- Toncoin price dropped 13% in last 7 days with a growing liquidation pool at $4.51.

- Whale activity surged 8.8%, with exchange net flows dropping by 779%.

Toncoin [TON] witnessed a significant dip over the last 24 hours, with its price dropping by 3.37% to settle around $4.69 at press time.

Over the past week, Toncoin saw a more substantial dip of 13%, reflecting broader bearish trends.

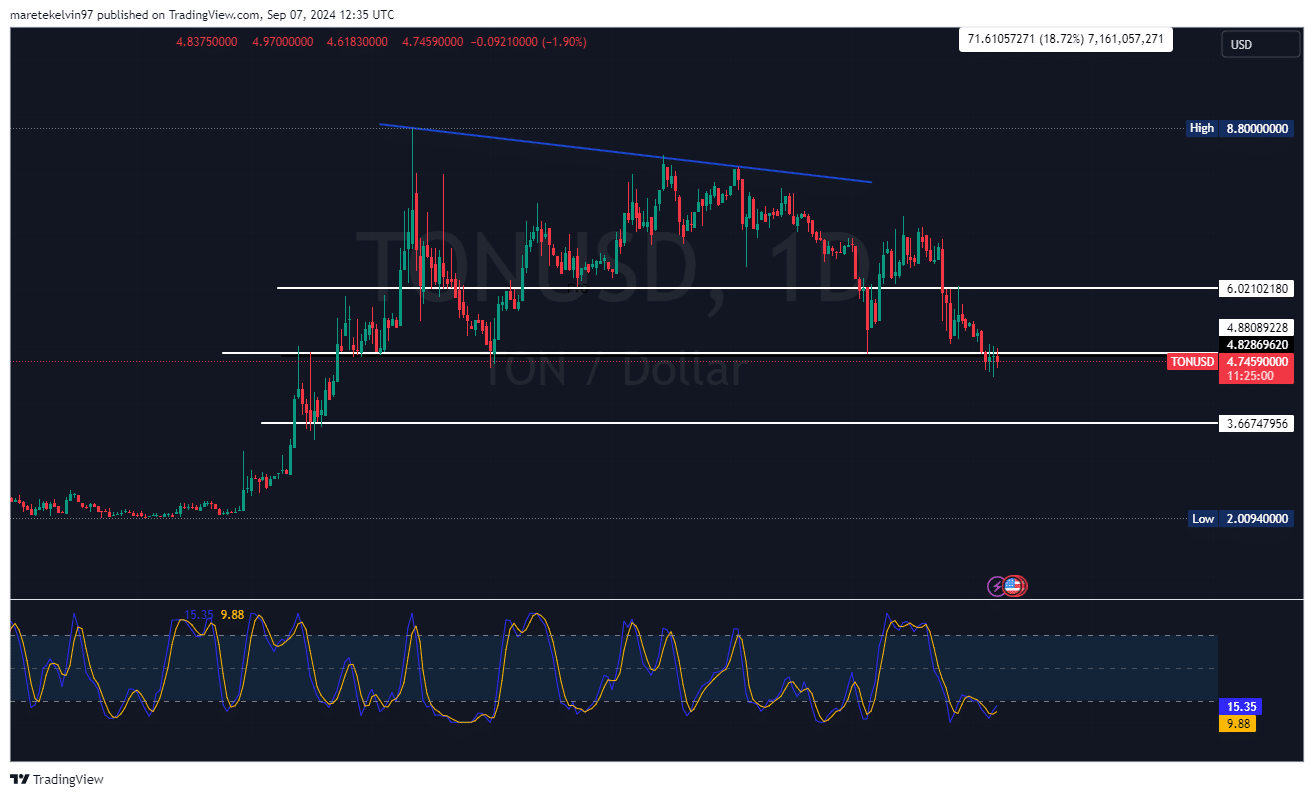

What the price charts show…

Toncoin was dipping from a critical resistance level at around $4.88 at press time. Historically, this level had proven crucial by preventing deeper declines.

However, with the recent fade in its bullish momentum and a rejection from key level at around $4.88, the sentiment is turning bearish.

If the resistance level at $4.88 holds, we could expect a potential further decline to leverage the liquidation pool at $4.51. Further bearish pressure could trigger a deeper correction toward the $3.66 support level.

A break below this key support would mark a bearish continuation.

