the Ethereum ecosystem will also aid ETH positively in the future. The gas usage on the Ethereum network remained consistent over the past month, suggesting a highly active ecosystem.

However, the overall number of NFTs being traded on the network fell significantly over the last few days, indicating that the interest in NFTs on the Ethereum ecosystem fell. This could hurt the activity on the Ethereum network in the long run.

Source: Santiment

Leave a Reply