- Cardano’s network activity remained high as active address transactions spiked.

- Market indicators looked bearish on the token.

Cardano [ADA] recently witnessed a major development in its ecosystem as a new stablecoin was launched on the blockchain.

The token’s price reacted positively to this development, as its value surged in the last 24 hours.

Cardano welcomes USDM

Cardano recently got its first 1-to-1 fully fiat-backed stablecoin, USDM. As per the announcement, USDM will slowly be arriving on-chain in the week of the 18th of March.

Since this might attract new users to the Cardano blockchain, AMBCrypto planned to take a look at its current network stats.

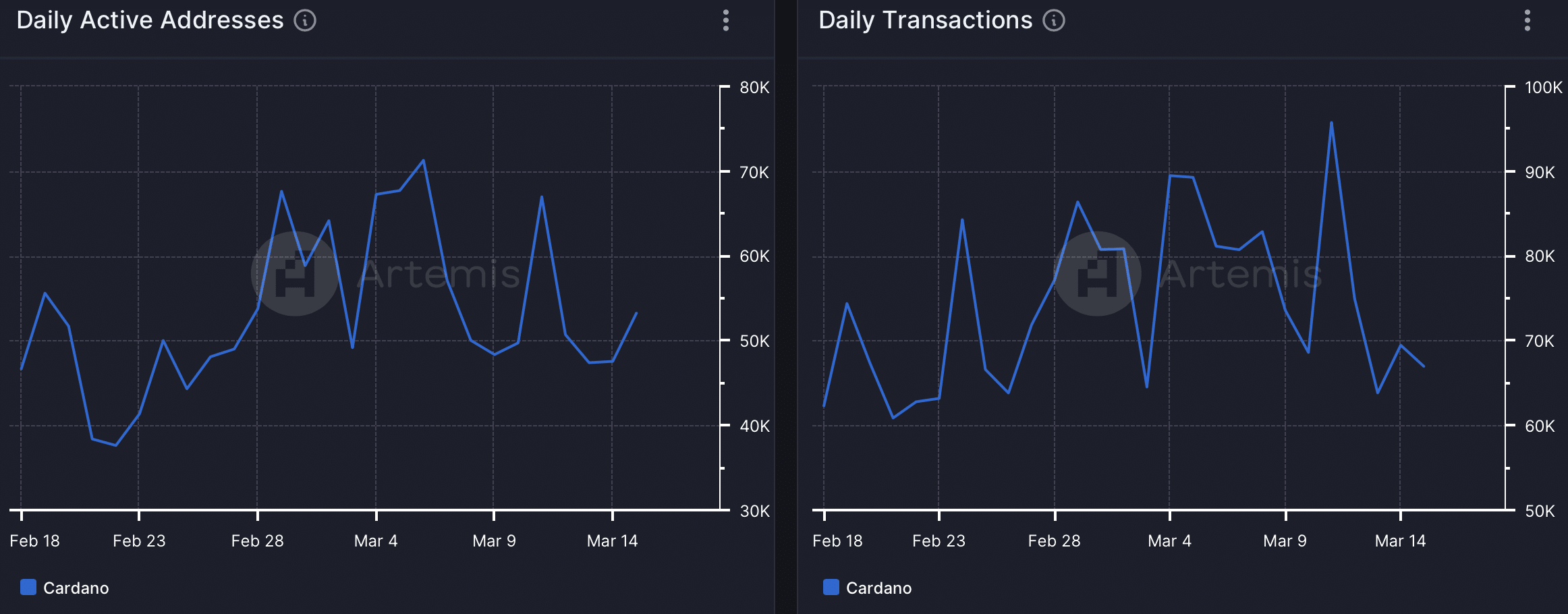

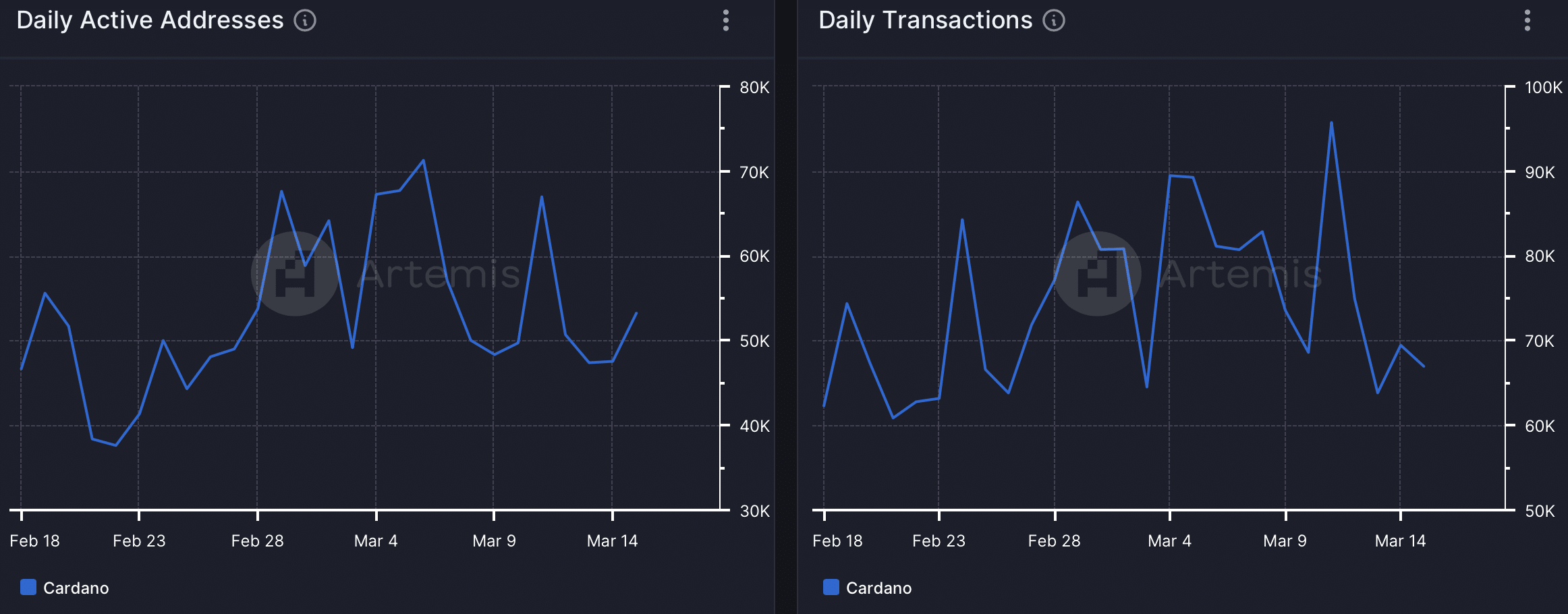

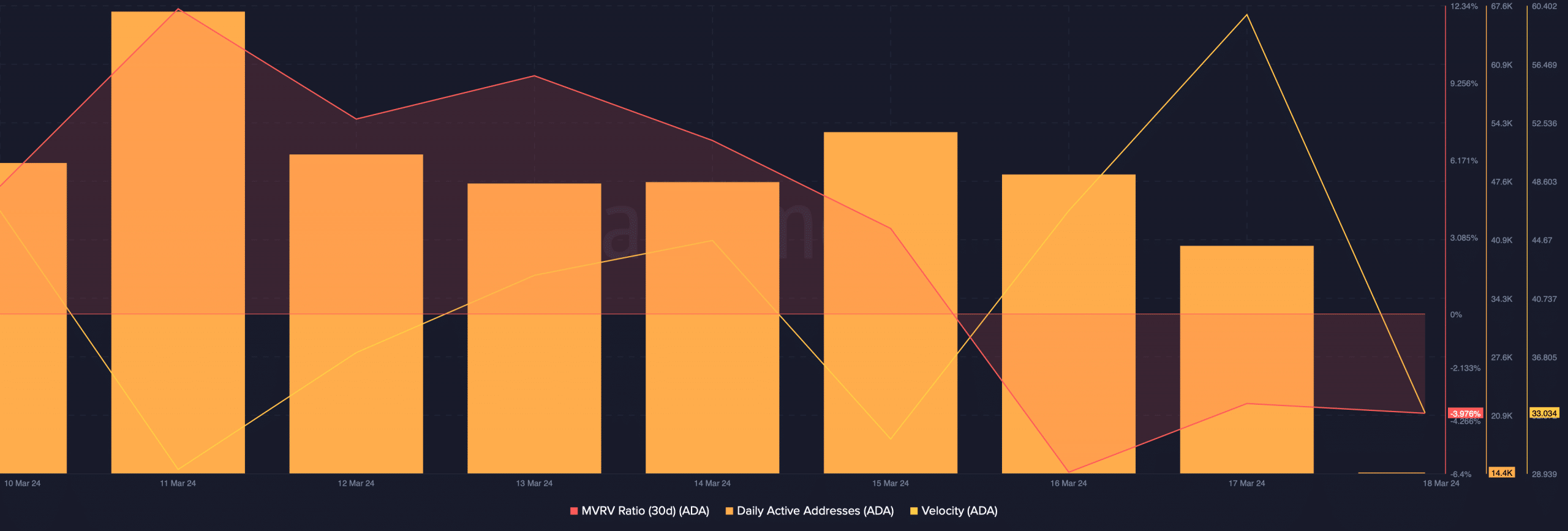

As per our analysis of Artemis’ data, ADA’s Daily Active Addresses have been relatively high throughout the last month. In addition, the blockchain’s Daily Transactions also spiked on the 11th of March.

Things on the DeFi front also looked pretty optimistic for the blockchain, as its TVL remained up.

Source: Artemis

Cardano’s price reacted positively

While Cardano onboarded the new stablecoin, ADA’s price also rose slightly. According to CoinMarketCap, ADA was up by over 1% in the last 24 hours.

At the time of writing, ADA was trading at $0.6786 with a market capitalization of over $24 billion, making it the eighth-largest crypto.

