- NEAR surged 16.61% in seven days as altcoins suffered from high sell-offs.

- NEAR Protocol affirmed its commitment towards the unification of blockchain and AI.

While most altcoins have experienced a downtrend alongside Bitcoin [BTC], which declined to a recent low of $60.777.32, Near Protocol [NEAR] has become more assertive.

With the continued development and increased adoption of AI, all AI-themed tokens have experienced sustained growth. Thus, although the crypto market is suffering from a decline overall, NEAR has continued to surge.

What’s driving NEAR’s surge?

A recent surge can be attributed to the increased adoption of AI and its collaboration with blockchain companies. This is evidenced by recent remarks by NEAR Foundation COO Chris Donovan.

In his remarks, he said,

” The solution… is the unification of Blockchain and AI.”

He further said,

“We think that creates a possibility for a world where user’s wellbeing can be optimized for.”

In addition to AI integration, recent developments for AI giant Company NVidia have influenced the recent NEAR price surge.

According to the report, Nvidia has become the most valuable company in the world after surpassing Microsoft, with a market cap of $3.3T.

Also, according to X (formerly Twitter) user PlanetaVeNEARa,

“In the last month, NEAR Protocol has reclaimed the top spot in the number of users among blockchains, boasting 16.3M addresses”.

These recent developments in AI technologies and integration within the NEAR protocol have undoubtedly raised NEAR prices.

