- BTC’s price increased marginally in the last 24 hours.

- Indicators and metrics suggest a drop in price soon.

Bitcoin’s [BTC] price has been in a consolidation phase for weeks under its new ATH. If the latest data is to be believed, then this trend might last longer, and investors might not see BTC reach new highs until the halving.

Bitcoin to remain sluggish

AMBCrypto reported earlier how BTC’s price plummeted under the $66k mark. The drop in price caused $200 million worth of liquidations across the board in the cryptocurrency market.

However, Bitcoin did show some signs of recovery as its price jumped above $66k. According to CoinMarketCap, at the time of writing, BTC was trading at $66,277.96 with a market capitalization of over $1.3 trillion, with the crypto expected to soon climb to at least $67,000.

But investors should not get ambitious, as the trend might not last.

Michael Van de Poppe, a popular crypto analyst, recently posted a tweet highlighting BTC’s state. As per the tweet, BTC was consolidating, and he did not expect BTC to touch a new ATH before the upcoming halving event.

For initiators, the next BTC halving is scheduled to happen in 15 days, which will reduce BTC’s issuance rate and miners’ rewards. In fact, Poppe’s analysis also mentioned the possibility of BTC plummeting to $60k–56k this summer.

Is $60k BTC’s support?

Apart from the analysis, AMBCrypto’s look at CryptoQuant’s data also pointed out quite a few bearish metrics that hinted at a price drop.