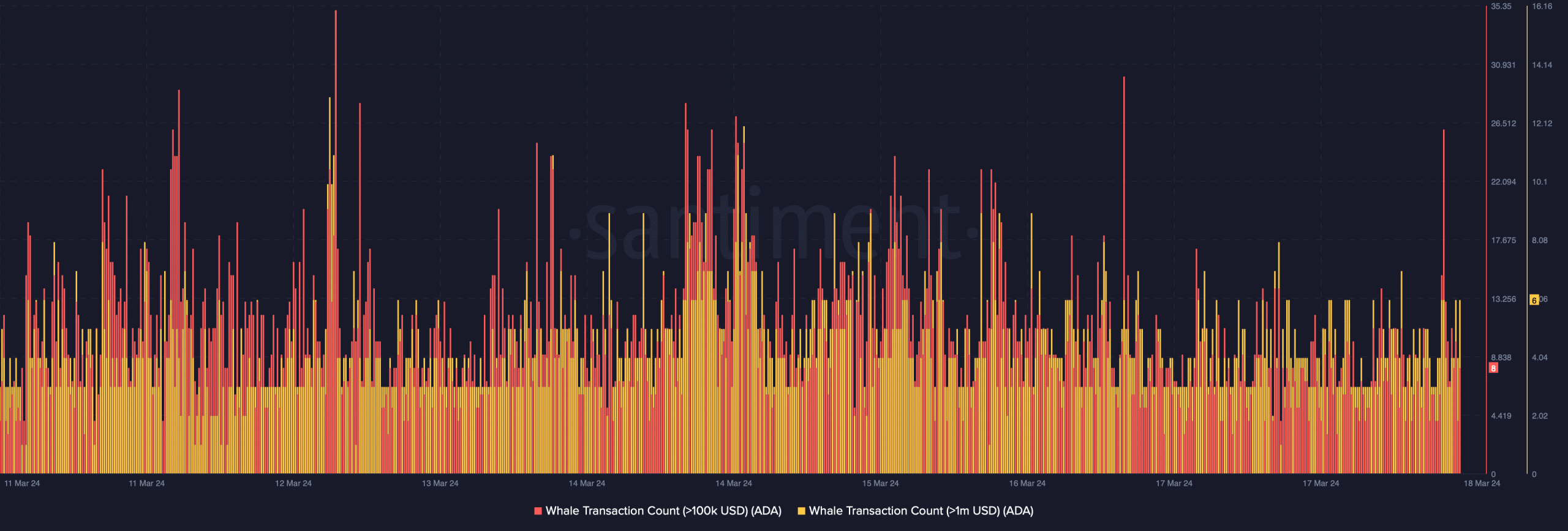

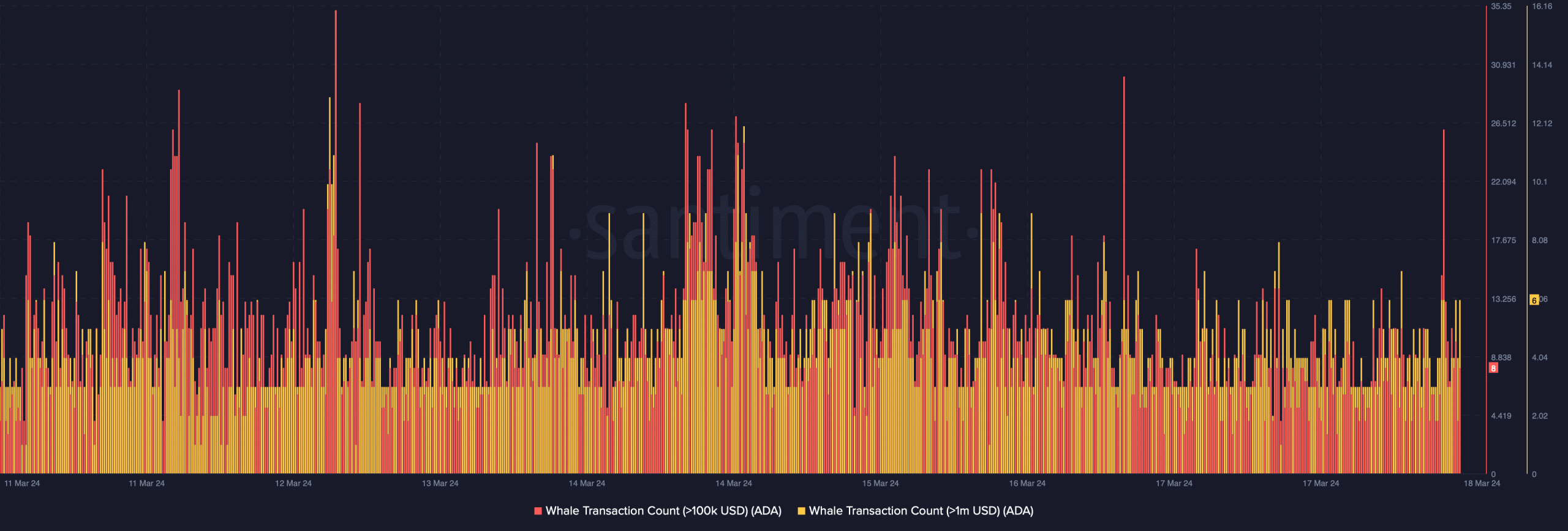

Whale activity around the token has also increased in the recent past. This was evident from the rise in its whale traction count during the last week.

Source: Santiment

To check whether this uptrend would last, AMBCrypto then checked Cardano’s other metrics. We found that not many investors were trading the token at press time, as its Daily Active Addresses dropped.

Despite the recent price uptick, ADA’s MVRV ratio remained in the negative zone, suggesting that the token’s price might plummet soon.

However, its velocity was up. A higher velocity means that Cardano was used in transactions more often within a set time frame.

