The Bitcoin ecosystem will change forever following the halving with the introduction of Runes, a novel fungible token protocol that promises to revolutionize tokens on Bitcoin’s blockchain.

Spearheaded by Casey Rodarmor, the creator of Ordinals, Runes emerges as a promising alternative to the previously established BRC-20 token standard. This new development signals a significant stride toward simplification and efficiency in creating and managing Bitcoin-based tokens.

You’ve probably seen a good deal of hype around Runes on the timeline. Why are people so excited? Many in the Bitcoin community believe the launch of Runes at the halving offers a new generational wealth opportunity — one source in the know described it as a “memecoin gold rush on Bitcoin.” Even Rodarmor has hailed the “delightful, artisanal shitcoining” Runes will bring to Bitcoin post-halving.

The Bitcoin halving is currently anticipated to occur on April 19 around 11:59 p.m. ET. However, this time may change based on the current block height and the average block time. You can find the latest countdown clock here. Runes will go live as soon as the halving occurs, and many of the most highly anticipated projects will launch immediately after. In fact, some projects are already offering exposure to forthcoming Runes launches via Pre-Runes inscriptions.

This guide gives an overview of Runes’s inception, mechanics, and potential impacts and offers resources on preparing for its launch later this week.

What are Runes?

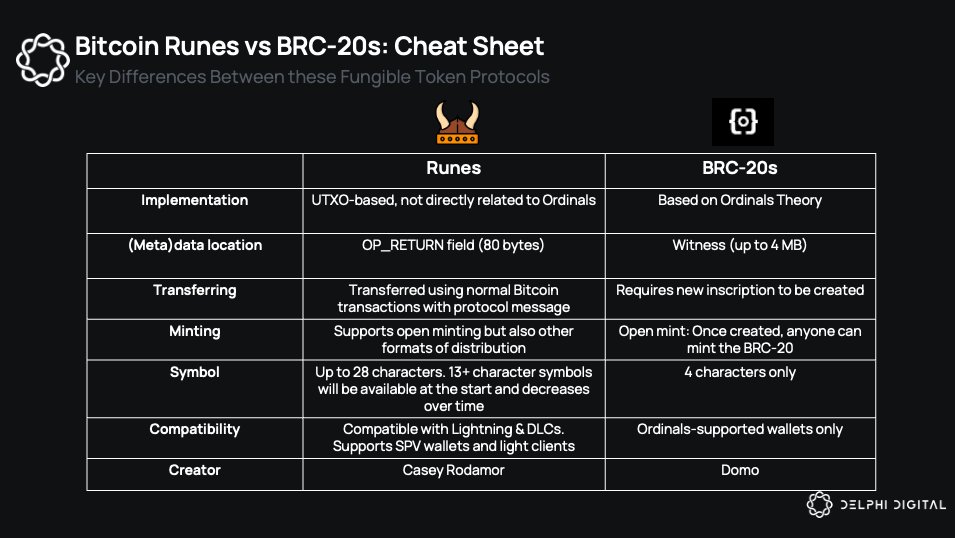

Developed by Casey Rodarmor, the creator of the Ordinals protocol, Runes was introduced in September 2023 as a streamlined, efficient alternative to the earlier BRC-20 token standard. Runes are fungible tokens that operate directly on the Bitcoin blockchain, utilizing a protocol that aims to minimize the clutter of unnecessary transaction outputs, commonly referred to as “junk” UTXOs (Unspent Transaction Outputs), which have historically clogged the network.

Prior to Runes, the BRC-20 standard, launched in March 2023, represented the initial attempt at integrating fungible tokens within the Bitcoin ecosystem. While innovative, BRC-20 was criticized for its inefficiency and the complexity it introduced into the network, particularly through the creation of excessive junk UTXOs that slowed transaction processing speeds. The Runes protocol addresses these inefficiencies by ensuring that data storage does not burden the network, promoting faster and more cost-effective transactions.

