- Bitcoin miners opted to mine Kaspa to offset their losses.

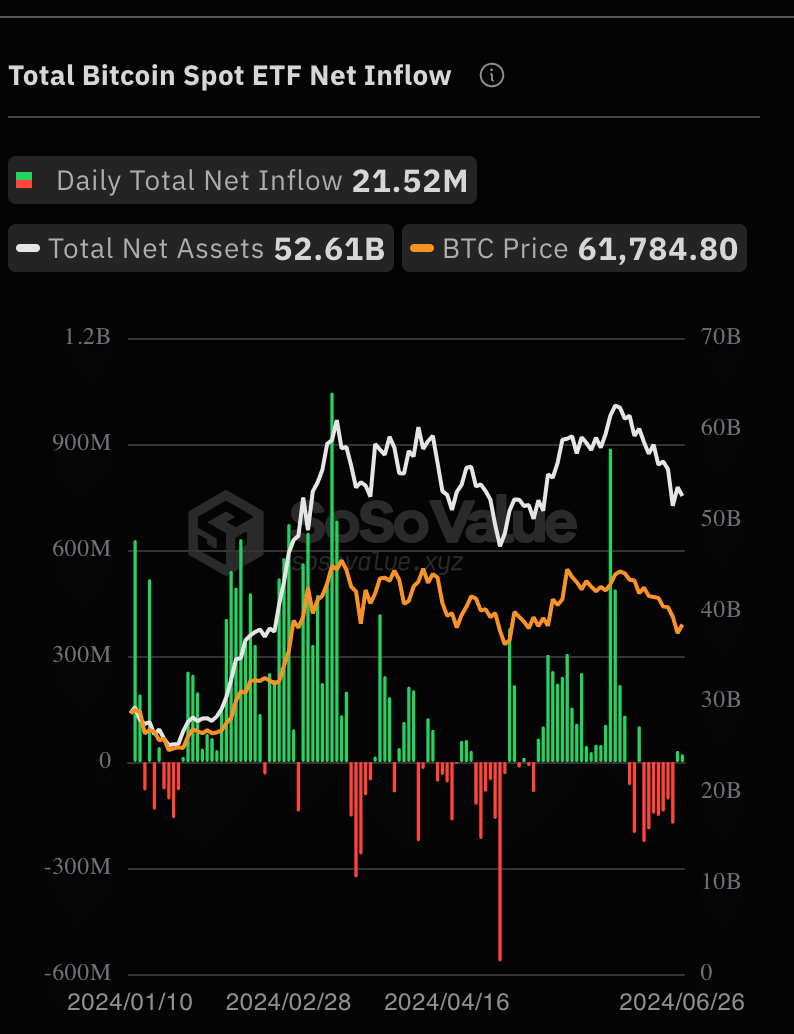

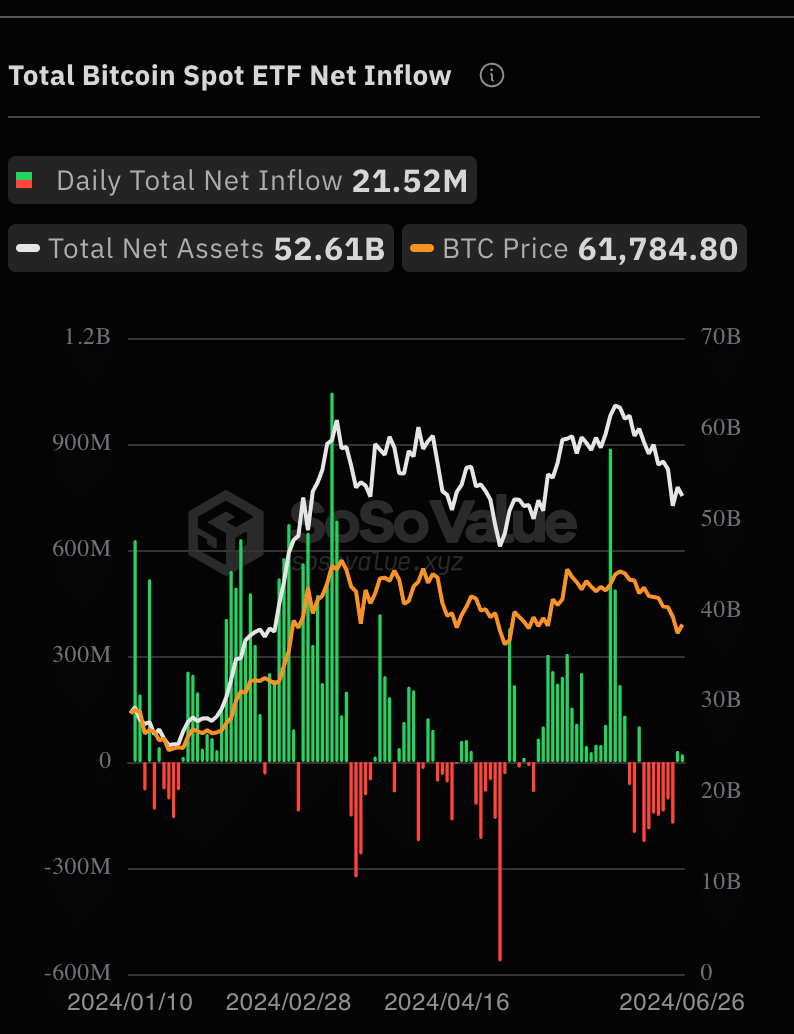

- Overall interest in ETFs remained high despite declining prices.

Bitcoin’s [BTC] recent decline in price has sent miners into a state of FUD (fear, uncertainty, and doubt).

Miners find new avenues

Due to this, many Bitcoin miners have decided to diversify their revenue streams and offset a decline in Bitcoin production.

