- Nate Geraci predicted that Ethereum ETFs could be approved on the 15th of July.

- Despite the growing anticipation around ETH ETFs, the price of the altcoin dropped 2.54%.

The long-awaited approval of the spot Ethereum [ETH] ETF may have received a new date.

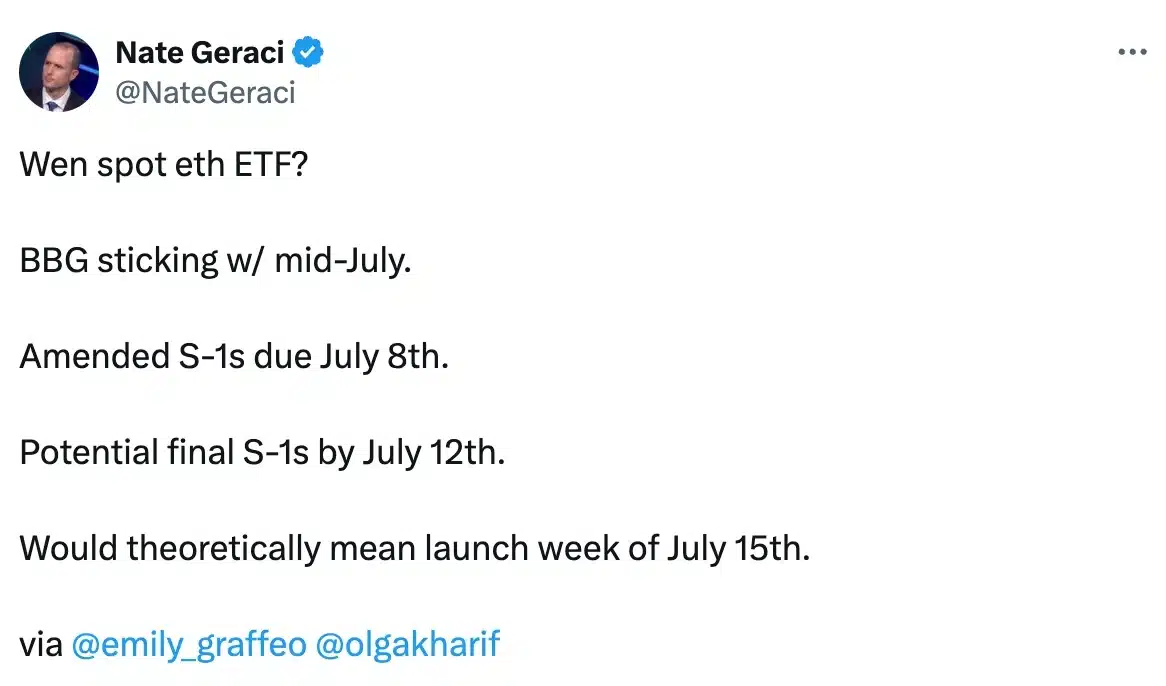

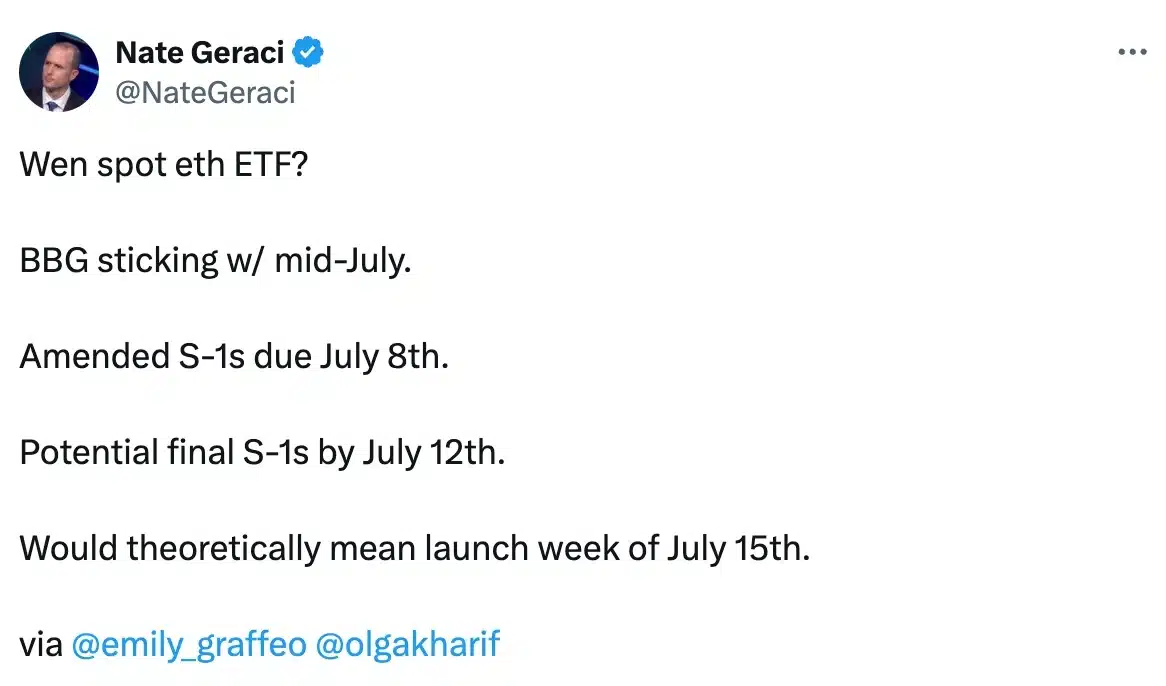

According to Nate Geraci, president of ETF Store, it is highly probable that the spot ETH ETF will receive approval on the 15th of July.

Source: Nate Geraci/X

In his post, Geraci indicated that following a revised S-1 submission for Ethereum ETFs, expected in July, final approval from the SEC could be granted by the 12th of July.

Therefore, according to Geraci, there is no reason why the SEC would not approve ETH ETFs on the 15th of July.

It’s important to note that the ongoing delay has stems from the SEC’s request on 28th May for issuers to address minor queries in their S-1 filings.

The reason behind the delay

Sources close to the situation report that issuers are currently engaged in resolving these problems.

However, with the SEC’s prior approval of 19b-4 filings in May, things might soon work in favor of the issuers.

Providing further clarity on the matter, Galaxy Digital’s head of asset management, Steve Kurz, in a recent interview with Bloomberg TV said,

