Disclosure: The views and opinions expressed here belong solely to the author and do not represent the views and opinions of crypto.news’ editorial.

The first smart contract blockchain, Ethereum, was monolithic by design, meaning it manages its own execution, settlement, consensus, and data availability. Over the years, new decentralized applications developed, leading to increased demand for blockspace. When the demand for blockspace is more than its supply, the constrained availability restricts the range of potential applications, causing a significant impediment to utility and widespread adoption.

You might also like: Decentralized payments is a gateway to economic development | Opinion

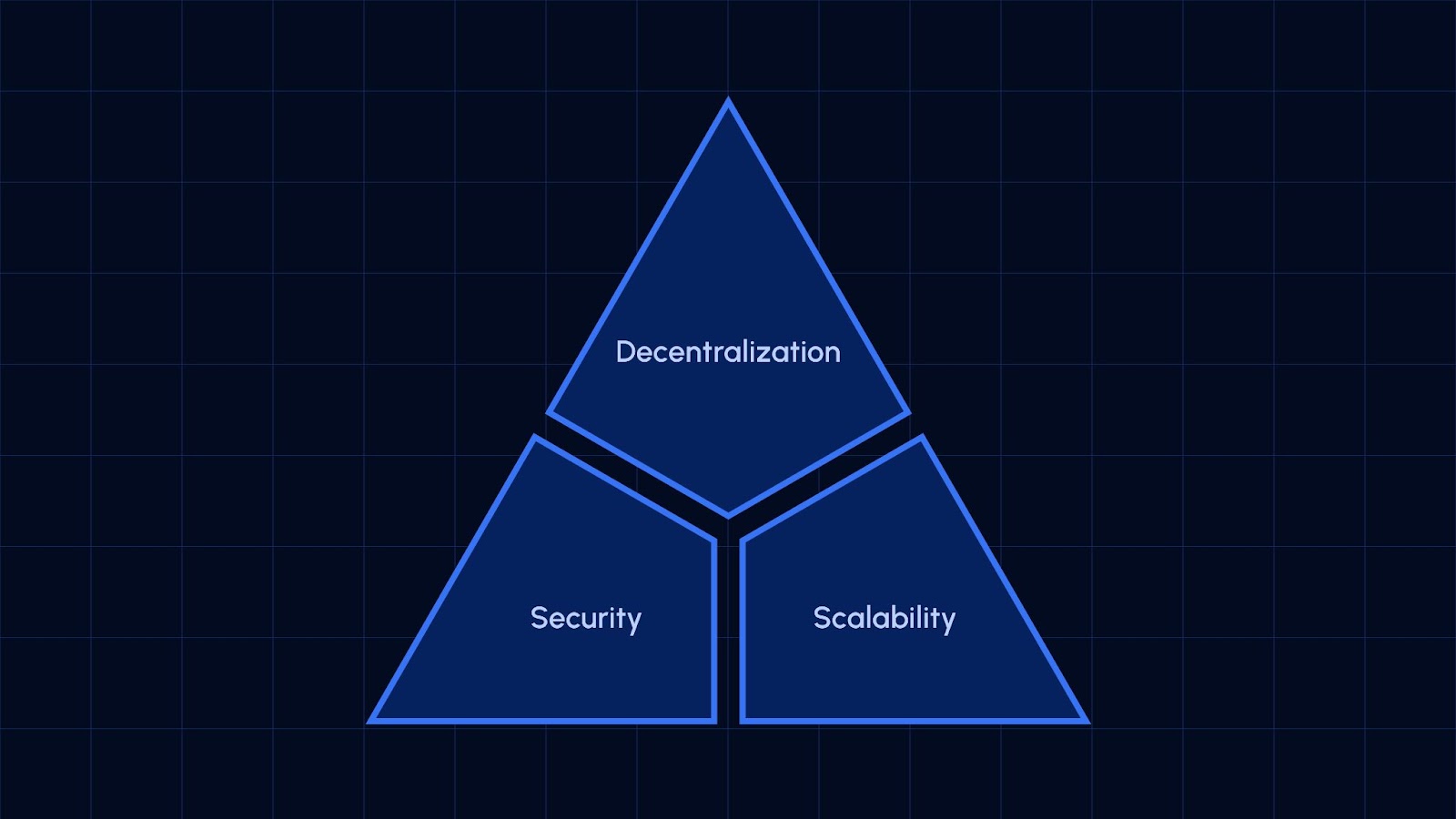

This limitation is called the scalability trilemma or, in a nutshell, the idea that no public blockchain can simultaneously achieve maximum decentralization or security to achieve optimal scalability. To overcome the limitations of the scalability trilemma, modularity has emerged as a way of outsourcing core components optimized to solve critical functions.

