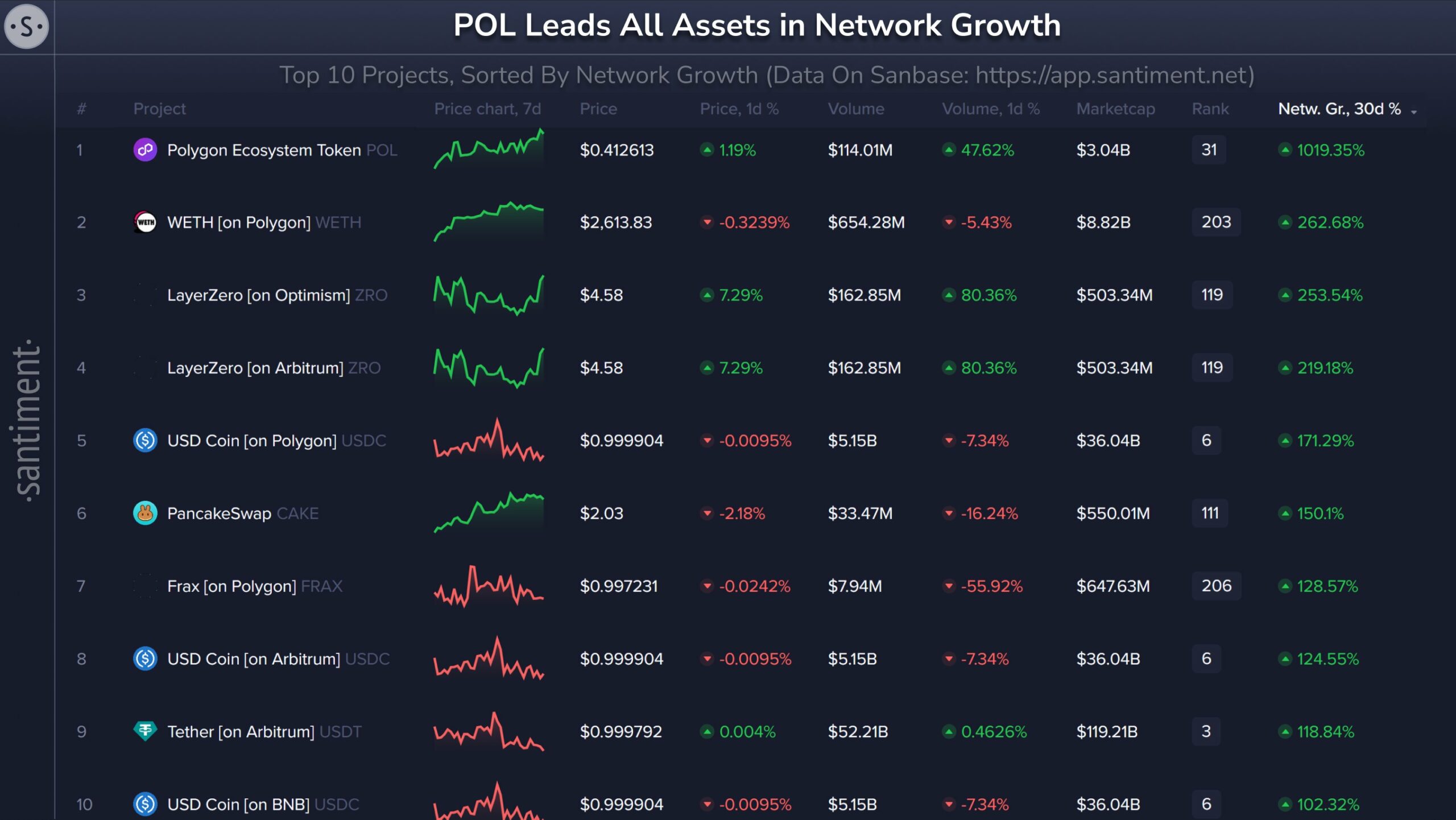

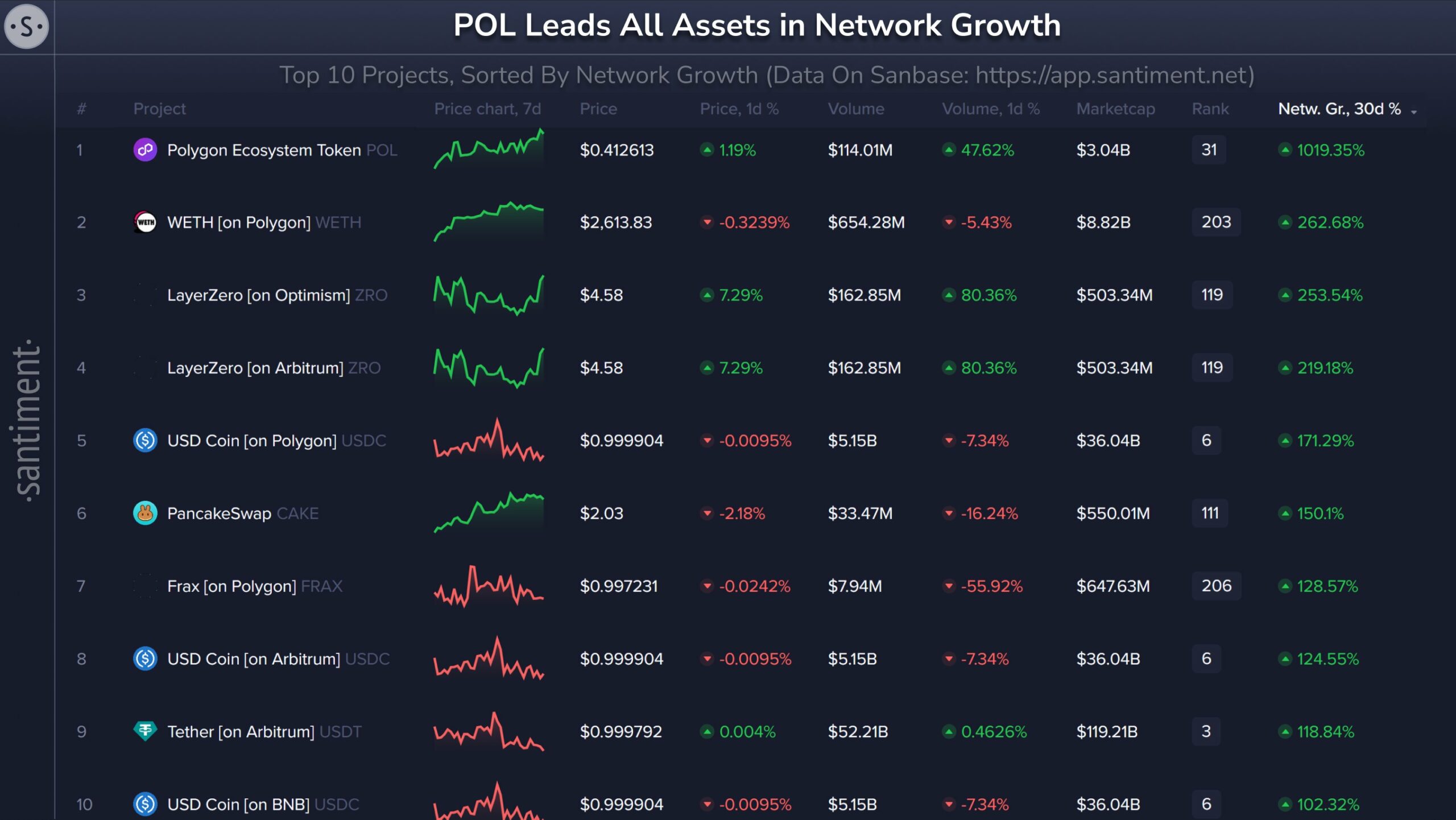

- Polygon leads all assets in network growth over the past 30 days.

- Polygon’s transaction count stands at 2.61 million, with a trading volume of $80 million in the last 24 hours.

Polygon [POL] recently transitioned from MATIC, with the upgrade process running smoothly, converting MATIC tokens to POL in a 1:1 ratio. This ensured that investors retained their portfolio value without any losses.

Following this upgrade, Polygon has led all assets in network growth over the past 30 days, showing an impressive 1,019% increase in new addresses.

This surge was followed by Wrapped Ethereum (WETH) on Polygon with 263% growth, LayerZero (ZRO) on Optimism with 254%, LayerZero on Arbitrum with 219%, and USD Coin on Polygon with 171%.

Source: Santiment

These statistics highlight that Polygon not only dominates on its own network but also in cross-chain performance. Historically, rising network growth is an indicator of increased utility, which boosts the long-term market cap potential for projects.

