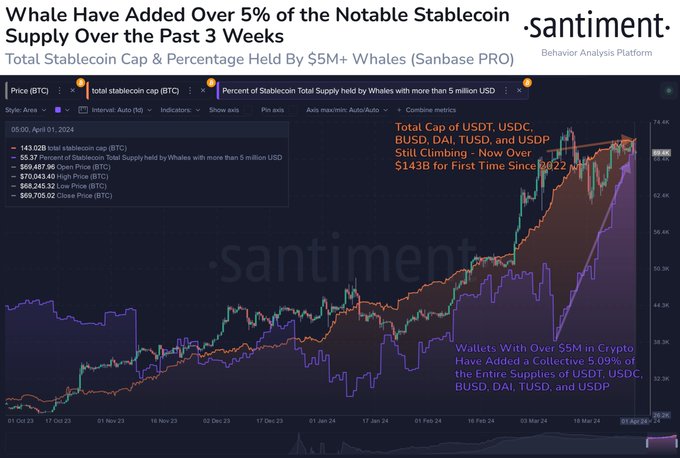

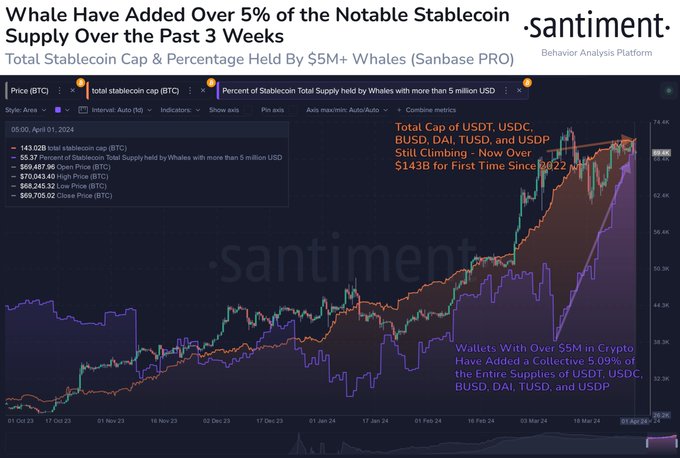

- More than 55% of the total stablecoins in circulation were in whale custody.

