- Cardano’s DEX volumes surged significantly in recent days.

- Despite heightened interest in the ecosystem, price continued on its bearish trajectory.

Cardano [ADA] has gained significantly as the market recovered in the last few days.

Cardano volumes on the rise

According to latest data, Cardano’s 24-hour trading volume surpassed $350 million. Moreover, Cardano’s Decentralized Exchange (DEX) trading volume crossed 50 million ADA this week.

This surge in trading volume suggests a growing adoption of decentralized finance (DeFi) applications on the Cardano blockchain.

Higher trading volume generally correlates with increased network activity, which can positively impact the overall health of the network.

Source: X

Even though DEX volumes on the Cardano network were on the rise, the activity on the Cardano network was depleted.

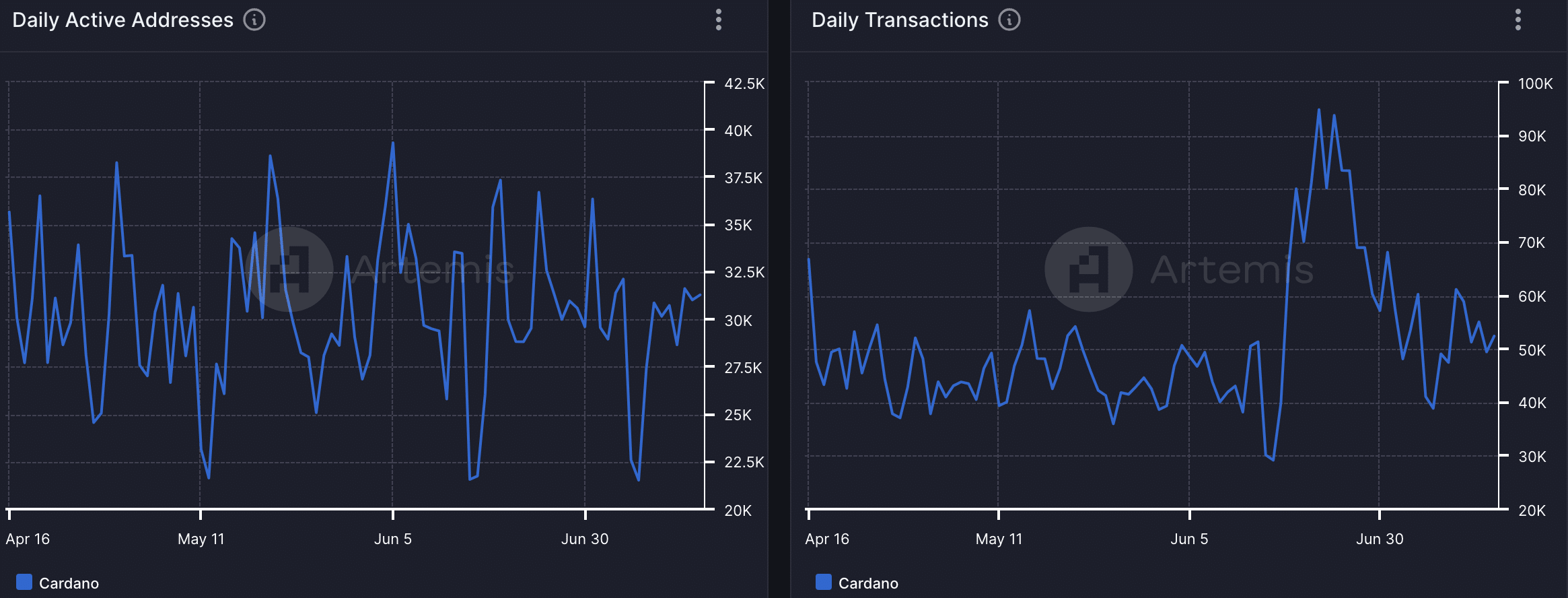

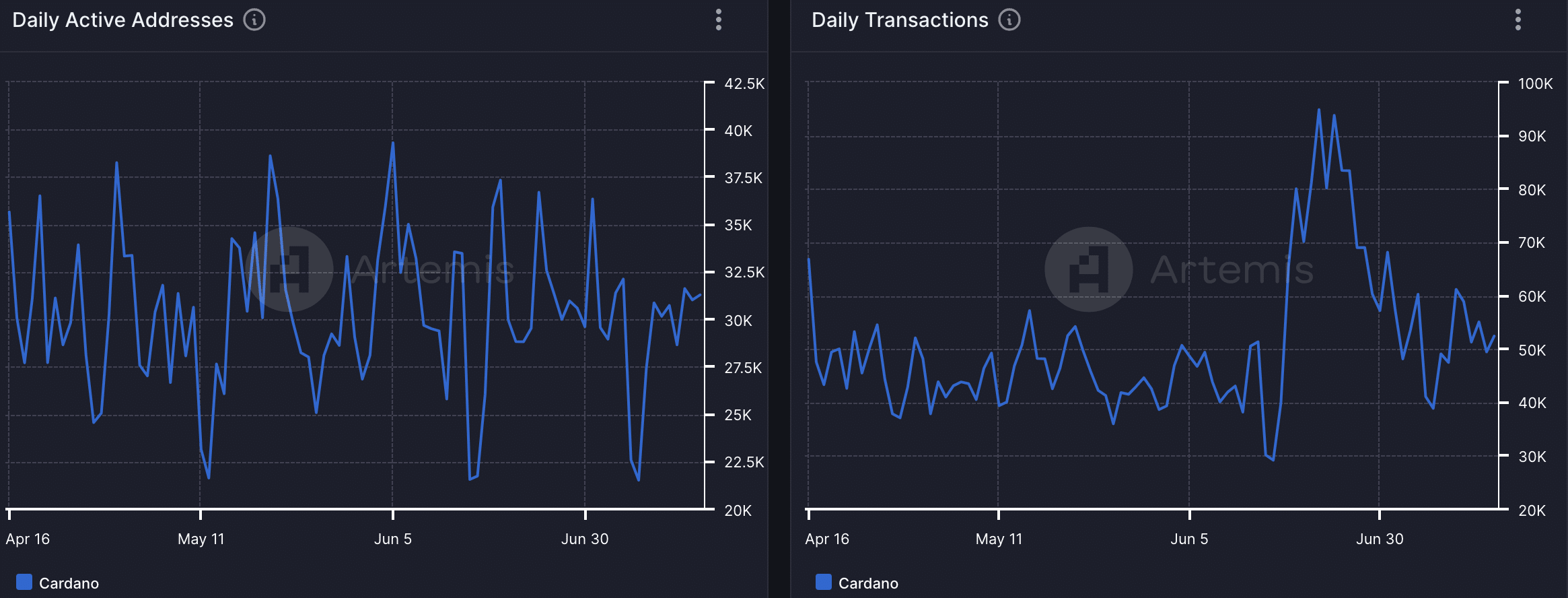

AMBCrypto’s analysis of Artemis’ data revealed that the number of daily active addresses on the Cardano network fell from 39,300 to 31,000.

Coupled with that, the number of daily transactions on the network also fell significantly from 94,000 to 49,500 recently.

