- The borrowed funds in BTC have hit a yearly high.

- The price continues to struggle around the $60,000 price range.

Bitcoin [BTC] recently broke through its psychological barrier, entering the $60,000 price range. However, this milestone has brought significant pressure, with some whales taking profits and Bitcoin’s Estimated Leverage Ratio hitting a year-high.

Bitcoin leverage hits a year-high

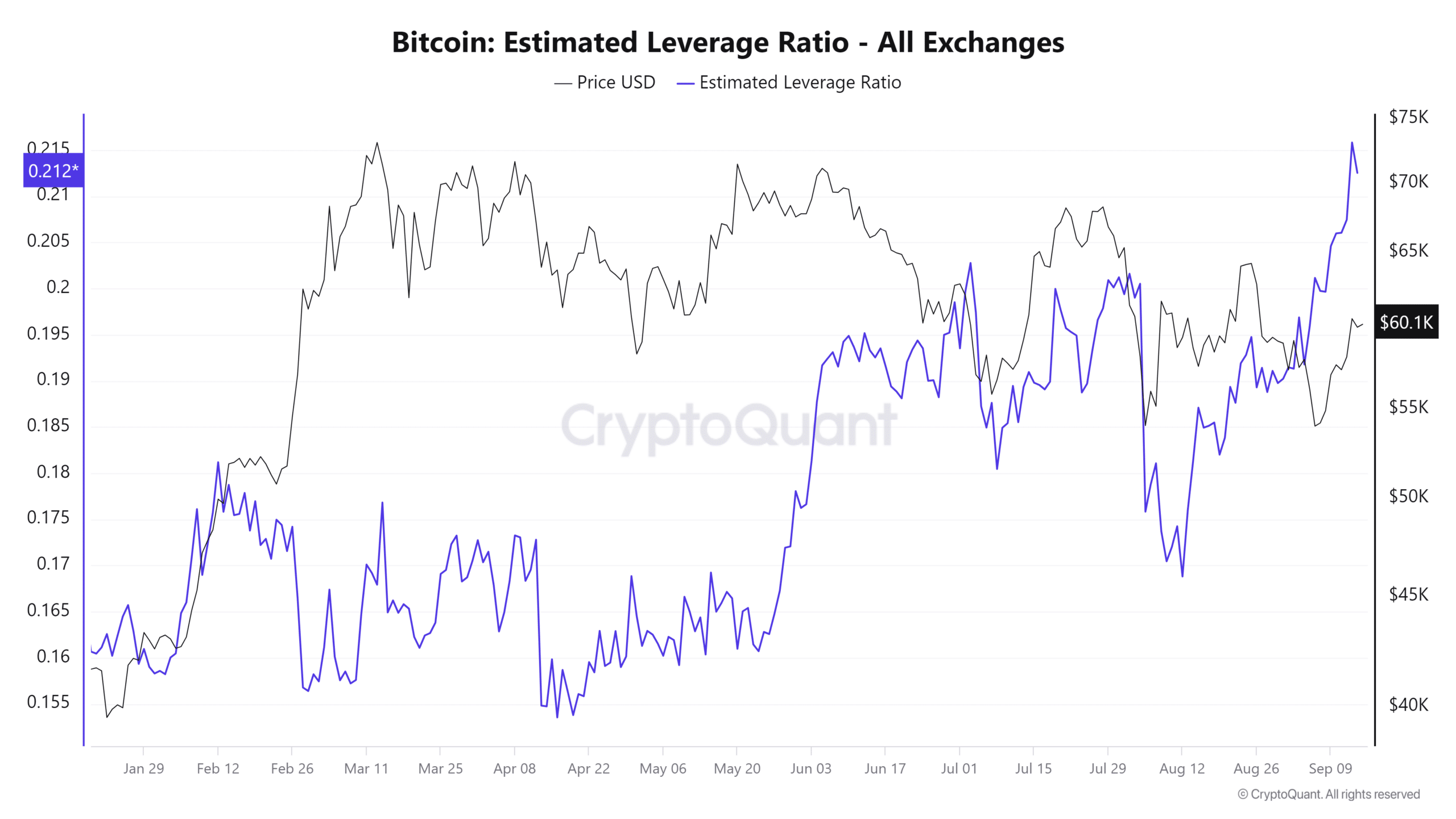

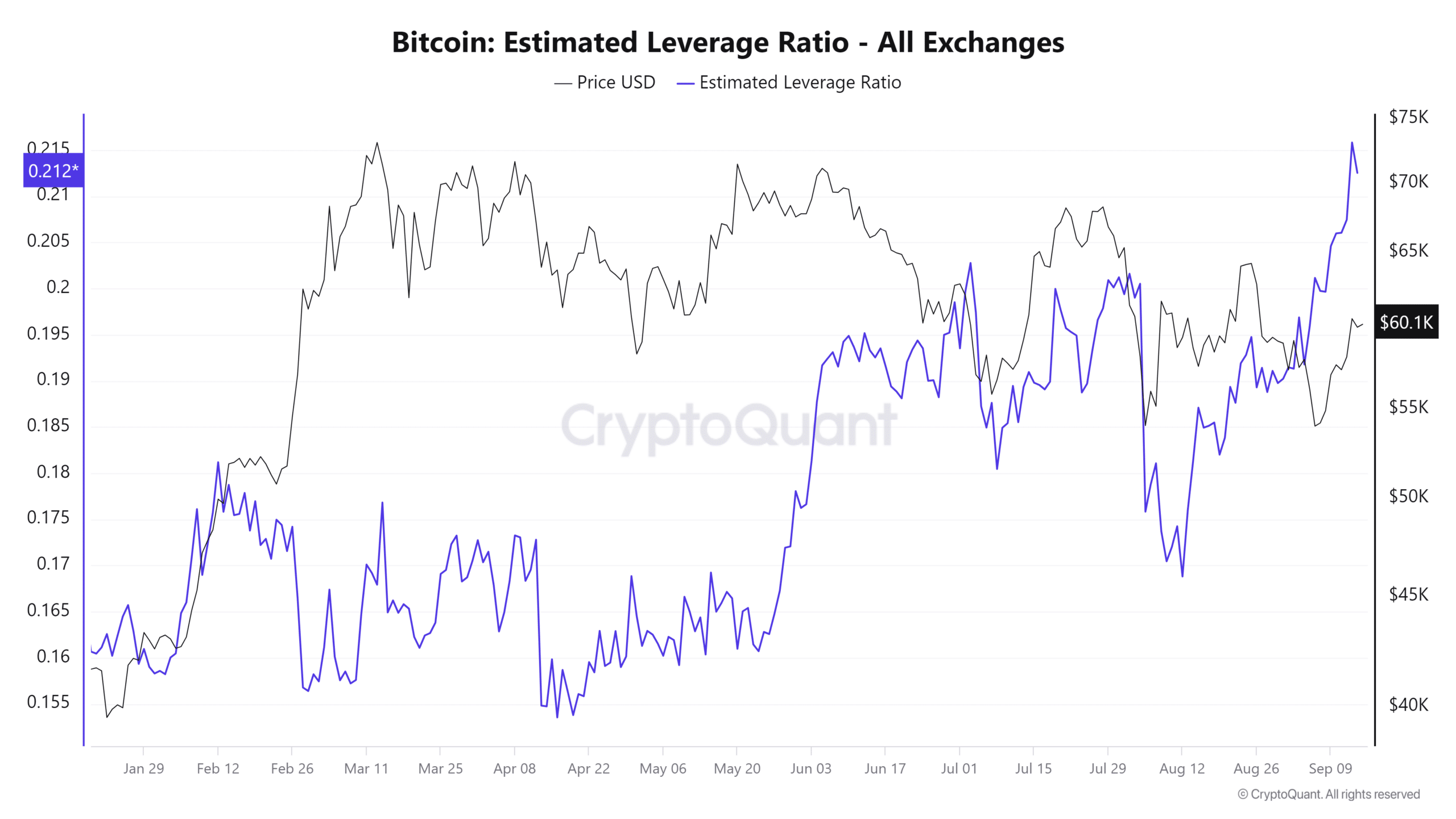

According to data from CryptoQuant, Bitcoin’s Estimated Leverage Ratio surged to 0.216, the highest level seen in 2024. This metric reveals how much leverage (borrowed funds) is being used in Bitcoin trading.

Source: CryptoQuant

An increase in leverage typically suggests that traders are taking on more risk. Suppose the BTC price moves in the opposite direction of these leveraged positions.

In that case, it can lead to large-scale liquidations as leveraged positions are forcefully closed. This often results in rapid price drops.

