- UNI shows promising signs of a bullish breakout, with multiple reversal patterns forming.

- High transaction values and a majority of holders in profit hint at strong investor confidence.

Uniswap [UNI] is looking strong and might aim for higher levels above the $10 resistance. After weeks of performing terribly, the altcoin has seemingly seen a reversal pattern, potentially staging a breakout.

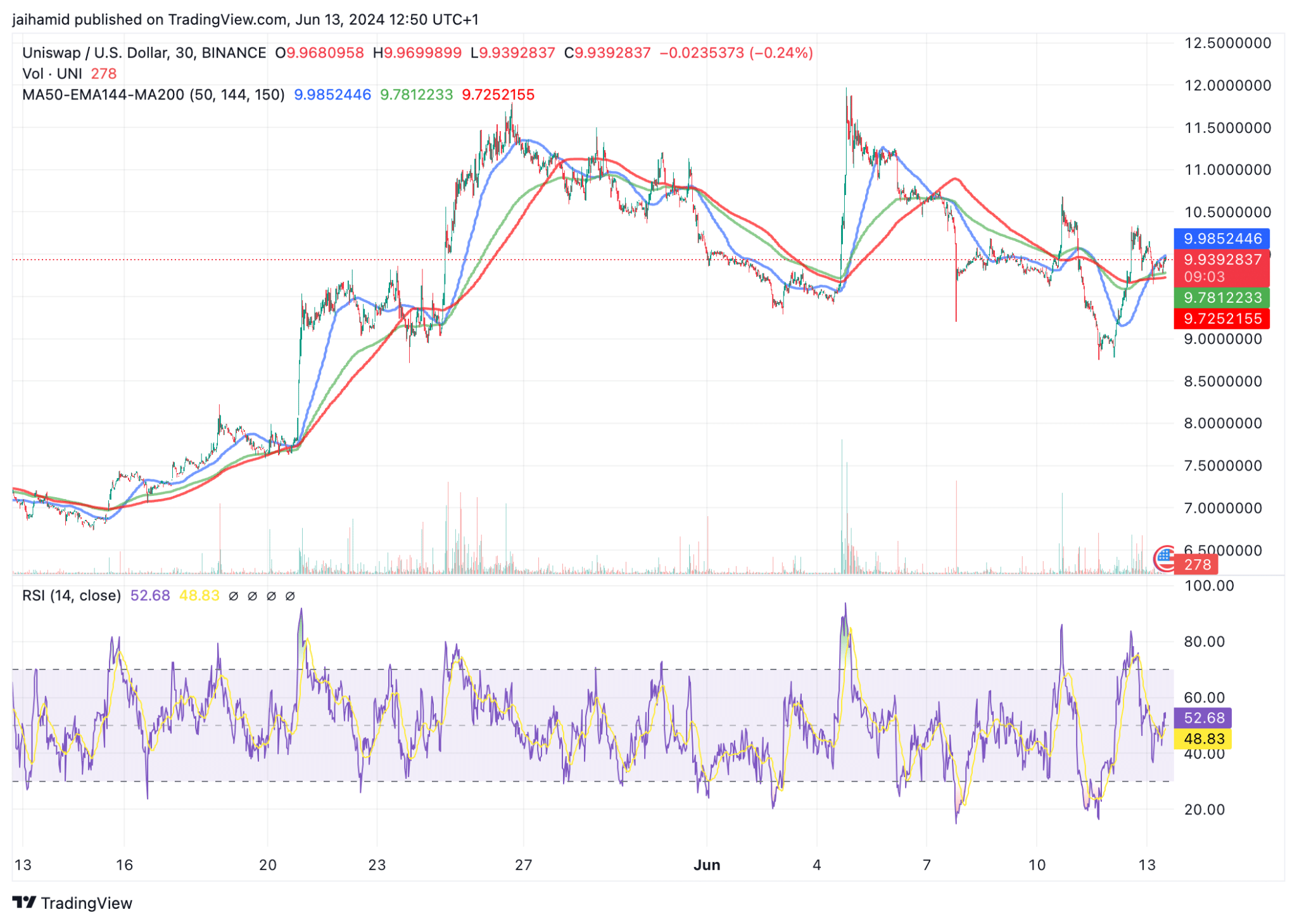

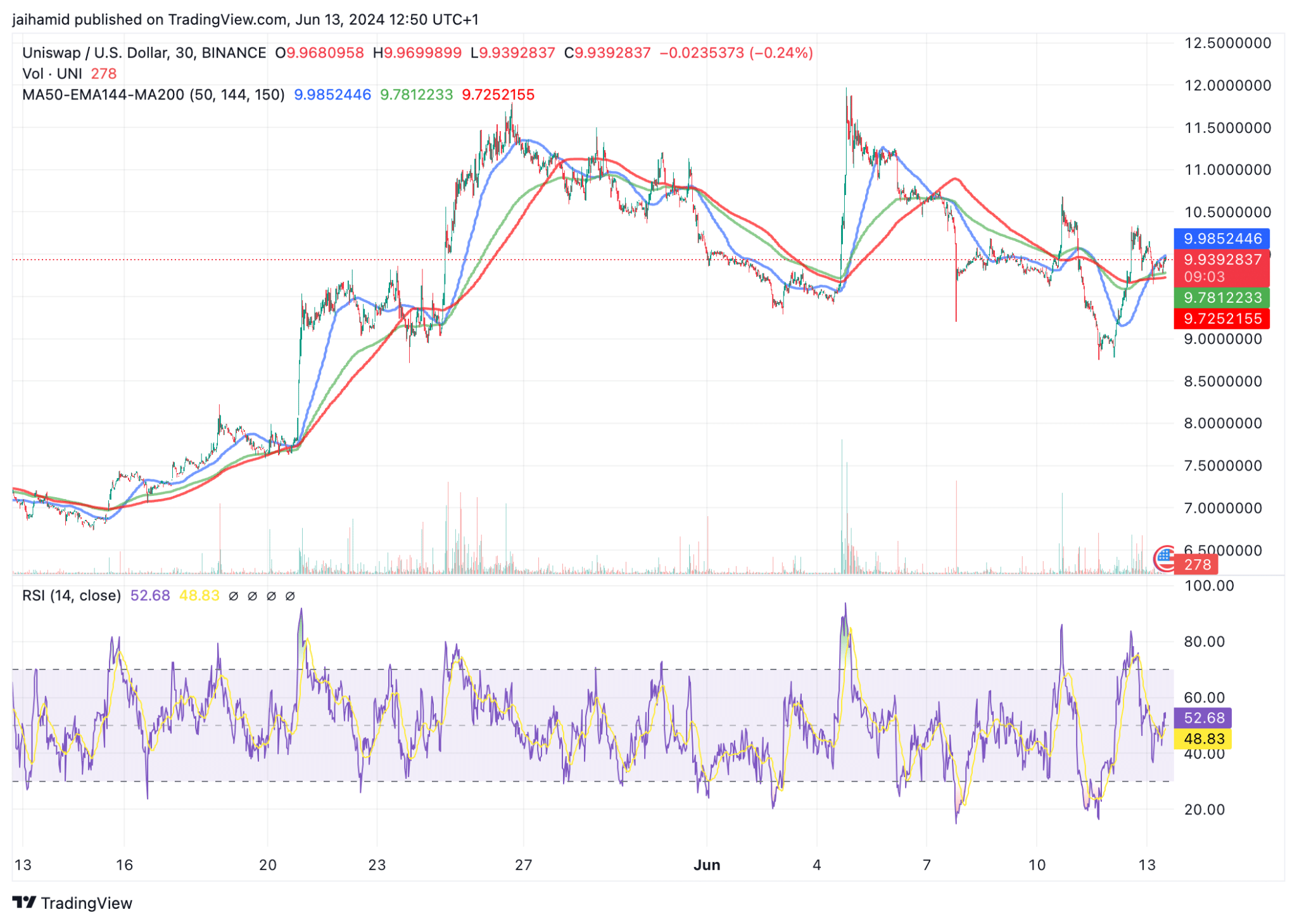

Source: TradingView

Recent price movements show a recovery from lower levels. The MA50 recently crossed above the MA200 (Red Line), which is typically a bullish signal known as a ‘Golden Cross.’