Source: TradingView

Source: TradingView

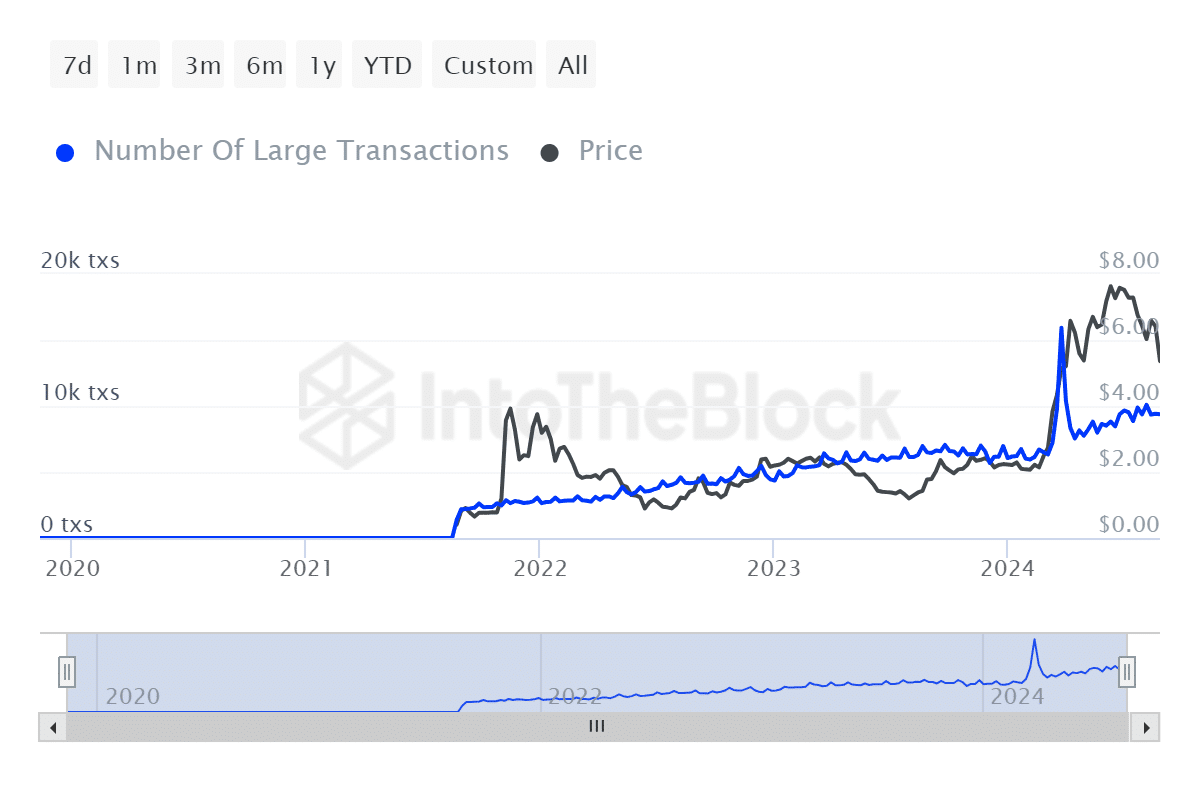

Whale activity on the rise

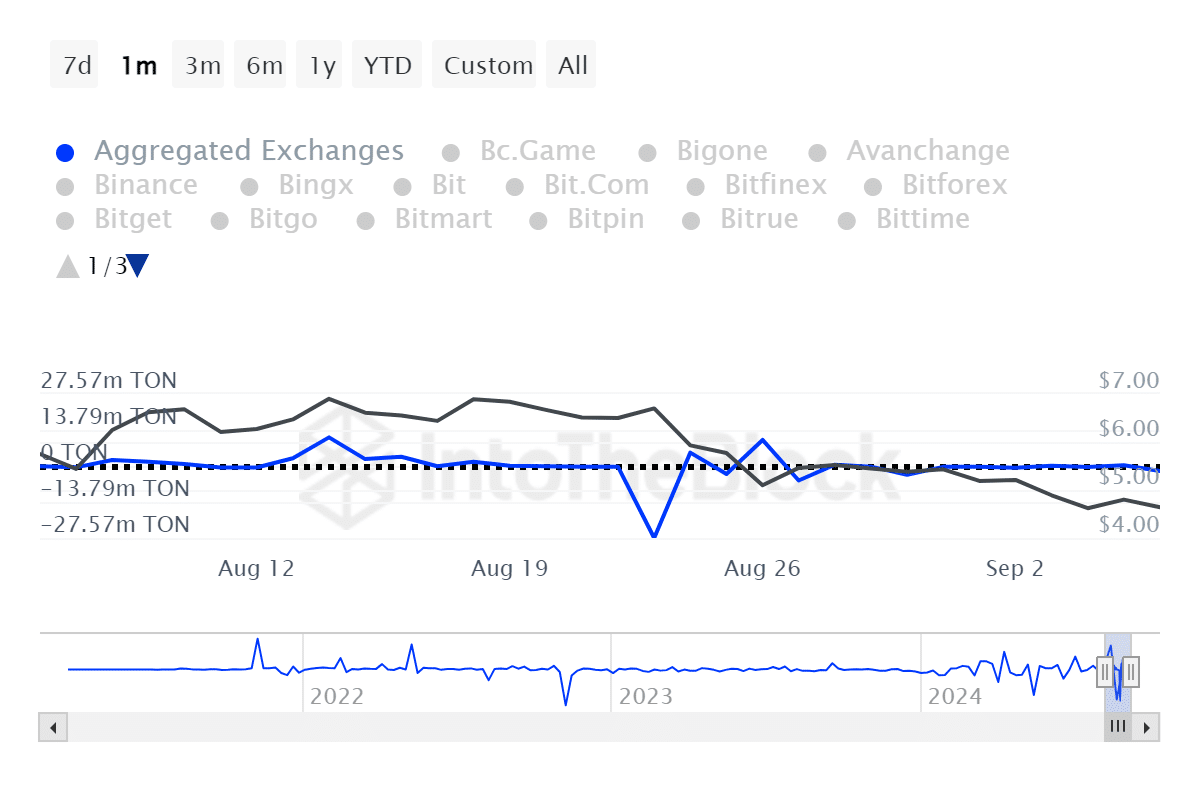

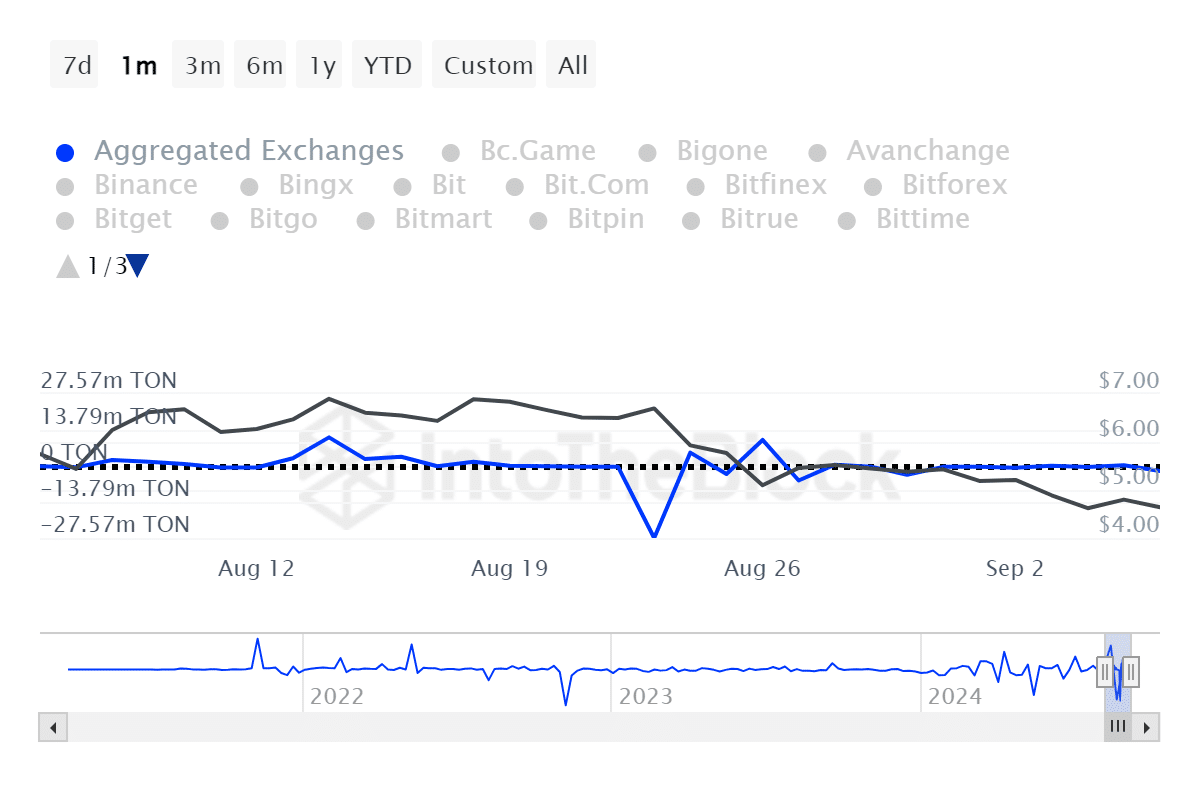

According to IntoTheBlock data, a notable uptick in whale activity is evident.

