- Network realized profits increased, indicating that holders took advantage of the recovery.

- The MDIA suggested a decline while price analysis indicated a further climb.

If you find someone humming “Count your blessings, name them one by one,” he/she may be a Cardano [ADA] holder who decided to sell on the 20th of March.

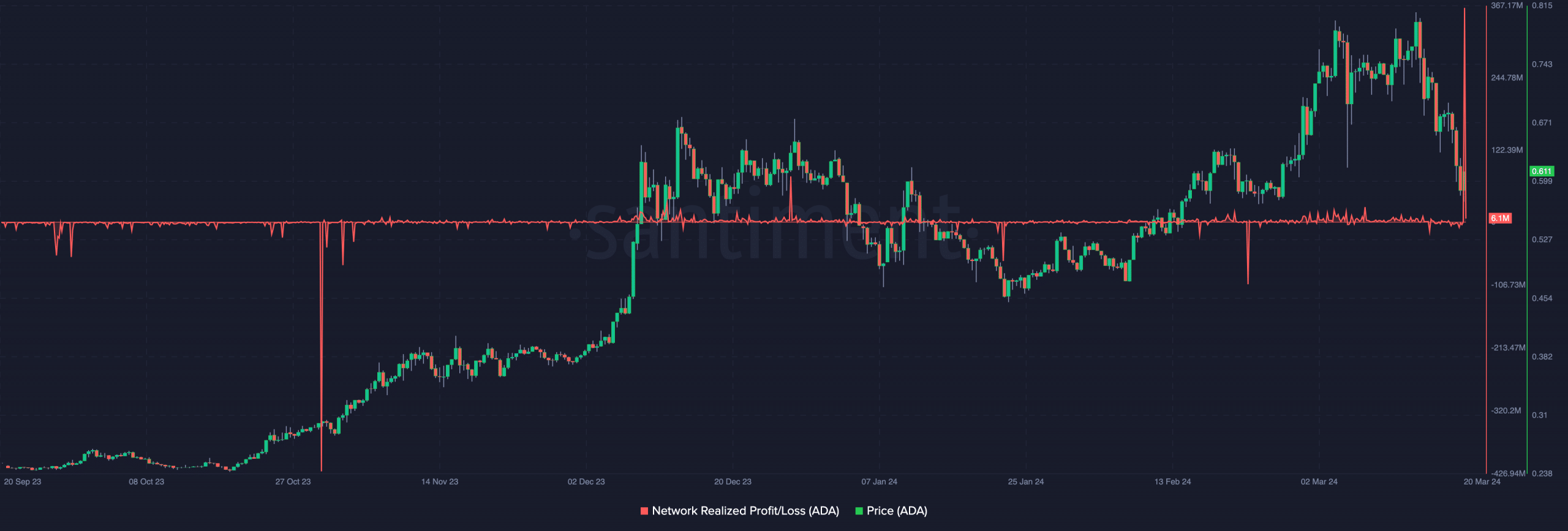

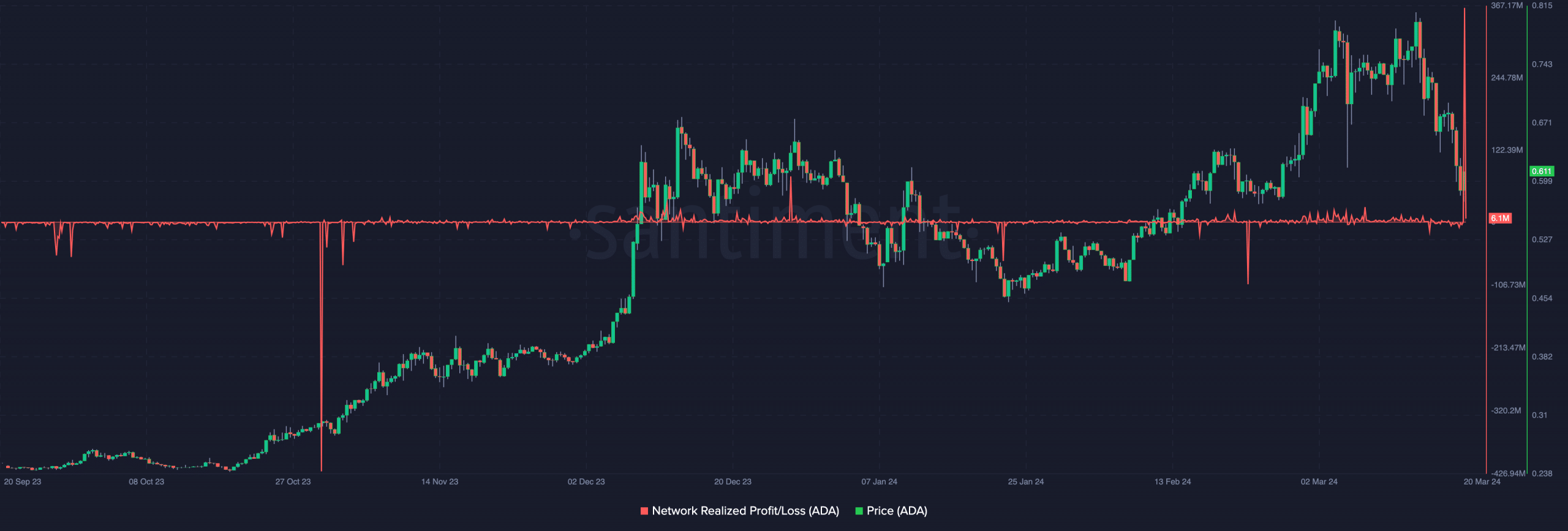

According to AMBCrypto’s analysis of Santiment, Cardano’s Network Realized Profit/Loss spiked to 6.1 million. A day before the same metric was around -2.2 million, indicating that net transactions on-chain were at a loss. Around that time, ADA’s price plunged to $0.58.

Source: Santiment

However, the jump into the profit region could be linked to the token’s performance. After the initial decline, ADA recovered and was changing hands at $0.61 at press time. This represented a 1.25% one-hour increase before the writing.

Is paper handing Cardano the right thing?

But the recent jump has not been able to erase all the losses of the past week. Within the last seven days, the value of the Cardano native token has decreased by 19.73%.

Therefore, one can conclude that the booked gains were minute. However, one on-chain metric suggested that the holders involved in the transactions might have let go too early. But another metric revealed that the right thing to do was to sell in the short term.

