- Aave reached its highest price in over a year at approximately $172, indicating a strong bull trend.

- The Total Value Locked (TVL) in the network surged to over $13 billion in 2024, nearing its 2021 levels, driven by increased activity.

Aave [AAVE] has been on a bullish trajectory over the past few weeks, reaching its highest price point in over a year during the latest trading session. On-chain data analysis indicates a robust bull trend, further supported by increased Total Value Locked (TVL) activities.

Aave sets a new annual price record

In the daily time frame, AAVE closed the last trading session at approximately $172, marking an almost 6% increase. This price level has not been retested since May 2022, making it a significant milestone for the cryptocurrency.

Source: TradingView

The recent surge has established a new support level at $136, with a longer-term support around $128, indicated by its short-term moving average (yellow line).

The Relative Strength Index (RSI) has remained above the neutral line for over a month, signaling a sustained bull trend since August. Currently, the RSI hovers around 70, entering the overbought zone due to the recent price rise.

Market capitalization mirrors price trends

AAVE’s market capitalization has climbed in tandem with its price. According to CoinMarketCap, the market cap now exceeds $2.5 billion. This is a substantial increase from a year ago when it stood at around $882 million.

The most notable growth occurred around August, jumping from approximately $1.3 billion to $2 billion.

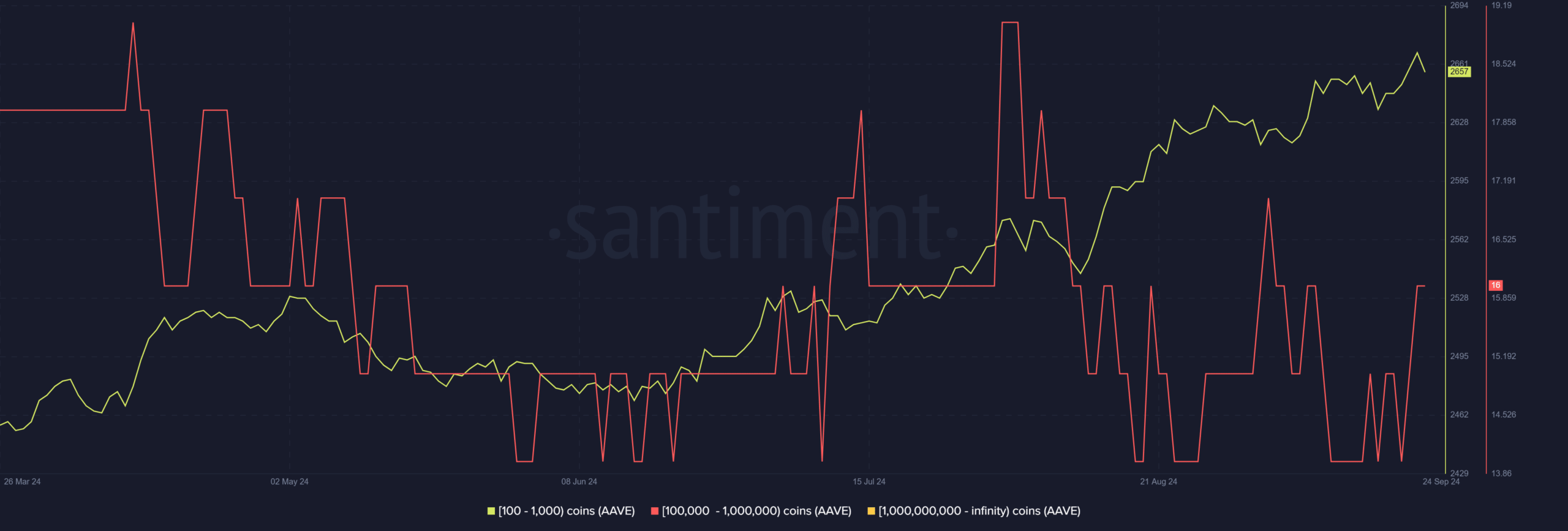

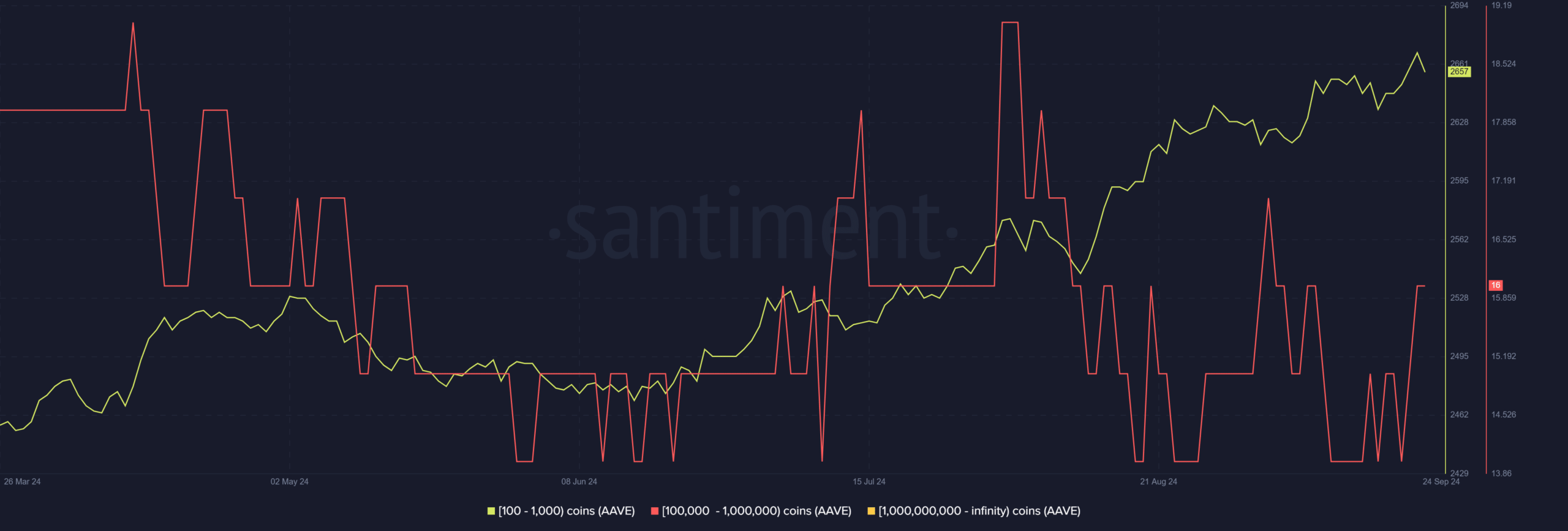

Bullish signals from Aave’s on-chain data