This indicates that the shorter-term momentum is becoming more bullish relative to the longer-term trend. The EMA is currently below the MA50, reinforcing the short-term bullish reversal.

The RSI at 52.68 means that Uniswap is neither overbought nor oversold, leaving room for potential movement in either direction without immediate pressure from traders looking to sell off an overbought asset or buy an oversold one.

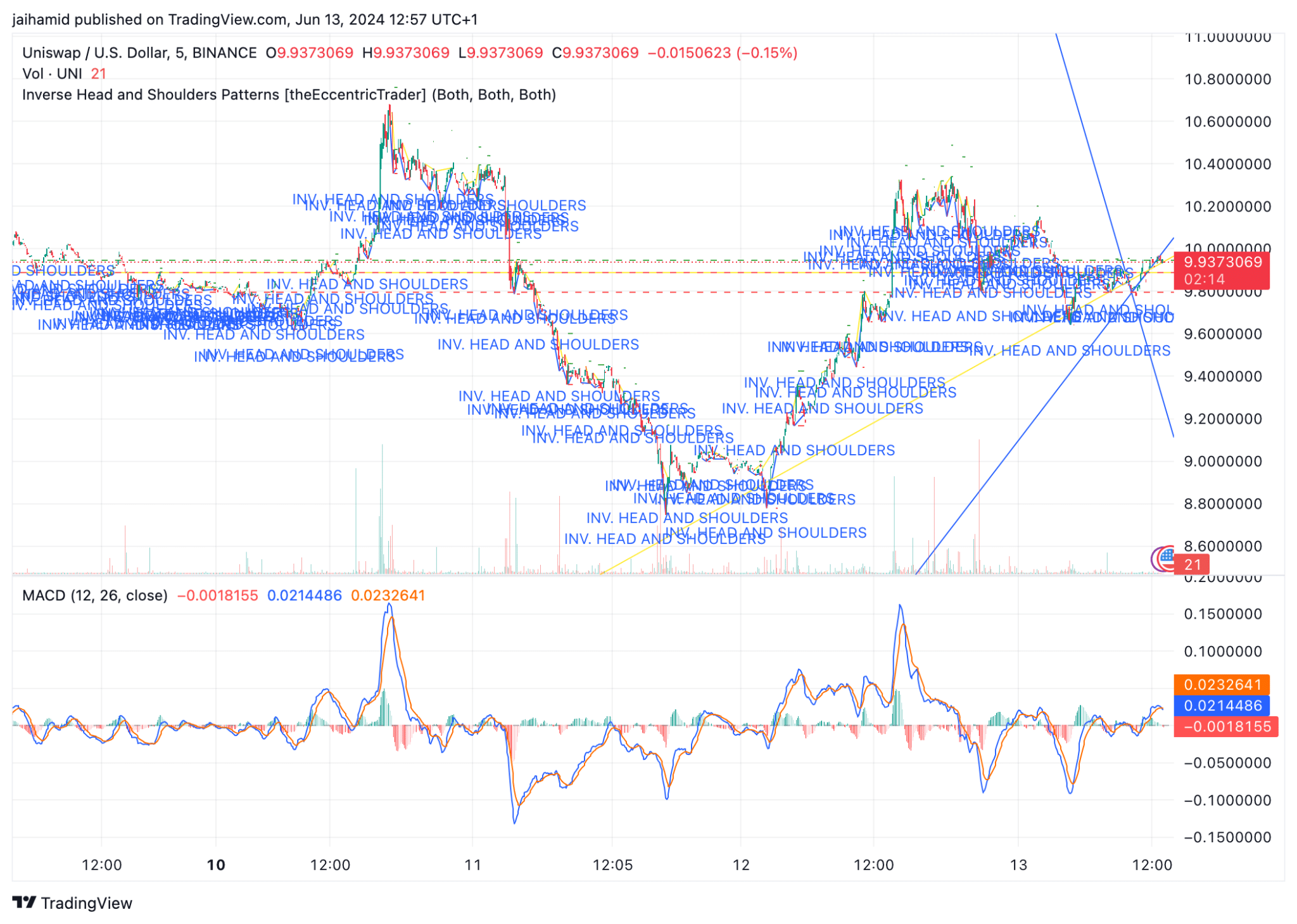

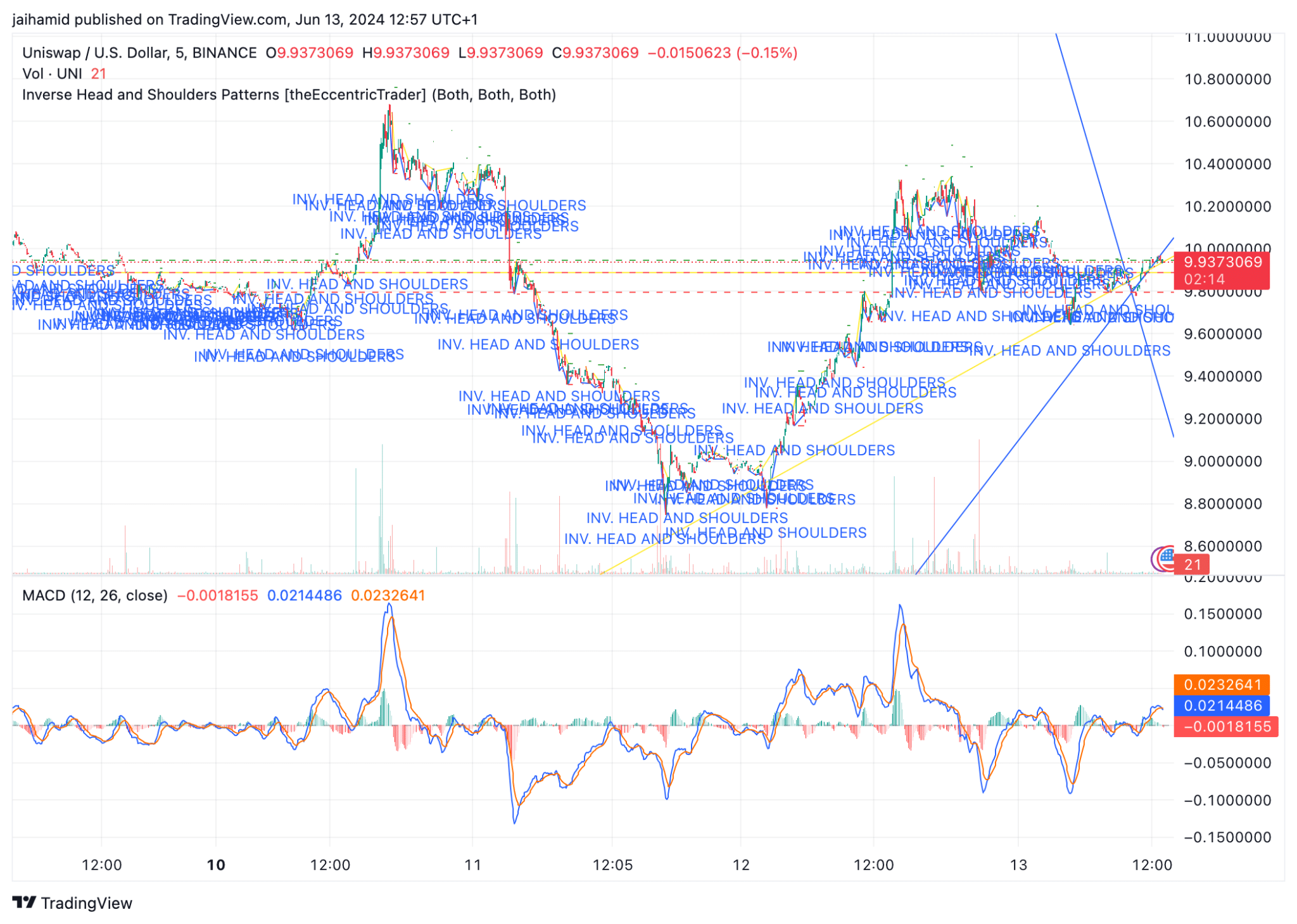

Source: TradingView

UNI to breakout?

Multiple inverse head and shoulder patterns are seen throughout the UNI/USDt chart. These patterns are typically considered bullish reversal setups. Completing the patterns always leads to a bullish phase.

However, the patterns’ effectiveness in predicting upward movement depends on their confirmation—namely, that decisive breakout above the neckline (indicated by the dashed lines) with significant volume.

The MACD line (blue) crossing above the signal line (orange) is visible at several points on the chart. This crossover is a traditional buy signal within the context of MACD analysis, and typically, a bull takeover comes immediately after.

Moreover, each double-bottom pattern on the chart signals a turning point where the buying interest is strong enough to prevent further declines and push prices higher, initiating a bullish trend reversal.

