- MATIC traded 23% lower than the same time last week.

- Wallets holding between 1,000 to 10 million coins increased sharply over the week.

The crypto market remained soaked in red, as Bitcoin [BTC] and most leading altcoins failed to counter downside volatility.

Not an exception, MATIC, suffered as well, dropping nearly 4% in the last 24 hours, according to CoinMarketCap.

The native token of popular layer-2 (L2) network Polygon was trading at $0.71 as of this writing, 23% lower than the same time last week.

Opportunity to stockpile some more?

Typically, such sharp corrections in a bull market are not viewed with an overtly negative sentiment, for they allow seasoned market players to accumulate coins at lower prices.

On-chain tracker Lookonchain drew attention to one such whale who utilized the downside to fill up their bags.

Among various altcoins, MATIC featured prominently, with nearly 2 million of them getting scooped up by the wealthy investor.

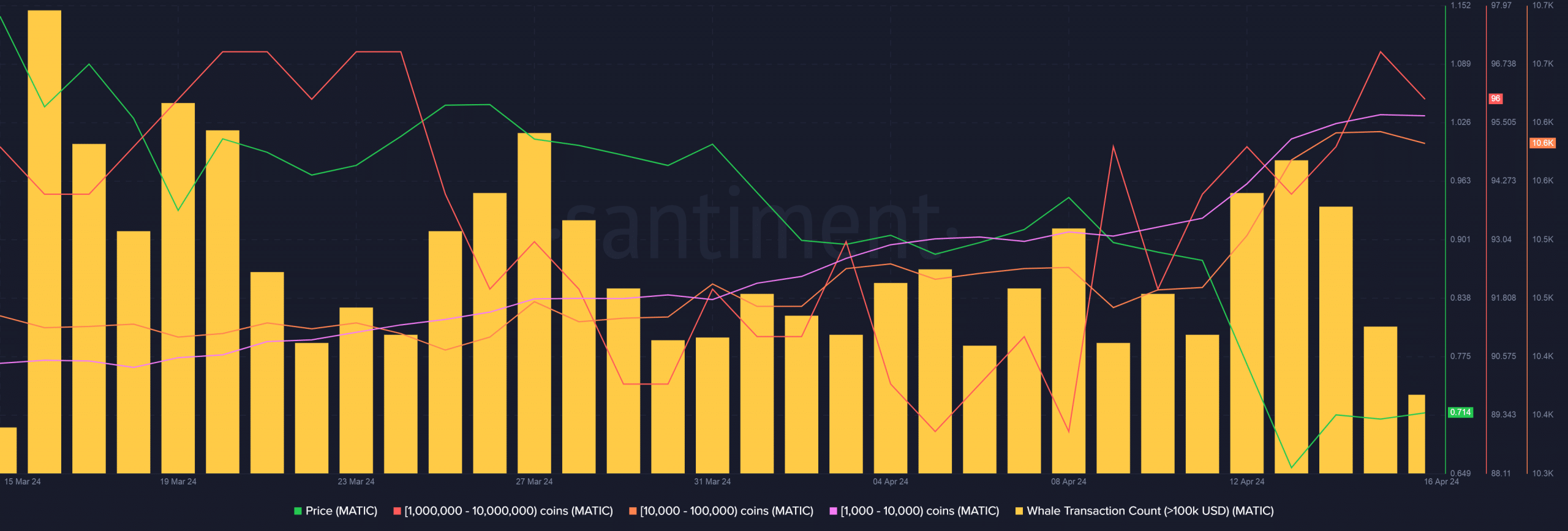

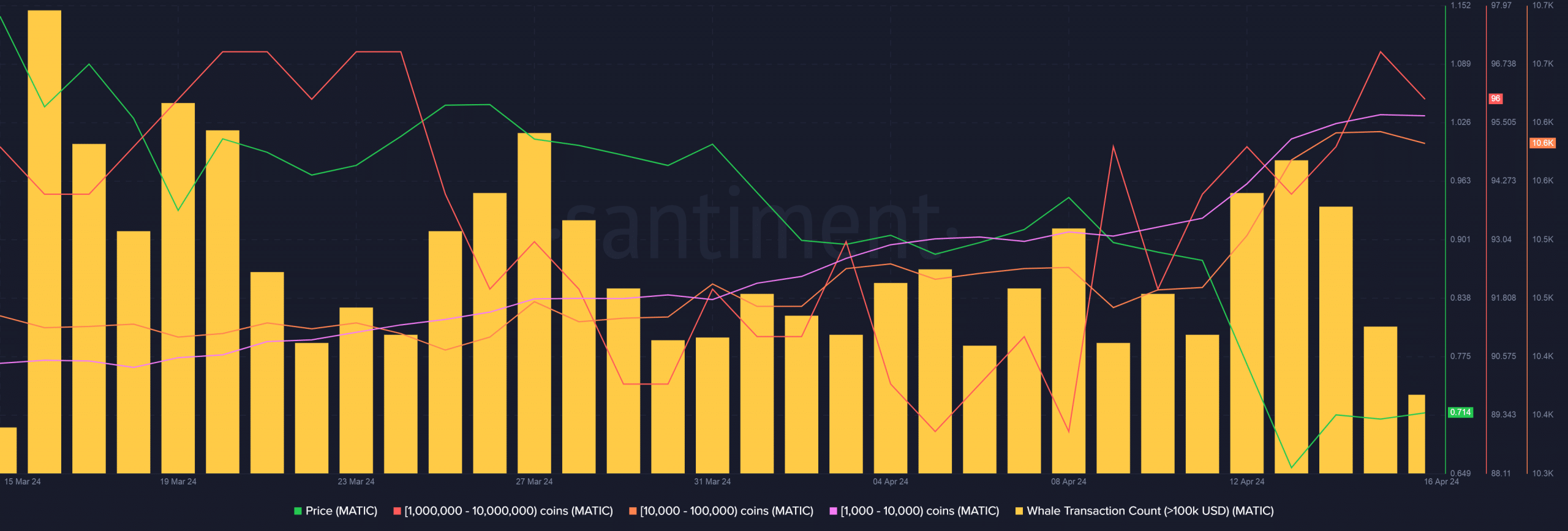

But this was not just a one-off incident. Using Santiment’s data, AMBCrypto noticed a noticeable uptick in holdings of whale cohorts.

The number of wallets holding between 1,000 to 10 million coins increased sharply over the week. At the same time, large transactions, worth more than $100,000, increased significantly.

This indicated that whales were indeed buying MATIC’s dip.

Source: Santiment

Whales confident of MATIC’s rebound?