NEAR Positive Fundamentals

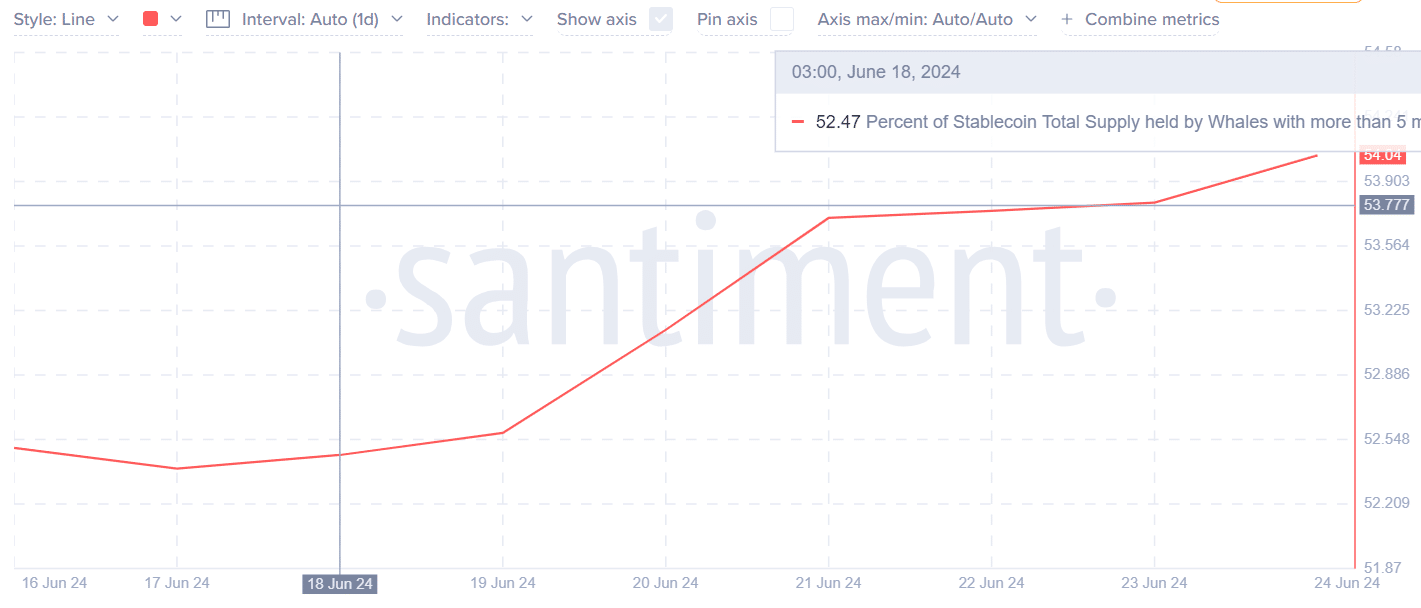

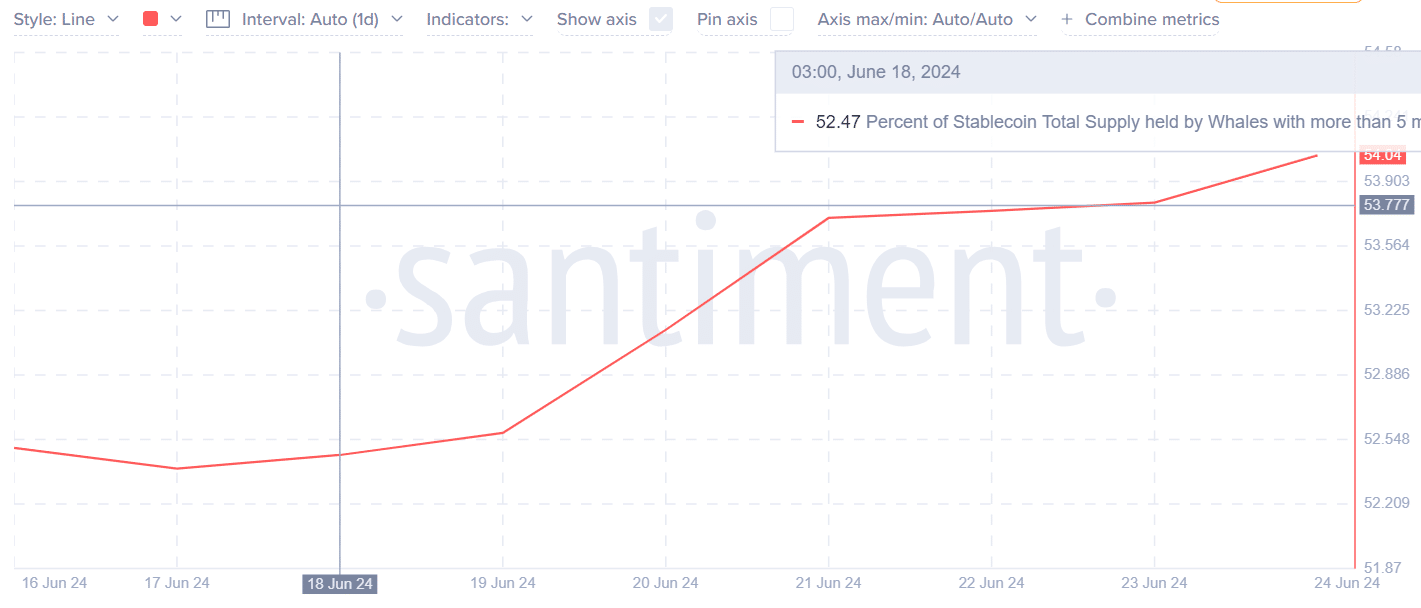

Source: Santiment

AMBCrypto’s analysis of Santiment showed that NEAR was well-positioned towards a bullish trend.

For instance, the percentage of stablecoin total supply held by whales, which is more than $5M, has surged from $52M to $54M in the last seven days.

This showed a whale accumulation phase as they prepare to deploy capital into the market. Higher accumulation by whales leads to a price surge and a bullish market sentiment.

