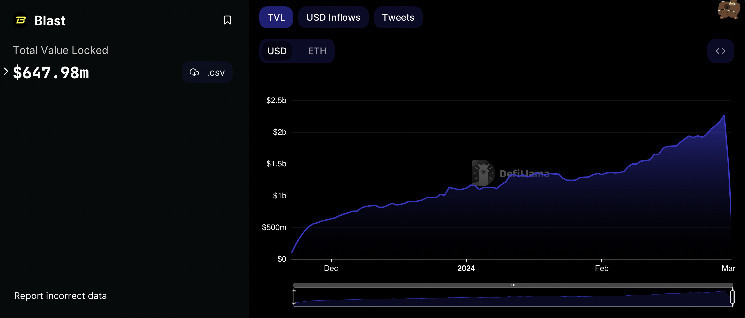

Total value locked (TVL) on Blast slumped from $2.3 billion to $650 million after withdrawals were opened on Friday.

50% of the upcoming airdrops will be issued to Blast depositors, with the other 50% being allocated to developers.

Several protocols including Zora and Pyth have announced Blast integrations.

Investors that staked ether (ETH) on newly-launched layer-2 network Blast have withdrawn $1.6 billion of assets in the first 24-hours after the mainnet went live, DefiLlama data shows.

Blast, promising on its website to be the “only Ethereum L2 with native yield,” announced a deposit-only bridge in November that quickly garnered more than $2 billion in deposits. Depositors received Blast points for holding their ETH on Blast, the points eventually be redeemed for a token airdrop.

Developers that create decentralized apps (dApps) on Blast will also receive 50% of the upcoming airdrop allocation.

Backed by Paradigm, Blast initially polarized crypto investors with several observers claiming that it was reminiscent of a pyramid scheme due to its controversial one-way bridge.

Yet in spite of skepticism, Blast rapidly became one of the most active layer-2 networks in terms of deposits even before the mainnet had gone live. It attracted $2.3 billion in deposits from 181,000 users, generating an annual yield of $85 million.

The Blast ecosystem experienced its first exit scam earlier this week, with a protocol named “RiskOnBlast” disappearing along with $1.3 million worth of ether.

Several projects have added Blast integrations, with NFT platform Zora and pricing oracle provider Pyth announcing their support on Thursday.

Leave a Reply