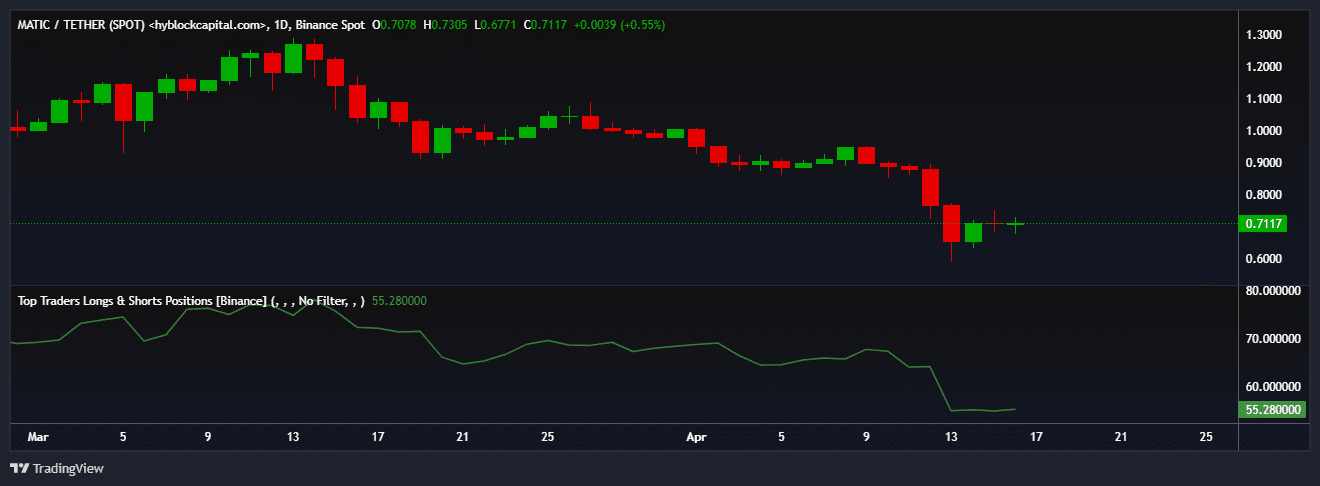

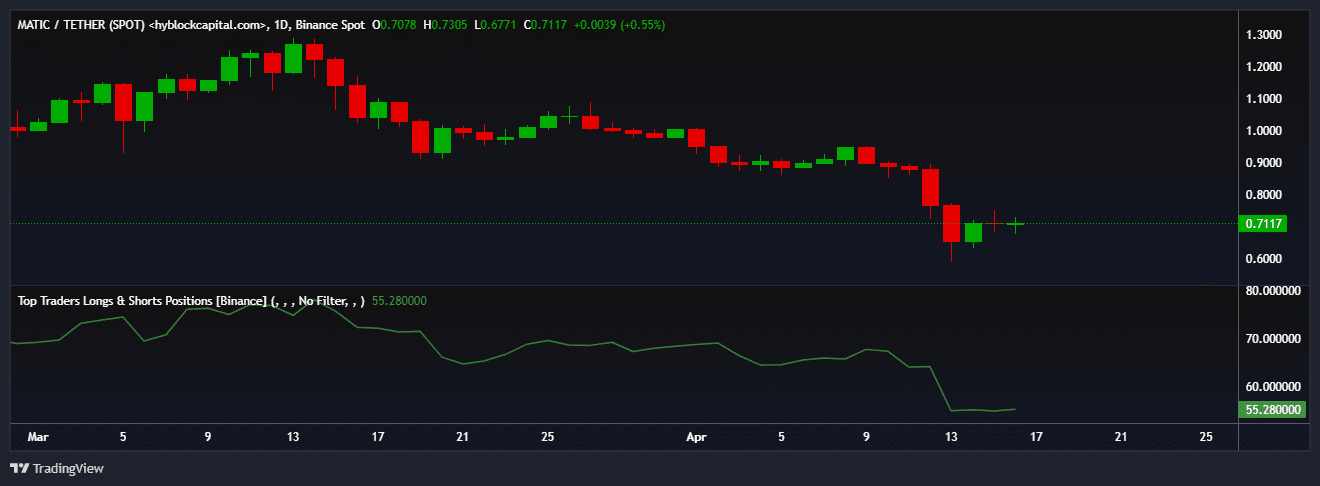

The motivation to accumulate was rooted in their bullish expectations from MATIC.

Despite a notable drop, nearly 55% of all whale positions for MATIC on Binance were long as of this writing, according to AMBCrypto’s analysis of Hyblock Capital’s data.

This suggested that they were confident of a rebound in the short term.

Source: Hyblock Capital

