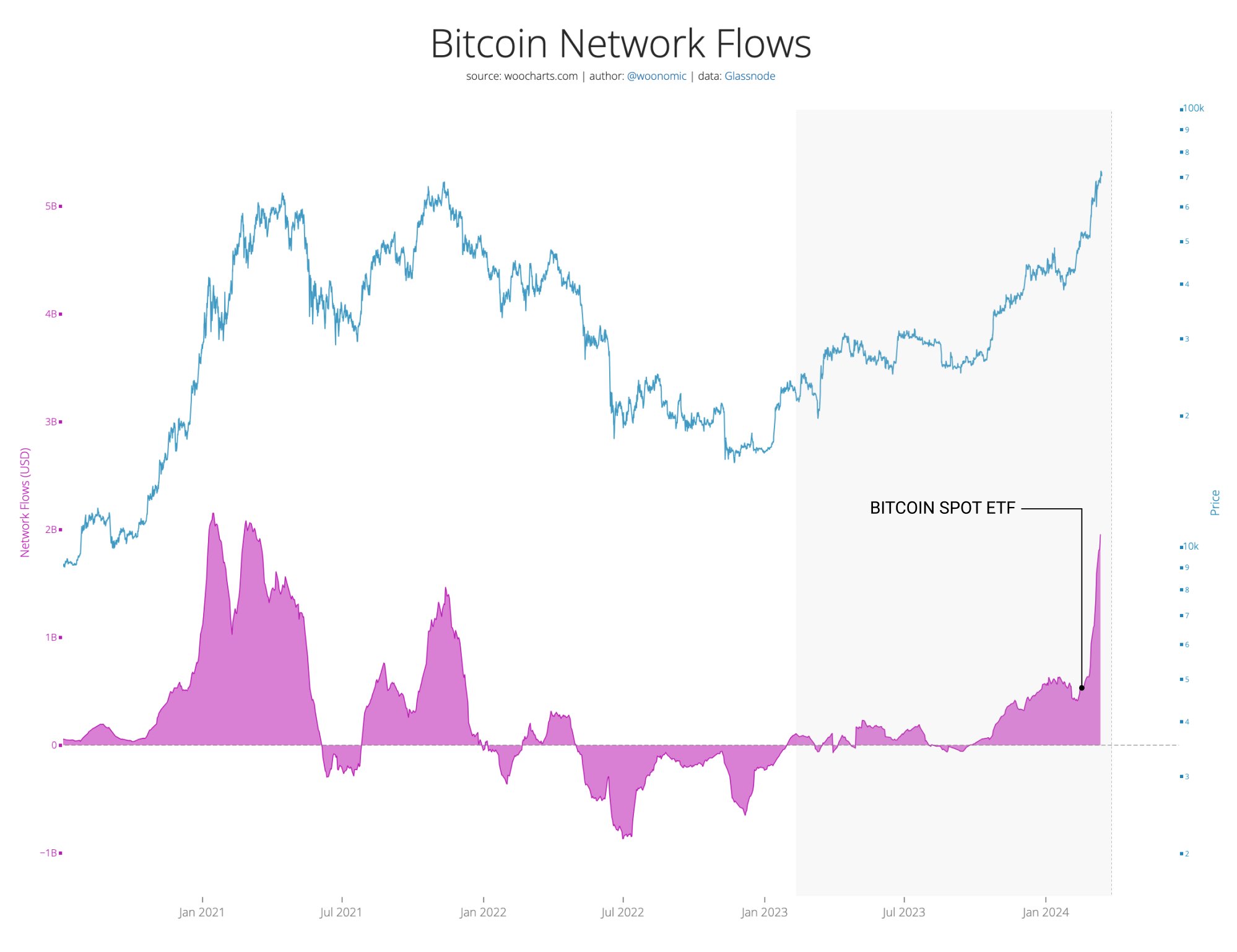

The level of new capital flowing onto the Bitcoin (BTC) network suggests the top crypto asset is in a “full-blown” bull market, according to on-chain analyst Willy Woo.

Woo tells his 1 million followers on the social media platform X that daily inflows of capital being stored by the Bitcoin network recently hit $2 billion per day, equivalent to the level of the last full-blown bull market.

“This time it should climb much higher. Spot ETFs (exchange-traded funds) are opening up the inflow pipes markedly.

The inflows are measured on-chain so this includes all investors. It’s about 90% accurate. Also indicative that the ETFs are around 30% of total flows right now.

Specifically, you take the daily change in entity-adjusted realized capitalization. Entity-adjusted Real Cap tallies the price paid for every BTC when they moved to the current HODLers, this is a measure of the USD stored in the network.”

Earlier this week, Woo said Bitcoin’s upper bound price model is $337,000.

“So this bull market is still early, equivalent to $20,000 of last cycle. Last cycle didn’t hit the upper bound due to the flood of paper BTC, this is less dominant this cycle.”

Paper BTC means derivatives that represent Bitcoin but don’t involve actual ownership of the asset.

Bitcoin is trading at $72,804 at time of writing.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Generated Image: Midjourney

Leave a Reply