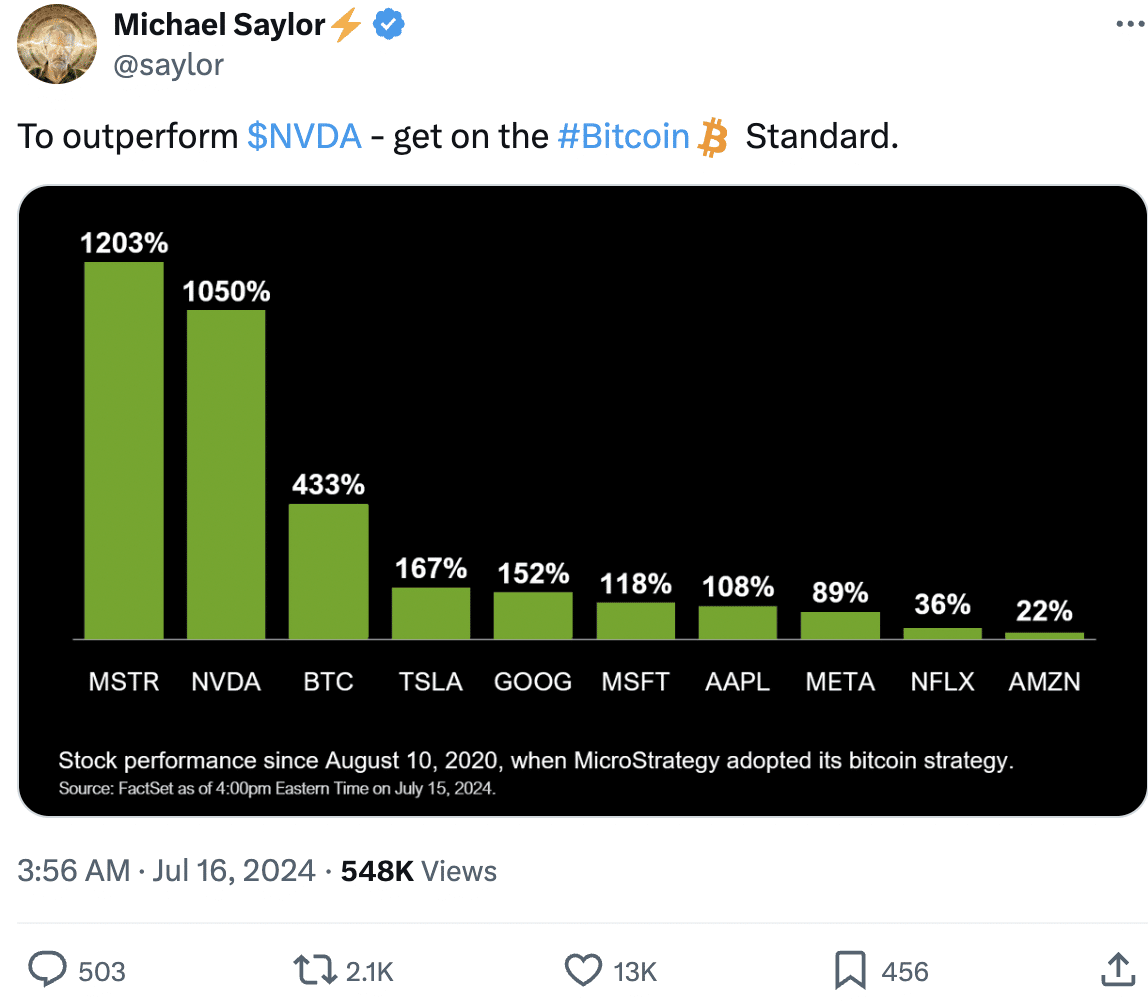

- MicroStrategy outperformed other major stocks in terms of price performance.