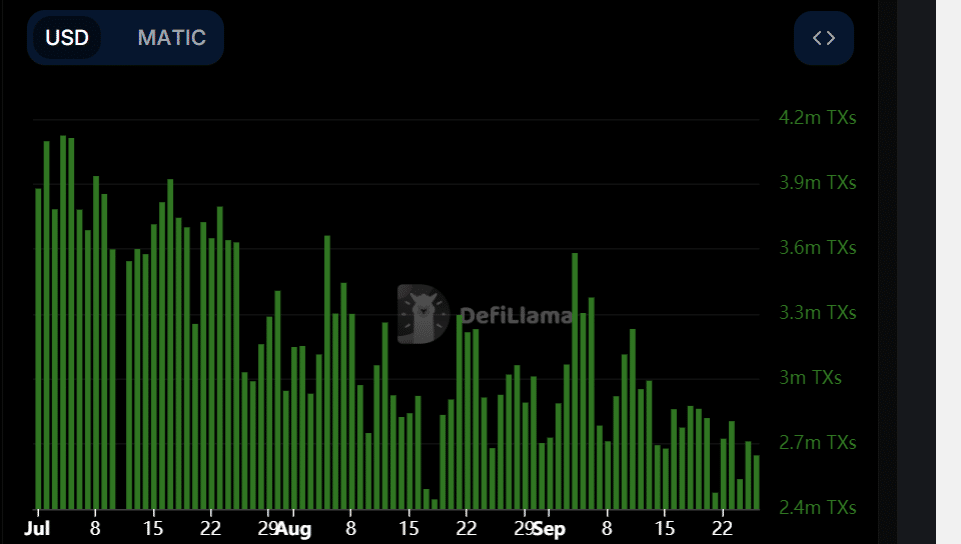

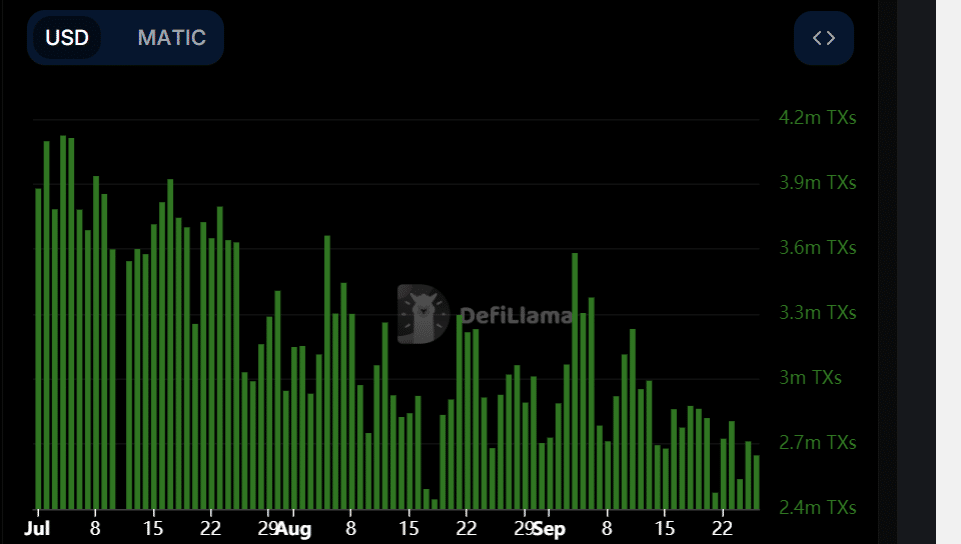

Polygon transaction count

Polygon’s transaction count has surged since the ecosystem upgrade. The transaction volume has consistently been high since July, although there were dips in mid August.

Nevertheless, Polygon’s metrics continue to show strong growth. As of the latest data from DefiLlama, Polygon’s transaction count stands at 2.61 million, with a trading volume of $80 million in the last 24 hours.

Source: DefiLlama

The inflow of POL tokens was recorded at $660 million, and the number of active addresses over the same period rose to 526,000. The total value locked (TVL) in the Polygon ecosystem reached $1.08 billion, indicating the increased activity and engagement within its ecosystem.

