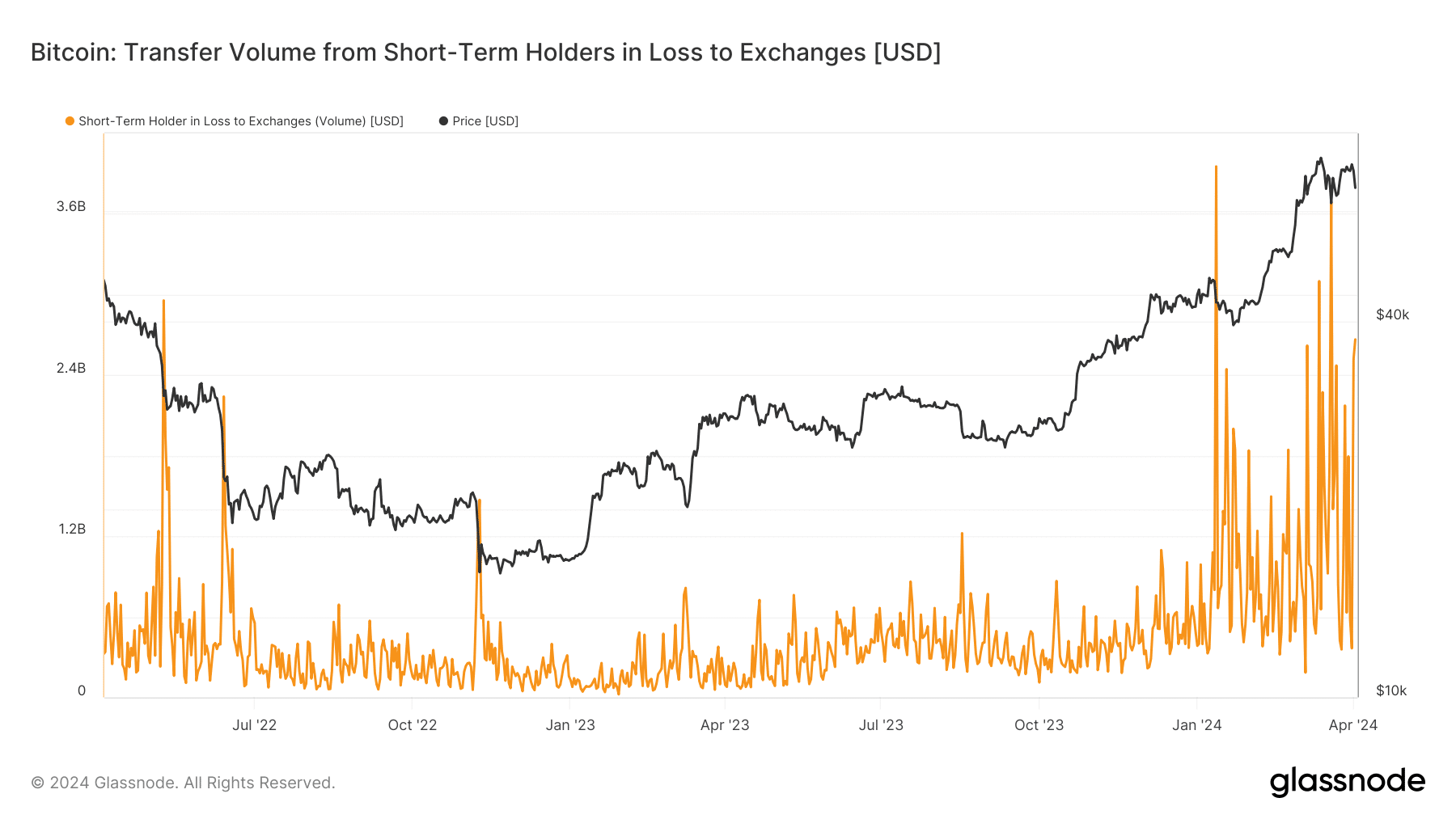

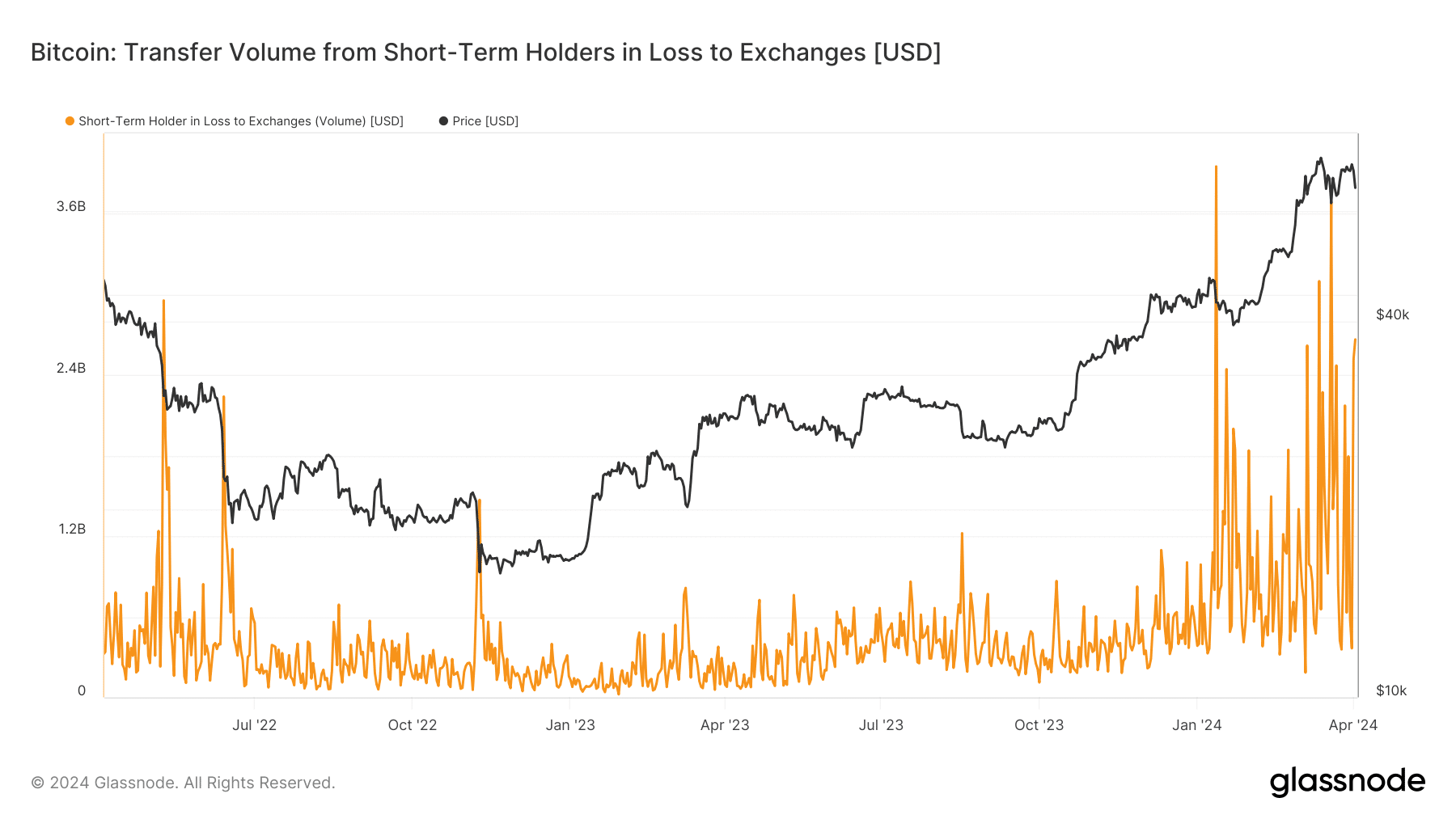

- Short-term Bitcoin holders began to sell their holdings.

- Interest in Bitcoin ETFs remained high despite price fluctuations.

Bitcoin’s [BTC] fall from $70,000 has inspired mixed reactions from the cryptocurrency market. Many addresses, who were not expecting this kind of volatility, were observed to be panicking.

Short-term holders panic

Based on recent data, over the past forty-eight hours, Short Term Holders (STH) sent $5.2 billion worth, equivalent to 76,000 Bitcoin, to exchanges at a loss. This action increased selling pressure on BTC.

The influx of Bitcoin into exchanges may temporarily saturate the market with supply, leading to downward pressure on prices.

This bearish sentiment can spread throughout the market and cause panic selling among other investors.

Prolonged downward pressure on prices may impact long-term investors, who could experience paper losses or reconsider their investment strategies.