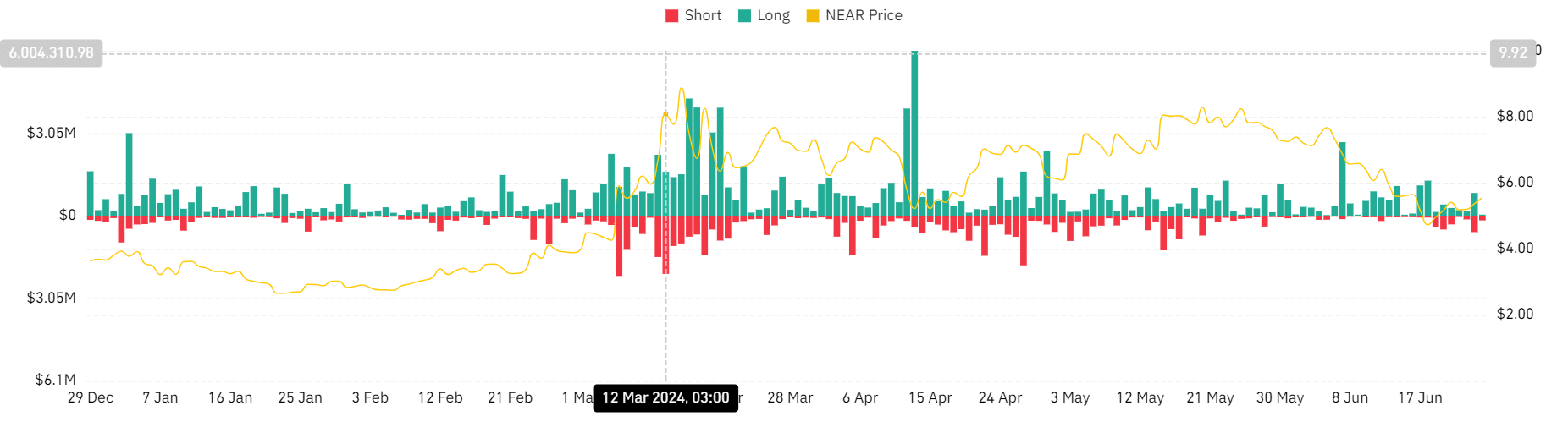

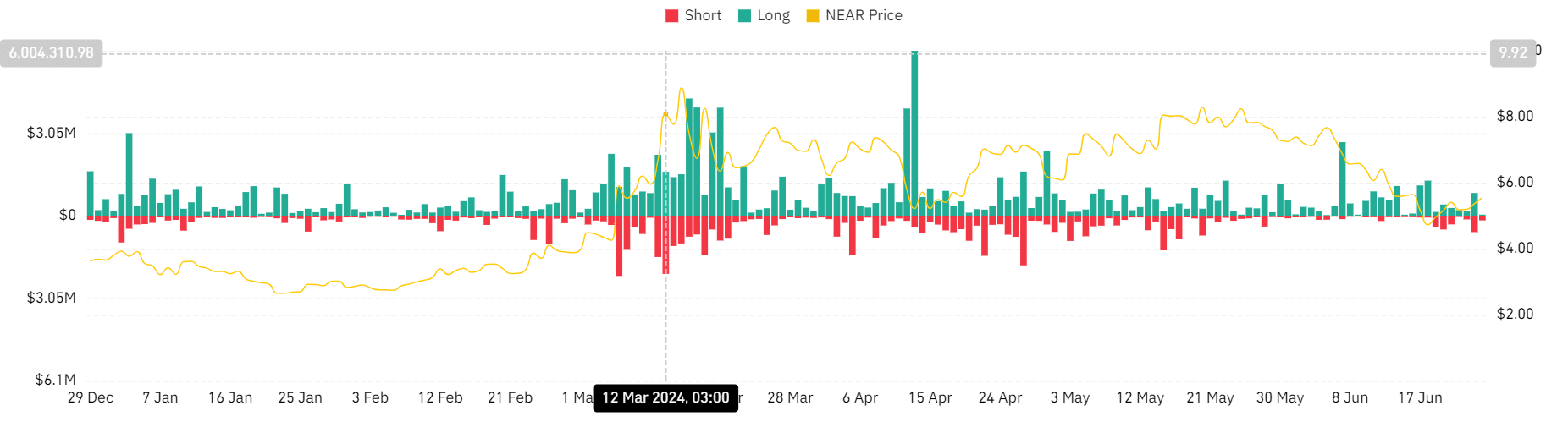

Source: Coinglass

Equally, our analysis of Coinglass showed a short squeeze scenario, with short sellers trying to cover their positions to limit losses in the last 24 hrs.

These result from unexpected price increases leading to higher buying pressure, thus increasing prices.