Is your portfolio green? Check out the MATIC Profit Calculator

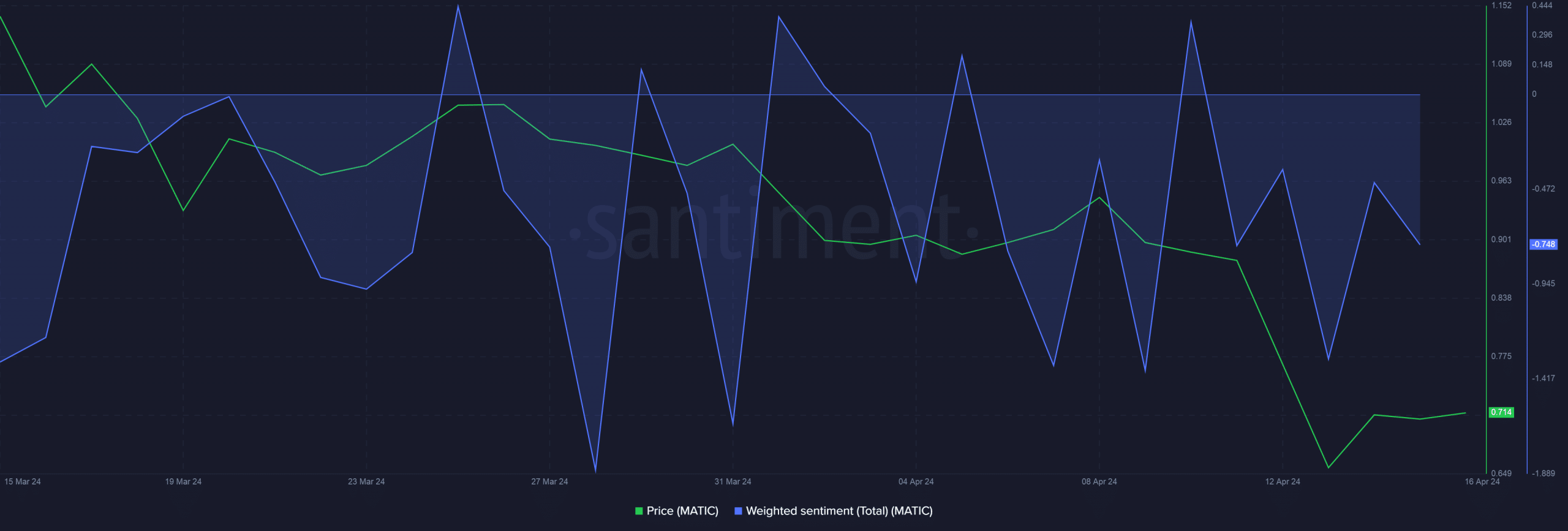

Negative commentary dominates

However, the price slump contributed to increased negative commentary around the coin, as evidenced by the negative Weighted Sentiment indicator.

Typically, such bearish takes could influence retail investors’ participation, as the latter are persuaded by discussions, particularly on social media.

Source: Santiment

Leave a Reply