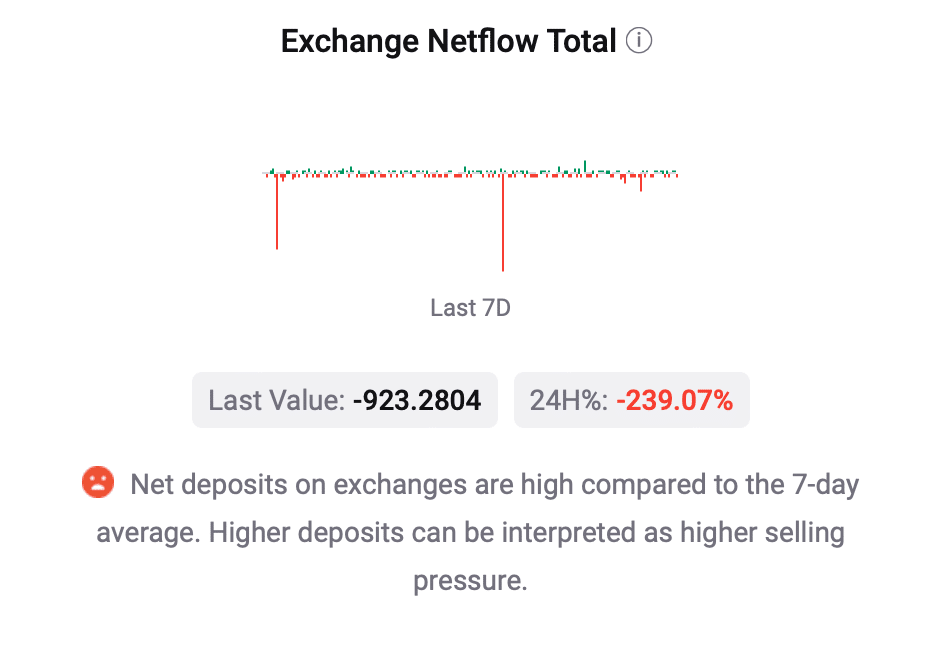

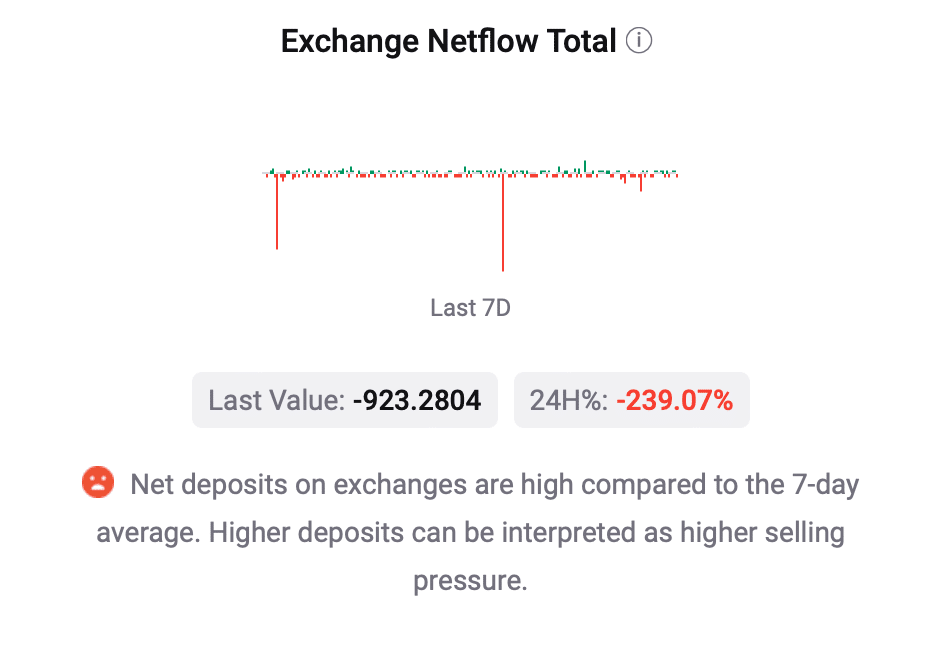

For instance, BTC’s net deposit on exchanges was high compared to the last seven-day average, suggesting that selling pressure on the coin was high.

Source: CryptoQuant

Bitcoin’s aSORP was red. This meant that more investors were selling at a profit. In the middle of a bull market, it can indicate a market top. Additionally, selling sentiment among Korean investors was also high, which was evident from its red Korea Premium.