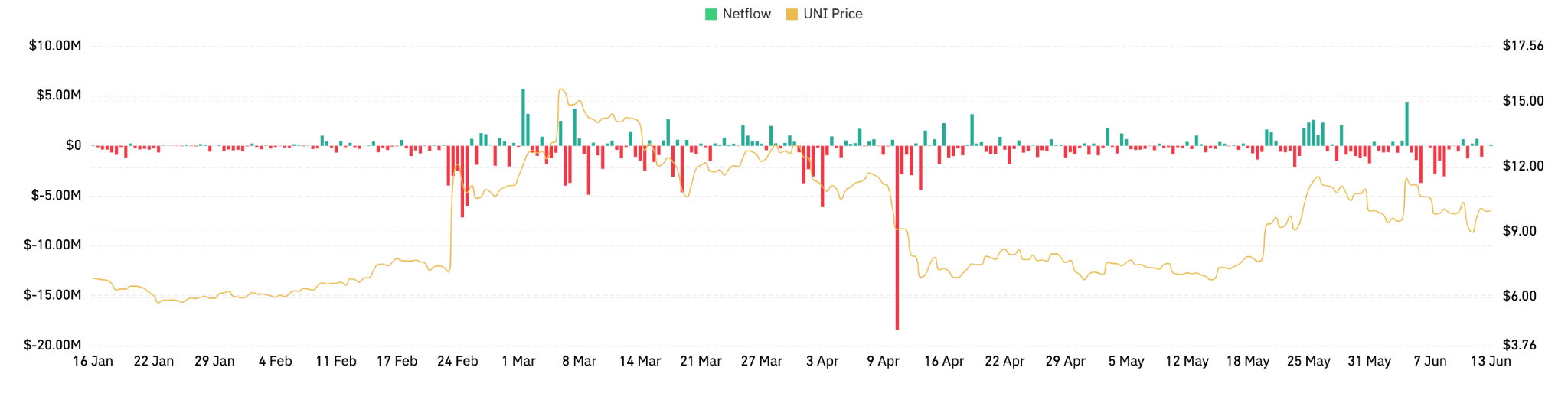

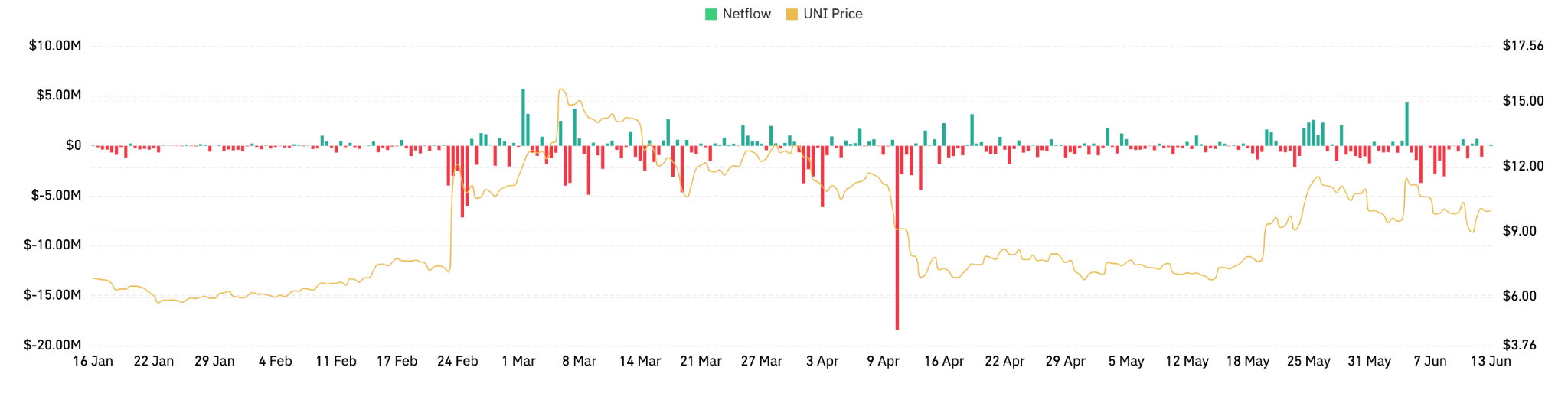

There is also a dramatic spike in net inflows, indicating a sudden increase in tokens being moved to exchanges.