Toncoin’s large transactions increased by 8.8% in the last 24 hours. This increased whale activity could signal institutional interest or significant sell-offs, potentially influencing TON’s short-term volatility.

Source: IntoTheBlock

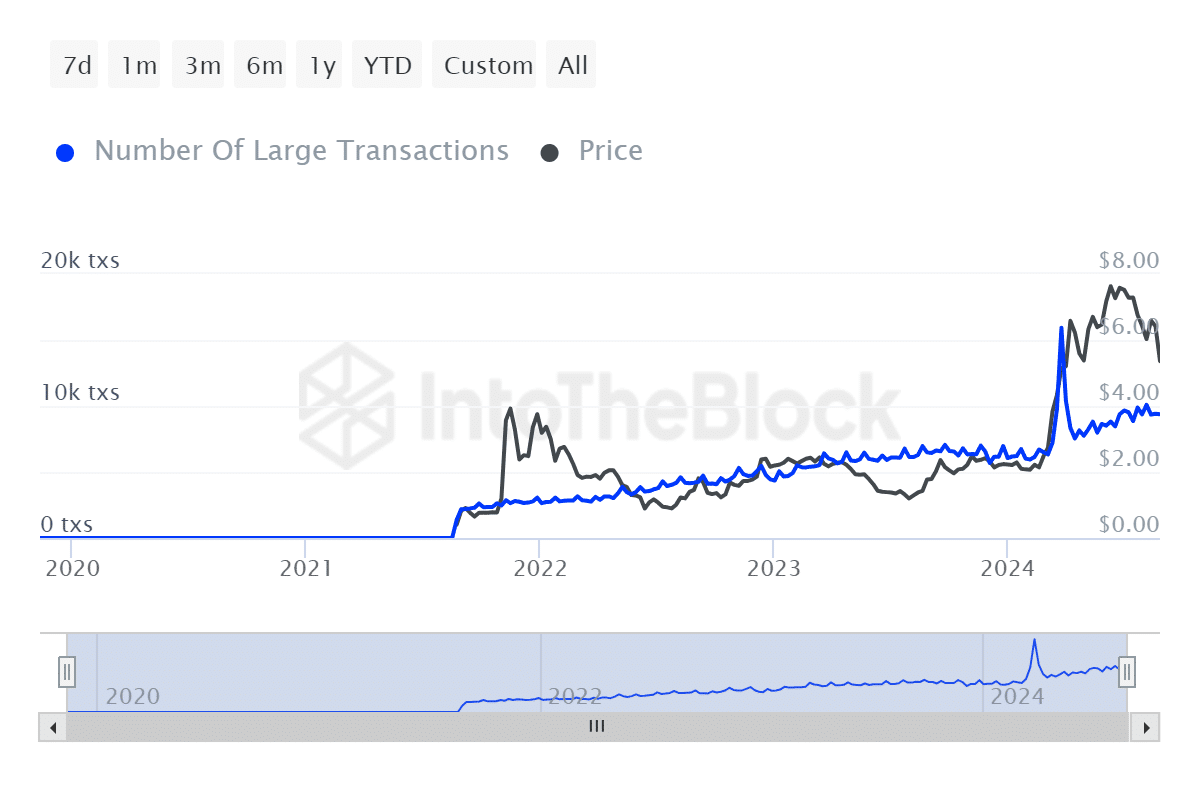

Conversely, exchange net flows showed a dramatic reduction by 779%.

This reduction indicates a significant outflow of Toncoin from exchanges, which typically suggests a more bullish sentiment as investors might be moving coins to cold storage, expecting a potential price recovery.

