- Solana leading all blockchains in netflows amid recent market gains.

- PumpDotFun generates income as Solana’s DeFi TVL surges.

Solana [SOL], now the fifth-largest cryptocurrency by market cap, is experiencing significant growth in both price and on-chain activity.

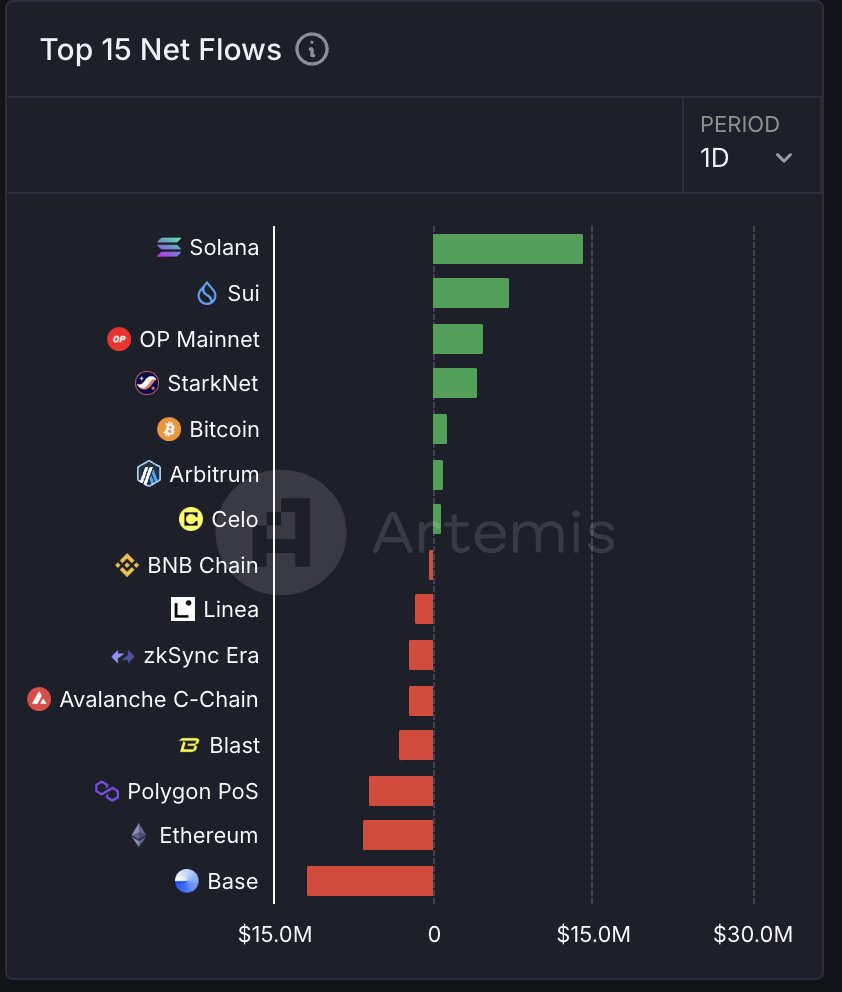

At the time of press, Solana was leading all blockchains in daily net flows, indicating strong investor interest. This upward trend positions Solana favorably for both short-term gains and long-term success.

Source: Artemis

As the overall crypto market shows positive momentum, SOL stands out as a key player in the industry.

Solana DeFi ecosystem is booming

The recent surge in interest surrounding memecoins is particularly beneficial for Solana. As the leading Layer 1 blockchain for memecoin launches, it is capitalizing on this trend.