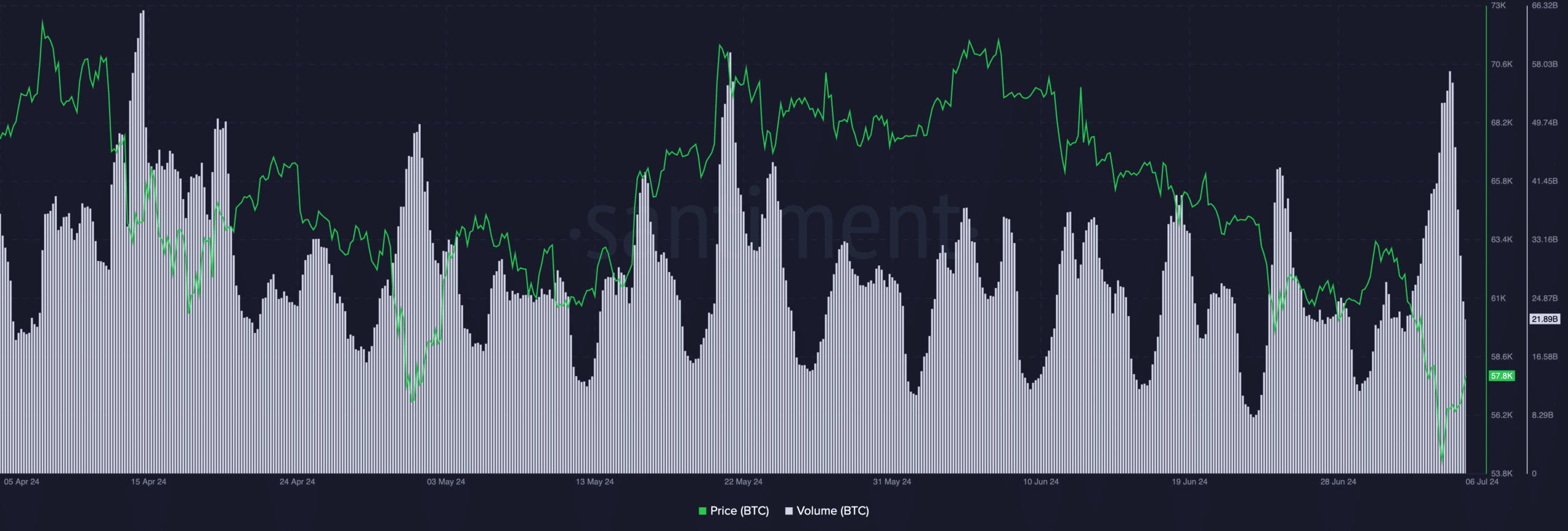

- The price of BTC retained the $65,000 level at the time of writing.

Bitcoin’s [BTC] recent rally has generated a sense of optimism in the market over the last few days. Apart from altcoins, companies related to cryptocurrencies have also gained.

MicroStrategy stock outshines everyone

MicroStrategy stock, in particular, has experienced a significant uptick. The company’s strategic decision to accumulate Bitcoin as a core component of its reserves has proven exceptionally lucrative.

As a result, MicroStrategy’s stock (MSTR) has outperformed tech titans such as Nvidia, Tesla, and Microsoft. The world’s largest corporate Bitcoin holder witnessed a remarkable 15% surge in its share price on Monday, closing at $1,611.

This impressive rally coincided with Bitcoin’s price climb to $65,000.

MicroStrategy has significantly outperformed Bitcoin over the past year, showcasing a remarkable growth trajectory. While Bitcoin experienced a modest 13% increase in price on a weekly chart, MSTR shares surged by over 22% during the same period.

The disparity in performance becomes even more pronounced when considering the broader timeframe. Since the beginning of 2024, MSTR’s share price has skyrocketed by an astonishing 135%, eclipsing Bitcoin’s 44% gain within the same period.

Moreover, on a yearly chart, MSTR stock boasts an impressive 258% increase.

A primary catalyst for MicroStrategy’s exceptional performance is its substantial Bitcoin holdings. The company’s strategic investment in Bitcoin has proven to be highly lucrative, driving significant shareholder value.

To enhance accessibility and broaden its investor base, MicroStrategy recently announced a 10-for-1 stock split. This corporate action is designed to make MSTR shares more affordable for both existing and potential investors, including employees.

The stock split is scheduled to take effect on August 1, with shares distributed after market close on August 7.

Michael Saylor boasts

Michael Saylor recently touted MicroStrategy’s exceptional performance in a tweet, showcasing a chart that revealed a staggering 1,203% share price surge since 10th August, 2020.

Its surge outpaced tech giants like Nvidia (1,050%), Tesla (167%), Amazon (22%), and Apple (108%).

Attributing MicroStrategy’s success to its Bitcoin strategy, Saylor encouraged businesses aiming to rival Nvidia to adopt a similar approach. The company has amassed a Bitcoin hoard worth $7.538 billion by aggressively acquiring the cryptocurrency since 2020.

To fuel these purchases, MicroStrategy has raised significant funds through debt offerings. In a bid to expand its Bitcoin holdings, the company successfully increased a June debt offering from $500 million to $700 million.

Source: X

At press time, BTC was trading at $65,321.79 and the volume at which it was trading at had fallen by 0.91% in the last 24 hours.

Source: Santiment

Leave a Reply