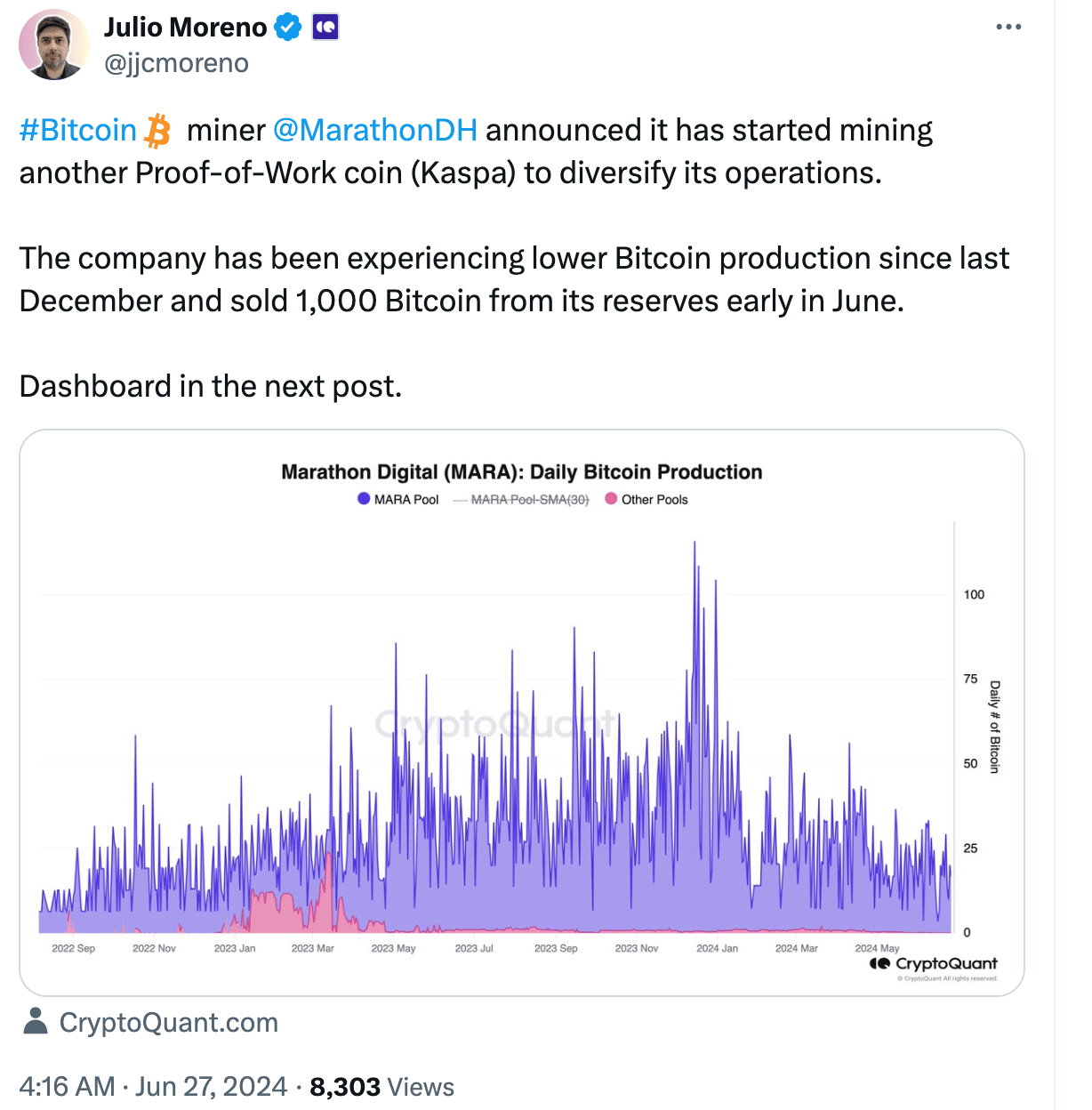

Major Bitcoin mining company Marathon Digital Holdings (MarathonDH) has begun mining Kaspa, another Proof-of-Work cryptocurrency.

MarathonDH has been grappling with lower Bitcoin production since December 2023, which culminated in the company selling 1,000 Bitcoin from its reserves in early June.

Kaspa, with its faster block times and potentially higher block rewards compared to Bitcoin, presented an attractive option for MarathonDH to increase its profitability.

If other major miners follow suit and start mining Kaspa to diversify, an increase in selling pressure on the Bitcoin market could occur, potentially driving down the price in the short term.

