- Bearish sentiment retained its dominance in Bitcoin’s market

- King coin might fall to $64k before another rally

Bitcoin [BTC] recorded a major price correction over the last 24 hours, a correction which can be attributed to traditional markets tanking and geopolitical uncertainty. The timing here is important, especially since BTC is awaiting its next halving in under a week.

However, investors should not lose hope as there are chances the cryptocurrency will recover on the charts soon.

Bitcoin’s chart turns red

According to CoinMarketCap, Bitcoin’s price fell by more than 5% in the last 24 hours. At the time of writing, it was trading at $67,241.90 with a market capitalization of over $1.32 trillion.

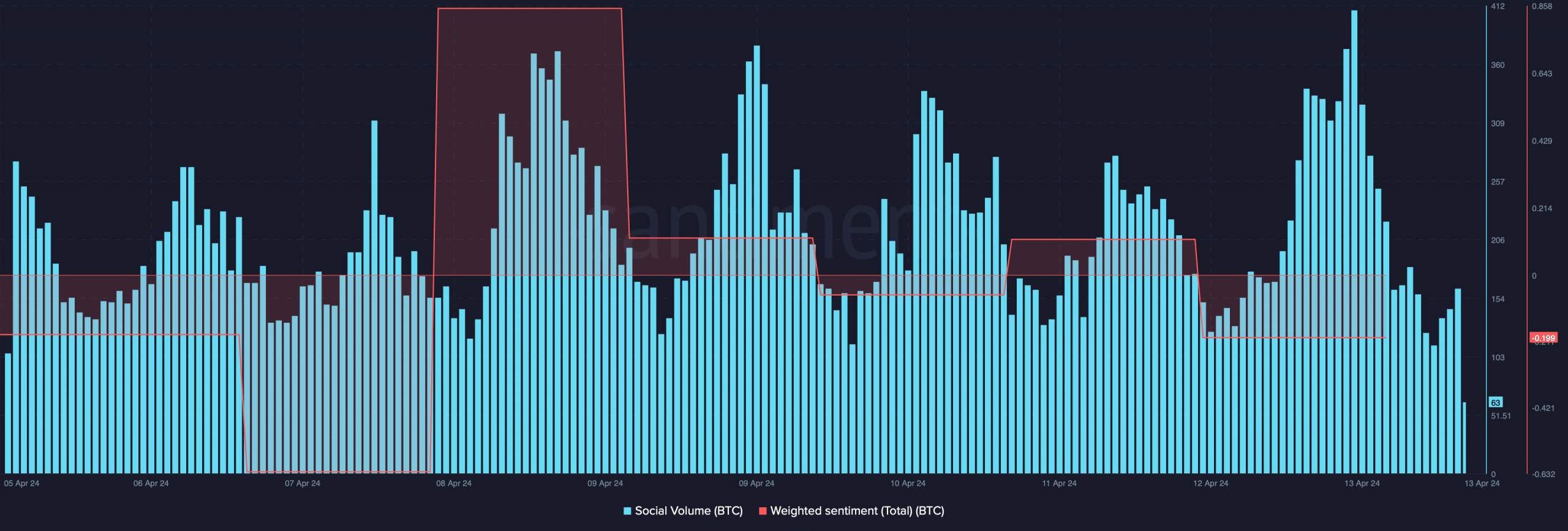

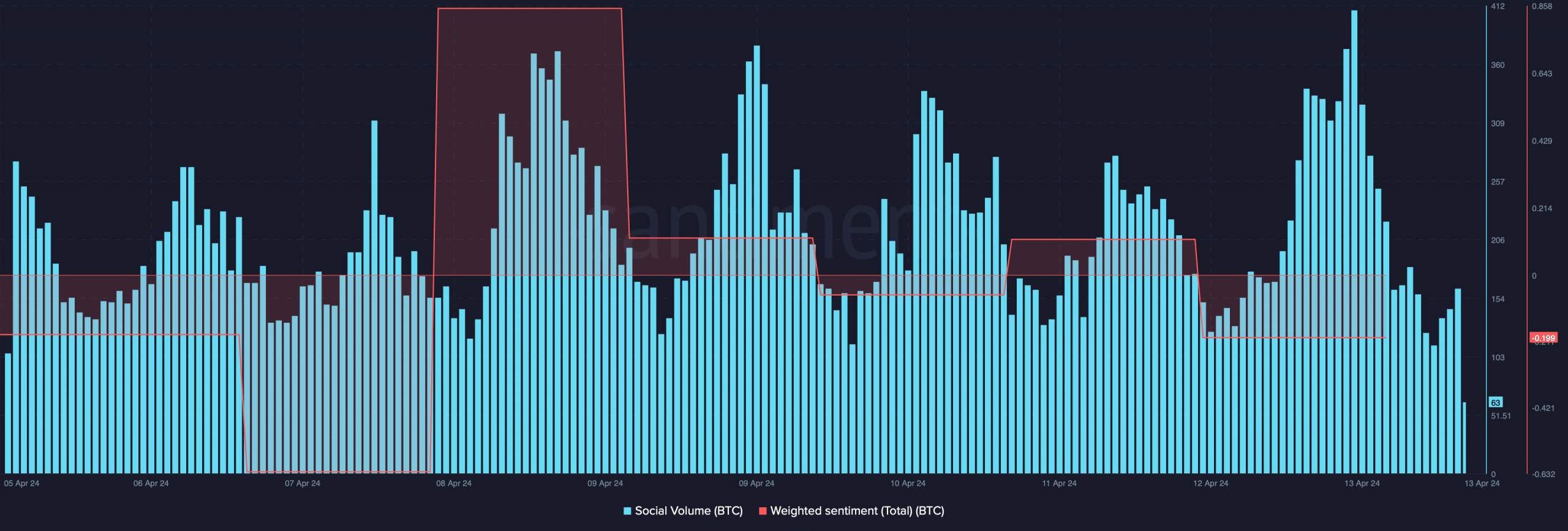

The price decline made BTC a topic of discussion in the crypto-space, with the same evidenced by the hike in its social volume. However, its weighted sentiment graph entered the negative zone, meaning that bearish sentiment retained its dominance in the market.

Source: Santiment

However, the aforementioned correction might just be a deception.

Captain Faibik, a popular crypto-analyst, recently shared a tweet highlighting an interesting update. As per the same, BTC’s price is still moving inside a bull pattern. A successful breakout above the pattern could result in BTC hitting a new ATH in the coming weeks. Before that happens though, there are chances BTC’s price might fall back to $66k.

Will BTC recover soon?

AMBCrypto’s look at Bitcoin’s metrics revealed that BTC might fall further in the short term.