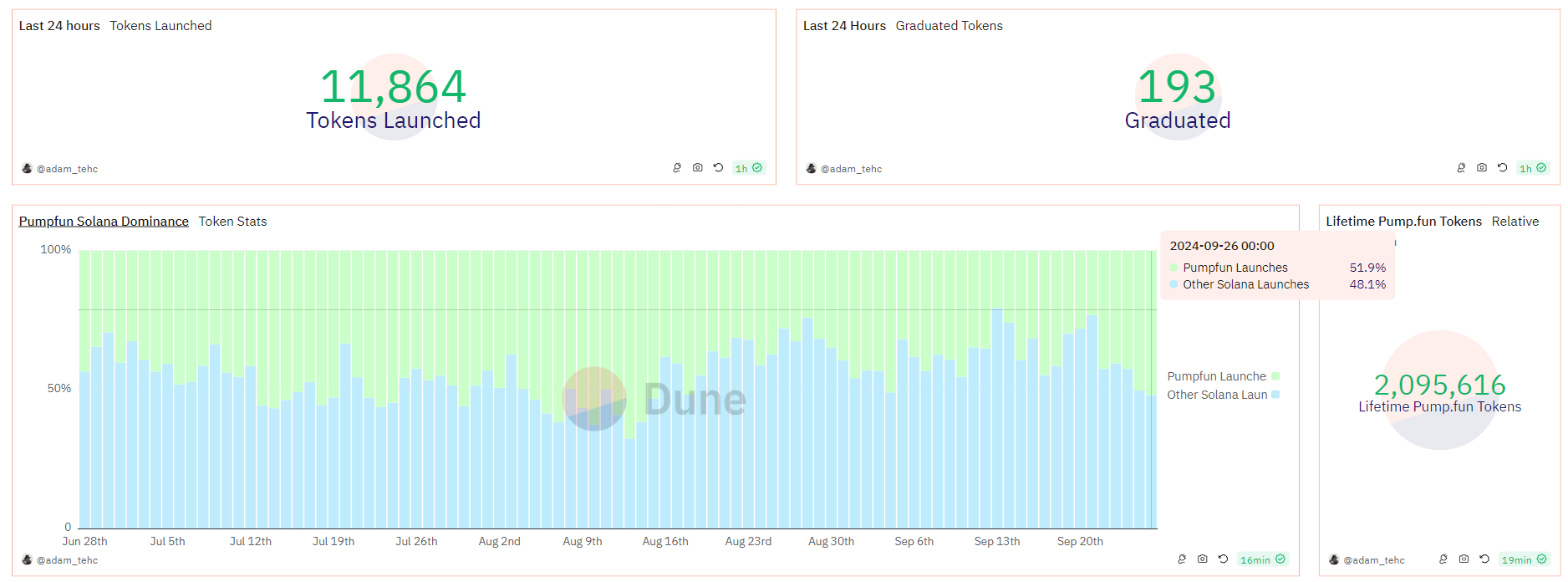

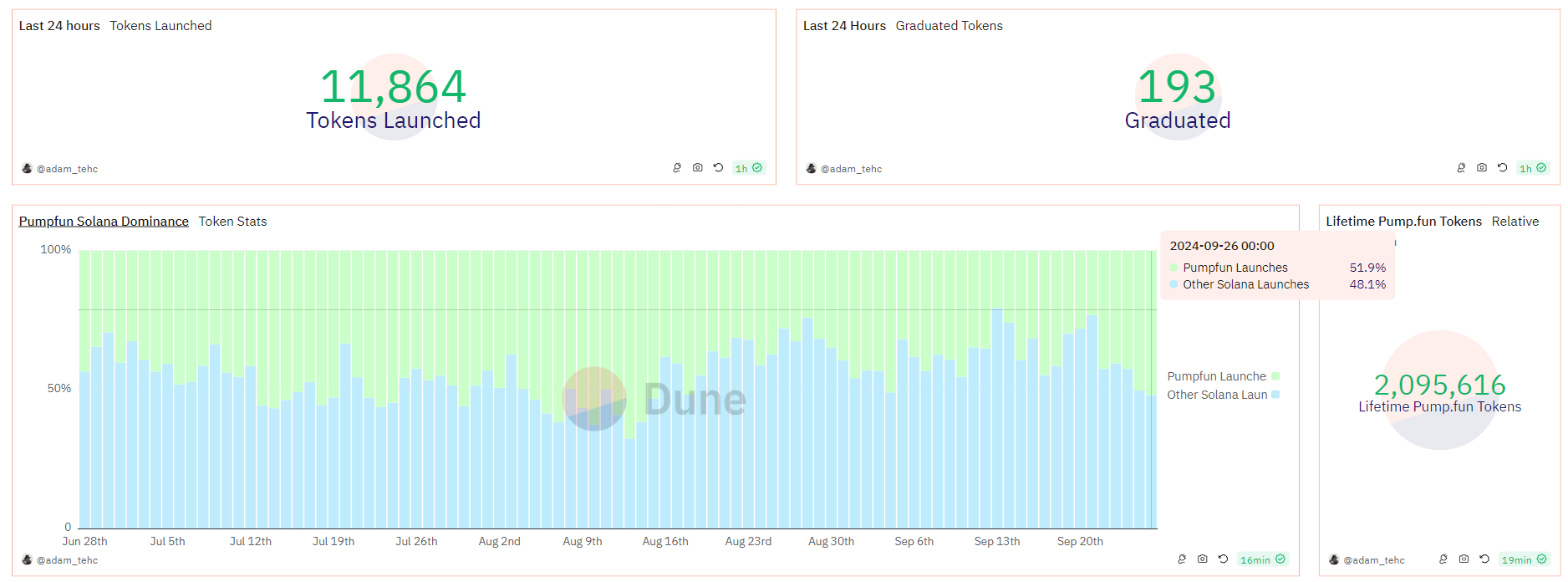

In the last 24 hours, over 11,864 tokens were launched on Solana’s PumpDotFun platform, with only 193 tokens reaching Raydium. This influx demonstrates the significant activity occurring within Solana’s ecosystem.

Notably, 51.9% of tokens from PumpDotFun are generated on Solana, suggesting that SOL is poised to benefit from the liquidity these memecoins bring.

Source: Dune

Moreover, the memecoin Bonk [BONK] recently surpassed Ethereum-based Floki Inu [FLOKI] in market cap, indicating that more liquidity is flowing into the Solana ecosystem.

This influx of new capital reinforces Solana’s position as a prominent player in the memecoin space.

