- ADA jumps 8.13% in 24 hours, possibly influenced by Bitcoin’s rally.

- The altcoin faced challenges with declining velocity and user numbers.

In the last 24 hours, Cardano [ADA] experienced a notable surge, rising by 8.13%. While this surge may seem tied to the recent Bitcoin rally, a deeper analysis spanning the past few weeks paints a more nuanced picture.

Looking at the price

Since the 22nd of January, ADA’s price has undergone a significant rally, marking a substantial 40% growth.

This performance showcased a consistent trend with higher highs and higher lows, hinting at potential sustainability.

If ADA successfully retests the 0.641 resistance, there’s potential for the surge to extend further.

The Relative Strength Index (RSI) for ADA reached 63.18 at press time, indicating growing strength. This could imply a positive sentiment among traders and investors.

However, the Chaikin Money Flow (CMF) declined from 0.34 to 0.17 at the time of writing, suggesting a potential shift in money flow and liquidity, raising concerns about the sustainability of ADA’s current trend.

At press time, ADA was trading at $0.6217, and the volume at which it was trading had grown by 93.48%.

However, some factors could hinder the ADA’s potential growth.

Some challenges ahead

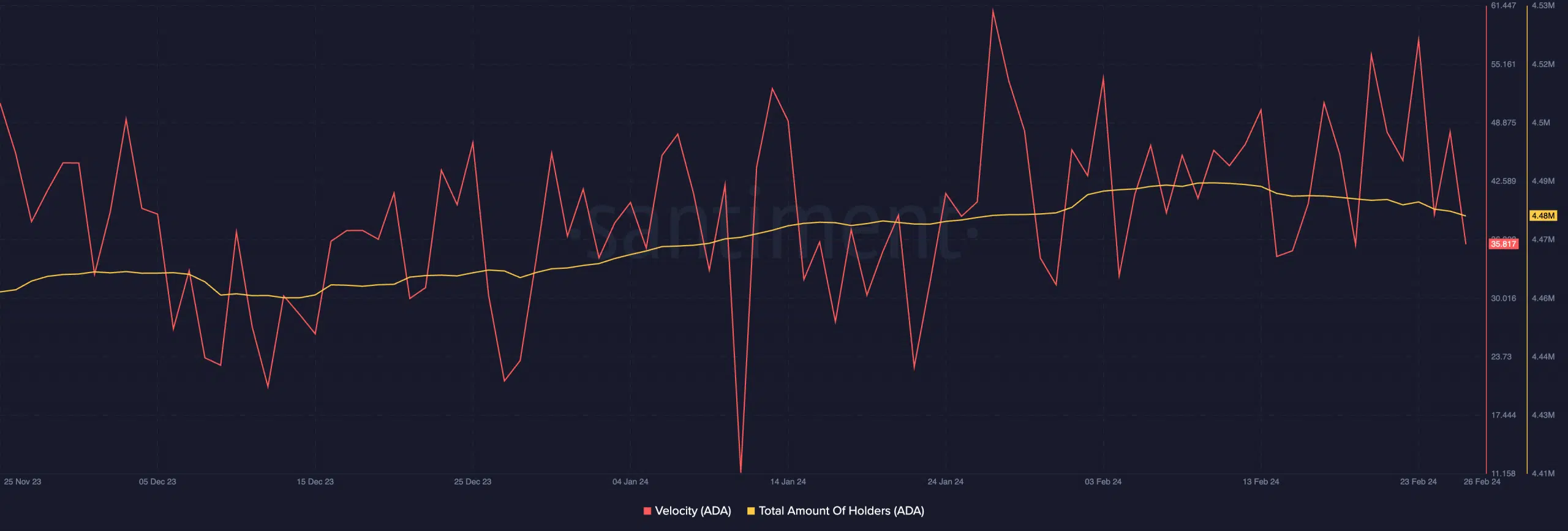

ADA’s velocity, representing the frequency of trading, exhibited a decline, indicating reduced activity.

A lower velocity may signal diminished interest or engagement, potentially influencing ADA’s short-term price dynamics negatively.

Moreover, there was a slight decline in the total number of holders accumulating ADA. While not a drastic drop, any reduction in holder accumulation could impact ADA’s resilience in the face of market fluctuations.

AMBCrypto’s examination of Cardano’s network activity provided a mixed bag of signals. The number of daily users on the network decreased, yet overall transactions surged.

How much are 1,10,100 ADAs worth today?

This dichotomy suggested that while the user base may have contracted, there was still active engagement in the network. There was an uptick in Cardano’s Total Value Locked (TVL) as well.

However, despite this growth, Decentralized Exchange (DEX) volumes on Cardano declined, which could point toward changing trading preferences or market dynamics.

Leave a Reply