Source: X

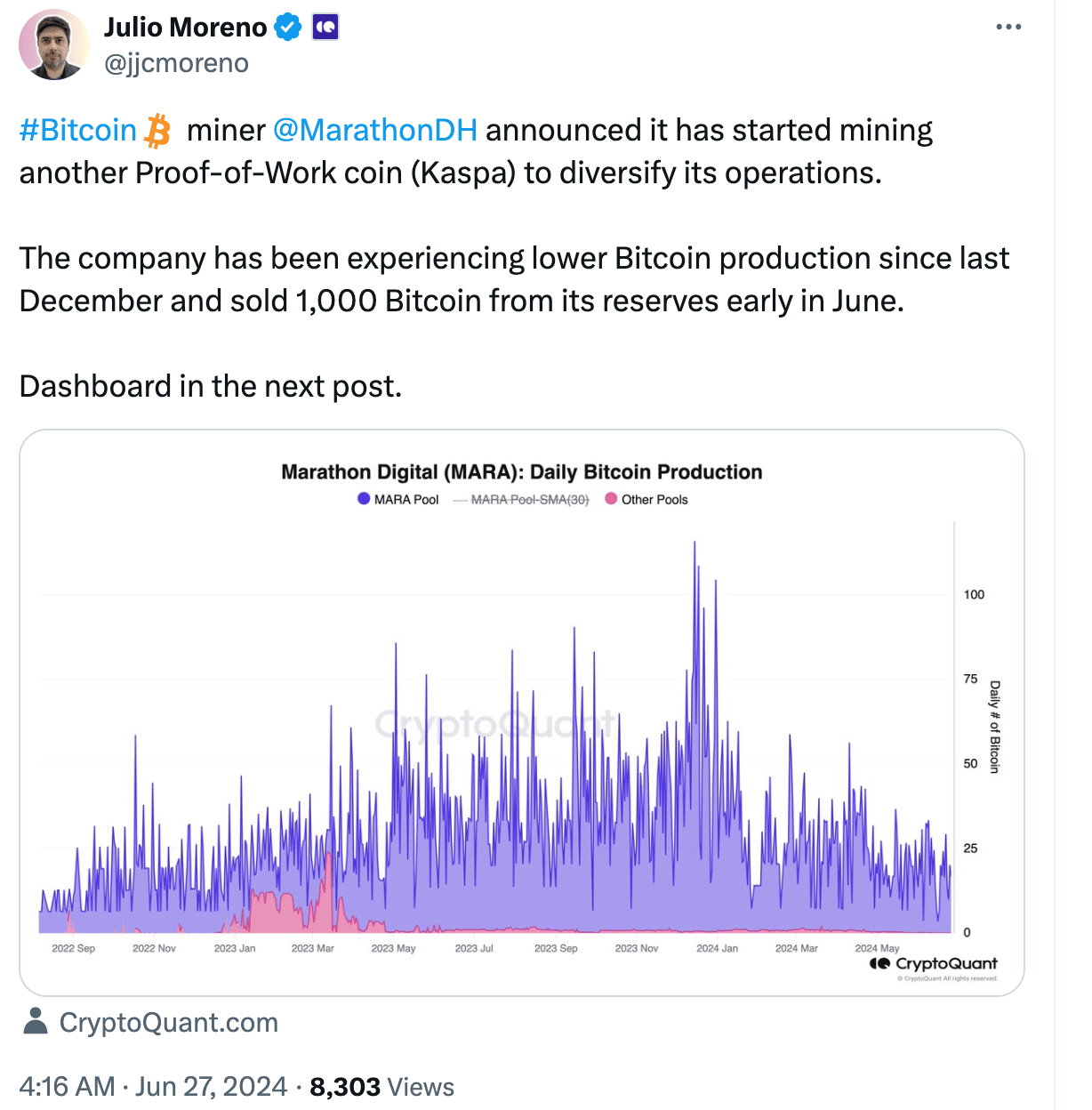

A dormant miner address, inactive for a staggering 14 years, woke up and transferred 50 BTC to a Binance [BNB] deposit address.

This miner earned these 50 BTC by mining on the 14th of July 2010, a time when the price of each Bitcoin was a mere $0.05.

The reawakening of this wallet and the transfer to Binance could indicate potential selling pressure on the Bitcoin market in the near future, further impacting the price.