Source: glassnode

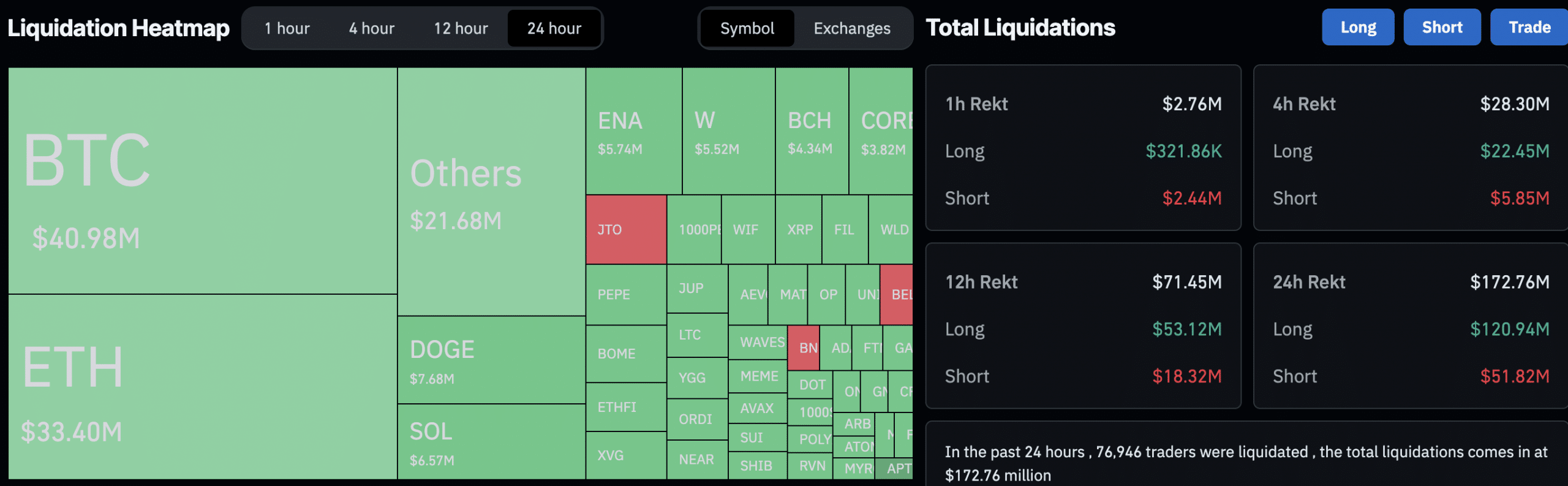

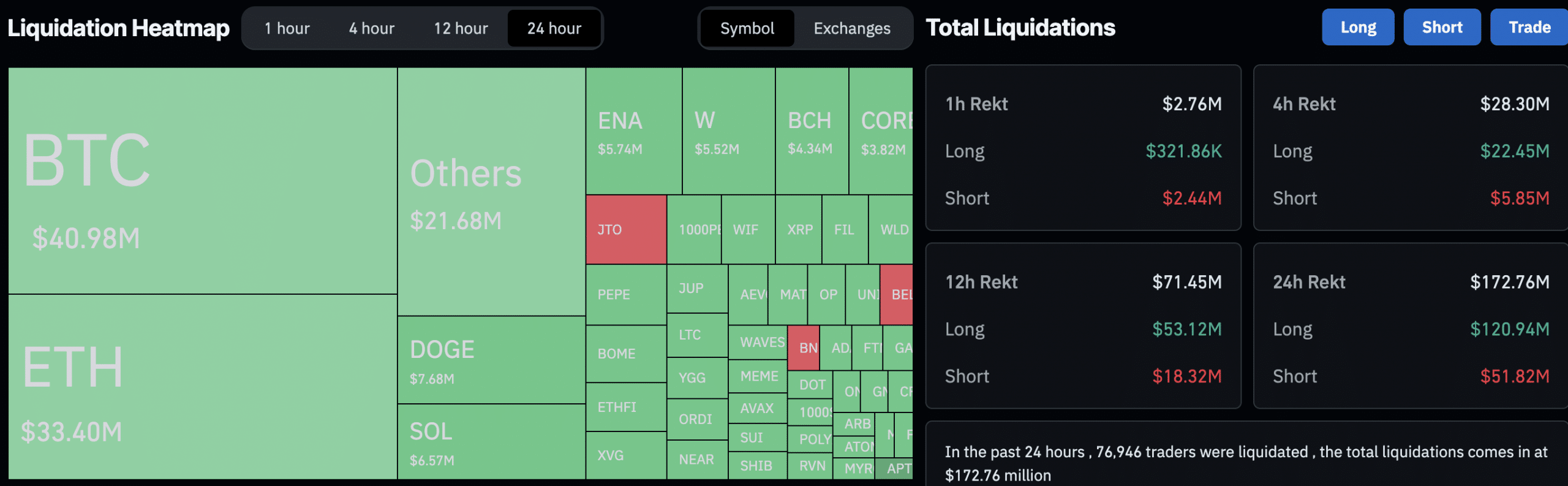

Due to the recent fluctuations of price, liquidations amounting to $40.98 million have occurred. Out of this, $26.6 million were long positions.