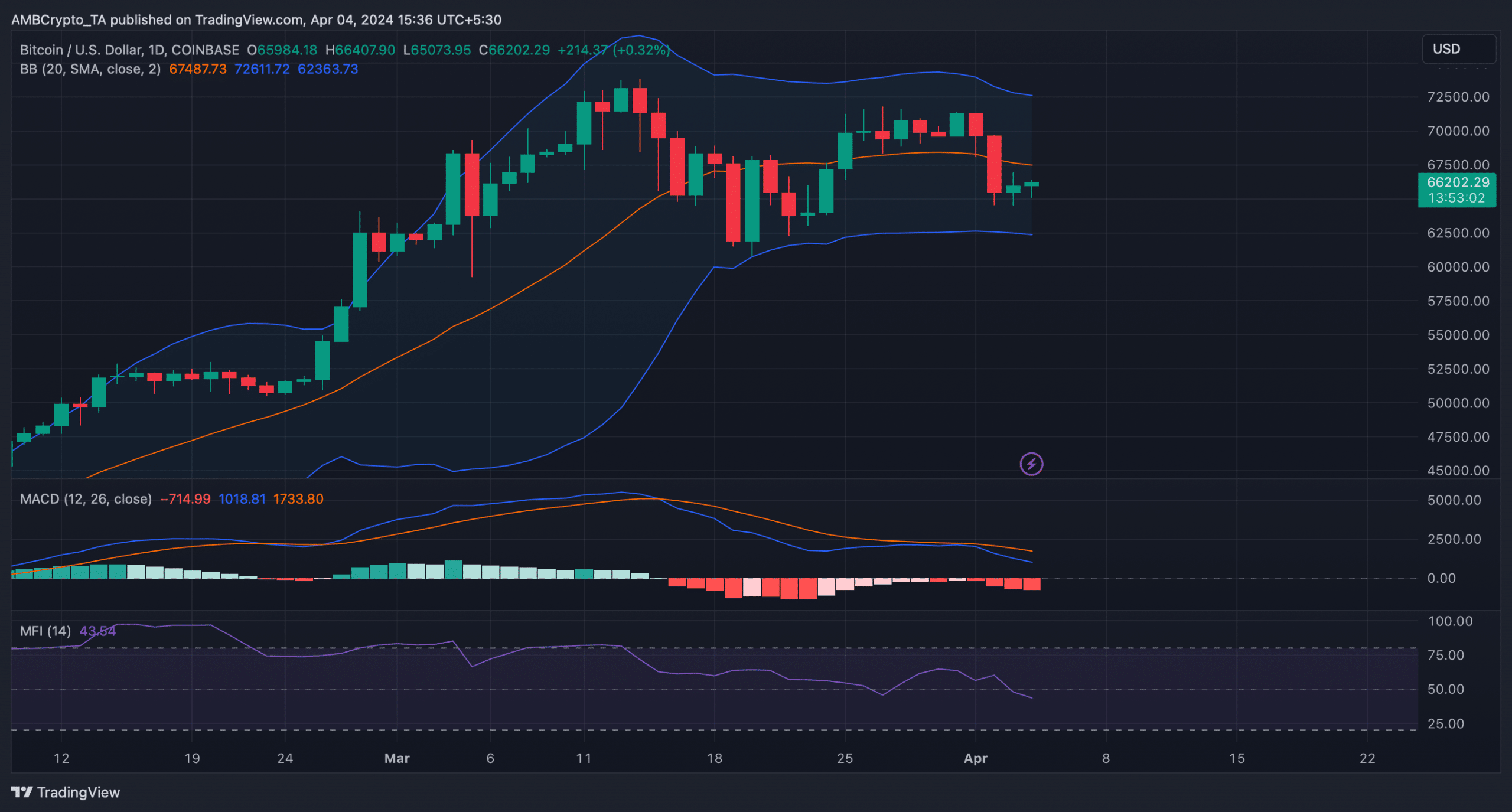

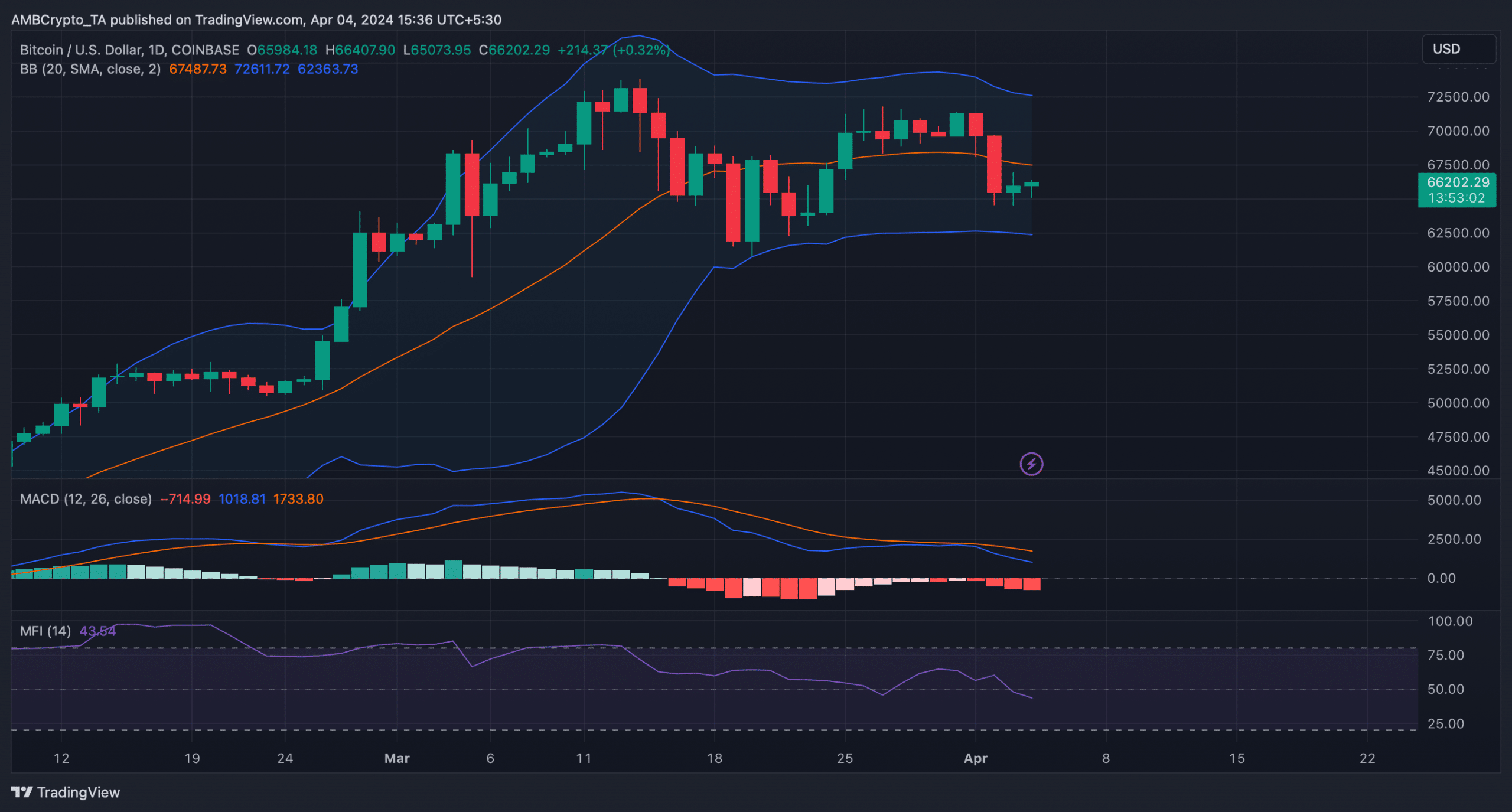

To check whether a downtrend is inevitable, we then checked Bitcoin’s daily chart. We found that its MACD displayed a bearish crossover.

The Money Flow Index (MFI) registered a downtick, hinting at a further price plummet. Nonetheless, the Bollinger Bands revealed that BTC’s price was in a less volatile zone, which can restrict BTC’s price from falling sharply.