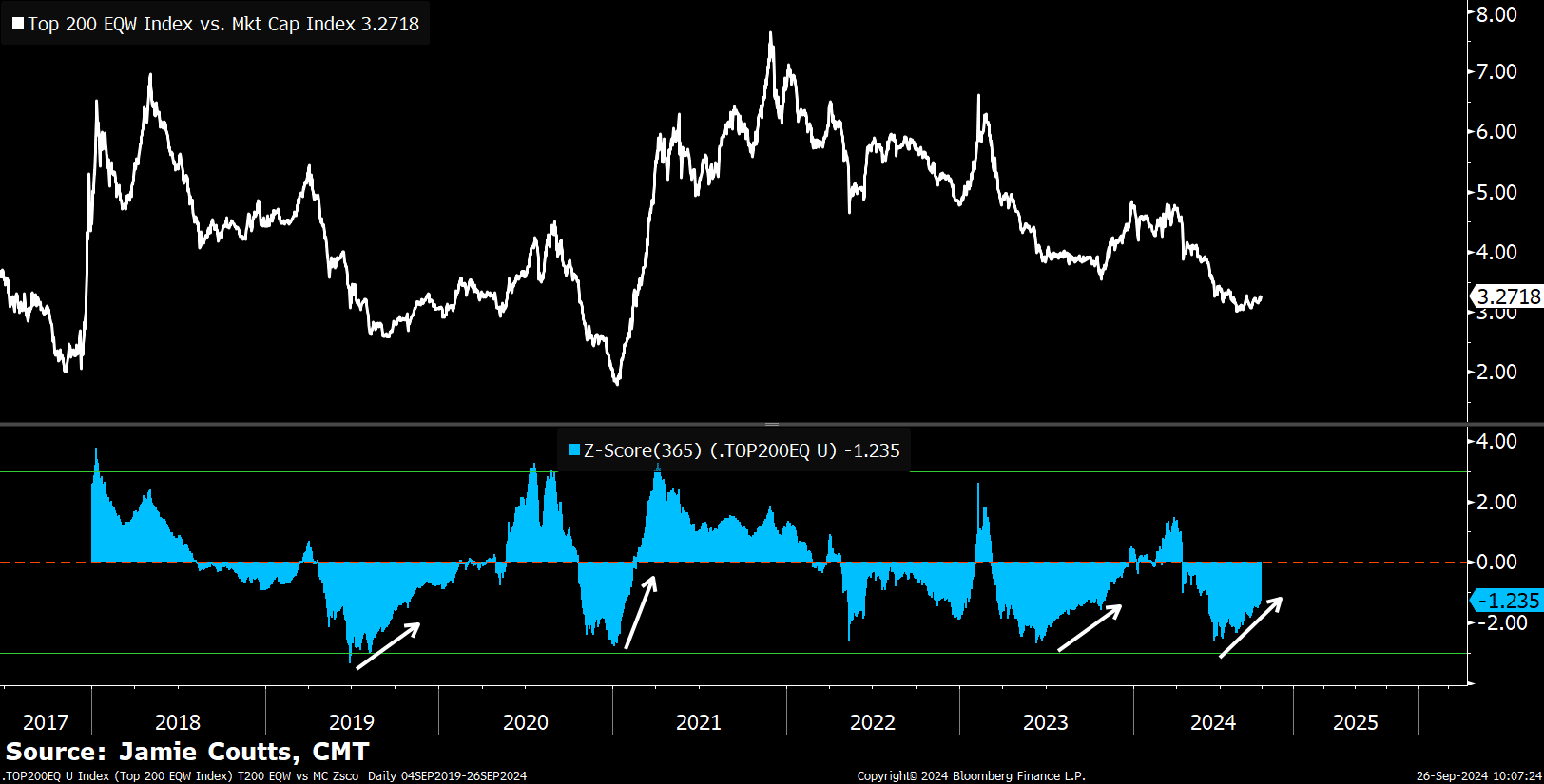

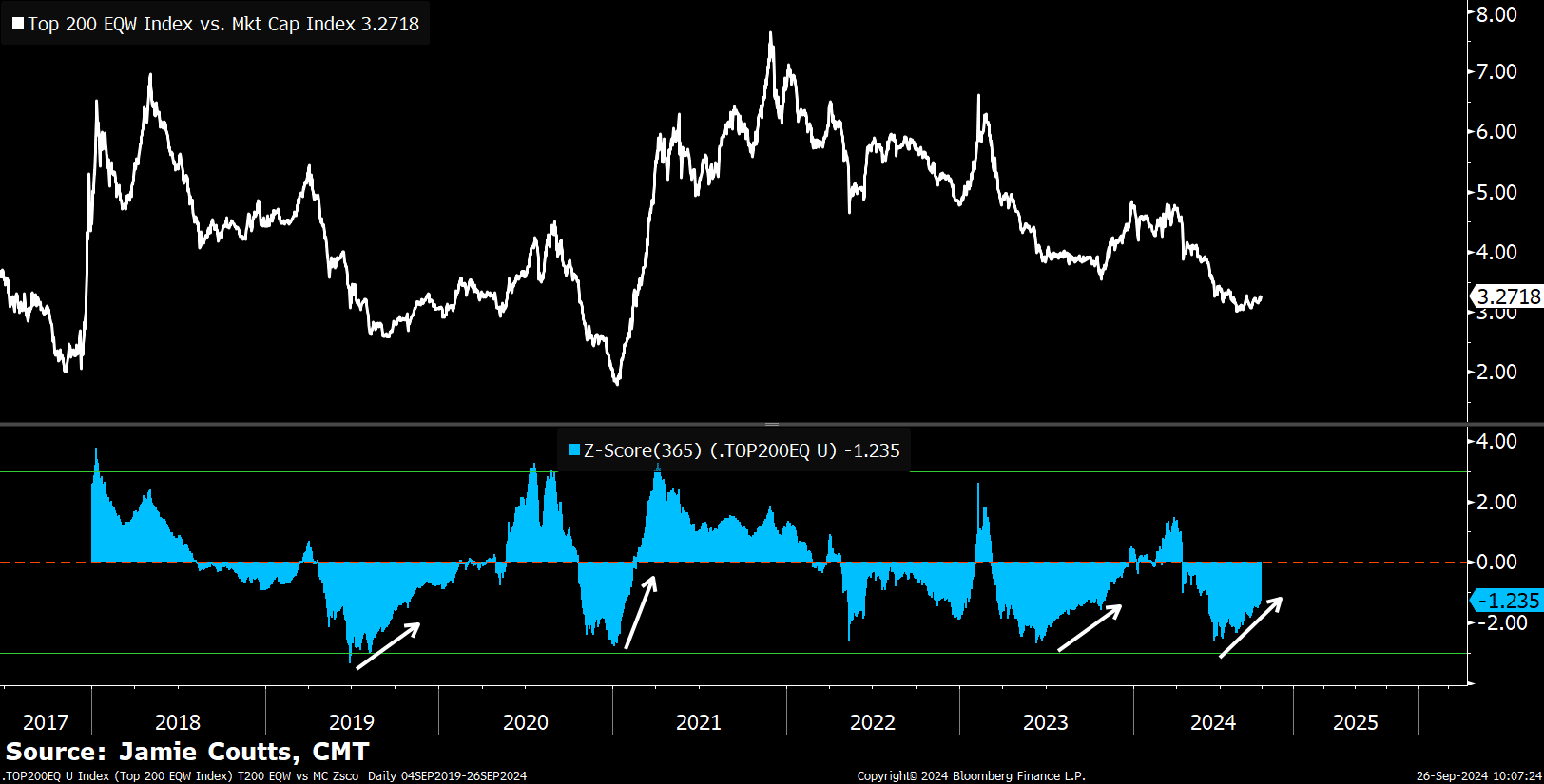

Crypto market breadth improving…

The broader crypto market is also showing signs of improvement. The Crypto Top 200 index vs. the Equal Weight index has proven to be a reliable indicator of market sentiment.

This index became extremely bearish on altcoins in July but is now turning higher in line with global liquidity. Historically, such shifts have been followed by periods of strong performance in the crypto market.

Source: Jamie Coutts, CMT

Given the rapid growth in the Polygon ecosystem and its strengthening market position, it is poised to be a solid investment for long-term gains.