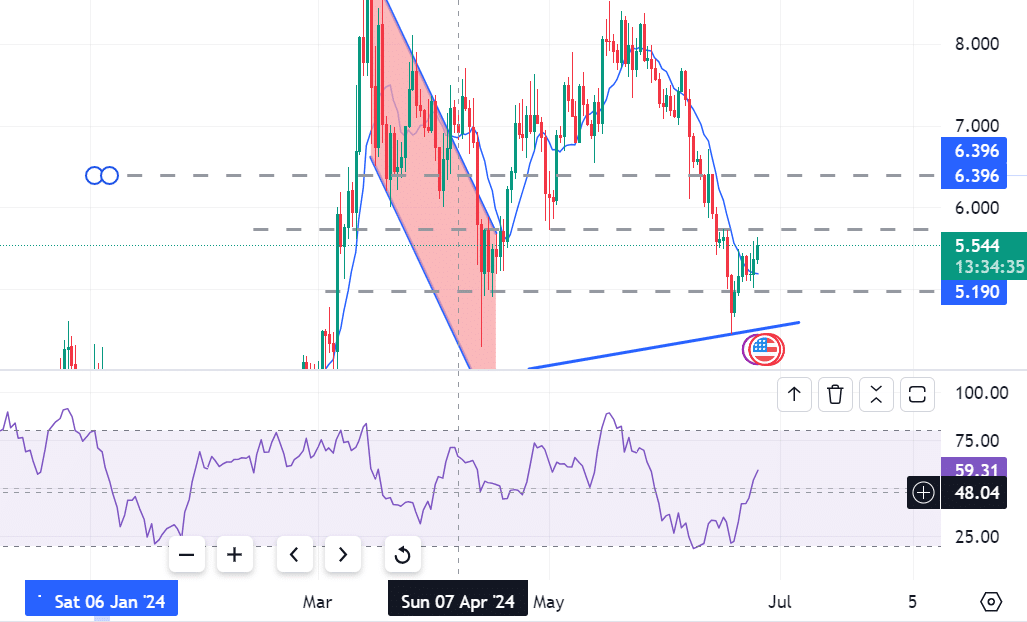

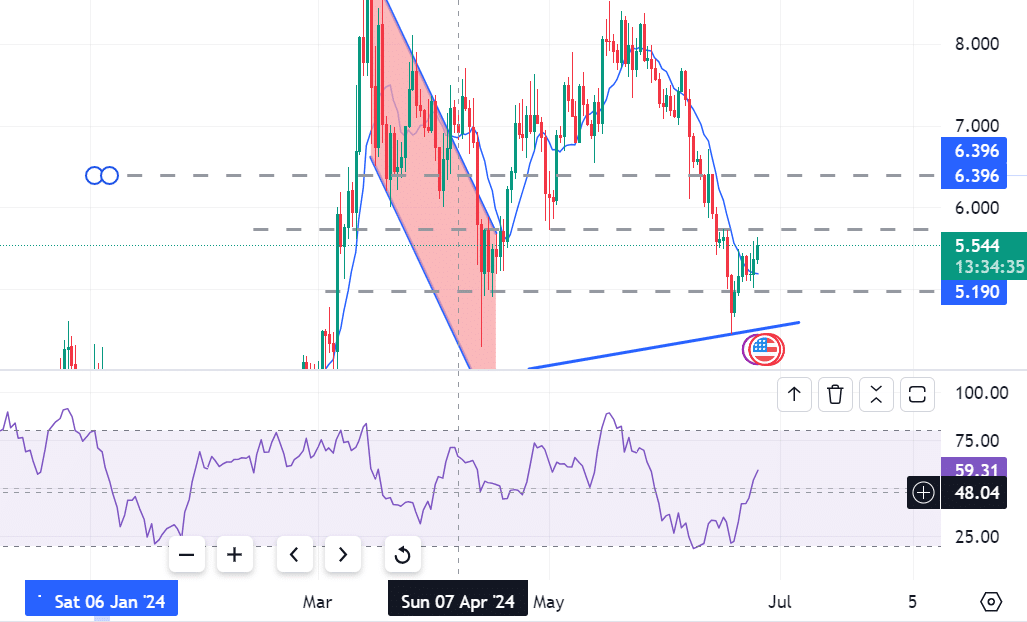

Source: Tradingview

The MFI (Money Flow Index) shows a surging buying pressure. At press time, NEAR reported an MFI of 59, which showed an increase in buying more than selling.

Higher buying pressure leads to increased prices, as the daily charts indicate.