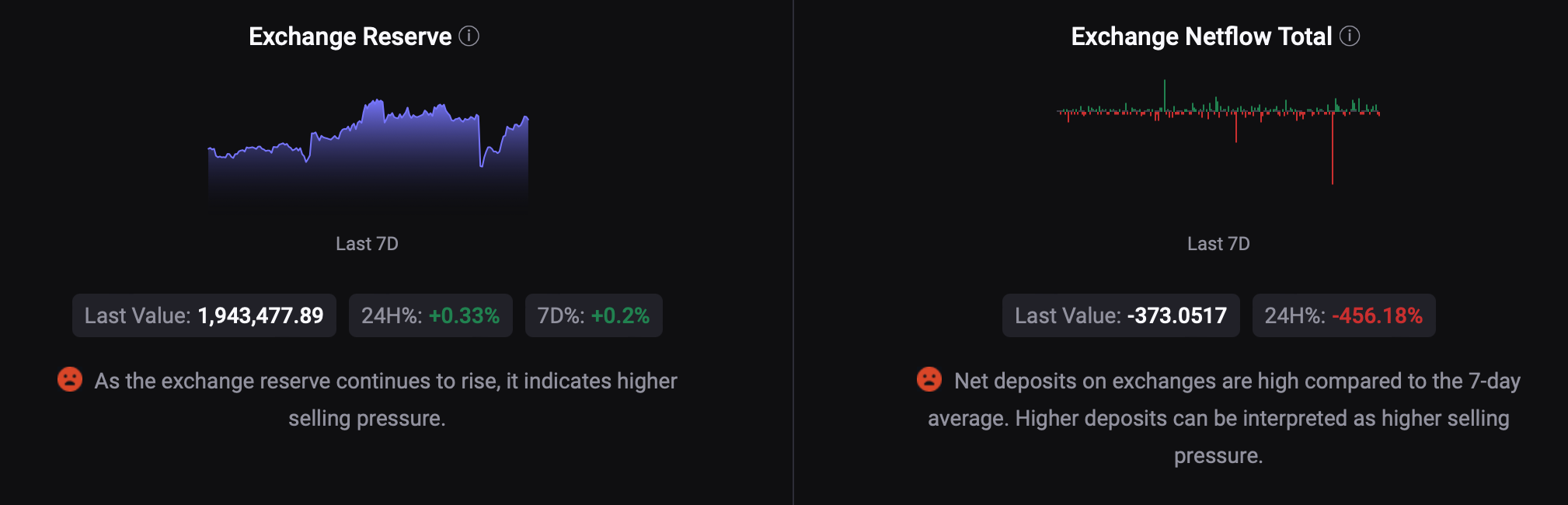

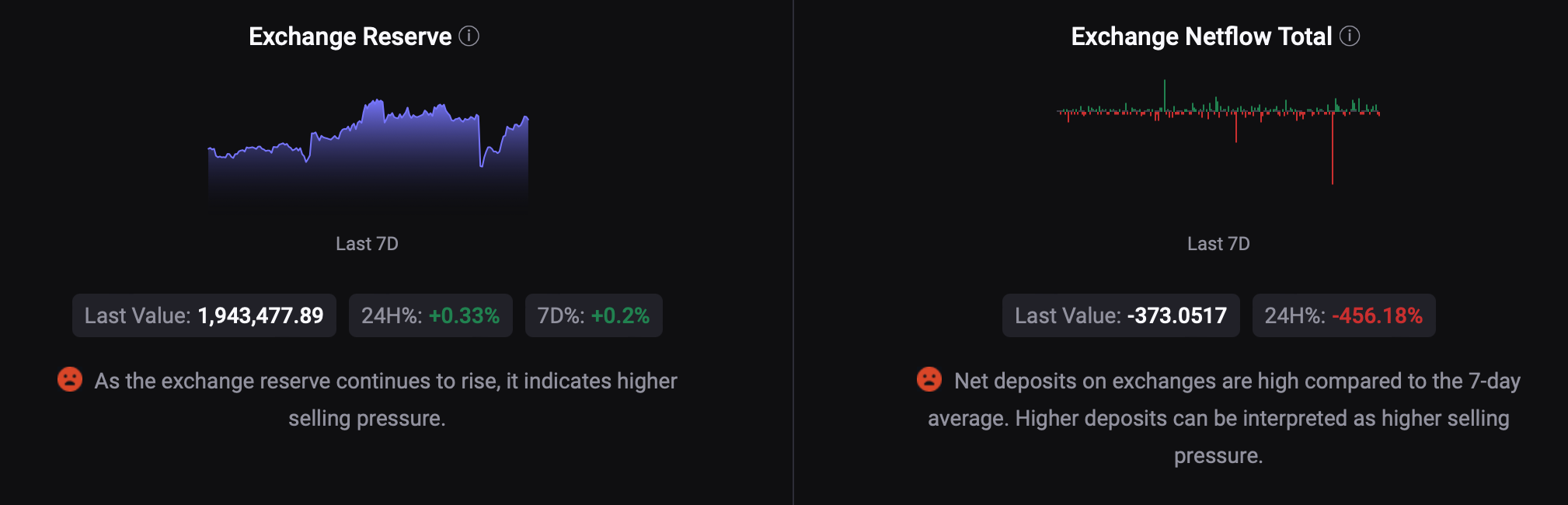

Our analysis of CryptoQuant’s data highlighted that the crypto’s net deposit on exchanges was high, compared to the last seven days’ average. Its exchange reserves were climbing too – A sign of high selling pressure.

Source: CryptoQuant

Additionally, Bitcoin’s aSORP was red, meaning that more investors have been selling at a profit. On top of that, BTC’s Net Unrealized Profit and Loss (NULP) suggested that investors were in a “belief” phase, one where they were in a state of high unrealized profits. All these metrics hinted at a further downtrend.