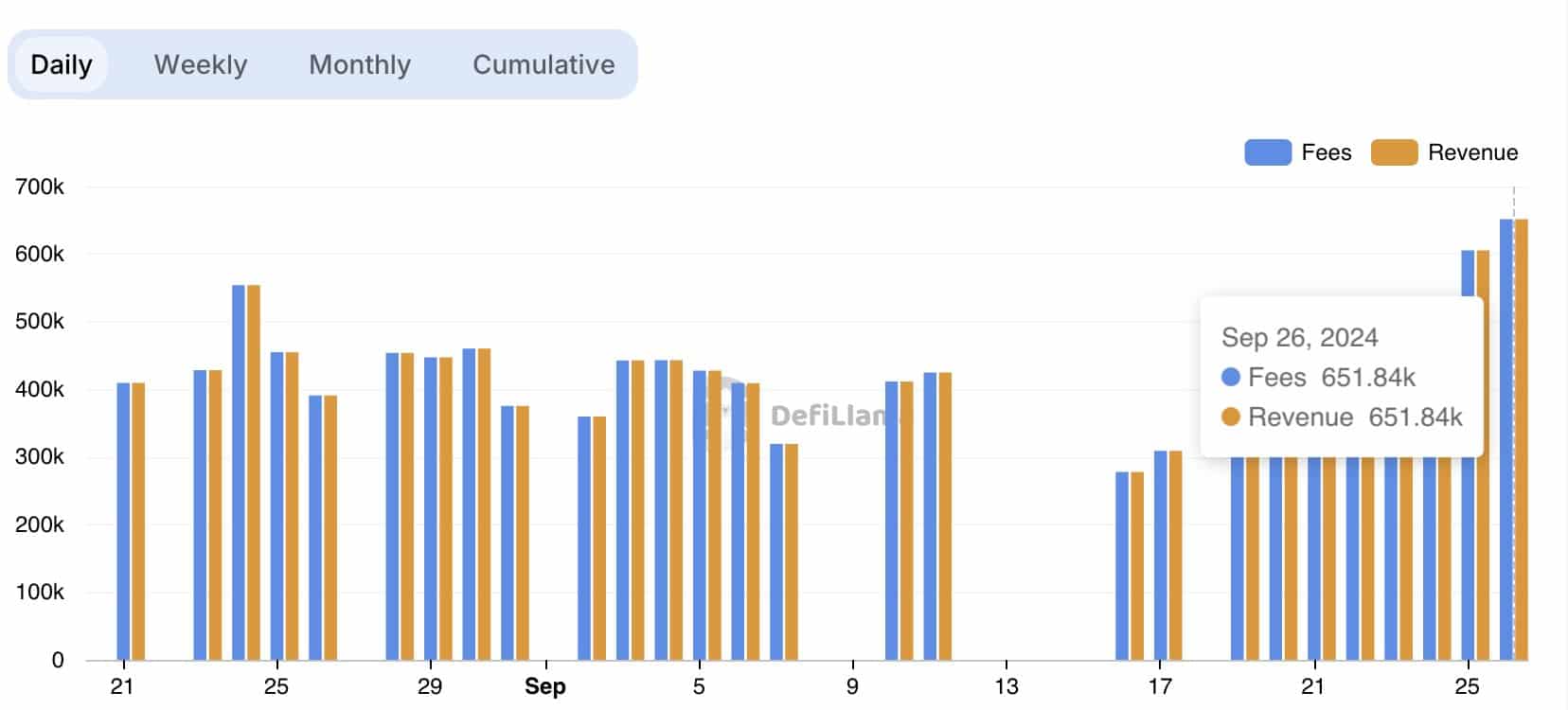

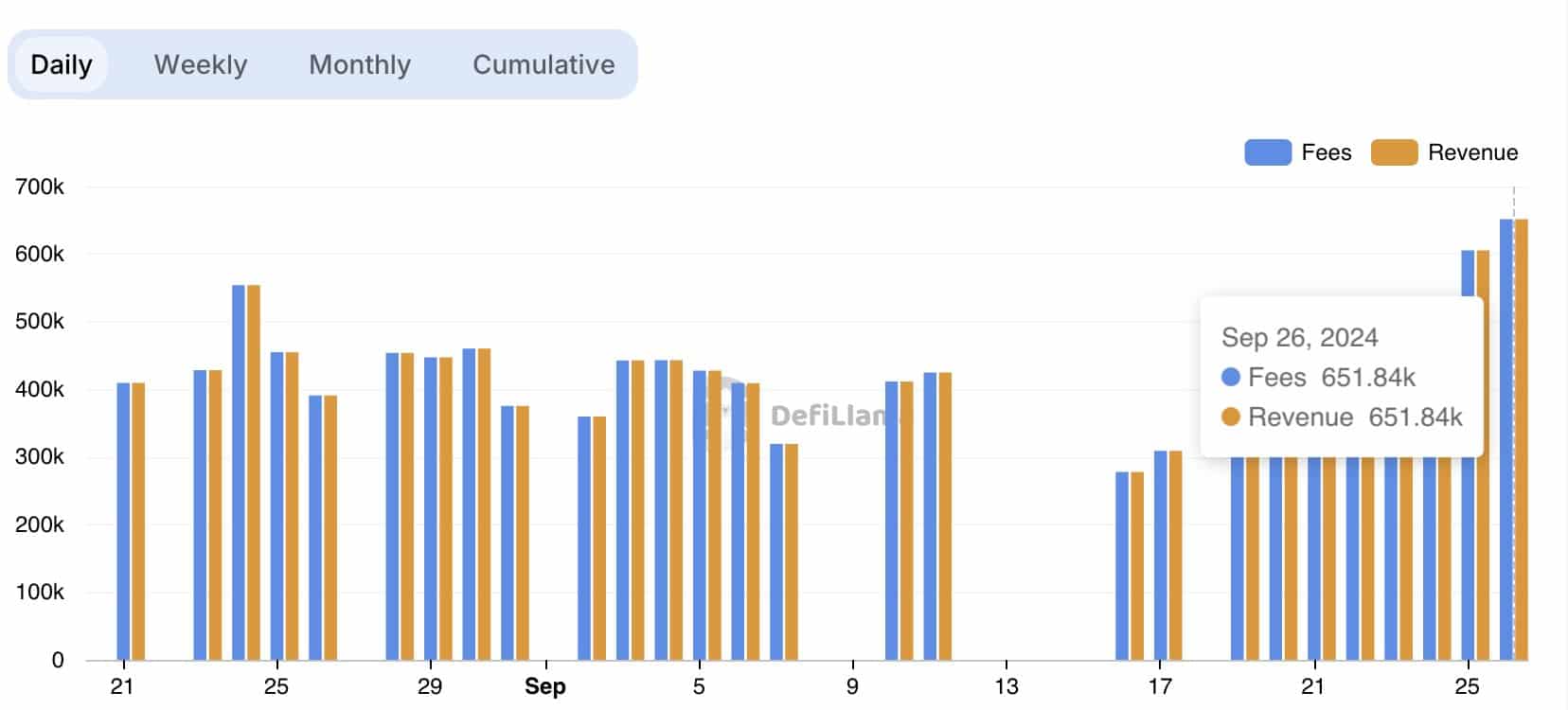

The revenue from PumpDotFun has also surged back above $600,000 in the last 24 hours, marking the first time in 30 days that the platform has reached this milestone.

