- Solana outperforms Ethereum in terms of Capital Efficiency.

- Even though Solana’s ecosystem saw growth, the price of SOL witnessed volatility.

Solana [SOL] has been on a roll over the last few weeks as its prices have surged due to the rising popularity of the network. One of the reasons for the growing popularity of Solana would be its Capital efficiency.

Solana takes the lead

Capital efficiency, crucial in Traditional Finance (TradFi), reflects a company’s adeptness in utilizing financial resources.

In DeFi, it underpins protocol vitality and sustainability, driving maximized returns, competitive edge, liquidity enhancement, risk reduction, and innovation promotion.

Liquidity efficiency in DeFi is essential, employing strategies like LP management, collateral assets, and protocol-owned liquidity.

Reflexivity Research’s analysis compared Capital Efficiency on Solana with Ethereum in the DeFi sector, indicating how it was much better.

The data indicated that Solana’s design boasts several features that enhance capital efficiency in DeFi. Faster transaction speeds and lower fees compared to Ethereum which meant less capital was tied up waiting for confirmation.

Moreover, parallel processing allowed for efficient handling of DeFi operations. Solana’s architecture also separates data storage from code, potentially lowering costs.

Positive capital efficiency can be a game-changer for Solana in the competitive DeFi landscape. By attracting users with faster transactions, lower fees, and the ability to do more with less locked-up capital, Solana can cultivate a thriving DeFi ecosystem.

This virtuous cycle of efficiency attracts more users and developers, fueling innovation and further solidifying the network’s position as a leading DeFi platform.

Ultimately, positive capital efficiency positions Solana to not only compete with, but potentially outperform, established DeFi players like Ethereum.

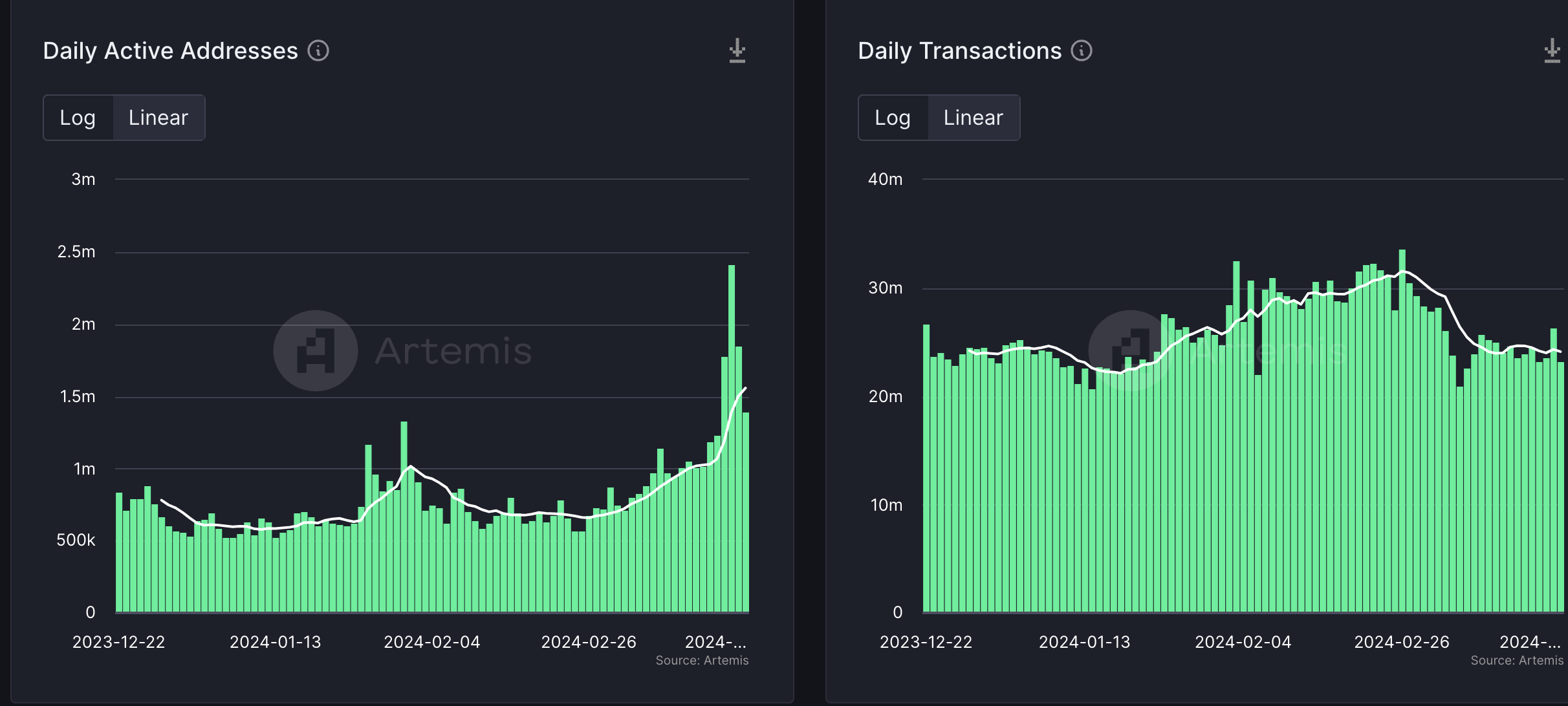

AMBCrypto’s analysis of Artemis’ data indicated that the number of daily active addresses on the Solana network grew from 870,000 to 1.56 million. The number of transactions occurring on the Solana network also remained the same.