On-chain indicators reveal increased accumulation of AAVE over the past few months. The total number of holders with a non-zero balance rose from around 168,000 to about 170,000 before a slight dip to 169,000.

This uptick indicates that more wallets have been purchasing the asset recently.

Source: Santiment

Further analysis shows heightened activity among AAVE sharks and whales. The number of wallets holding between 100 and 1,000 AAVE tokens increased by over 1,000.

Additionally, wallets holding between 100,000 and 1 million tokens grew by two in the last three days, signifying significant accumulation by large holders.

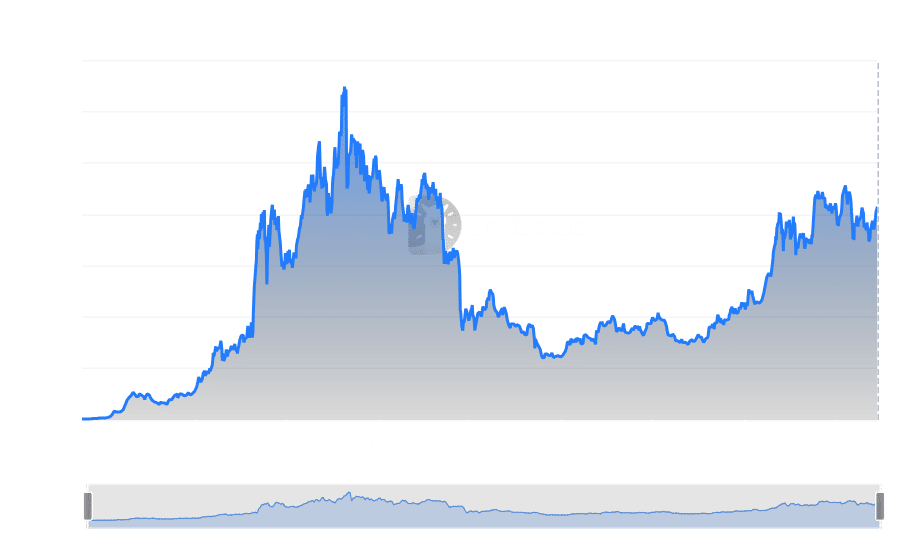

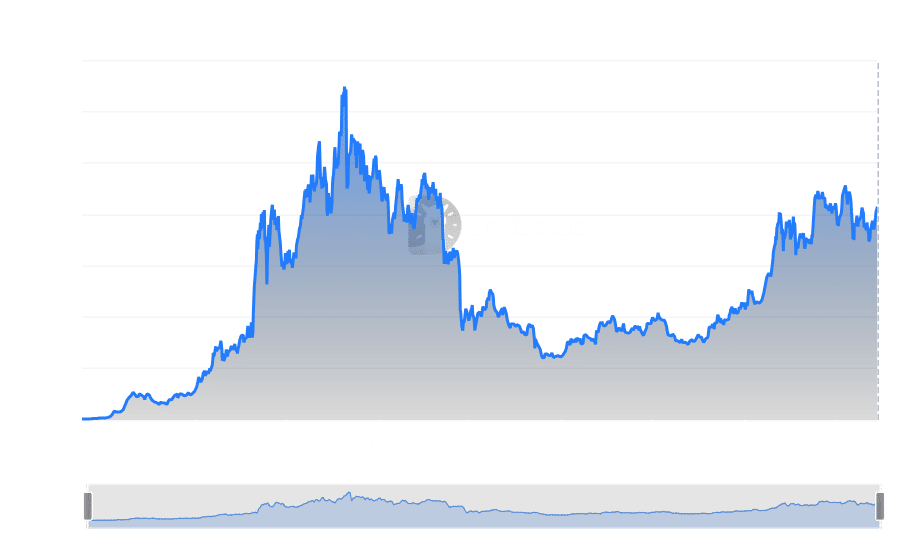

TVL experiences significant growth

According to a Santiment report, Aave’s increased activity is partly due to a loss of trust in Curve Finance, which suffered a major security breach during the summer of 2024.

Aave’s expansion into Layer 2 (L2) platforms has also contributed to the uptick in activity.

Source: DefiLlama

An analysis of Aave’s TVL on DefiLlama confirms this growth, bringing it closer to its 2021 levels. The TVL dropped to around $7 billion in May 2022 but rebounded to approximately $6.38 billion at its peak in 2023.

In 2024, the TVL surged to over $13 billion in the current quarter. At the time of writing, the TVL stands at around $12.4 billion.

Is your portfolio green? Check out the Aave Profit Calculator

Conclusion

Aave’s impressive price performance and the bullish signals from on-chain data suggest a strong upward momentum.

The increased market capitalization, growing number of holders, and significant rise in TVL all point to Aave’s strengthening position that could continue for a while.

Leave a Reply