This renewed interest in memecoins is driving substantial activity on Solana.

Source: DefiLlama

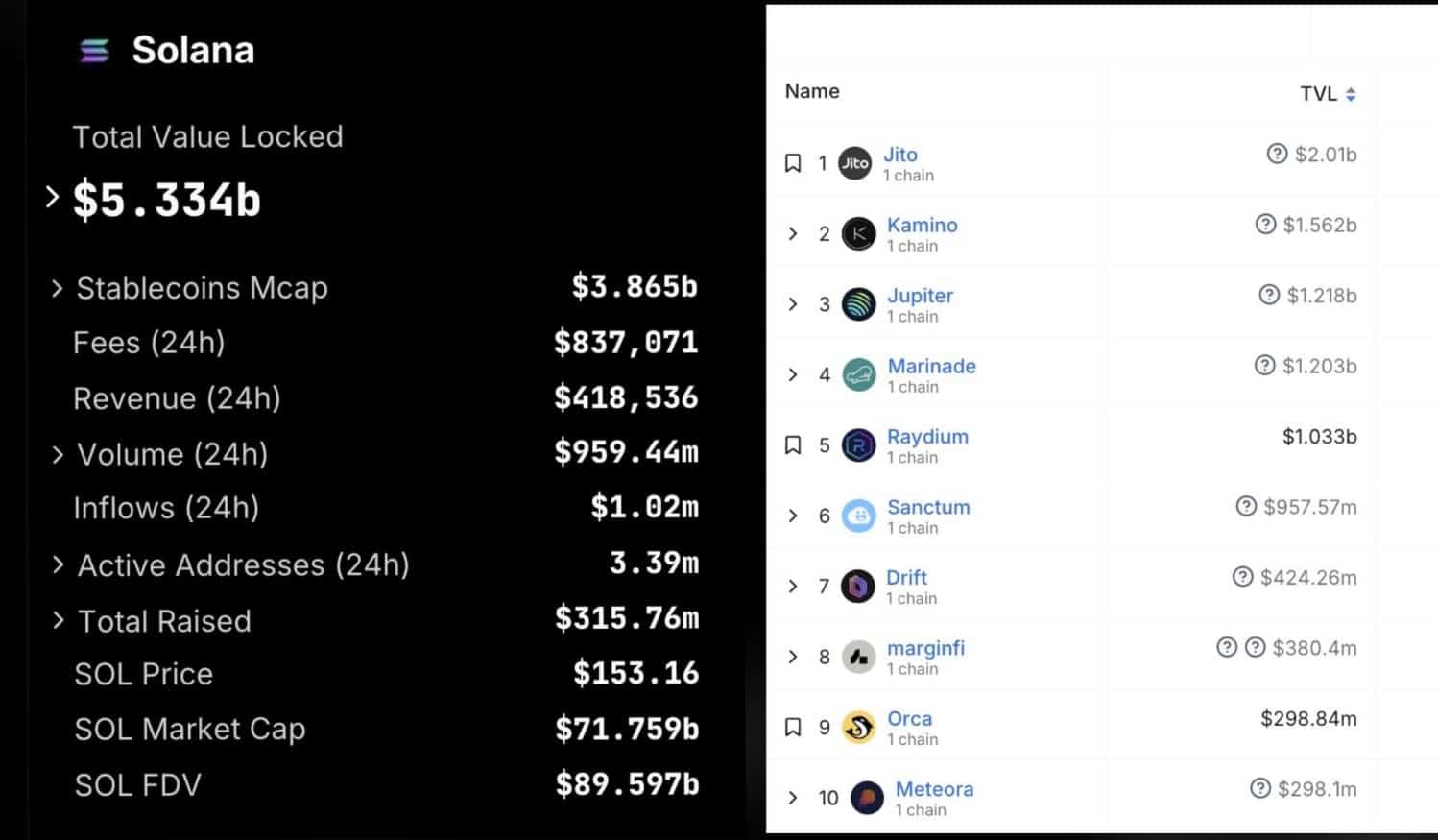

Solana’s DeFi landscape generally thriving, with the Total Value Locked (TVL) reaching $5.33 billion. This growth can be attributed to the top ten DeFi protocols on Solana, with Jito leading at $2 billion in TVL.