The courtesy of the Inco’s team

The modular blockchain thesis centers on role specialization. It proposes decentralizing traditional blockchain functions—like execution or data availability—across specialized networks. By segmenting these functions from a singular L1 into distinct layers, blockchains can be tailored for optimal performance in specific areas, significantly boosting customization, efficiency, and, where necessary, decentralization, security, and scalability.

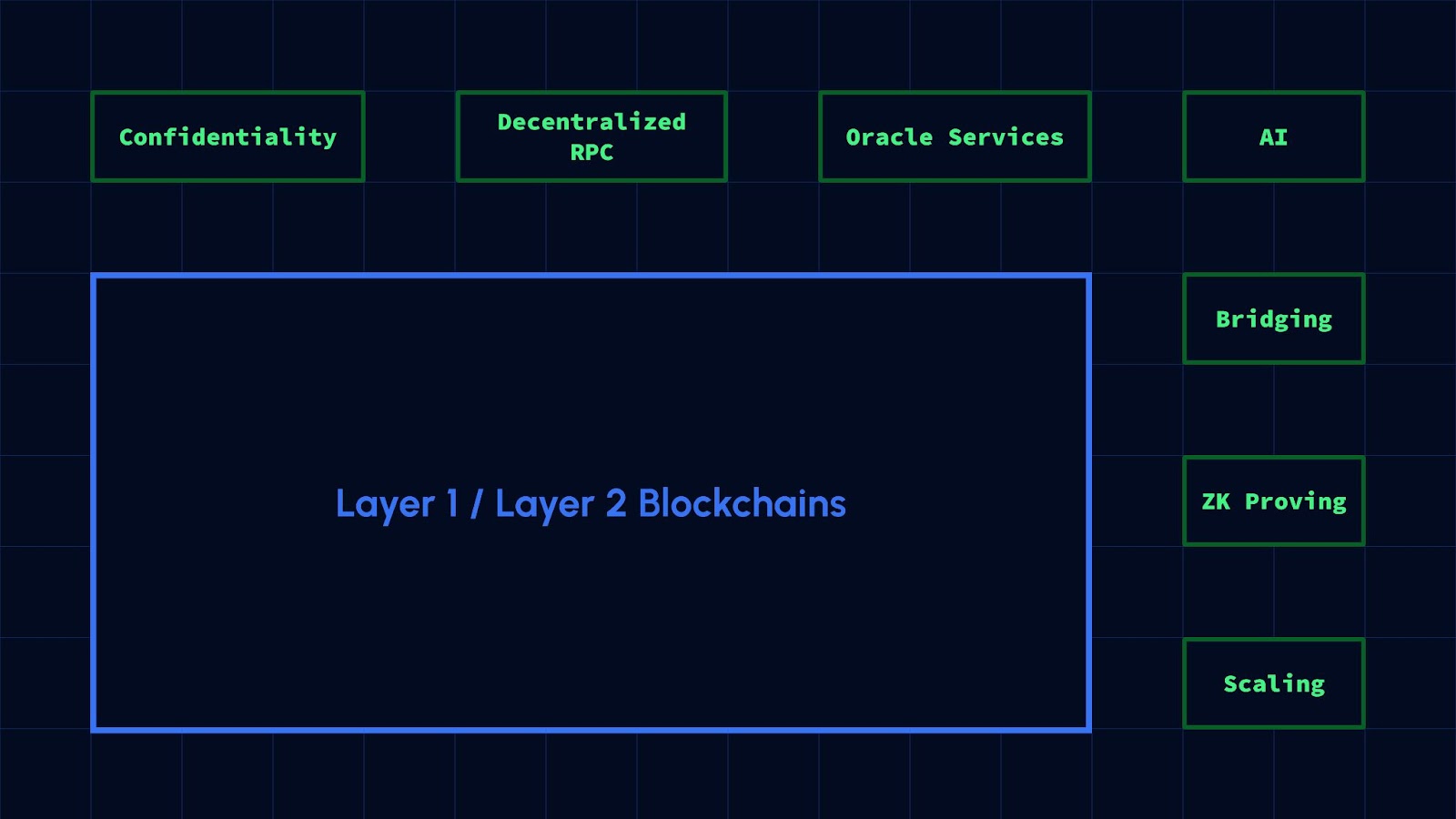

Given the diverse range of use cases, these functions can be different. A modular network could be specialized to push oracle price feeds, provide zero-knowledge proving services, make available data, or enable a more scalable execution layer on top of another underlying blockchain.

The need for modularity in the crypto industry

Ethereum exemplifies the gradual transformation into a modular world. The chain was first launched with a monolithic design, following in the footsteps of Bitcoin. Arbitrum, a layer-2, represents the success story of rollups in separating the intensive computation needed for scalability off-chain while settling back on-chain. Many more projects have adopted this design thanks to the resource effectiveness and less costly design of processing transactions using rollups.

It doesn’t stop there. Networks that help developers see and unlock the value of modularity have been on the rise. Celestia is a great example of solving an obvious problem: the significant cost of storing data availability (DA) back to Ethereum. While rollups allow for higher throughput, the cost of transacting is still relatively high because it ultimately depends on the storage cost of the settlement layer. A solution to this problem is to offer an alternative DA layer.

The realization that a single monolithic design cannot meet today’s blockchain demands without a trade-off is why the space is moving towards modularity. Ethereum is the most secure blockchain with smart contracts but has continued to face various shortcomings with processing transactions and gas fees.

The courtesy of the Inco’s team

In addition to solving blockchain’s architectural challenges, it’s becoming clear that additional services are necessary for enabling new use cases and pushing for web3 adoption. Examples of such add-on services include oracle services, decentralized RPC, ZK prover networks, AI, to name a few. However, blockchains cannot support these services natively due to the additional overhead, hardware requirements, or technical incompatibilities. Given the composable nature of the modular architecture, blockchains don’t need to support everything themselves anymore—everything can be plug-and-play like legos.