How Runes Works

At its core, the Runes protocol capitalizes on the foundational UTXO model of Bitcoin. Each transaction in Bitcoin consumes certain inputs and produces outputs, which are then either spent in future transactions or remain as UTXOs. The Runes protocol assigns the token supply to specific UTXOs, which can hold varying quantities of Runes, thereby facilitating efficient management of token balances and transfers.

The Runes protocol starts with an issuance transaction defining the token’s characteristics, such as its symbol, total supply, and decimal places. These details are assigned to a specific UTXO, which can contain any quantity of Runes, be it billions or just a few. This flexibility allows for efficient management of token supplies without congesting the network.

For token transfers, the Runes protocol splits a single UTXO into multiple new UTXOs, each representing different amounts of the token, which are then sent to the respective recipients. In contrast to previous token standards, which required off-chain data or separate native tokens to operate, Runes maintains all transactional data on-chain, utilizing the OP_RETURN function—a script that allows for embedding data directly into Bitcoin transactions without affecting the network’s efficiency.

Etching and Minting Runes

Etching is the foundational step in the lifecycle of a Rune, where the digital token is first created and defined on the blockchain. This process involves setting the specific characteristics and governance rules of the Rune, which include its divisibility, the conditions under which it can be minted, and its initial distribution through what is known as a “premine.”

The premine is an optional yet pivotal phase in the etching process, where a predetermined amount of the Rune is allocated to the creator or initiating party before it becomes publicly available. While not mandatory, the premine serves multiple strategic purposes: it provides initial funding for the project’s ongoing development, rewards the creators, and can allocate tokens for community incentives or other programmed distributions. This initial allocation can be crucial for bootstrapping the token’s ecosystem by ensuring that developers and early contributors have a stake in the project’s success.

Following the initial creation, the Rune may undergo minting— the process by which new tokens are generated. Minting can be structured as either an open or closed system, each defined by specific pre-set conditions established during the etching phase.

- Open Minting: This model allows for the democratic creation of new tokens by any individual who meets the previously set conditions. This openness ensures that the community can actively participate in the growth of the token’s ecosystem.

- Closed Minting: Under this model, new tokens can only be created when certain predefined criteria are met. These could be reaching a particular threshold or the elapse of a specific time period. Once these conditions are no longer satisfied, the minting process is terminated, thus capping the token supply.

The specifics of how and when Runes can be minted are governed by a set of terms agreed upon during the etching process. These terms typically include:

- Cap: This is the maximum number of tokens that can be minted. Reaching this cap halts further token creation, thereby controlling inflation and maintaining the token’s value.

- Amount: Specifies the number of tokens generated in each minting transaction, providing clarity and predictability in the token supply.

- Start and End Heights: These parameters dictate the specific points within the blockchain’s lifecycle—measured in block heights—between which tokens can be minted. They can be set to precise block numbers or calculated as offsets from the block containing the initial etching.

These structured parameters ensure that the minting process remains within the bounds of the initial design, promoting a stable and predictable expansion of the Rune’s presence on the blockchain.

How to Prepare for Runes

As with any new launch on a bleeding-edge technology frontier, preparation is your best chance to succeed.

For the most comprehensive guide on preparing for Runes, the Pizza Ninjas Ordinals community has put together an incredible Survival Guide that is token-gated in their Discord. However, if you’re unable to shell out the 0.189 BTC ($12,000) for a Pizza Ninja, many great free resources are also available.

Here’s an overview of some important steps you’ll want to take to obtain a competitive advantage for the Runes launch.

1. Install Bitcoin Core

You’ll want to run your own Bitcoin node to avoid relying on third parties. Begin by installing Bitcoin Core from bitcoin.org on a SSD hard drive. While the files take up around 700 GB, we recommend a 2 TB drive to account for future size increases. Choose the version appropriate for your system (ARM for M-series Macs, x86 for Intel-based Macs). Do not restrict blockchain storage to ensure a complete download of Bitcoin’s history. Depending on your connection, this can take anywhere from 24-72 hours, so make sure to give yourself enough time!