Source: TradingView

Read Bitcoin’s [BTC] Price Prediction 2024-25

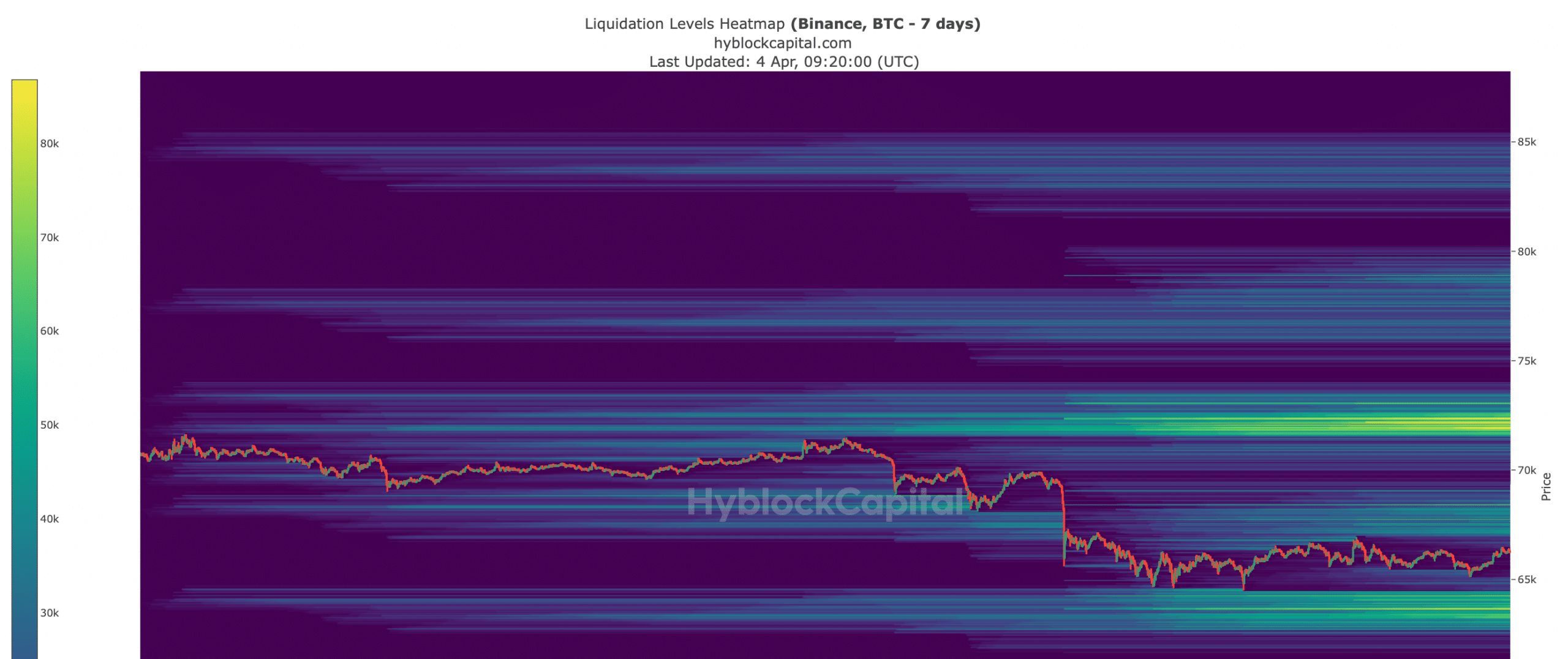

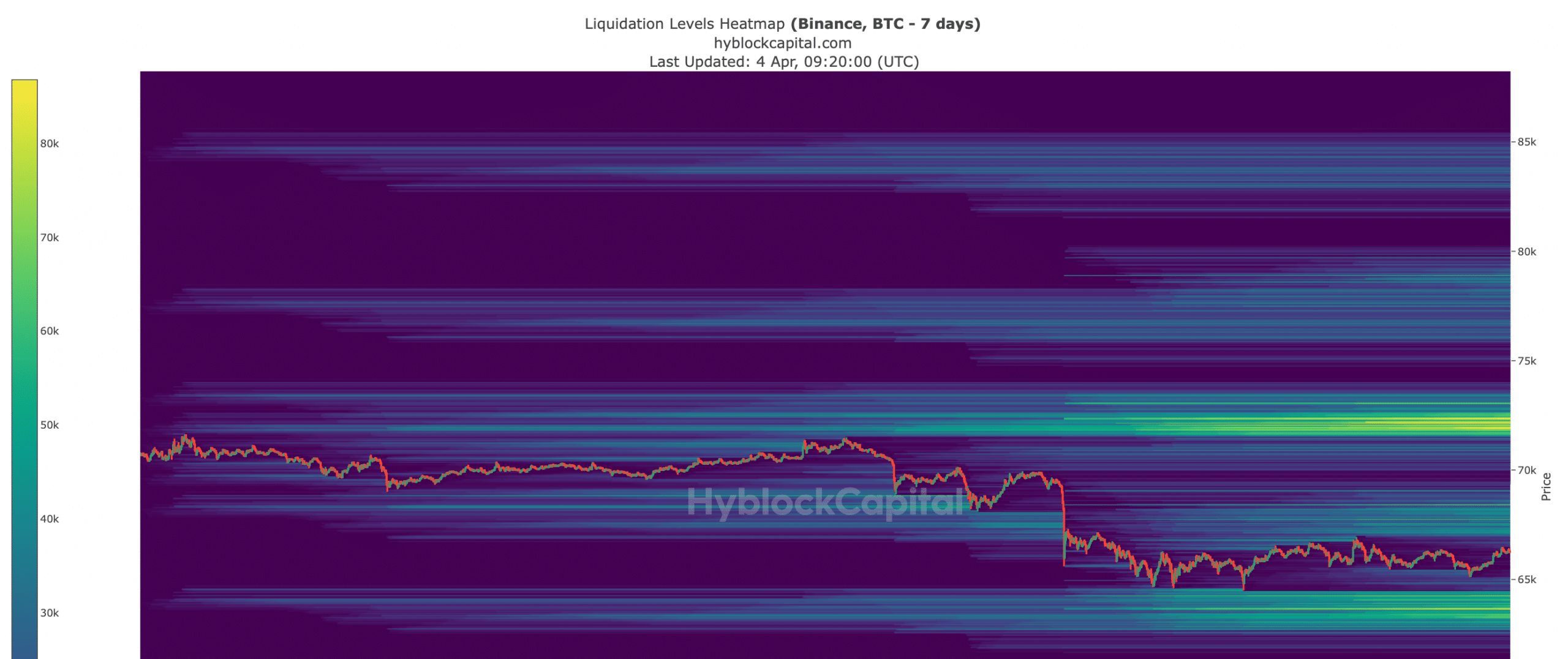

AMBCrypto then checked Hyblock Capital’s data to look for support levels if a BTC downtrend happens. We found that BTC has strong support near the $66k mark.

However, considering past incidents, if BTC’s price fails to test that level, then its price might plummet to $60k, where it also has strong support.

Source: Hyblock Capital

Leave a Reply