Source: X

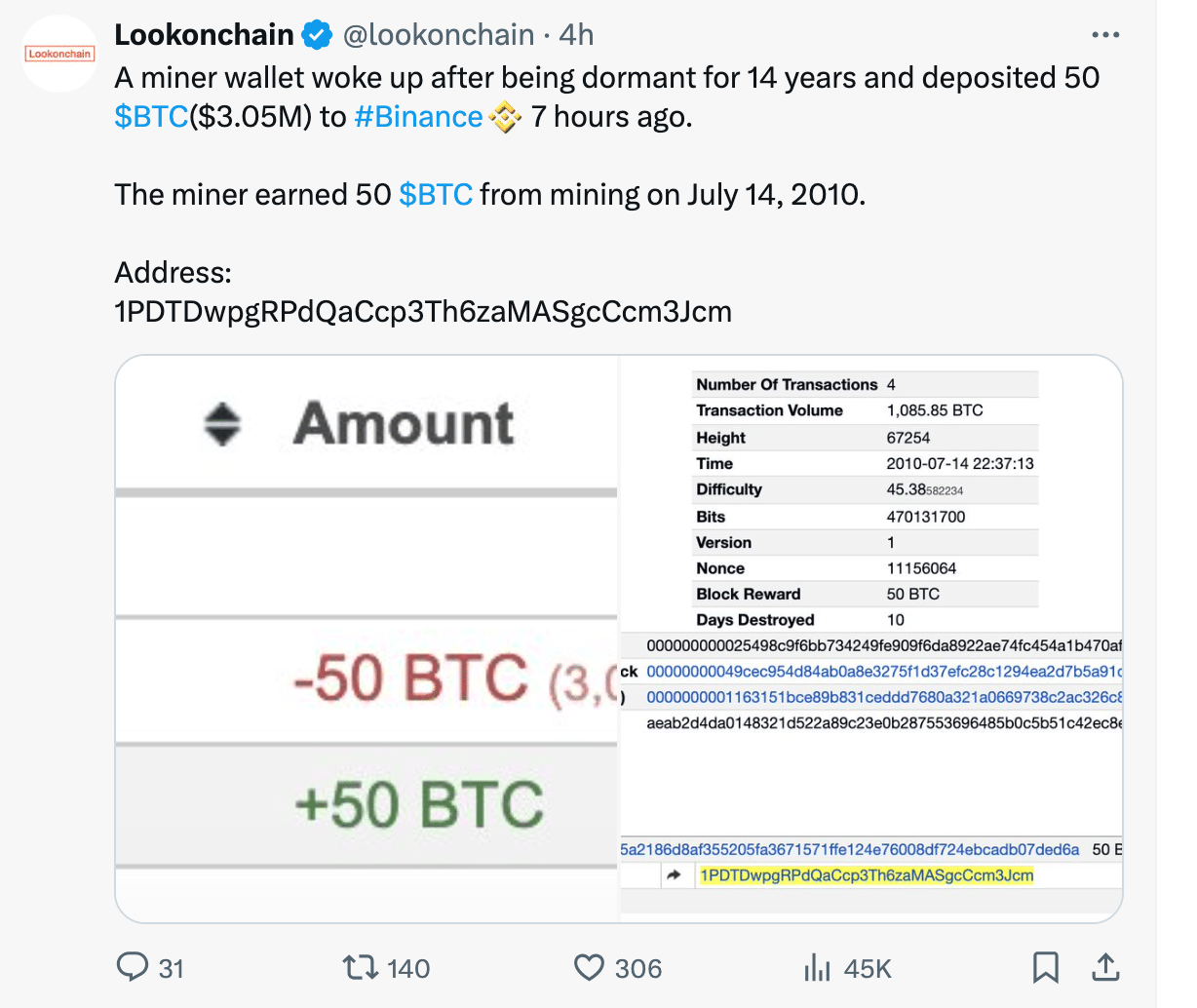

Adding to the problem, the daily revenue generated by these miners had depleted significantly over the last few days. Since the 7th of June, the revenue generated by miners fell from $54 million to $24 million.

If miners fail to see a surge in revenue they would be forced to sell their holdings to remain profitable, which can cause further damage to BTC’s price.

Source: Blockchain.com

Interest in ETFs grew

Even though the state of the miners is not looking positive, the interest in BTC ETF’s could help the price of Bitcoin sustain under immense selling pressure.

SoSo Value’s data indicated that at the time of writing, Bitcoin spot ETFs saw investor interest on June 26th, recording a net inflow of approximately $21.4 million. This comes after a period of outflows.

Two leading funds, Grayscale Bitcoin Trust (GBTC) and Fidelity Bitcoin ETF (FBTC), were the primary beneficiaries.

Read Bitcoin’s [BTC] Price Prediction 2023-24

GBTC raked in $4.33 million, while FBTC attracted a more significant sum of $18.61 million in a single day.

Notably, FBTC’s total net inflow has reached a staggering $9.185 billion, solidifying its position as a major player in the Bitcoin ETF landscape.

Source: Sosovalue

Leave a Reply