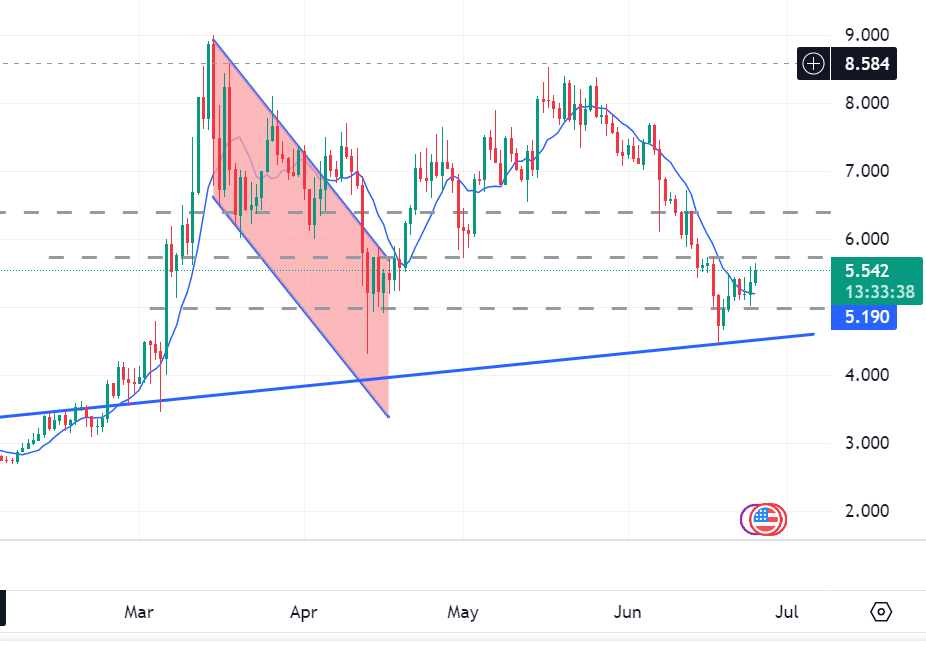

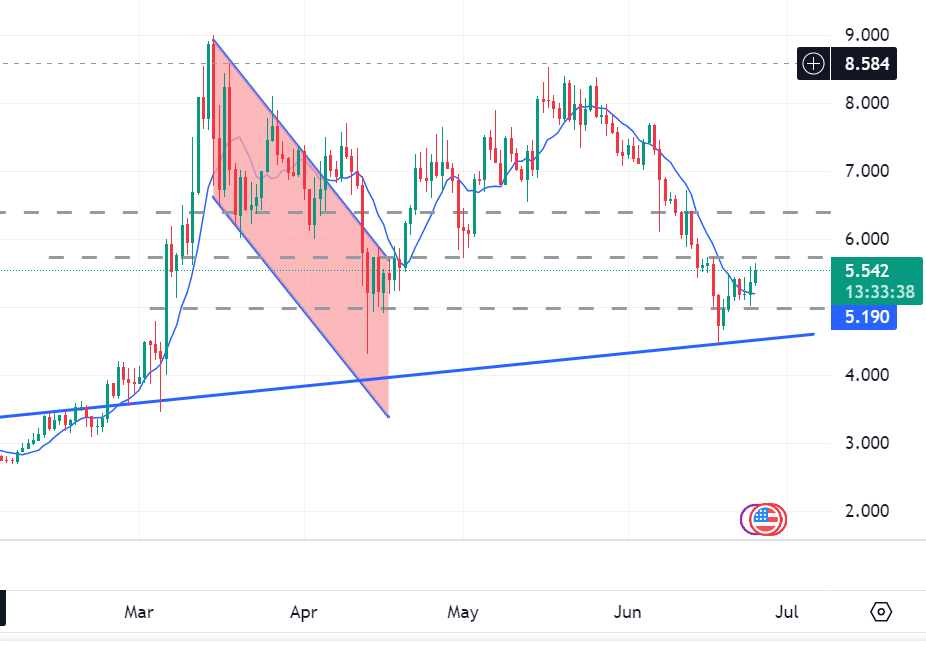

Source: Tradingview

Equally, the SMA (Simple Moving Average) was below the press time prices, indicating positive market sentiment.

When prices are above SMA, buying pressure is dominant, with buyers showing more strength than sellers, leading to an uptrend.

Realistic or not, here’s NEAR’s market cap in BTC’s terms

How far can NEAR go?

At press time, NEAR is trading at $5.58, a 2.36% surge in the last 24 hrs. Also, trading volume has increased by 29.98% in 24 hrs to $492M.

Thus, if the current buying pressure continues, NEAR will reach $5.755 in the short run. If it breaks out of the next resistance level, around $5.755, it can reach $6.396 in a highly bullish scenario.

Leave a Reply