Source: Coinglass

Is your portfolio green? Check out the UNI Profit Calculator

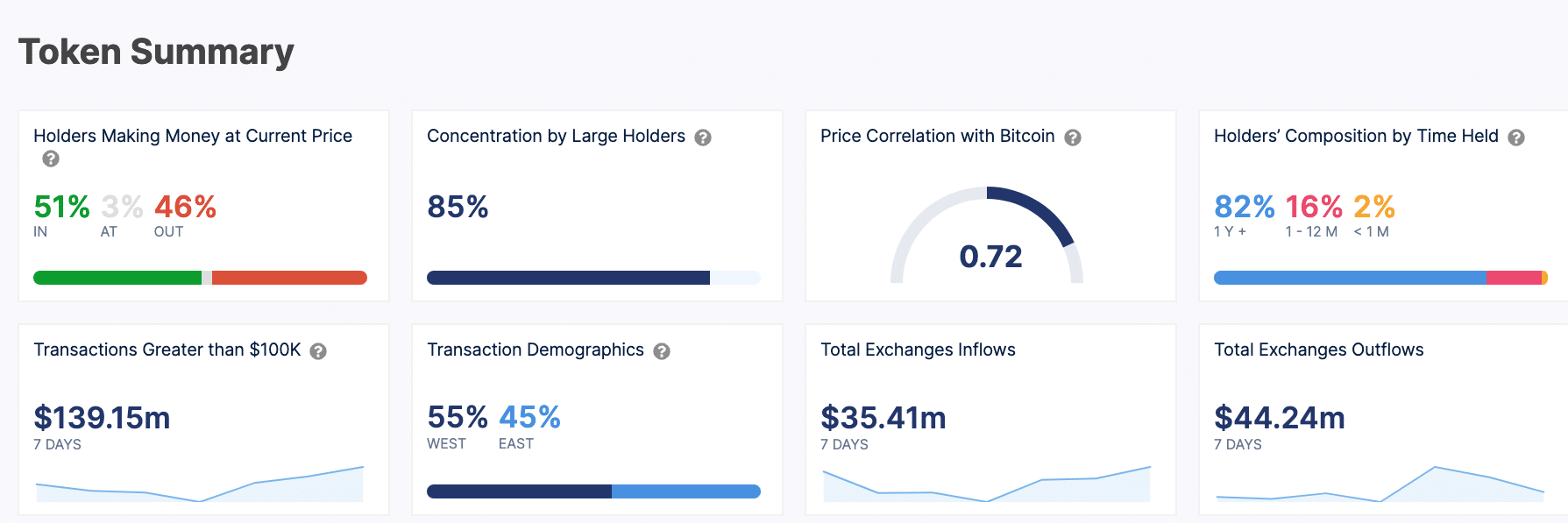

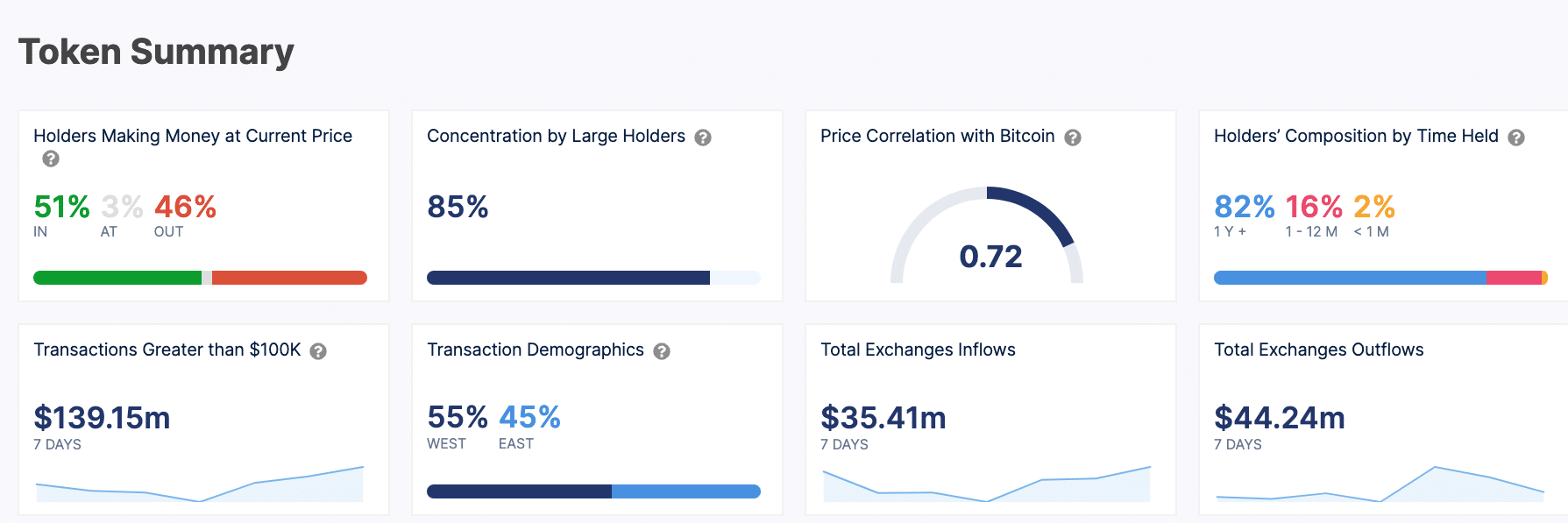

A slight majority (51%) of Uniswap holders are currently in profit at the existing price level, which may provide a psychological incentive to hold onto their investments in anticipation of further price increases.

Source: IntoTheBlock

The high transaction values also show huge interest from larger investors and institutions, which could further drive higher price movements for UNI.

Leave a Reply