Source: Artemis

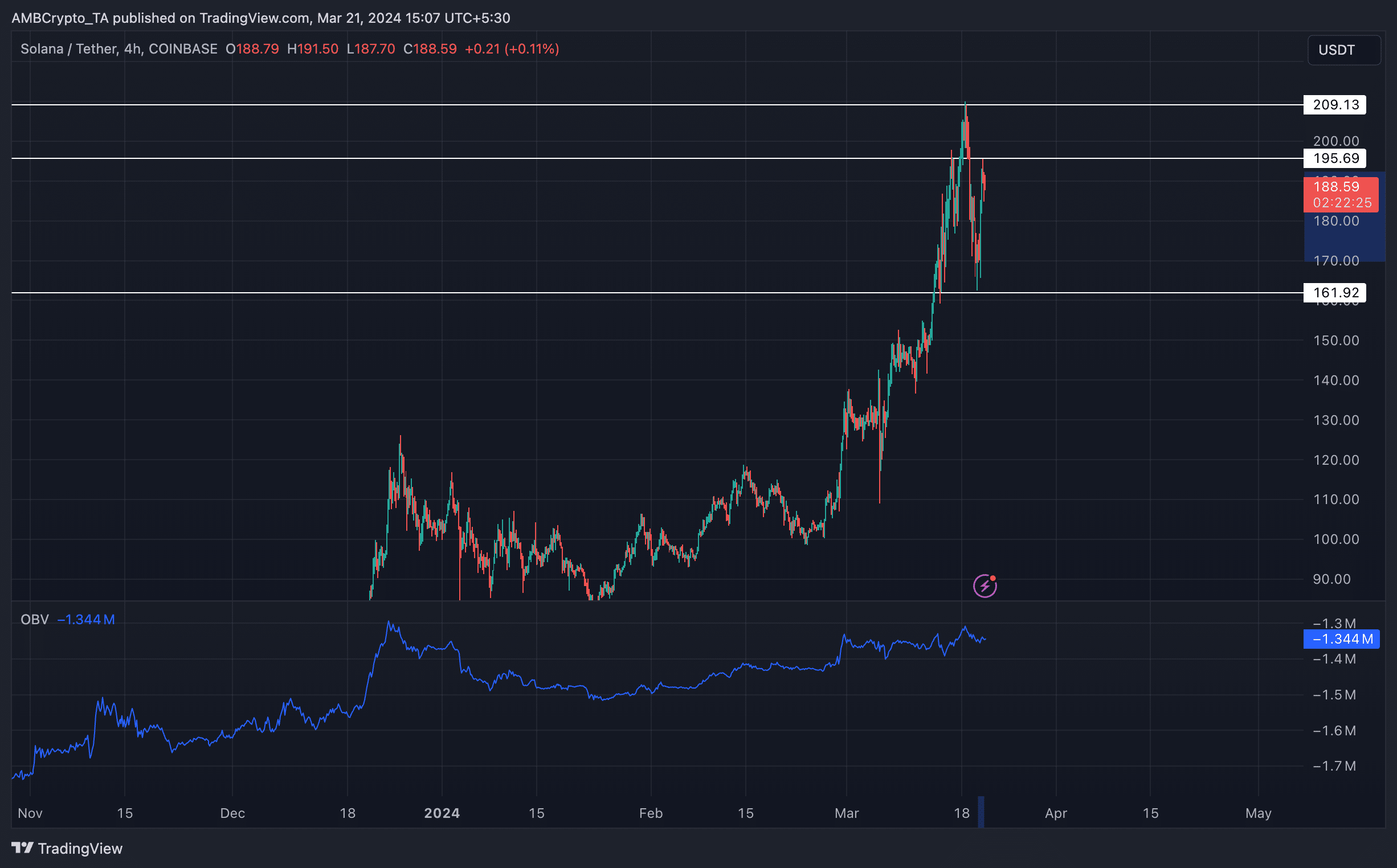

Despite the positive performance of the network, the price of SOL witnessed some volatility. In the last few days, the price of SOL fell by 20% after reaching the $209 level.

How much are 1,10,100 SOLs worth today?

After that, the price of SOL regained positive momentum and surged by 13.42% and climbed up to $195.69 level. Despite this, the OBV of SOL declined.

A decline in OBV despite a price rise for SOL suggests weaker buying pressure, which could lead to a reversal in the upward trend or limit future price gains.

Source: Trading View

Leave a Reply