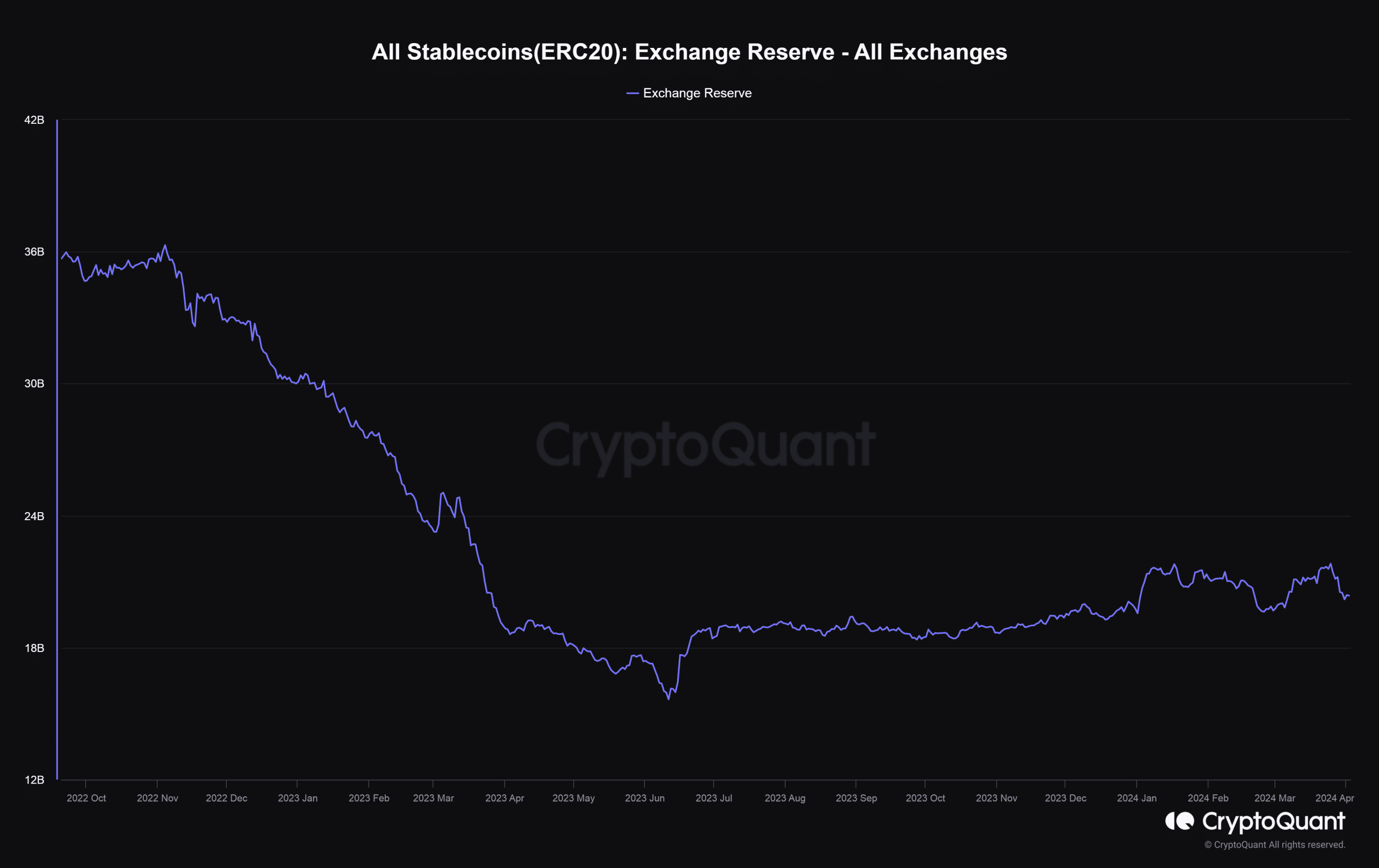

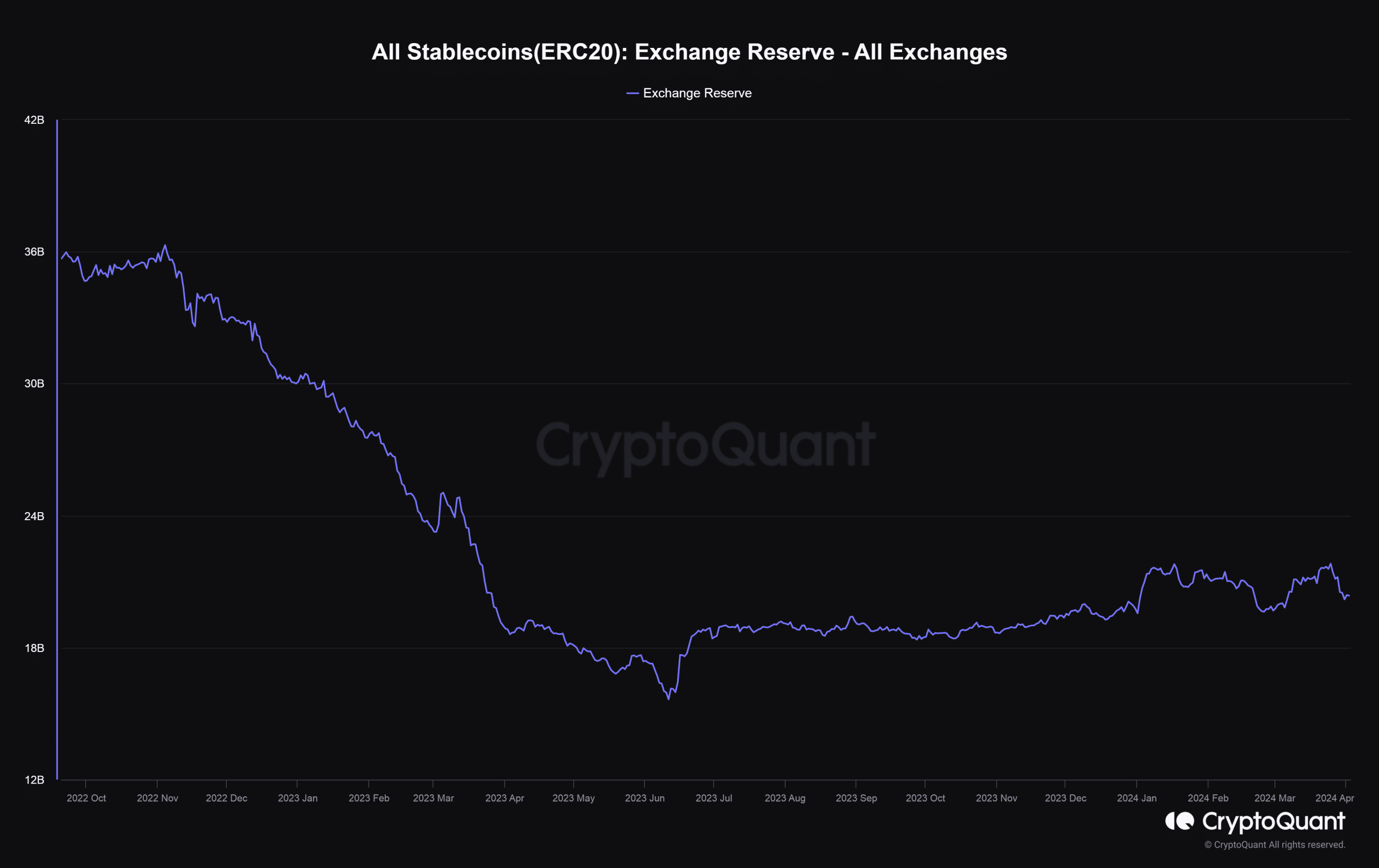

- Stablecoin reserves on exchanges have risen substantially since the start of the year.

One of the biggest bullish signals for the crypto market is increasing reserves of stablecoins. This is because they are extensively used to buy other cryptocurrencies, all while preserving the fiat value.

Whales hoard stablecoins

According to on-chain analytics firm Santiment, whale wallets with more than $5 million in holdings have been on an stablecoin accumulation spree over the past three weeks.

Indeed, this cohort acquired more than 5% of the total supplies of these leading coins, including USDT, USDC, DAI, and TUSD over the past three weeks. As of the 1st of April, more than 55% of the total stablecoins in circulation were in whale custody.

Source: Santiment

Buying pressure to increase?

Santiment agreed to the theory that whales might be waiting for the market to correct significantly, allowing them to buy big and add on to their Bitcoin [BTC] positions.