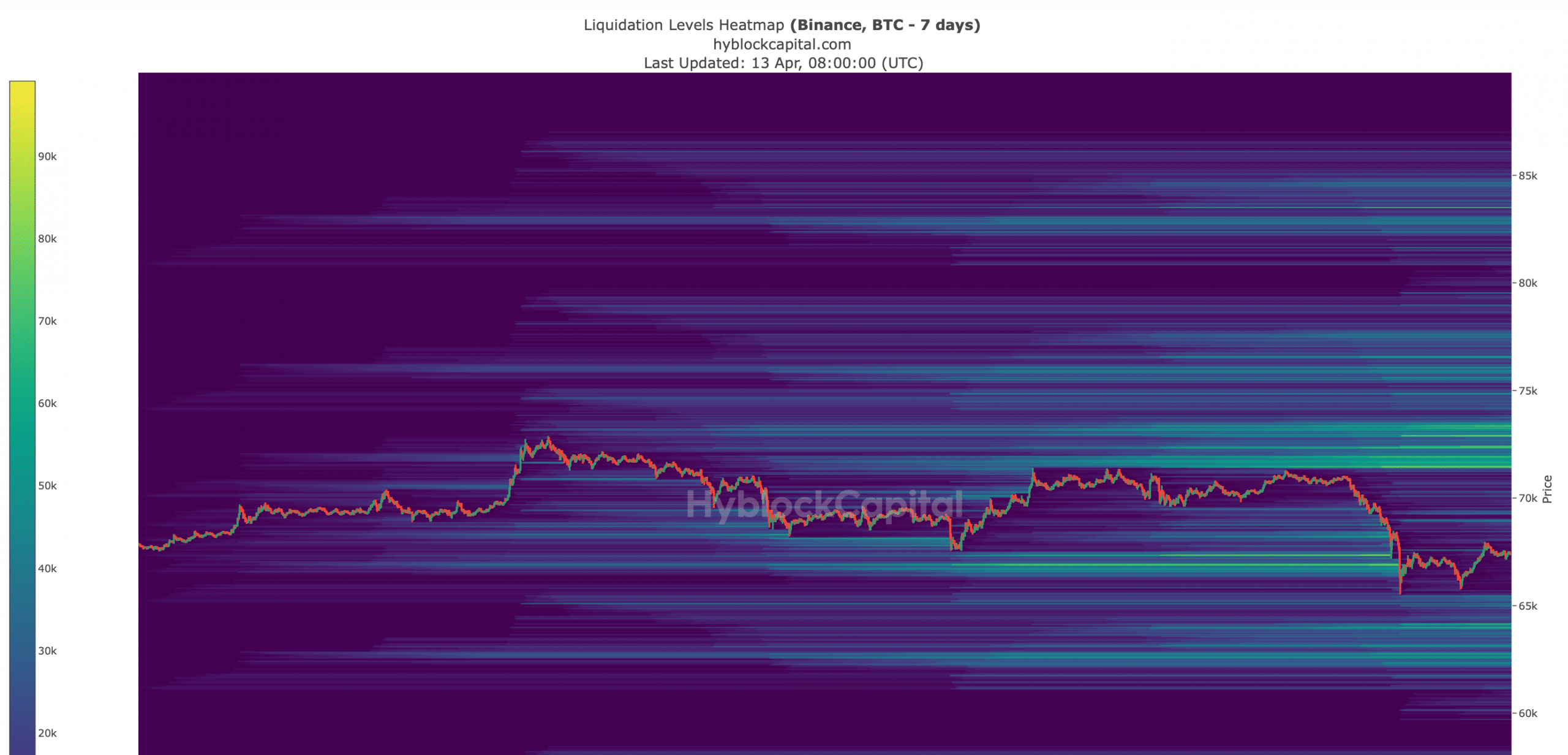

As per our analysis of Hyblock Capital’s data, if the downtrend continues, BTC’s price might soon touch $66k or $64k. Once BTC reaches that level, the chances of a quick recovery are high if BTC tests the bull pattern that formed on its chart. However, if Bitcoin fails to test the pattern, then investors might as well see BTC falling to $57k.

Source: Hyblock Capital

Read Bitcoin’s [BTC] Price Prediction 2024-25

The halving effect

Though several metrics flashed bearish signals, Bitcoin has a trick up its sleeve, one which can help turn the situation upside down. The king of cryptos is awaiting its next halving in just under a week. The halving will reduce BTC’s issuance rate. This drop can result in an increase in BTC’s demand and help lift its price.

Additionally, the event can also stir up bullish sentiments around the coin, which can aid in BTC’s recovery in the coming days.

Leave a Reply