Source: Artemis

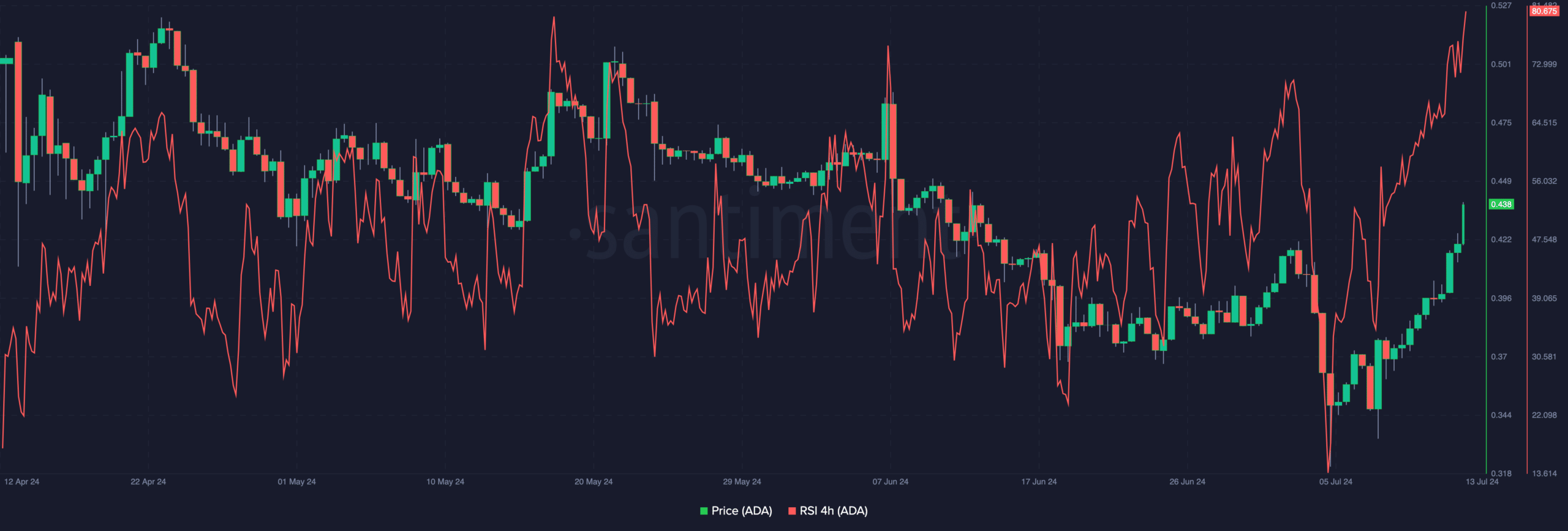

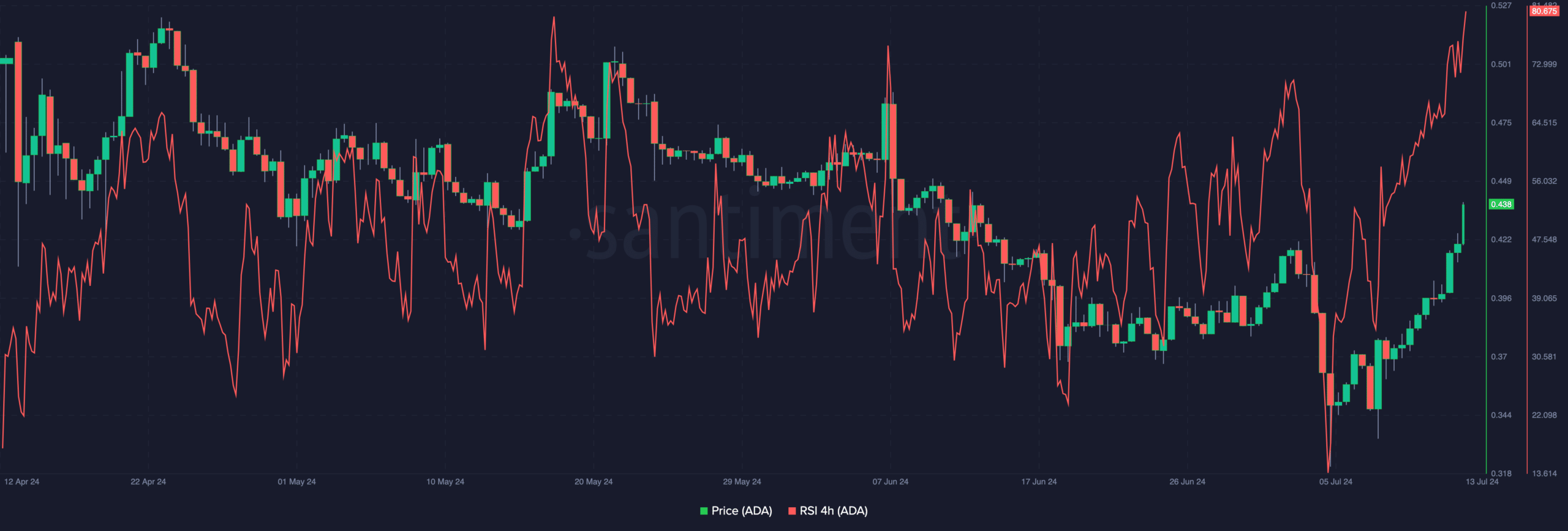

At press time, ADA was trading at $0.444 and its price had surged by 1.89% in the last 24 hours. Despite the uptick in price, the overall trend for ADA remained bearish indicated by its multiple lower lows and lower highs.

The Relative Strength Index for ADA rose in the last few days, implying that the bullish momentum around the token was increasing.