Other notable protocols include Kamino, Jupiter, Marinade, and Raydium, which collectively contribute to Solana’s robust DeFi ecosystem.

As more users engage with these platforms, the overall value locked in it continues to rise.

Source: Solana Floor/X

Whale activity signals market confidence

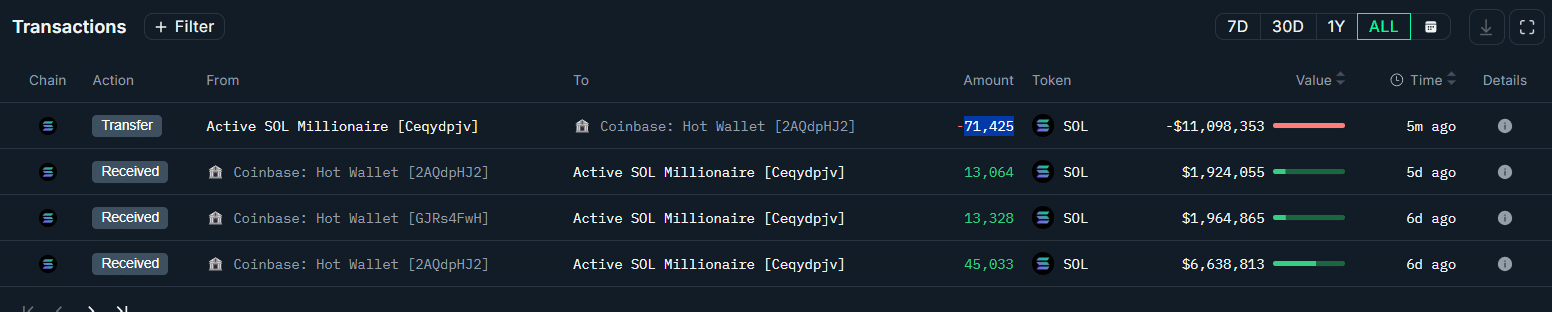

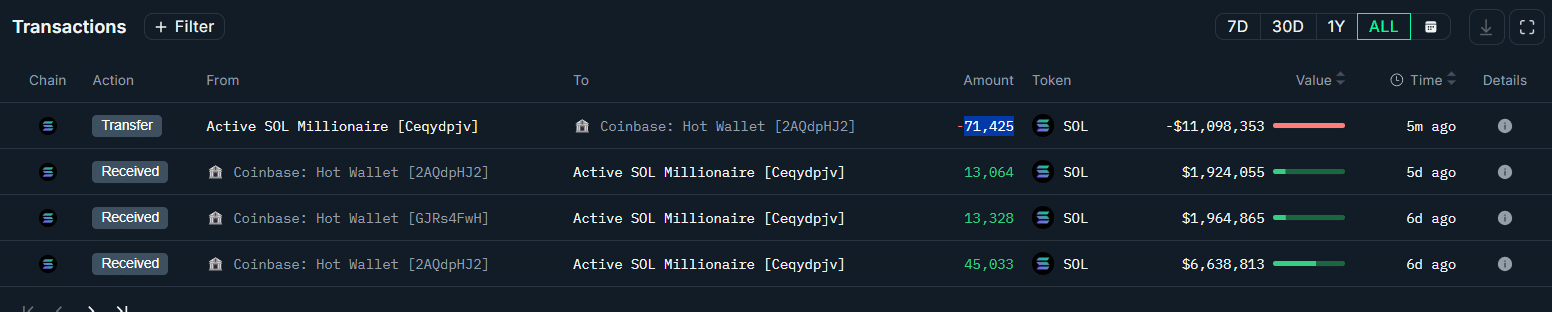

Solana whales are actively participating in the market, further highlighting the positive dynamics at play. Recently, a whale transferred 71,425 SOL, valued at $11.09 million, to Coinbase.

This whale had initially withdrawn SOL from Coinbase just six days earlier and is currently sitting on a profit of $570,000.

Source: Onchain Lens

Read Solana’s [SOL] Price Prediction 2024–2025

Another Solana whale unstaked 200,000 SOL worth $30 million over three days and deposited it into Binance. This particular whale previously unstaked 1.2 million SOL and sold it between June and July of this year.

These activities illustrate the increasing confidence in Solana’s potential, reinforcing its growing on-chain momentum. As SOL’s price continues to trend higher, it remains a cryptocurrency to watch in the coming months.

Leave a Reply