- Helius Labs’ exec raises concerns about big corporations being top Solana validators.

- However, one of Solana’s native validators is amongst the super minority group.

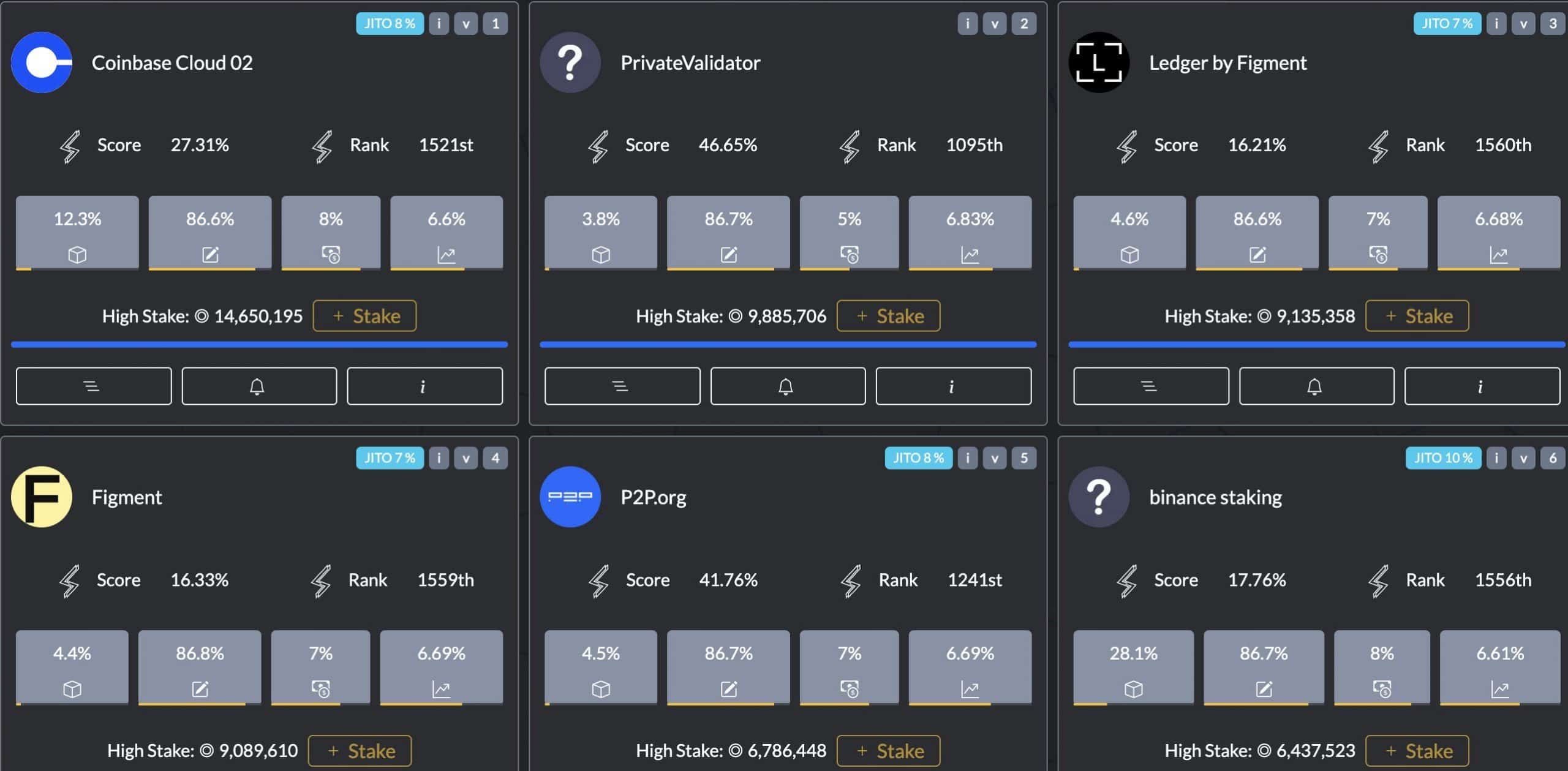

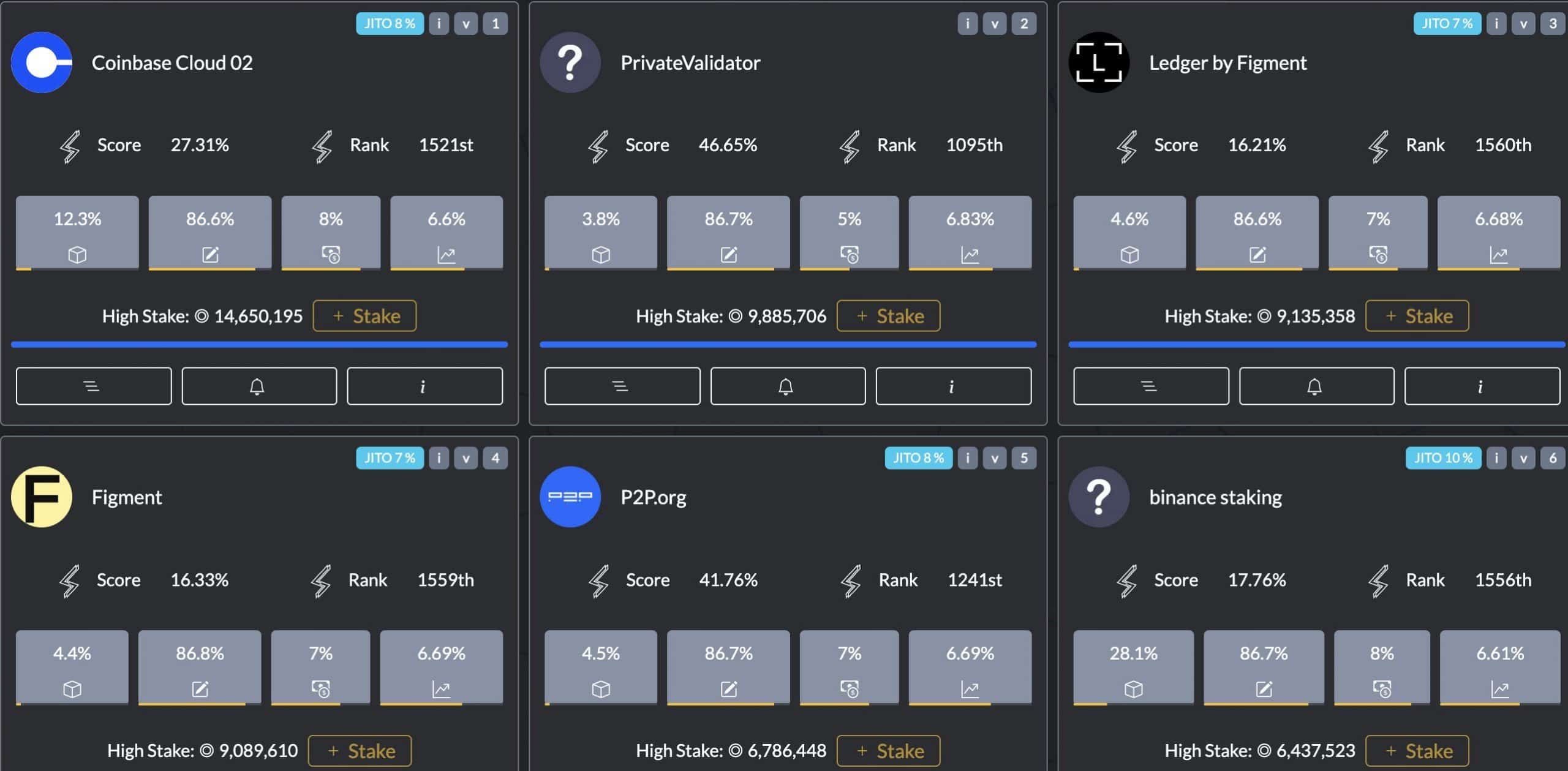

Big corporations like Coinbase and Binance [BNB] largely dominate the Solana [SOL] validator ecosystem. There are over 1700 Solana validators, with 22 controlling over 33% of the total staked SOL (superminority).

Mert Mumtaz, Co-founder and CEO of Helius Labs — a Solana developer platform for crypto investors, has raised concerns about this dominance.

Taking a swipe at the giant corporation’s false “trust,” “security,” and high fees, the Helius Lab executive has called for users and investors to consider staking with Solana native teams.

“Large corporations generally give you some false sense of trust and security. Trust me when I say that Solana is complex enough that a Solana-native team can navigate uncertainty much better than any giant corporation.”

The problem with top Solana validators

According to Mert Mumtaz, the top six giant corporations running Solana validators charge an 8% commission. This is a high fee when there are alternatives, per Mumtaz;

“Really don’t like that the top six validators on Solana are giant corporations instead of Solana-native team, need to change this. And they charge up to 8% commission. Stake with native teams, you are paying too much in fees”

Source: X/OxMert

The exec tipped Solana native team validators like Cogent, Laine, and Overlock. He added that,

“You get a much higher yield with most Solana-native teams, so it’s literally safer, a better investment into the network, and a better return all at once.”

Interestingly, according to Solana Beach data, Laine (Laine stakewiz.com), one of the teams Mumtaz tipped, is amongst the top 22 validators.

That means it’s part of the super-minority that can theoretically censor the network if they collude—a critical centralization risk. That seems counterintuitive to what Mumtaz aims to achieve, especially on the “security” front.

In the meantime, SOL reversed its post-network upgrade rally and traded at $133 at press time.

On the higher timeframe charts, $130 was a crucial support level for bulls. So, a drop below it could offer bears more leverage.

Leave a Reply