The high amount of long liquidations could impact bullish sentiment around BTC in the long run.

Source: Coinglass

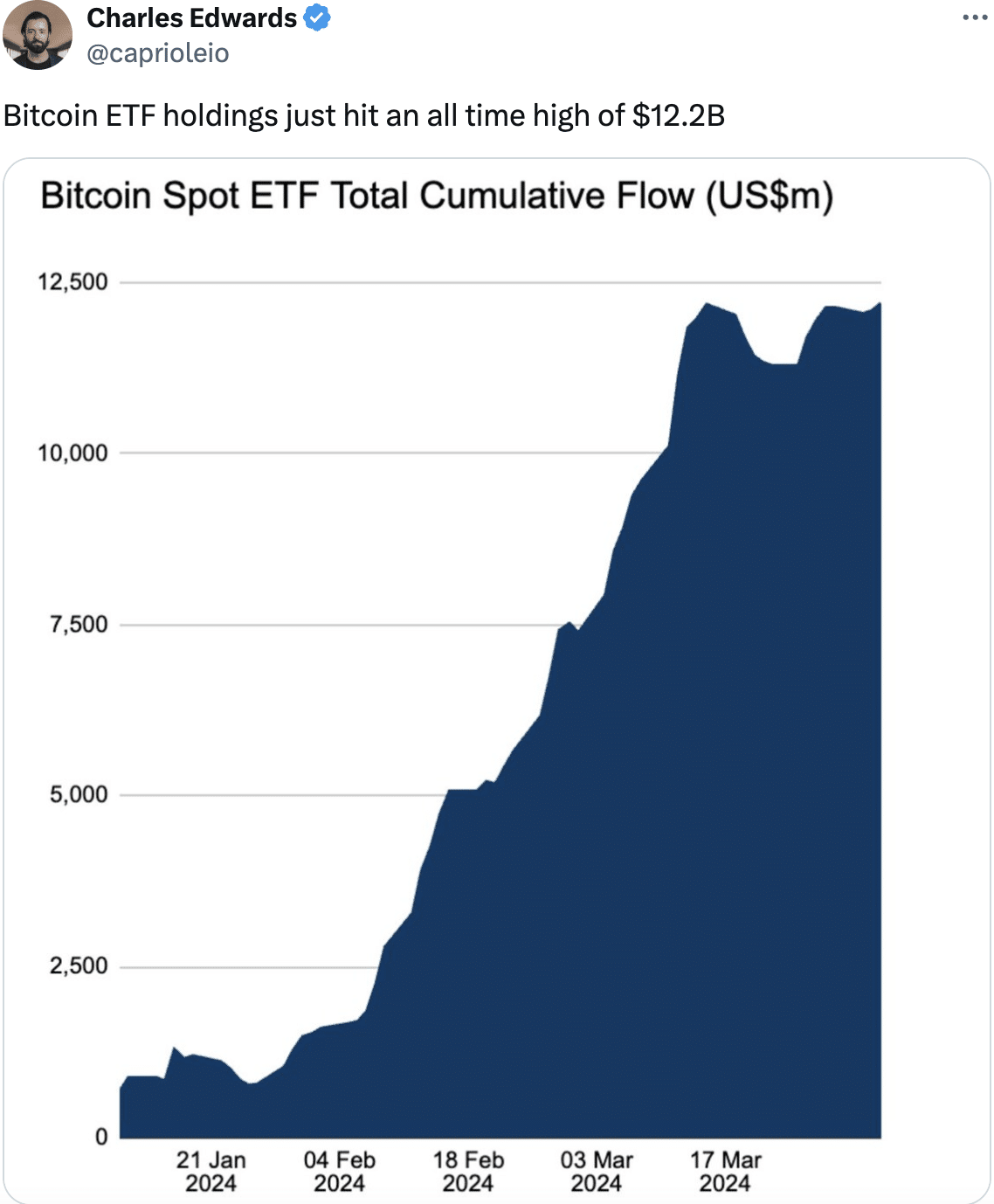

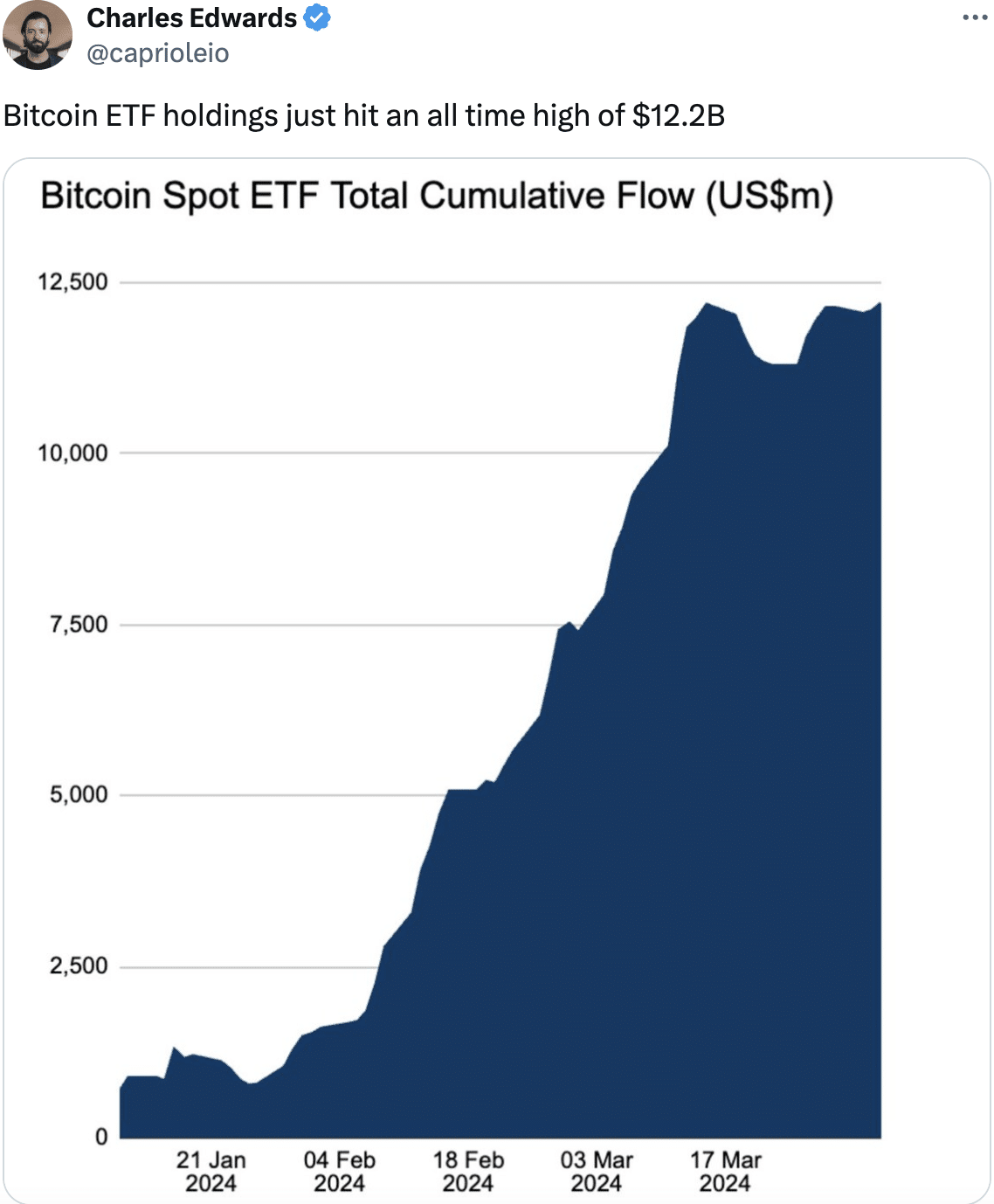

However, in the traditional finance markets, BTC was doing relatively well. At the time of writing, Bitcoin ETF holdings had just hit an all-time high of $12.2 billion. This signified growing institutional interest.

Institutions investing in Bitcoin ETFs often do so as a way to gain exposure to the cryptocurrency market without directly holding Bitcoin, which can attract more conservative investors.

Source: X

With market giants such as BlackRock advocating for BTC, more traditional investors could be attracted to invest in Bitcoin, despite the recent volatility showcased by the king coin.

At the time of writing, BTC was trading at $65,775.97 and its price had fallen by 0.76% in the last 24 hours. Moreover, the volume at which BTC was trading at had also declined by 33.14% during this period.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Daily Active Addresses on the Bitcoin network also fell in the last few weeks.

This suggested that the overall interest in Bitcoin’s ecosystem had fallen in the last few days, which could further impact BTC’s future prospects negatively.

Source: Santiment

Leave a Reply