- The EMAs formed a death cross, indicating that DOGE might drop below $0.12.

- The 90-day MCA increased, suggesting selling pressure on the coin.

On the 27th of April, Dogecoin [DOGE] attempted to revisit $0.17, but the 4-hour chart showed that resistance at $0.15 suspended the move. As a result, the price of the coin retraced to $0.14.

But Dogecoin’s challenges seem to be more than a mere rejection. AMBCrypto found this after checking the Exponential Moving Average (EMA). For the unaccustomed, EMA measures trend direction over a while.

No buyers in sight

From our analysis, the 50 EMA (yellow) crossed over the 20 EMA (yellow) on the 24th of April, hinting at a bearish trend. Since that time, the positions of the EMA have not changed.

This trend is also known as a death cross, meaning that the price of DOGE has a higher tendency to face a steep correction. Confirming the potential was the Elder Force Index (EFI).

The EFI tracks buying and selling activity in the market. At press time, the EFI on the DOGE/USD 4-hour chart, flatlined, indicating a massive dearth of trader activity with Dogecoin.

Source: TradingView

Furthermore, the Fibonacci indicator suggested a possible crash for DOGE. This was because of the position of the 1.618 Fib level, also tagged as the golden ratio.

As of this writing, the 1.618 Fib was positioned at $0.12. This gave a hint that Dogecoin’s next support could lie around the region. If bulls can defend the support, DOGE might bounce and head toward $0.16.