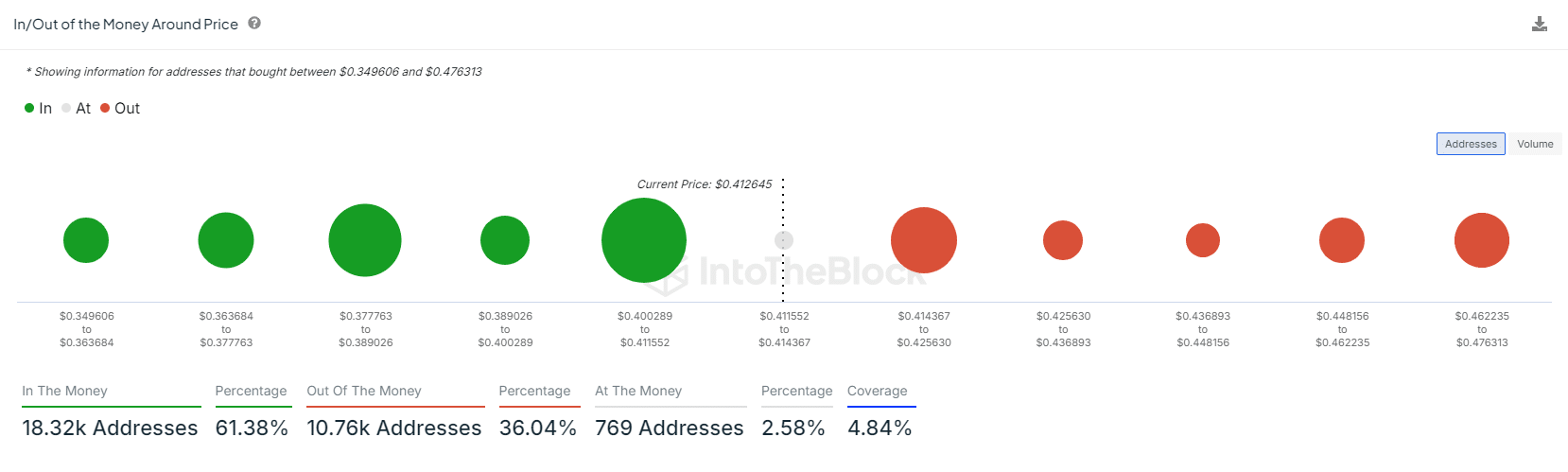

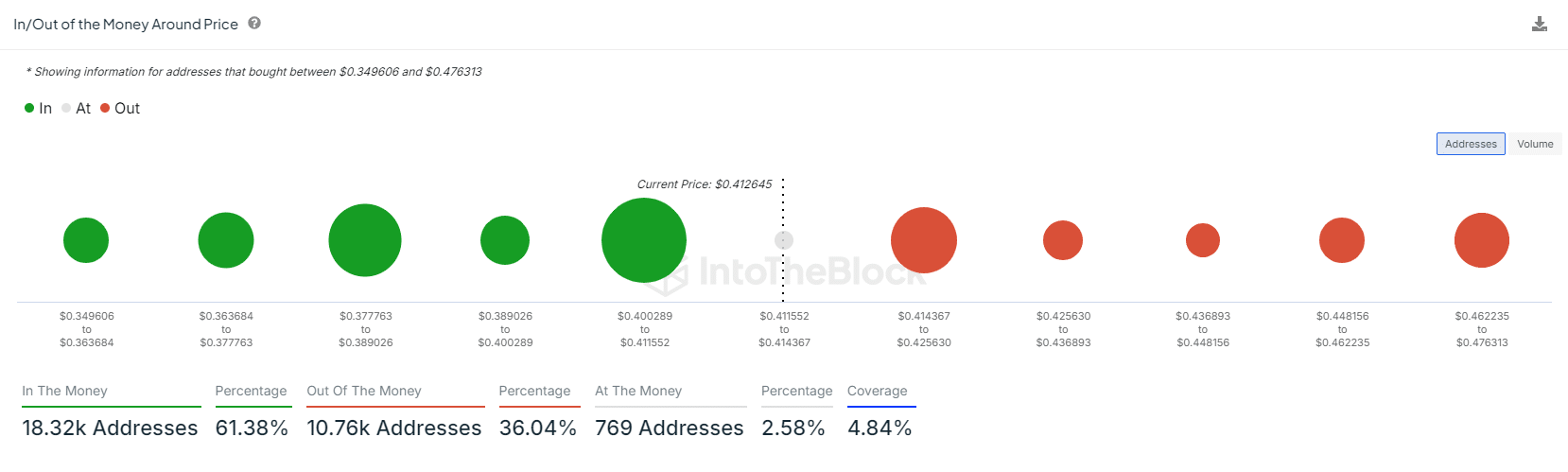

In/out of the money around price

When assessing the “in/out of the money” metric, data reveals the largest number of profitable addresses. Approximately 7.03K addresses fall within the $0.4002 to $0.4116 price range.

Overall, 61.38% of addresses holding POL are in profit. This means 18.32K addresses show gains. In contrast, 36.04% of addresses, or 10.76K, are out of the money. Only 2.58% of addresses, around 769, are neutral.

Source: IntoTheBlock

Is your portfolio green? Check out the POL Profit Calculator

This data shows that Polygon’s future prospects are strong, with many holders benefiting from current price levels. It indicates a solid foundation for future growth.

With all these metrics aligned, Polygon (POL) is well-positioned for its price to move higher. This is supported by increased network growth, active transaction volume, and long-term investment potential.

Leave a Reply