The courtesy of the Inco’s team

As an example, one unsolved problem that this space will keep on tackling is around confidentiality. Most of the widely adopted blockchains today are transparent and cannot add on-chain confidentiality without requiring resource-intensive hardware for their validators when utilizing cryptography methodologies such as zero-knowledge proofs (ZKP) or fully homomorphic encryption (FHE).

Beyond the existing four blockchain layers (execution, settlement, data availability, and consensus), a confidentiality layer on top of existing dApps is a critical missing piece that will enable net new use cases that are not feasible on top of transparent blockchains. Inco is an example of a modular protocol that acts as the fifth layer—confidential computing—by introducing fully homomorphic encryption (FHE) to Ethereum and other blockchains without changing the base protocol.

Today, modular protocols are gaining traction, and with the widespread adoption of decentralization, they will likely become the standard for building in web3. This standard will undoubtedly disrupt the vertically integrated approach of monolithic chains and tap into specific Lego blocks that can be matched to create distinct modular stacks. This means projects will use the modules they need for their specific needs instead of trying to do everything.

This will unlock infinite scalability because a network could depend on Ethereum for security, Move as the execution environment, Celestia for data availability, and Inco for confidential computing. The ultimate goal is for disparate ecosystem modules to coexist and grow together.

The landscape of blockchain technology is poised for significant expansion with the advent of modular architectures in 2024 and beyond. These novel blockchains delegate at least one of the quintessential functions—settlement, consensus, confidentiality, data availability (DA), or execution—to another distinct blockchain framework.

Read more: Trust, but verify (with better data): overcoming AI’s hallucination problem | Opinion

Remi Gai

Remi Gai is the founder and CEO of Inco. He is a web3 founder fellow at South Park Commons, with a background in engineering (Google, Microsoft), entrepreneurship (founding member of Parallel Finance, a suite of defi protocols on Polkadot that reached over 500M in TVL backed by Polychain, Sequoia, Founders Fund, Coinbase Ventures), product management (web3 UX lead at co-founded blockchain studio), and venture capital (8 Decimal Capital). Now, he builds Inco, aiming to break down the final barrier to mass adoption of web3.

Leave a Reply