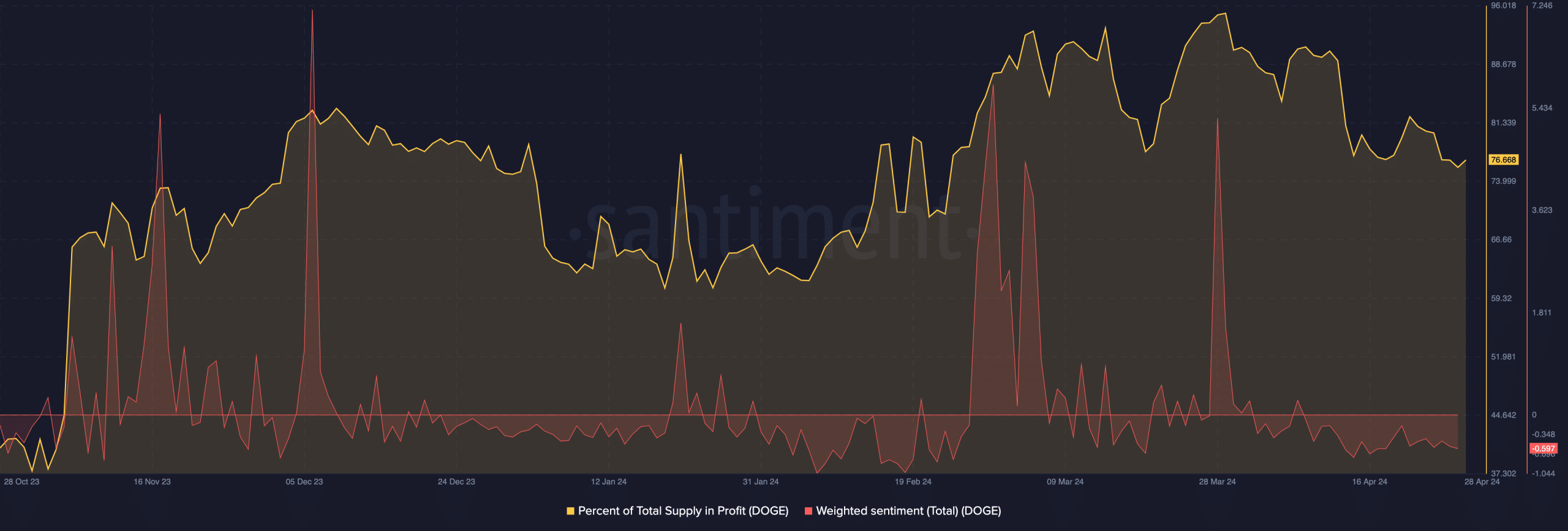

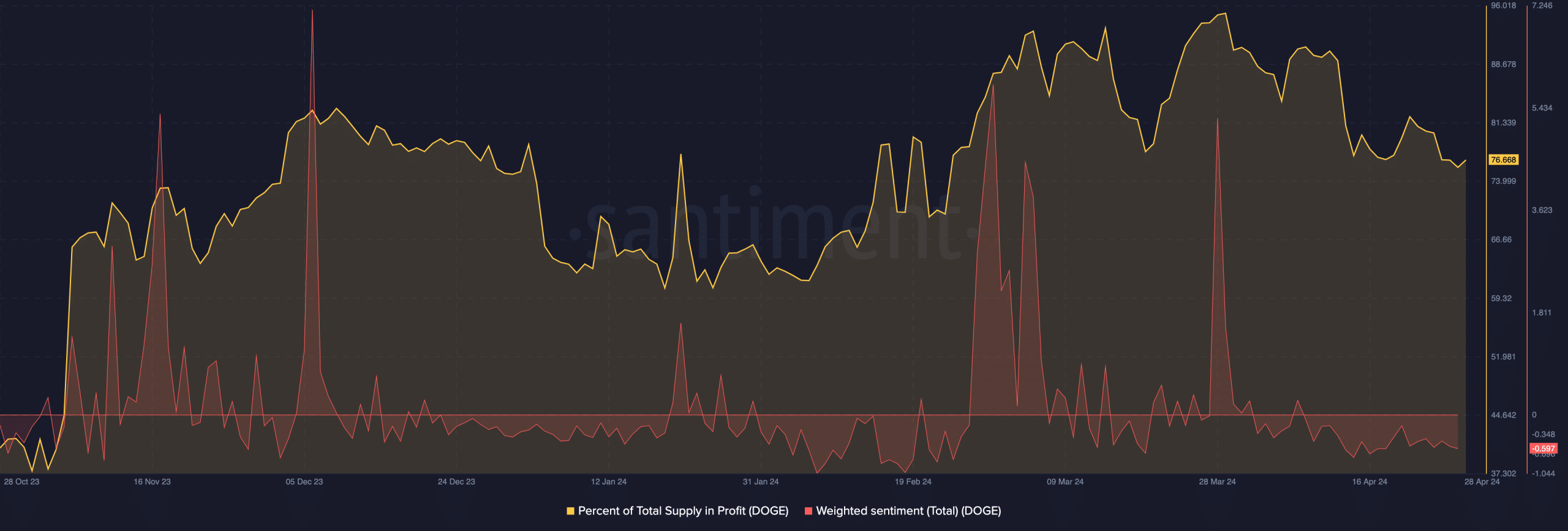

However, failure to shield the $0.12 support from bears could end up sending the coin down to $0.10. Despite the DOGE’s decline, on-chain data showed that 76.66 of the total supply was in profit.

Heats hits DOGE

This ratio could be connected to the coin’s 90-day performance. According to AMBCrypto’s evaluation of the market, the price of the coin increased by 83.65%.

A high supply of profits is not always a good sign for cryptocurrencies. This is because there is a high chance that some participants might book profits, especially at a time when the previously bullish momentum has slowed down.

If this happens, DOGE’s price might slide below $0.12, and the supply in profit might go below 70%. As per the Mean Coin Age (MCA), data from Santiment showed that the metric spiked.

The MCA is the average age of all tokens on the blockchain. This metric correlates with price. If the MCA decreases, it means that a lot of new coins have been accumulated and sent to cold wallets.

Source: Santiment

Realistic or not, here’s DOGE’s market cap in BTC’s terms

If this were the case, DOGE’s short-term prediction would align with an increase. But the coin age was high, hinting that many old coins had been moved.

For the price, this suggested selling pressure and the movement could coincide with the liquidation of the assets.

Leave a Reply