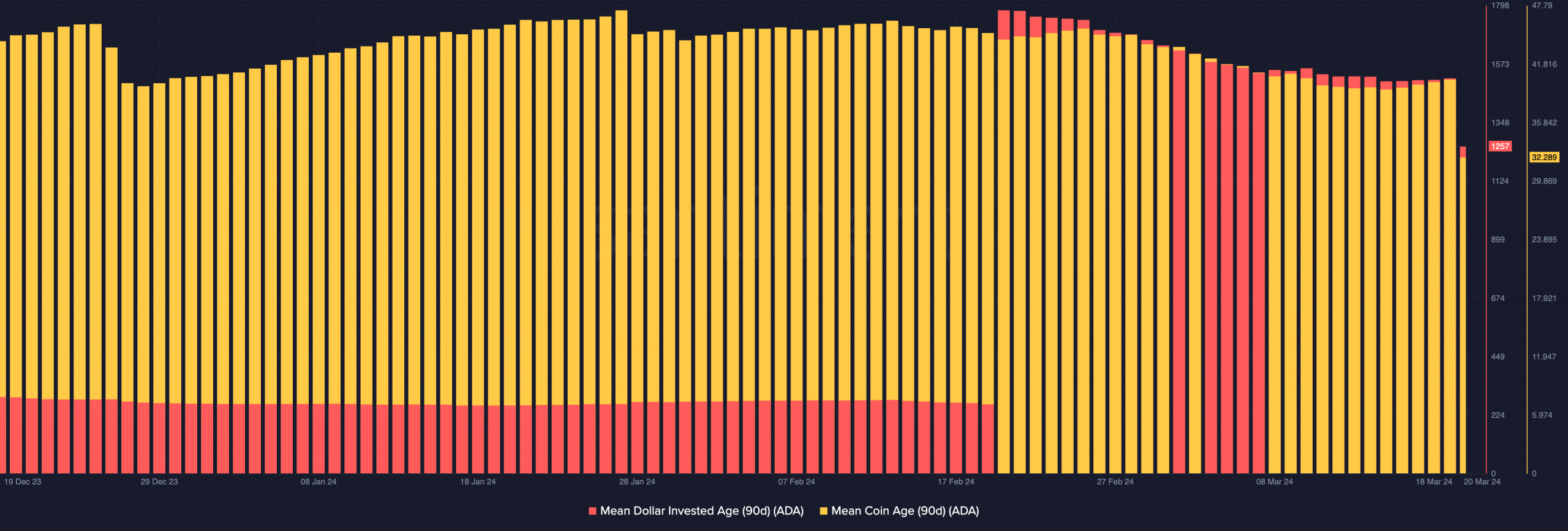

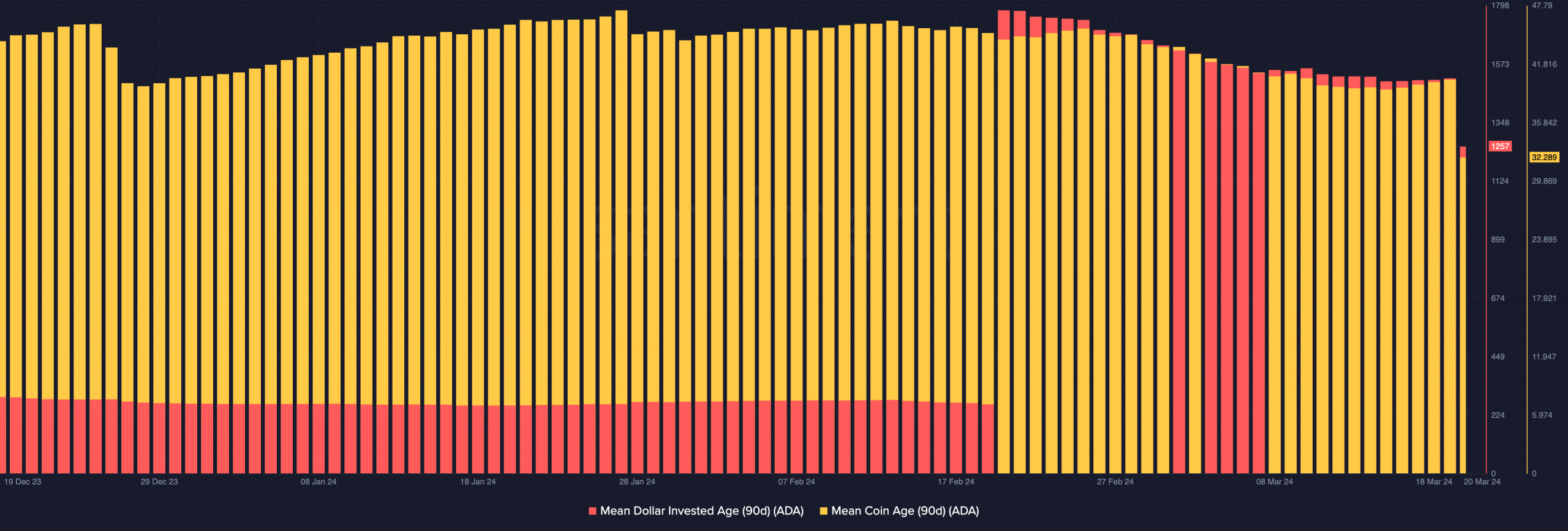

First off, we considered the Mean Dollar Invested Age (MDIA). This is the average age of all tokens weighted by the purchase price. At press time, the 90-day MDIA was down to 32.298.