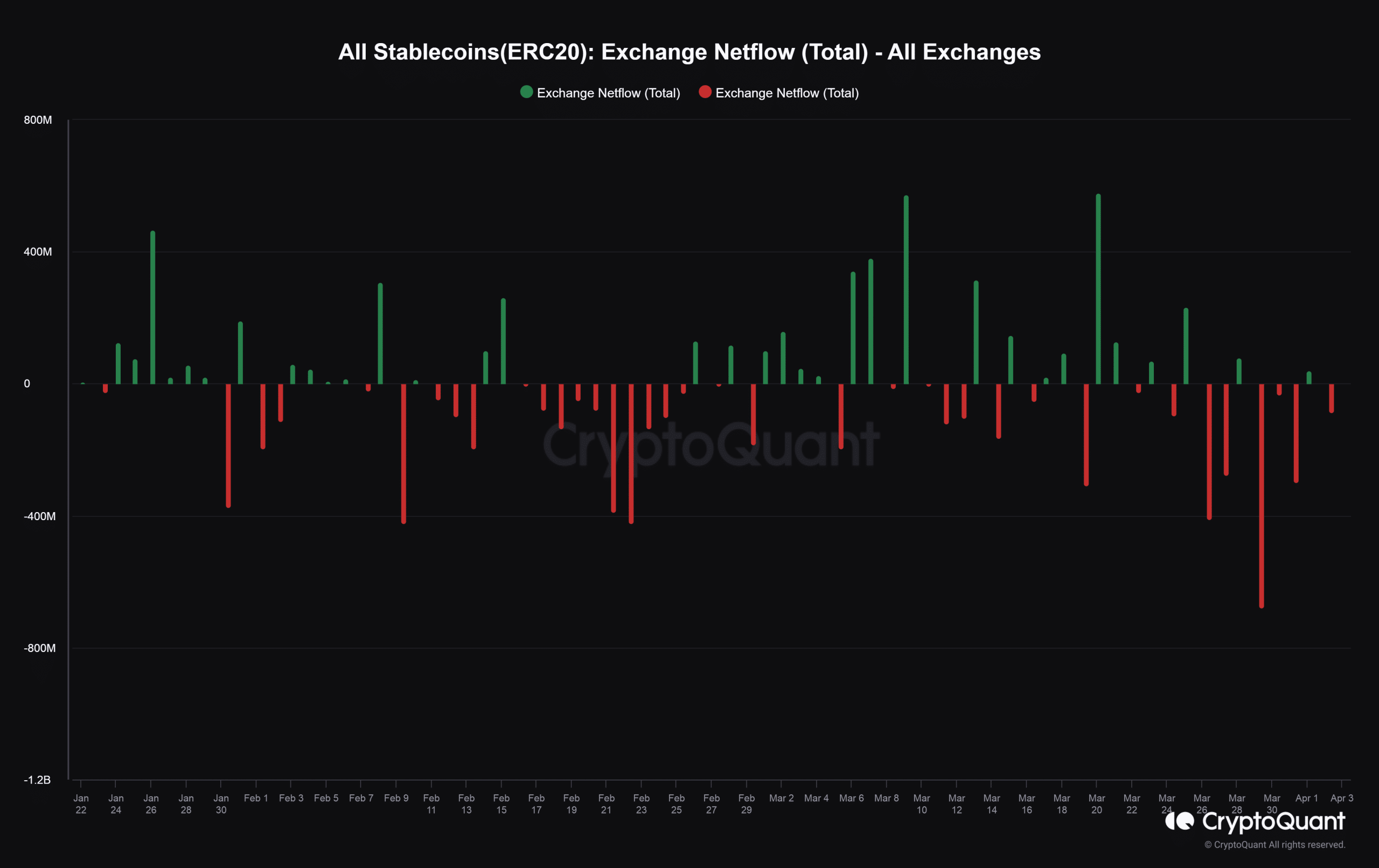

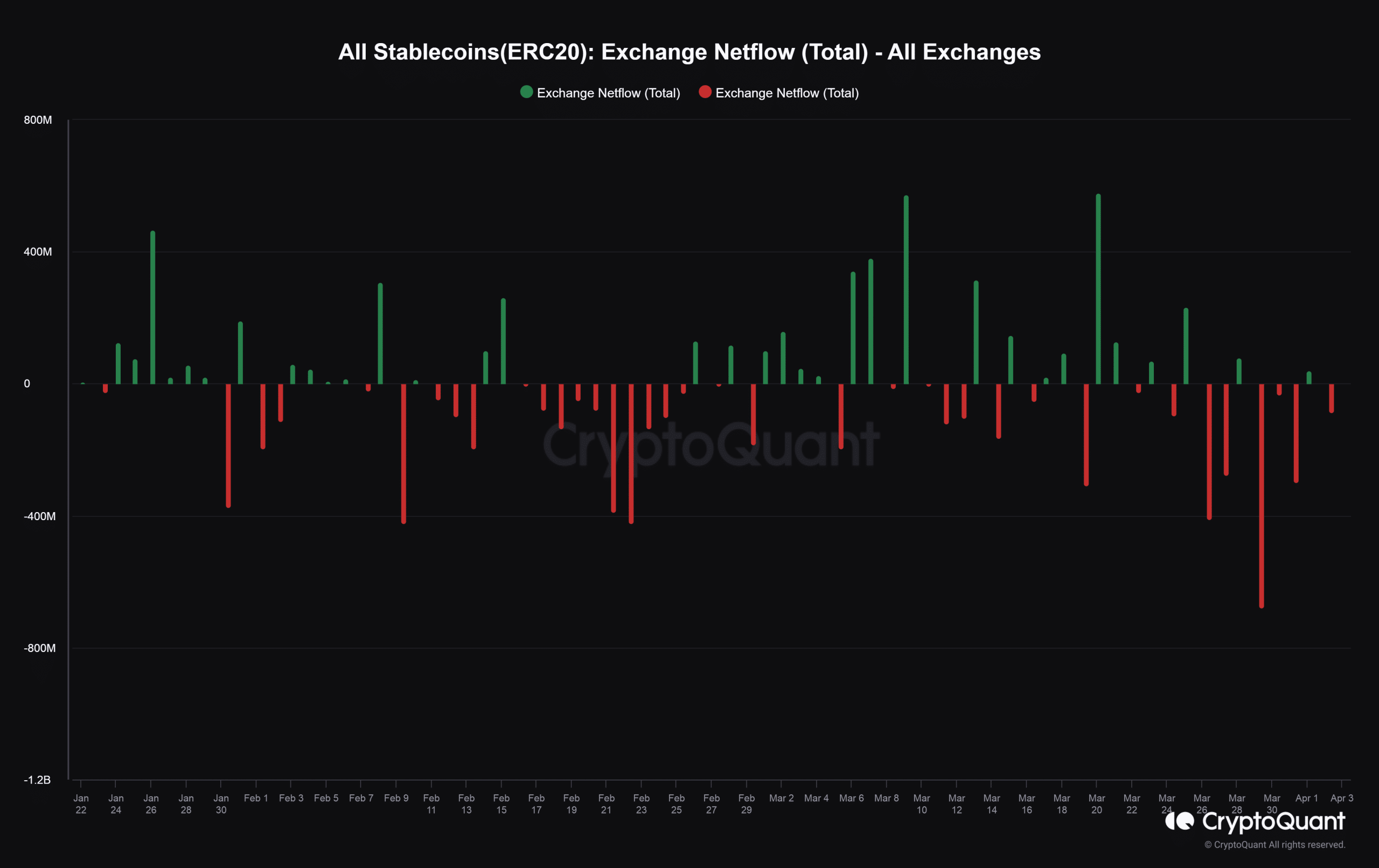

Interestingly, the market did retrace on the 1st of April. AMBCrypto investigated CryptoQuant data and spotted net stablecoin inflows to cryptocurrency exchanges, lending credence to the aforementioned narrative.

Source: CryptoQuant

Stablecoin reserves on exchanges have risen substantially since the start of the year. As of this writing, nearly 20.36 billion coins were held in exchange wallets, highest in more than a year.

Historically, rise in stablecoin deposits have preceded sharp increase in Bitcoin’s market price. Hence, there was a higher likelihood of increased volatility and Bitcoin’s rebound in the next two weeks or so.

