- LINK was down by more than 8% in the last seven days.

- Most indicators and metrics looked bullish on the altcoin.

Chainlink [LINK] showcased immaculate performance for the past few weeks, earning it a spot in the top 10 list. However, the last week was not in investors’ interest as the token’s value plummeted by over 8%.

During this time, LINK slipped off the top 10 list by market capitalization. According to CoinMarketCap, at the time of writing, LINK was trading at $18.30 with a market capitalization of over $10 billion.

What’s Chainlink’s current state?

Daan Crypto Trades, a popular crypto influencer, recently posted a tweet highlighting the possibility of Chainlink rebounding.

Therefore, to better understand whether LINK could once again reclaim the $20 mark, AMBCrypto took a look at its on-chain metrics.

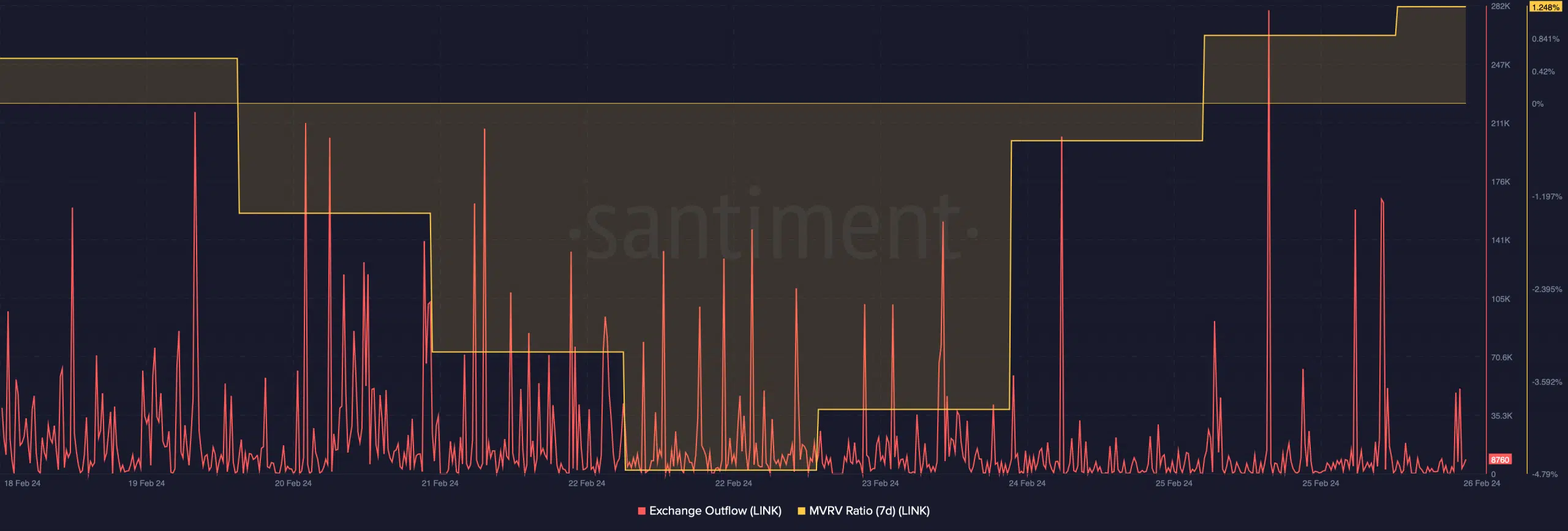

As per our analysis, LINK’s exchange outflow spiked several times last week, meaning that buying pressure on the token was high. Additionally, the token’s MVRV ratio registered an uptick in the last week.

This is a typical bull indicator, suggesting a price uptrend in the coming days.

