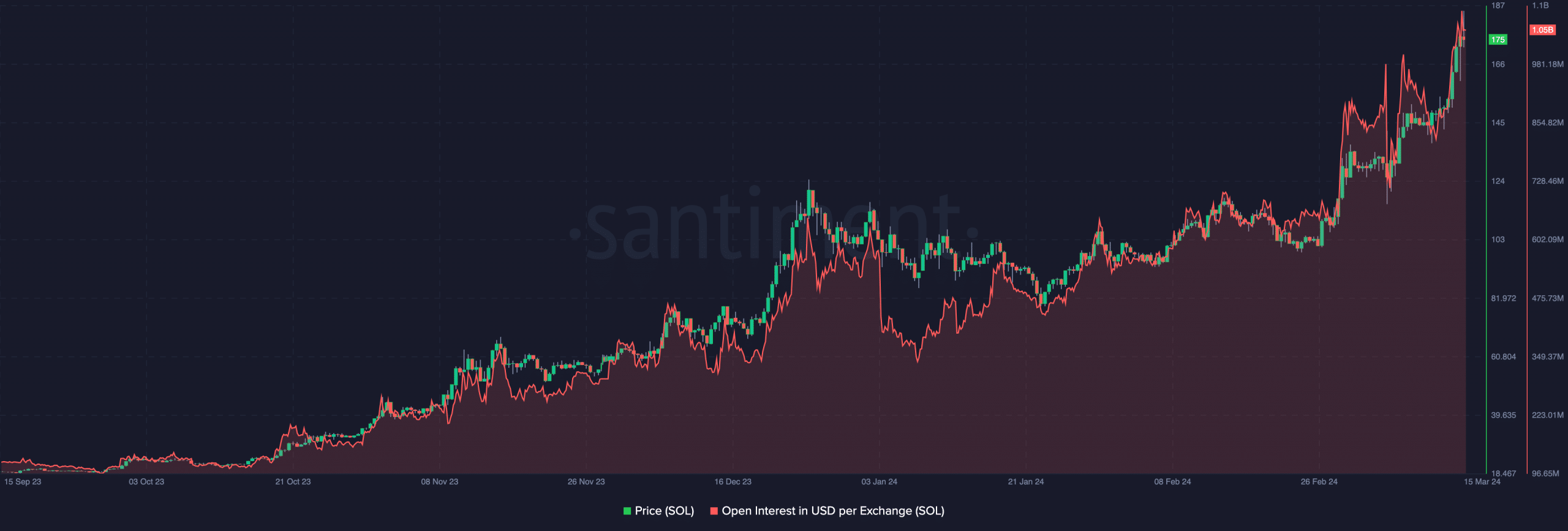

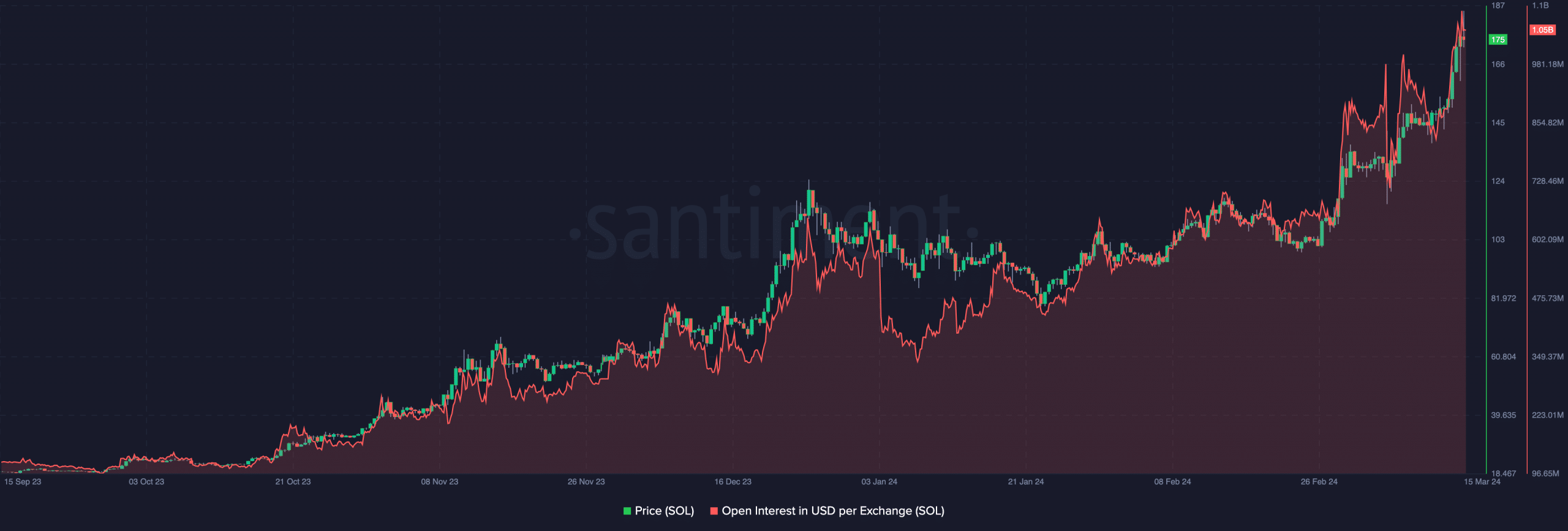

- SOL’s price hit $185.96 before its recent decline.

