The crypto markets faced a massive setback at the beginning of the month as global factors influenced the cryptos and the traditional financial markets. The growing fear of war between Israel & Iran is said to disrupt many things. This is impacting the markets as Bitcoin is slowly losing local support every day, and with the latest pullback, a drop below $60,000 is largely expected.

What’s next for the crypto markets? When will the tokens begin to recover? After the bearish September was flipped, will the bullish October also be flipped?

The rejection of $66,000 has raised suspicion that the BTC price will remain stuck within a descending parallel channel with support close to $53,000. Unless and until the price breaks above the resistance at $68,000, the fear of testing the support looms over Bitcoin. Now the price has rebounded from the average bands of the channel but a drop below $60,300 may validate a bearish move towards the support.

A similar drop is observed with the Ethereum price rally as the token failed to sustain above $2600 but has been defending the ascending trend line, which has been strong support since June 2022. The ETH price is required to surpass $2682 and this move will validate the beginning of a fresh bullish spell.

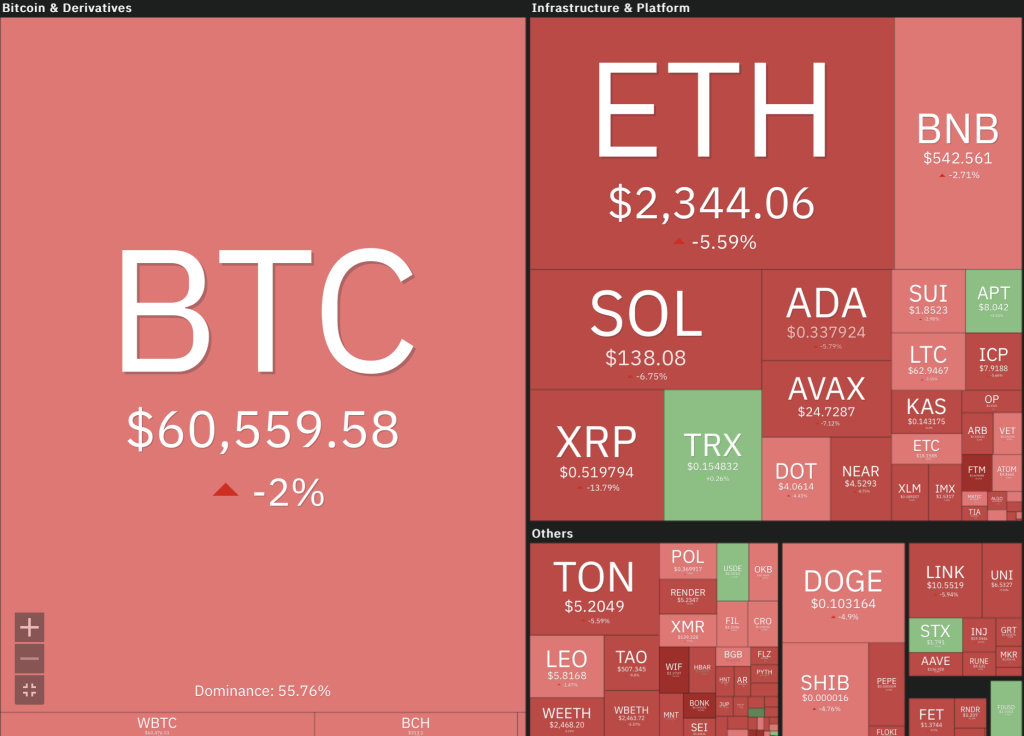

Besides, cryptos like Solana, Dogecoin, Toncoin, Cardano Avalanche, Shiba Inu, etc. and a few more witnessed a price drop between 2% and 5%, while Tron is trying hard to keep up a bullish trend with a +0.13% price surge. Interestingly, the Flare token (FLR) has emerged as the leader among the top gainers, gaining more than a 16.5% jump, while the XRP token is facing a pullback of over 10% since the start of the day.

The Global crypto market cap has dropped by over 1.35%, while the 24-hour trading volume has also plunged over 20% in the past 24 hours. Meanwhile, Bitcoin dominance continues to surge by over 0.57, which stands at around 56.82%. The current market dynamics are in favour of the bears and hence the top tokens are believed to maintain a consolidated descending trend for a few more days.

Leave a Reply