More details on Chainlink’s position

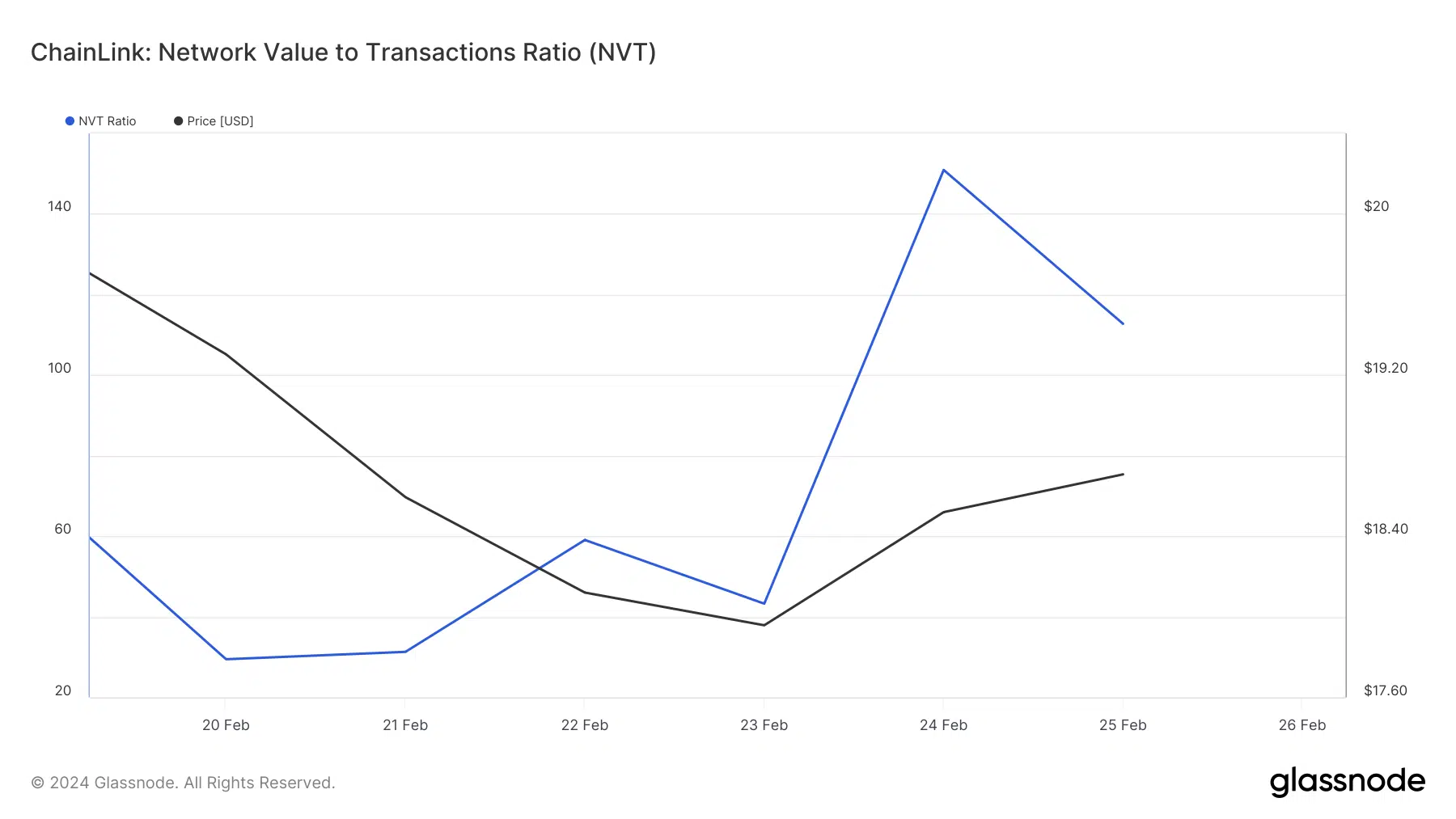

AMBCrypto’s analysis of Glassnode’s data pointed out that Chainlink’s Network Value to Transactions (NVT) ratio registered a downtick.

For starters, the NVT ratio is computed by dividing the market cap by the transferred on-chain volume, measured in USD.

Whenever the metric drops, it means that the asset is undervalued, indicating that the possibility of a northward price movement is high.

To double-check the possibility of a bull rally, AMBCrypto took a look at LINK’s daily chart. We found that the MACD displayed a clear bearish advantage in the market.

On top of that, the token’s Relative Strength Index (RSI) registered a downtick, hinting at a southward price movement.

Read Chainlink’s [LINK] Price Prediction 2024-25

As suggested by the Bollinger bands, LINK’s price went under its 20-day simple moving average (SMA), which is a bearish indicator and might act as a resistance.

Nonetheless, the Chaikin Money Flow (CMF) remained bullish. Considering all these metrics, only time will tell whether Chainlink will manage to reclaim its $20 level soon.

Leave a Reply