2. Install Ord and Runes

Next, you’ll need to install the Ord and Runes clients. Follow the relevant guides to install Ord and Runes, depending on your operating system. Links for installation guides are typically available on respective developer community sites. You’ll also need to build in time to index the the Ord client to Bitcoin Core’s index.

3. Practice on Testnet

Practice makes perfect. You wouldn’t play a basketball game without warming up first, so why would you go into halving day cold? Luckily, anyone who has Bitcoin Cord, Ord, and Runes set up can get their feet wet with the command lines and processes for etching and minting Runes on the testnet.

4. Keep a Finger on the Pulse

The Runes launch is about as Wild West as it gets, so you won’t find the latest alpha on news websites. You’ll need to build a network for real-time updates to stay on top of the Runes projects launching in the crucial early hours and days. Curate an X list of leaders in the Runes space like Casey Rodarmor, Trevor Owens, Leonidas, and BitGod. Be sure to jump into the Discords for leading Ordinals and Runes projects to connect and share information with like-minded Runes explorers.

Runes Ecosystem

As the Runes ecosystem evolves within the Bitcoin blockchain, several platforms are emerging to support the trading, launching, and lending of these new digital tokens. Understanding these platforms will be crucial for users looking to engage with the Runes economy effectively. Here’s a look at the current landscape of Runes wallets, marketplaces, Pre-Runes, and launchpads.

Runes Wallets

You’ll need a trusted wallet client to store and transact your Bitcoin Runes. Our recommendation is Xverse, a wallet offering a streamlined and secure way to manage Runes tokens. Available as a mobile app for both Android and iOS, as well as a Chrome browser extension, Xverse integrates smoothly with supported Runes marketplaces, allowing for easy buying and selling of Runes tokens. Users need to ensure they have enough BTC to cover transaction fees, but can rest assured that their Runes tokens will be securely stored within the Xverse wallet once purchased.

Runes Marketplaces

At the forefront of the Runes ecosystem are the marketplaces, digital hubs where users can buy and sell Runes and their derivatives. Prior to the full activation of the Runes protocol, traders can familiarize themselves with the market dynamics by trading Pre-Rune tokens on platforms such as Magic Eden and OKX.

Here are some notable Pre-Runes and forthcoming projects to be aware of:

- Rune Pups — The $PUPS token associated with the white-hot Ordinals project Bitcoin Puppets will be shifting from BRC-20 to Runes following the halving. Holders of Rune Pups inscriptions, which were airdropped free to Puppets holders, will receive 23% of the $PUPS supply.

- Runestones — Airdropped for free to more than 112,000 holders of three or more Ordinals in March, this project by Leonidas already promises three token airdrops following the Runes launch, including a highly anticipated dog memecoin.

- RSIC Metaprotocol — After making waves by mysteriously airdropping 21,000 inscriptions to holders of select Ordinals projects in January, this project allows collectors to “mine” tokens in anticipation of its forthcoming Runes launch.

- Prometheans—While not currently available, CyberKongz’s free Runes project will launch next week with a 21,000 token supply and airdrops to leading Ordinals communities.

Runes Launchpads

To support the growth and introduction of new tokens within the ecosystem, Runes launchpads offer critical infrastructure and promotional assistance. These platforms ensure that new projects have the tools and visibility required for a successful market entry. In addition to established marketplace players like Magic Eden and BitX, keep an eye on launchpads like Ordinalsbot, Runespad, Meta Runes and more.

Editor’s note: This article was written by an nft now staff member in collaboration with OpenAI’s GPT-4.

The post Inside Bitcoin Runes: A Guide to the New Fungible Token Standard appeared first on nft now.

(Pre-runes) Tokens

(Pre-runes) Tokens

Leave a Reply