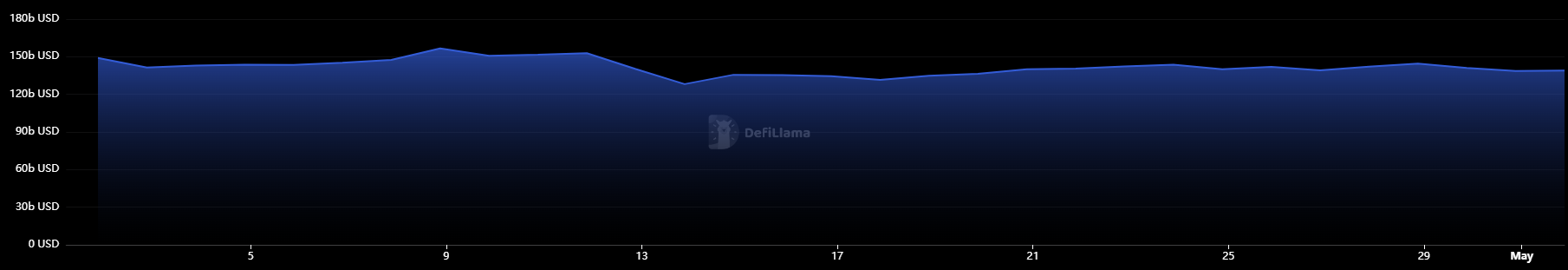

The total value locked (TVL) on decentralized applications fell $10 billion in April, according to data aggregator DefiLlama. That’s a 7% drop in 30 days, as the decentralized finance (DeFi) ecosystem closed last month with $138.6 billion, including liquid staked amounts.

Considering the 10 largest blockchains by TVL, Avalanche registered the most significant monthly drop, with 31.5% of the funds leaving the chain. Solana also saw a considerable amount of crypto leaving its ecosystem as its TVL slump was almost 30%.

Nevertheless, the over $6 billion locked in its applications makes Solana the third-largest blockchain in total value locked. Meanwhile, despite the 14.2% drop, Ethereum still dominates almost 69% of DeFi’s TVL.

Despite the outflow of locked funds seen in the decentralized ecosystem, Base and Bitcoin managed to attract more capital and surpass the $1 billion threshold. The Layer-2 blockchain created by crypto exchange Coinbase presented an 18.4% growth, led by Moonwell, Seamless Protocol, and Tarot applications.

Bitcoin was propelled by new L2 infrastructure, which boosted its TVL by almost 39% in a month. Moreover, the Bitcoin DeFi narrative is hyped by industry players, such as services provider Trust Machines. Mark Hendrickson, a member of Trust Machines’ team, shared with Crypto Briefing that Bitcoin has as many functionalities as other blockchains, and events such as Stacks’ Nakamoto upgrade will boost the DeFi narrative.

Blast, another layer-2 blockchain built on Ethereum, showed a slight growth of 4.4% in April and closed the group of winners for the past 30 days.

Leave a Reply