- Open Interest increased, suggesting that the token might trade higher soon.

If you hold Solana [SOL], it is possible that you are thanking your stars for choosing the cryptocurrency. No, it’s not because the price of the token has increased by almost 8x in the last 365 days. But time and time again, SOL has proven why traders should not fade it irrespective of the challenges it might face.

While you might wonder why, the answer lies in the 24-hour performance of the token. On the 14th of March, the broader market experience correction as price lost hold on the upswings. But not Solana.

Though the price later dropped, it went as high as $185.96 before its decline below $175. Despite the recent drawdown, SOL’s 24-hour performance was a 4.19% increase at press time when other cryptocurrencies went red.

Frenzy in Solana land

One reason why Solana’s price jumped could be linked to the demand for the token. In several articles, AMBCrypto gave in-depth details explaining how the memecoin mania has been fueling the token’s price increase.

Apart from that, SOL has been able to avoid a nosedive because of a recent Binance announcement. On the 15th of March, Binance announced that it has integrated its web3 wallet with Solana.

Source: X

This means that active users on the blockchain can access different Solana decentralized applications (dApps) via Binance’s wallet.

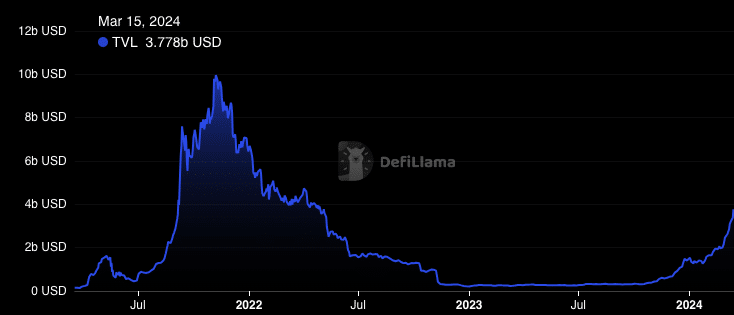

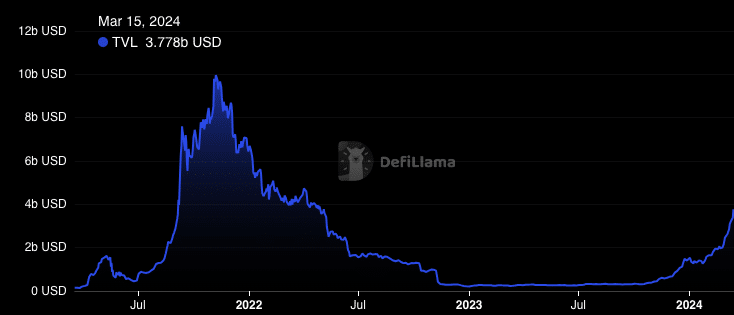

In the meantime, price action is not the only metric gathering strength. According to DeFiLlama, Solana’s Total Value Locked (TVL) has been increasing.

Bullish conviction continues to rise

At press time, the TVL was $3.77 billion. From AMBCrypto’s findings, the surge could be attributed to the increase in activity on dApps like Jupiter, marginfi, and Kamino.

The increase in TVL implies that more capital had been locked in the protocols. It also suggest that market participants seem to be enjoying better proceeds from the ecosystem.

If the overall value of asset deposited continue to rise, then the TVL might have a chance at hitting $10 billion this cycle.

Source: DeFiLlama

However, the TVL increase does not always impact the price. Therefore, we went ahead to analyze another metric. This time, the focus was on Open Interest (OI).

For those unfamiliar, the OI increases based on net positioning. When you see an increase in OI, it does not mean that there are more buyers than sellers. Instead, it suggests that buyers are more aggressive.

The opposite occurs when the OI decreases as sellers take center stage. As of this writing, Solana’s Open Interest had increased past $1 billion.

Source: Santiment

Read Solana’s [SOL] Price Prediction 2024-2025

From a price perspective, the increasing Open Interest could be good for SOL. If the value of open contracts continue to rise alongside the price, then the price might rally to $200.

If not, SOL’s bullish momentum might slow down.

Leave a Reply