“Look, we’ve done this before. This is methodical, this is window dressing, the SEC is engaged. We did it for the Bitcoin ETF, the products are substantially similar — we know the plumbing, we know the process.”

Bitcoin ETF vs. Ethereum ETF

With the Ethereum ETF approval facing delays, industry executives are now drawing comparisons to the Bitcoin [BTC] ETF approvals.

The journey of BTC ETF began in July 2013 when Cameron and Tyler Winklevoss, co-founders of Gemini crypto exchange, initially filed their application with the SEC for a spot Bitcoin ETF.

Fast-forward to January 2024, nearly a decade later, and after numerous applications and rigorous regulatory scrutiny, the SEC finally granted approval for 11 Bitcoin ETFs.

However, some argue that despite delays, BTC had a relatively straightforward path to approval but the process for ETH’s ETF approval has been caught up in much more regulatory complexities.

This has led to many believing that ETH ETF will not be a good competition to BTC ETF.

Will ETH match the BTC ETF hype?

Remarking on the same, Matt Hougan, CIO at Bitwise, during a recent episode of the “Bankless” podcast said,

“I don’t think Ethereum ETFs will match Bitcoin ETFs but I do think it will be measured in terms of many billions of dollars.”

Additionally, despite expectations of a positive impact from the ETH ETF approval date, Ethereum’s price failed to rally.

At press time, ETH was trading at $3,351, marking a 2.54% drop in the last 24 hours, according to CoinMarketCap.

Leave a Reply