Source: Santiment

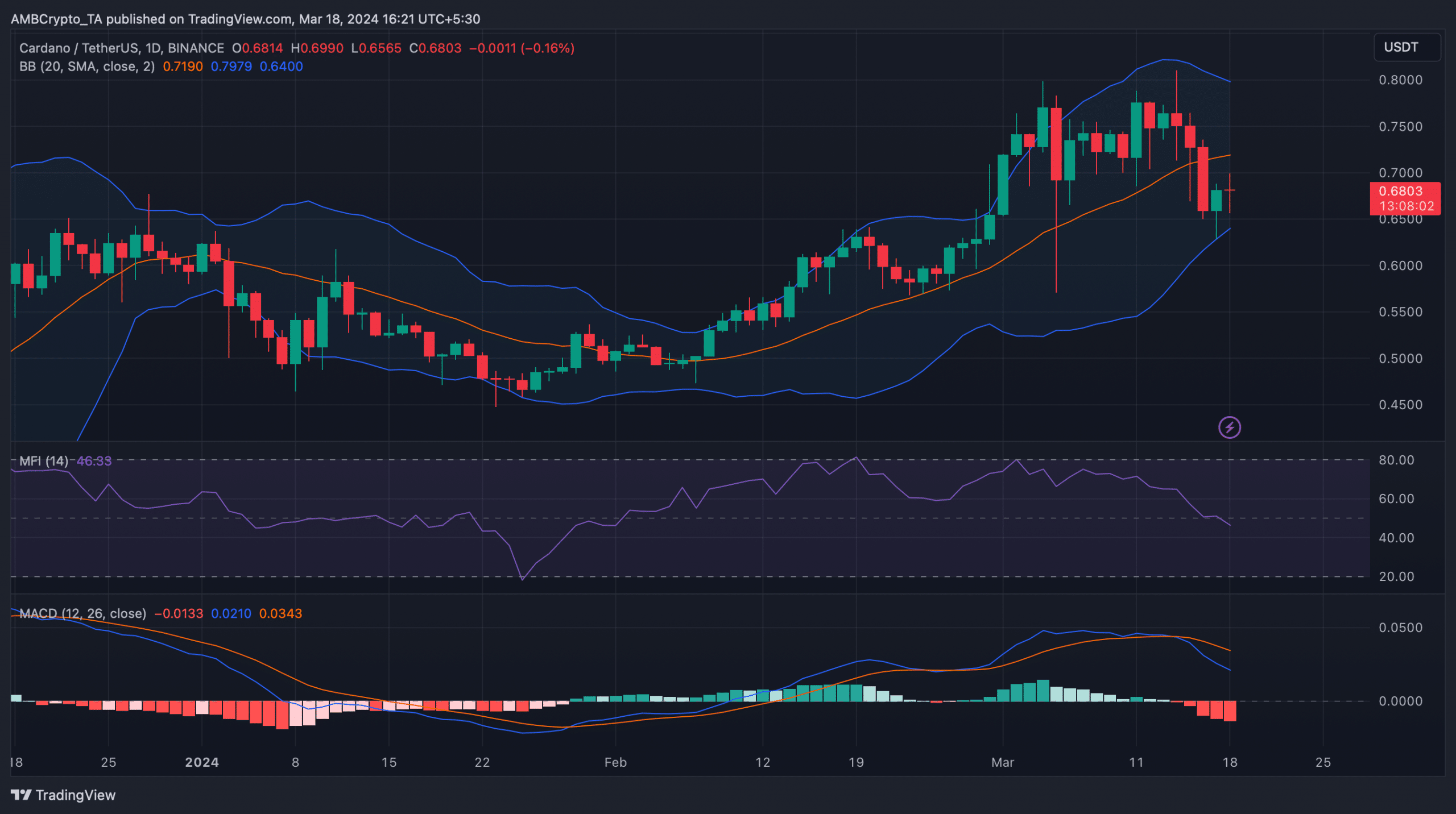

AMBCrypto then took a look at Cardano’s daily chart to better understand whether the token could sustain its bull rally. We found that the token’s MACD displayed a bearish upperhand at press time.

Read Cardano’s [ADA] Price Prediction 2024-25

As per the Bollinger Bands, ADA’s price was entering a less volatile zone. Additionally, its Money Flow Index (MFI) registered a downtick and was headed further south from the neutral mark.

These indicators suggested that ADA’s marginal price uptick might get neutralized soon, as the chances of a price decline were high.

Source: TradingView

Leave a Reply