Source: IntoTheBlock

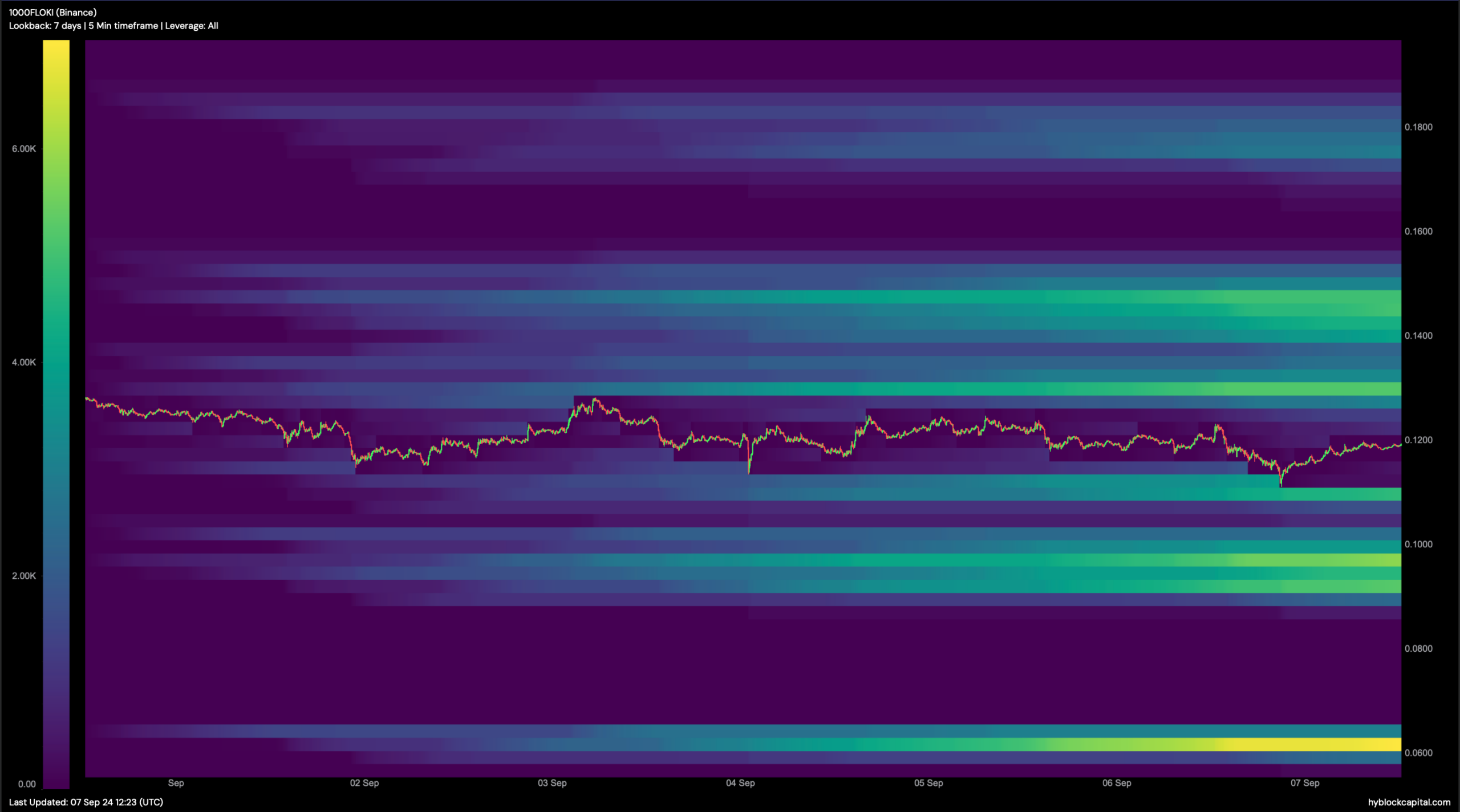

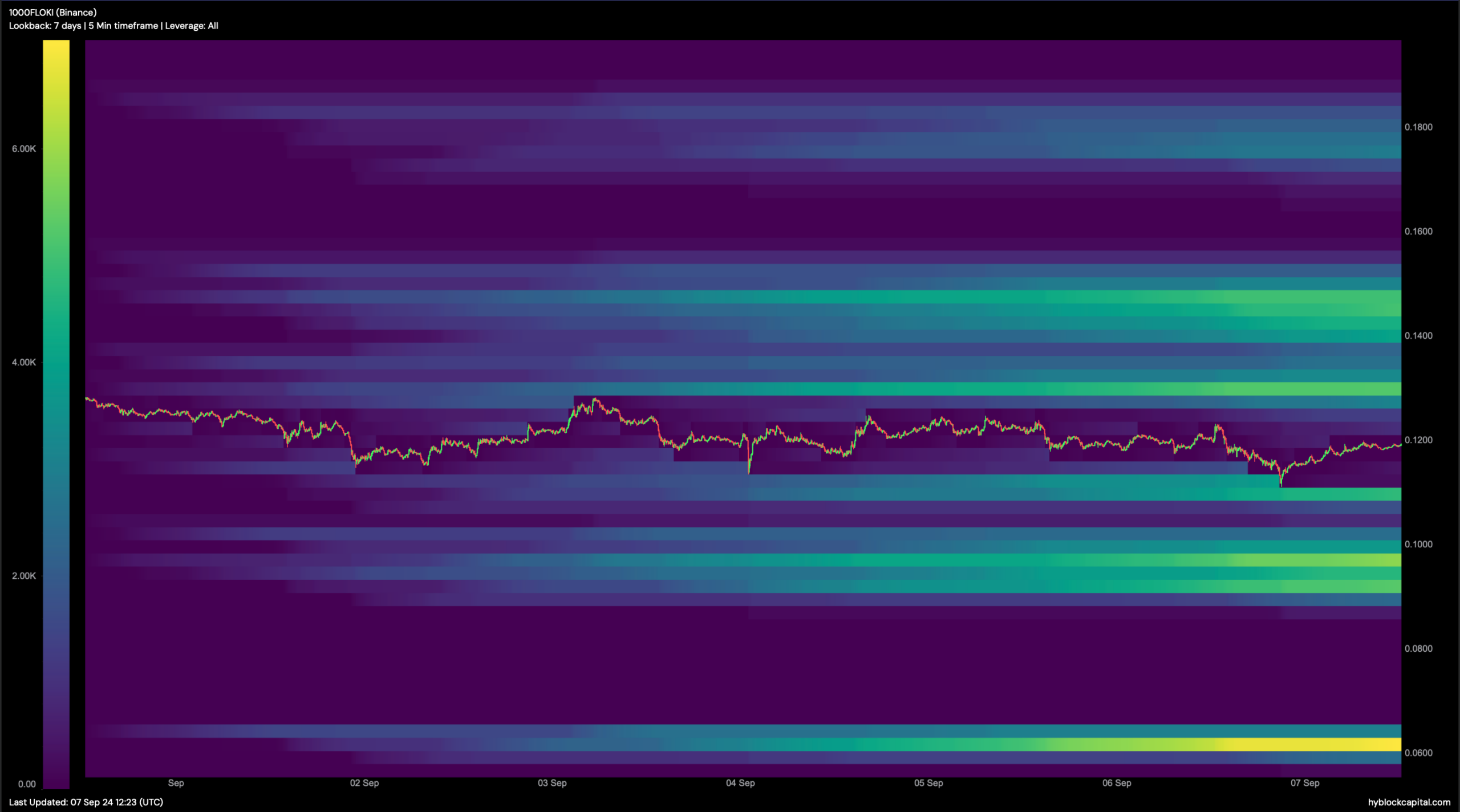

Toncoin liquidation pool grows at $4.51

The liquidation heatmap reveals a growing liquidation pool at the $4.51 price level, with approximately 322,000 Toncoin currently at risk.

This suggests a potential influx of sell orders if Toncoin drops closer to this price, potentially leading to increased downward pressure.

Source: Coinglass

The stochastic RSI currently points to a possible bullish reversal, with the indicator moving into the oversold region.

While a crossover has not fully materialized, market participants should watch for a potential bullish signal, which may trigger short-term buying momentum.

Is your portfolio green? Check out the TON Profit Calculator

Recovery or further decline for Toncoin?

Looking ahead, if Toncoin manages to hold above the key support, the upcoming quarters could see a gradual recovery.Especially, if whale activity continues and the liquidation risks are mitigated.

However, further bearish sentiment could emerge if the support fails to hold, leading to extended price declines to test lower supports.

Leave a Reply