Source: CryptoQuant

Top stablecoins in full demand in 2024

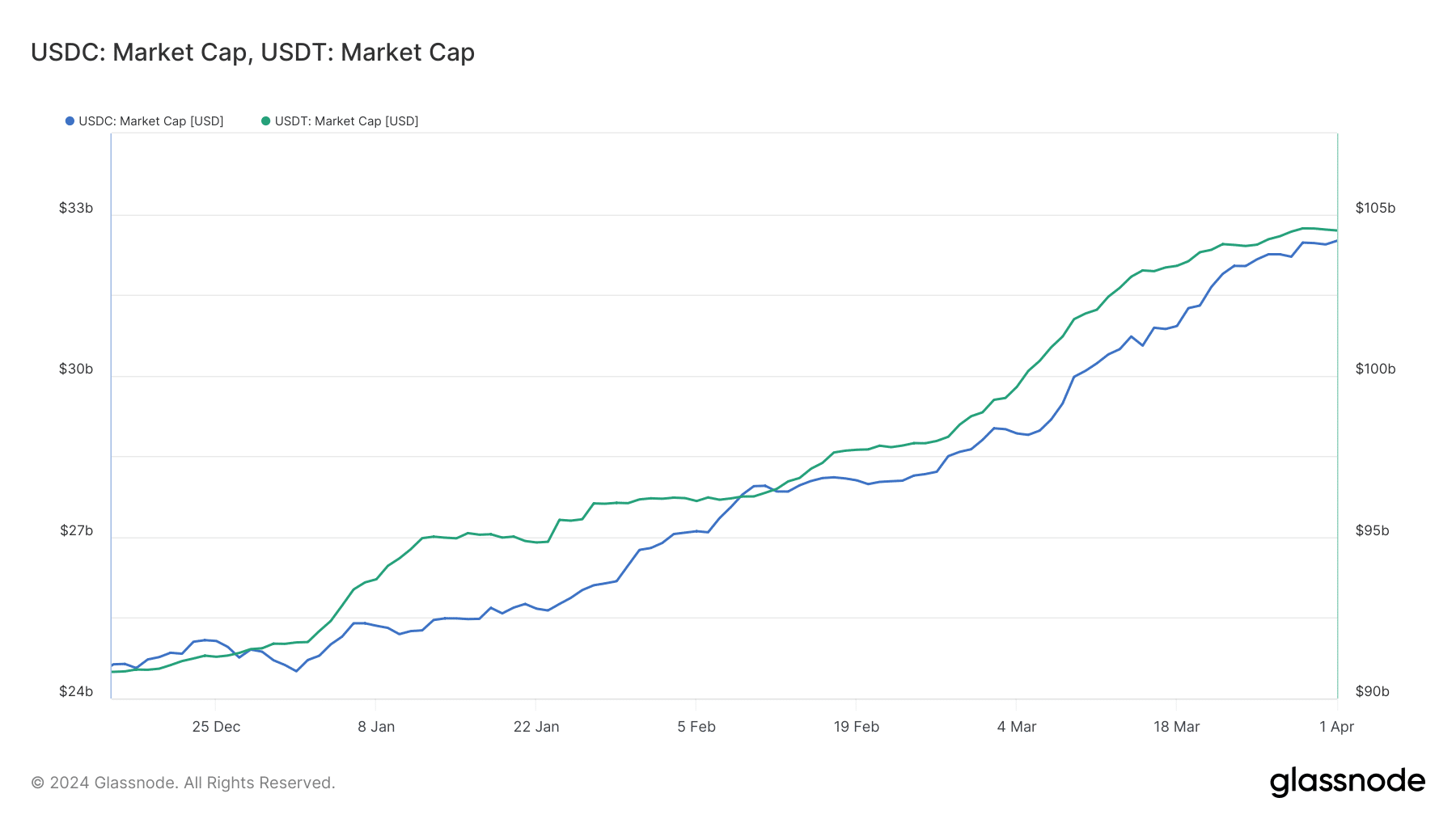

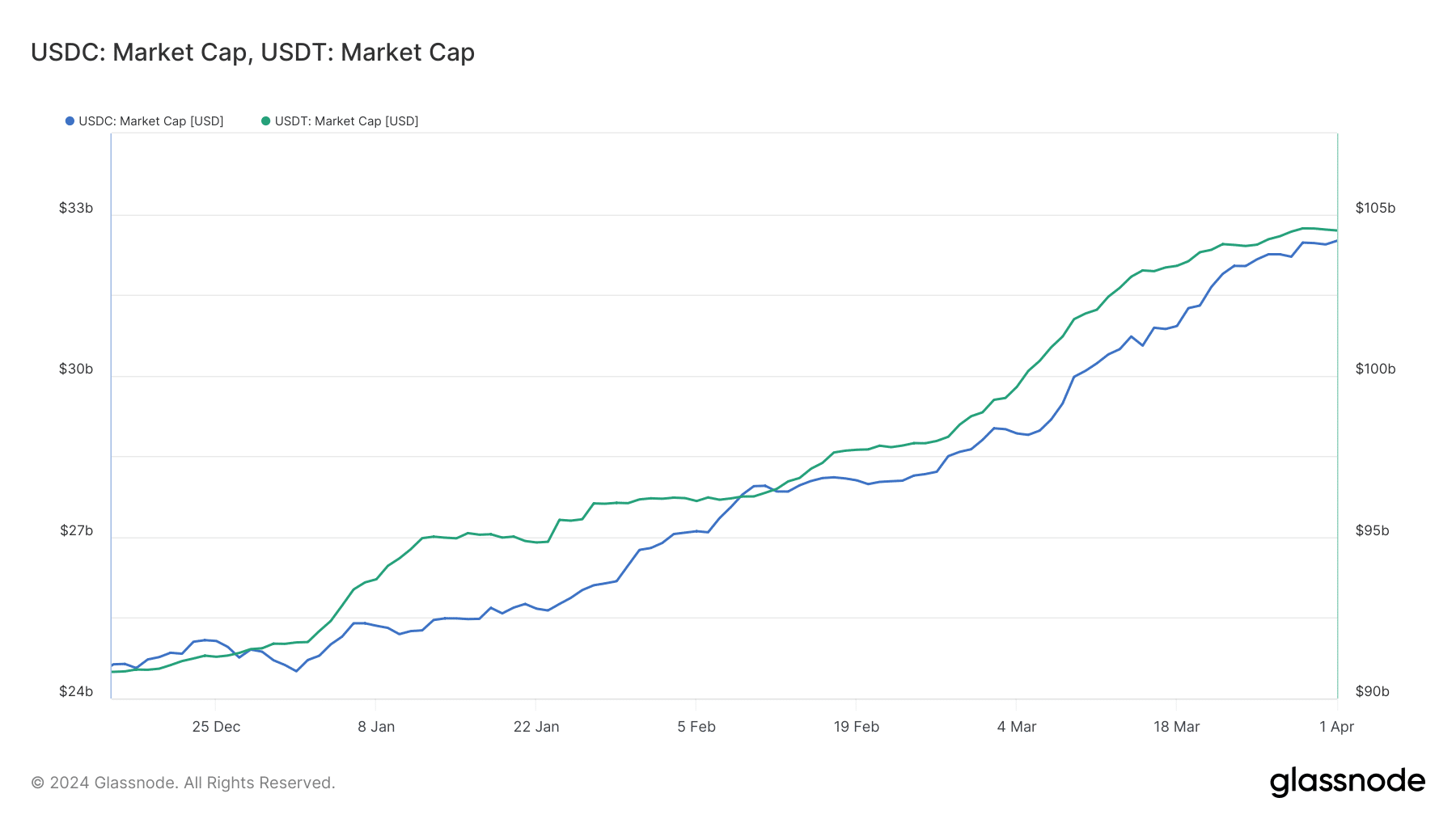

Meanwhile, the global stablecoin cap continued to mount, going past $143 billion for the first time since 2022. The recovery was led by the two leading assets – USDT and USDC.

World’s largest stablecoin, USDT, has carried on the positive momentum from last year, growing 13% year-to-date (YTD) to a whopping $104 billion in market valuation.

However, the real success story has been USDC, jumping 33% YTD to $32 billion, after encountering major downsides last year.

Source: Glassnode

Leave a Reply