High values of this metric indicate that short-term holders are accumulating. But when it decreases, it implies that investors are liquidating their holdings.

For Cardano, the decrease aligned with the latter. Therefore, it is likely that ADA’s price might fall below $0.61 in the coming days. However, the 90-day Mean Coin Age (MCA) had another inference.

Like the MDIA, the MCA reading also dropped. However, the interpretation of these closely related metrics is different. For the MCA, a low coin age indicates that long-term holders were accumulating.

Source: Santiment

ADA is set to retry

If ADA’s MCA had a high reading, it would have implied that old tokens were being moved. Therefore, while ADA’s price might slide in the short term, the long-term potential leaves the rest of its holders with a possible “moon bag.”

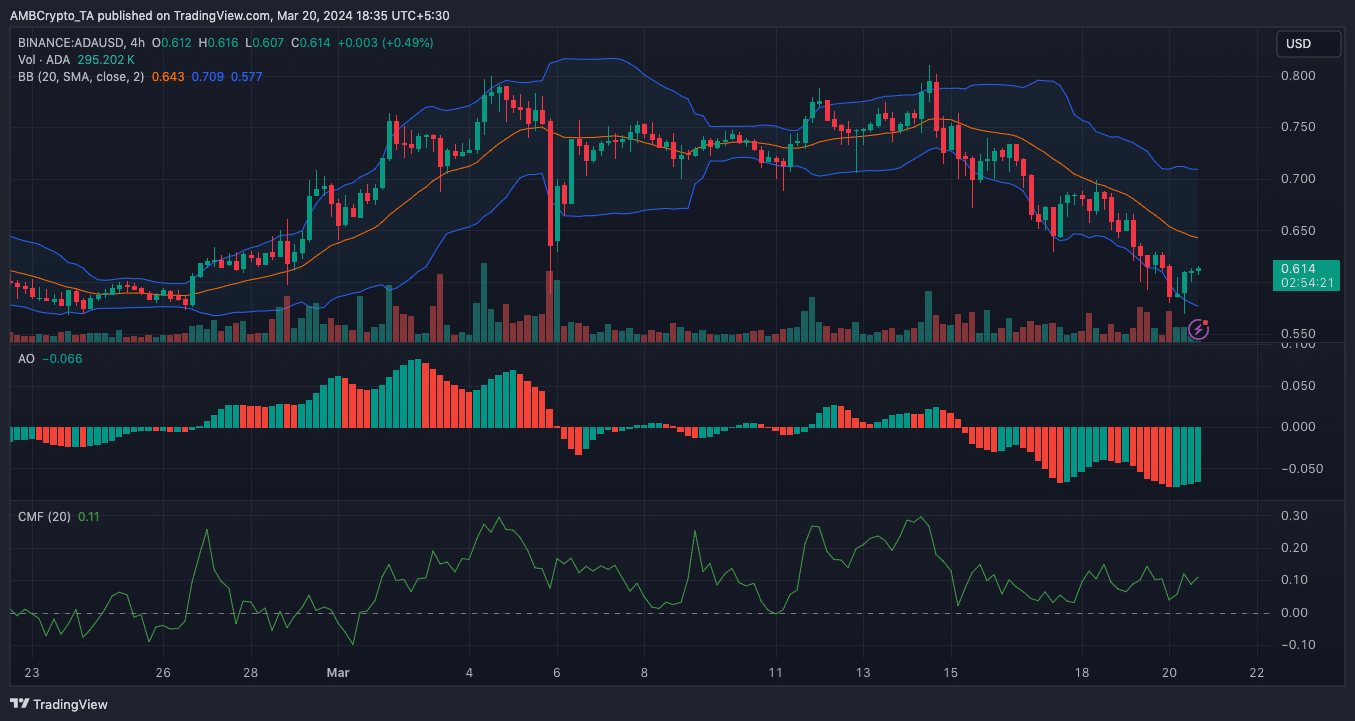

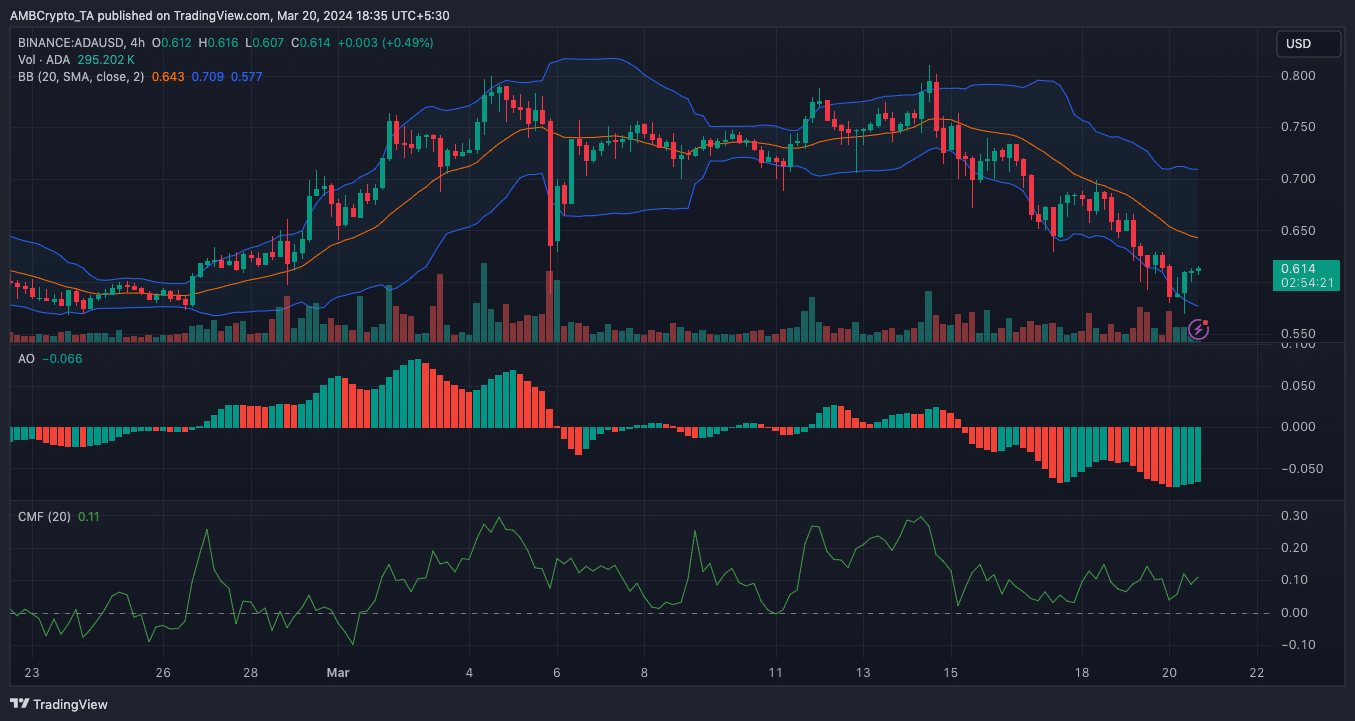

On the 4-hour ADA/USD chart, the Awesome Oscillator (AO) was negative. However, the appearance of green histogram bars on the AO suggested that the bearish momentum might cool off.

How much are 1,10,100 ADAs worth today?

Furthermore, indications from the Bollinger Bands (BB) showed that the token was earlier oversold. This was because the lower band of the BB tapped ADA’s price at $0.58.

Source: TradingView

The BB also indicated that volatility was high. With the Chaikin Money Flow (CMF) in the positive region, ADA’s price might defy all odds and extend toward $0.70.

Leave a Reply