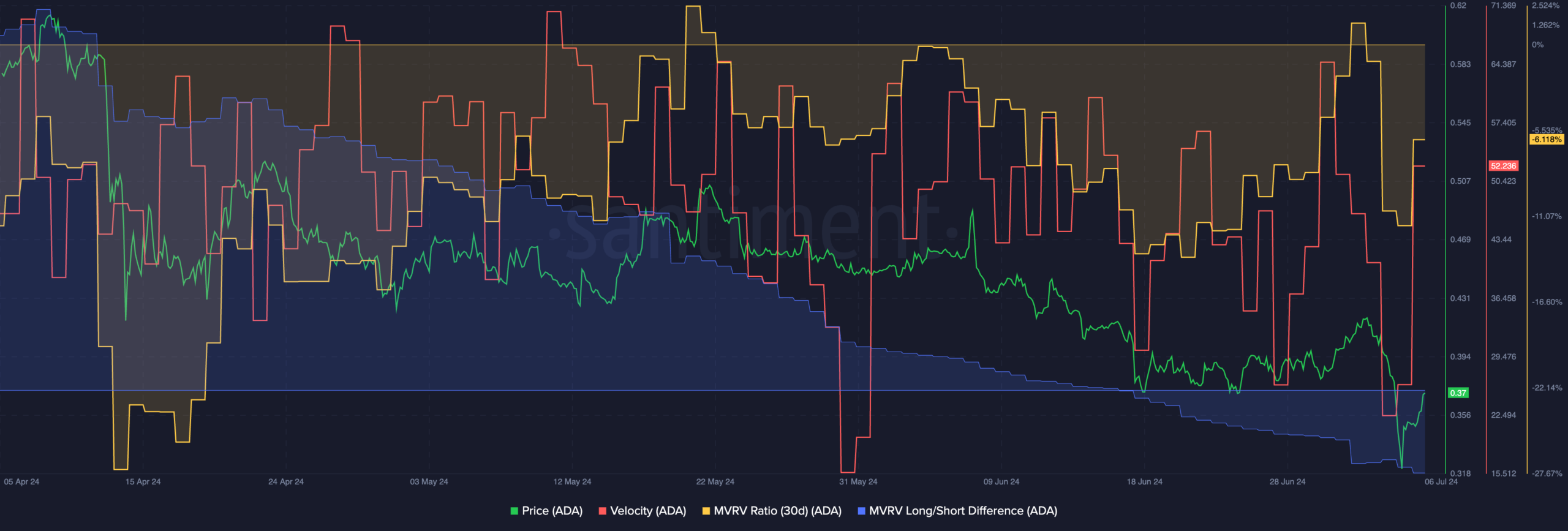

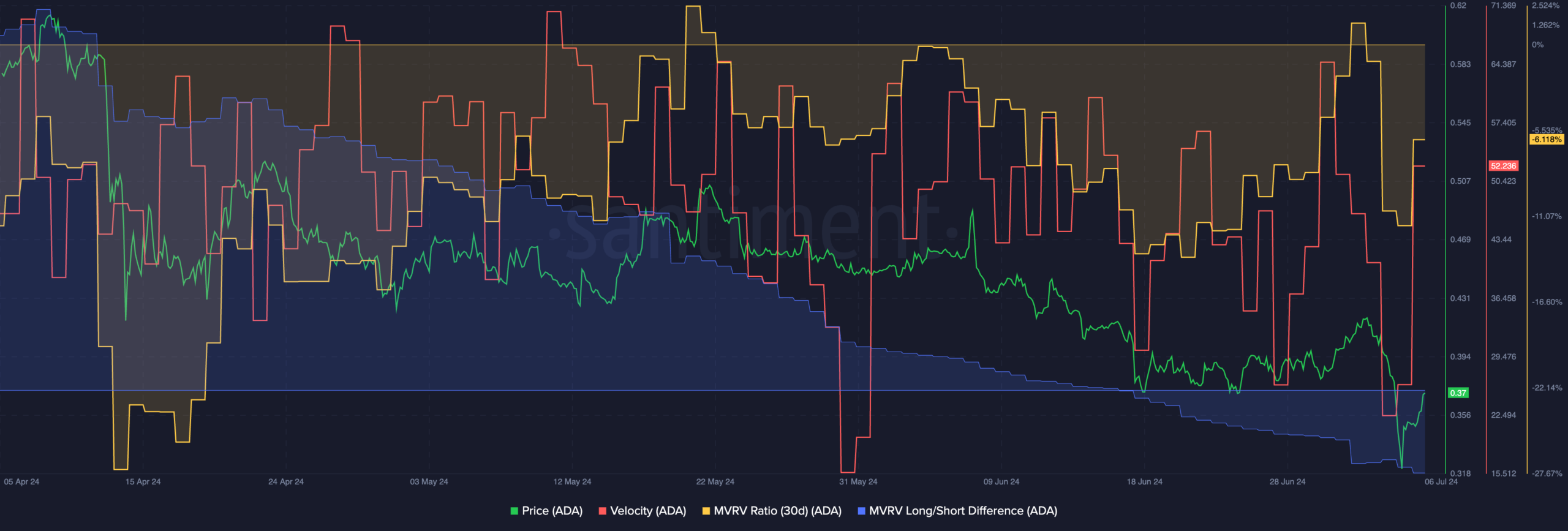

Source: Santiment

Looking at the on-chain data

The velocity at which ADA was trading at increased as well, implying that the frequency at which ADA was trading rose.

Moreover, the MVRV ratio for ADA remained negative, indicating that holders were unprofitable. This meant that ADA had more room to grow as holders may be waiting to be profitable before they sell their holdings.

Read Cardano’s [ADA] Price Prediction 2024-25

The Long/Short difference for ADA declined significantly in the last few weeks. A falling Long/Short ratio meant that the number of new addresses holding ADA outnumbered the number of old addresses holding the token.

New addresses are more likely to sell their holdings in a period of volatility and profitability and may add significant selling pressure on ADA going forward.

Source: Santiment

Leave a Reply