Additionally, a rising leverage ratio signals potential price volatility. As more leverage enters the market, price movements, whether upward or downward, are amplified.

If BTC continues to rise alongside increasing leverage, it could lead to an overheated market, where any pullback might cause significant liquidations.

Alternatively, a sudden price drop could trigger liquidations, causing a sharp decline in BTC’s price.

Bitcoin faces resistance after price break

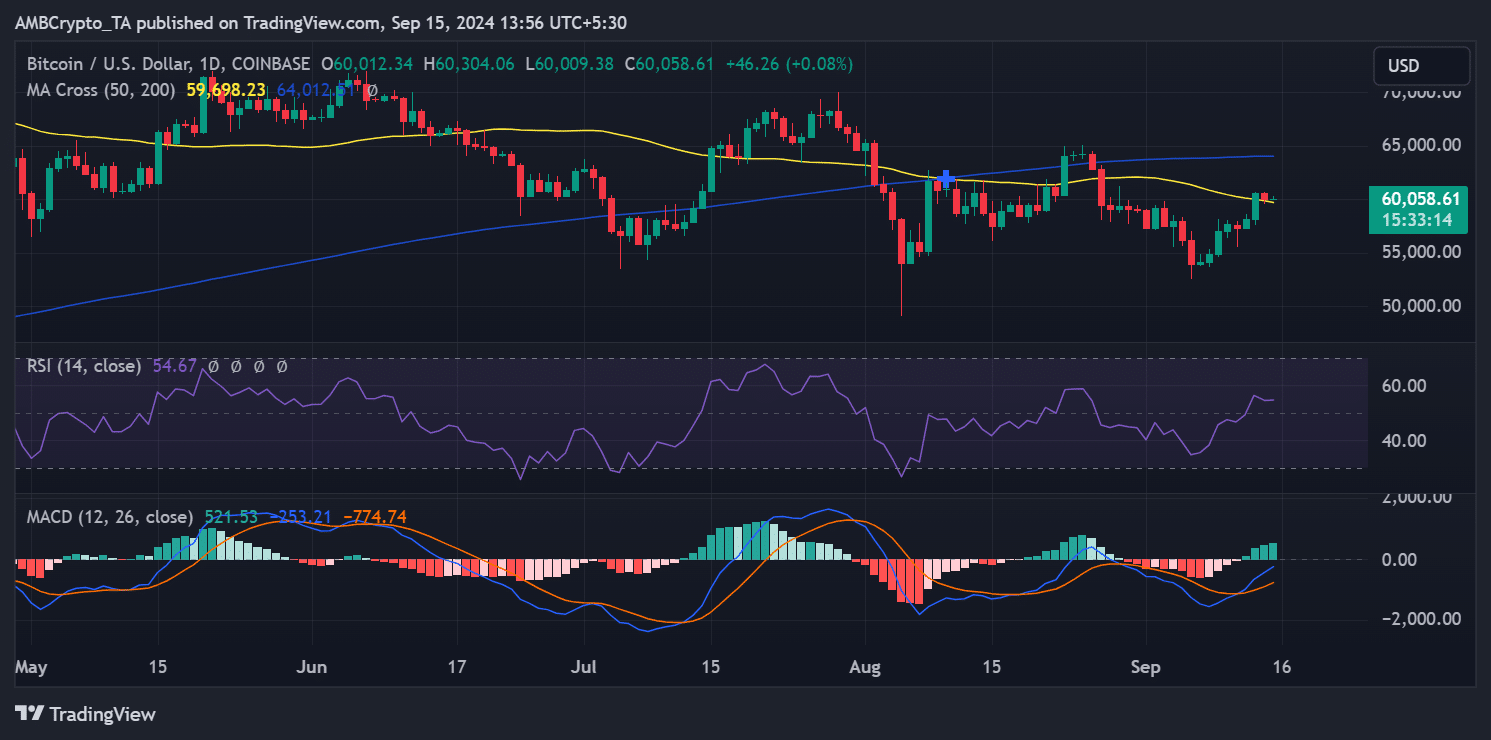

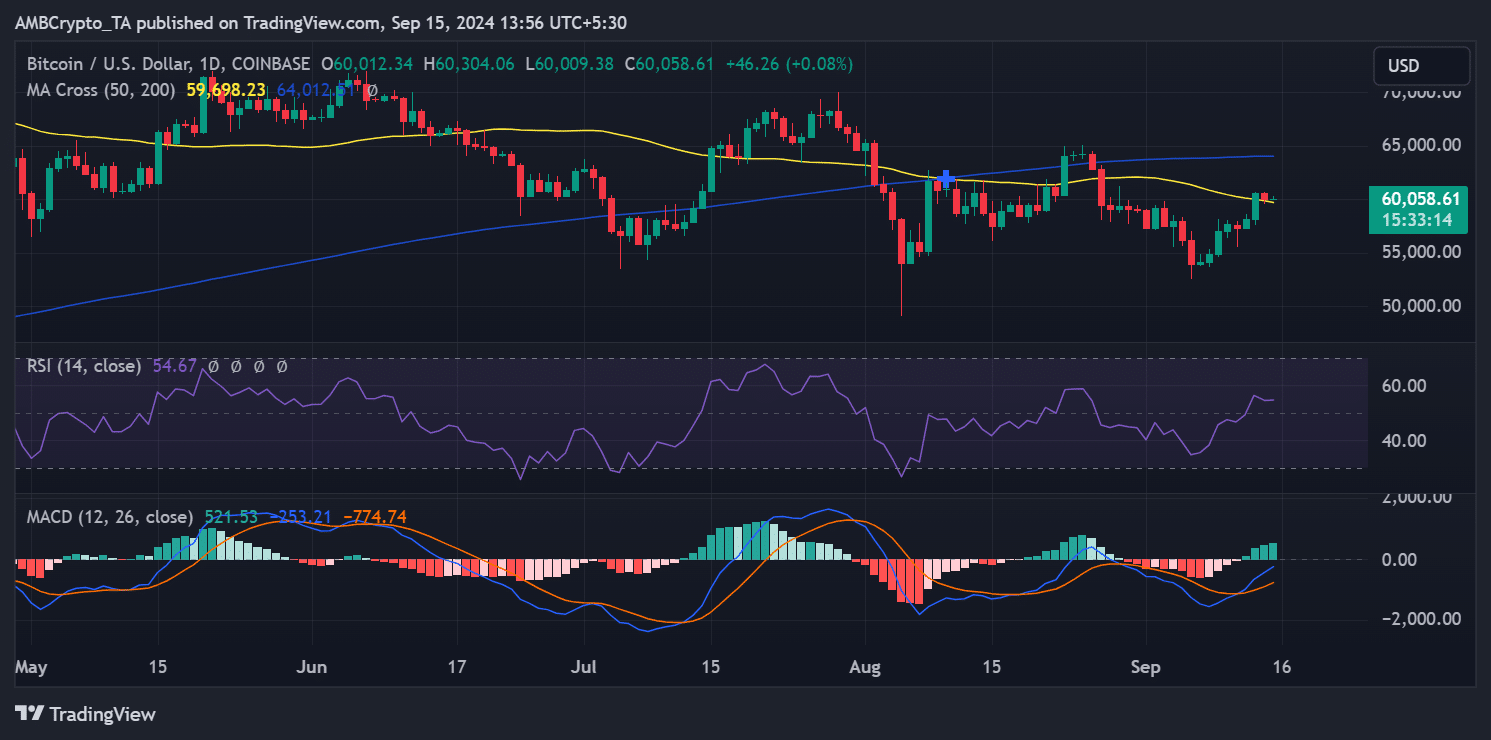

After surging by over 4% on 13th September, Bitcoin broke through its short-moving average, trading at around $60,543.

However, it struggled to sustain this momentum, as seen from subsequent trends. Bitcoin dropped by 0.8% in the following trading session to around $60,012.

Source: TradingView

BTC has slightly increased trading at around $60,095 as of this writing. The lack of a strong follow-up indicates that the asset has faced substantial selling pressure, with some investors taking profits after BTC’s rise.

Whales take advantage of price rise

Data from CryptoQuant showed that Bitcoin whale addresses took advantage of the recent price surge to realize profits. When BTC broke the $60,000 barrier, the realized profits of these whales spiked.

Read Bitcoin (BTC) Price Prediction 2024-25

Whale addresses reportedly took profits exceeding $50 million, capitalizing on the price increase.

This whale activity underscores Bitcoin’s pressure at this price level as large investors lock in gains, potentially leading to short-term price volatility.

Leave a Reply