- Solana could reach $240 and $260 quickly if this pattern plays out.

- The data from Futures markets highlighted bearishness and sidelined speculators.

Solana [SOL] formed a bullish flag pattern that would likely see prices rally past $200.

AMBCrypto also analyzed the market sentiment and found that buyers were dominant despite the market-wide setback in the past three days.

On the other hand, there were reports of whales sending SOL to exchanges, which could ramp up the selling pressure once more. How should investors respond to these conflicting signals?

Examining the pennant formation

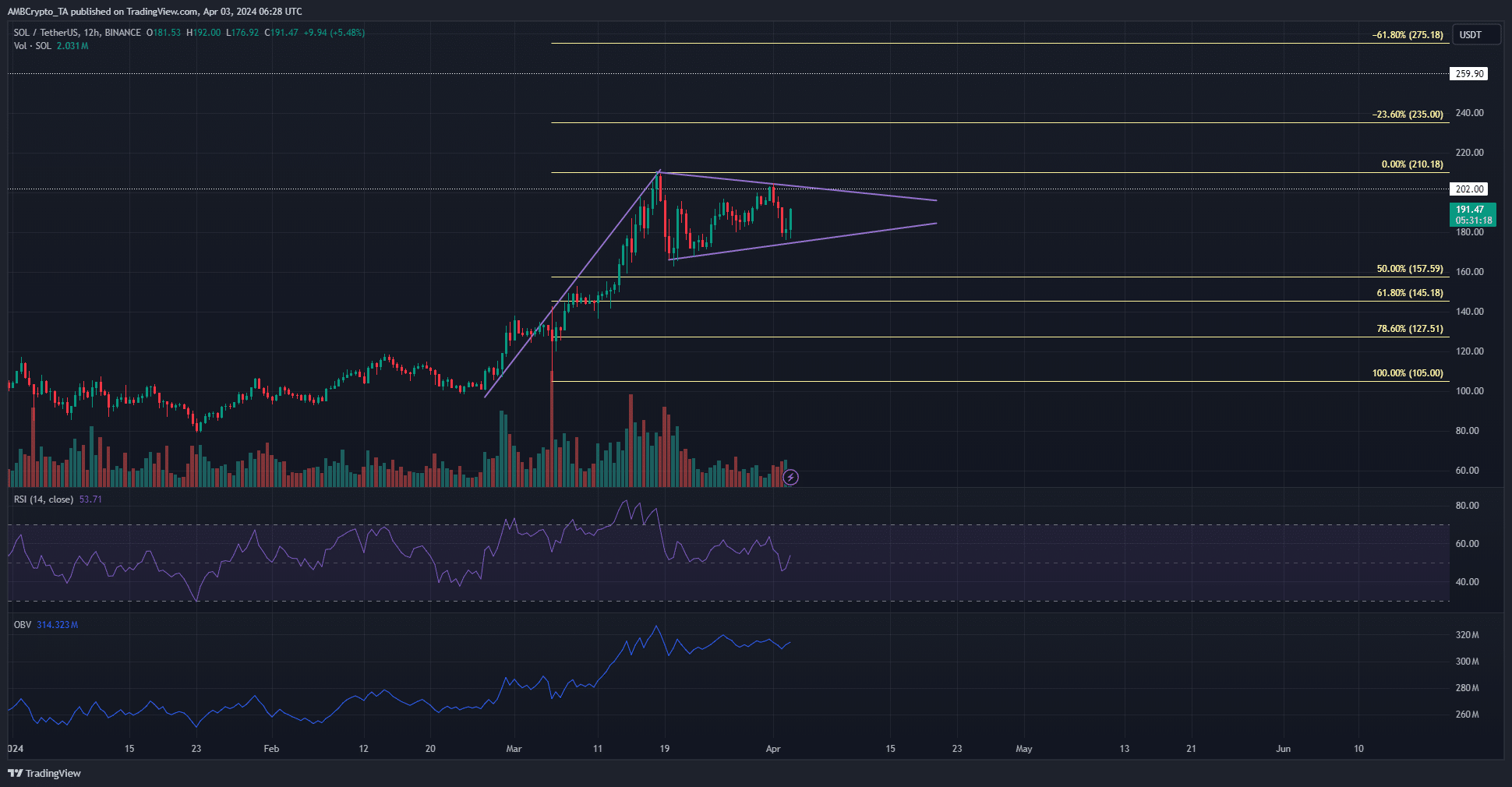

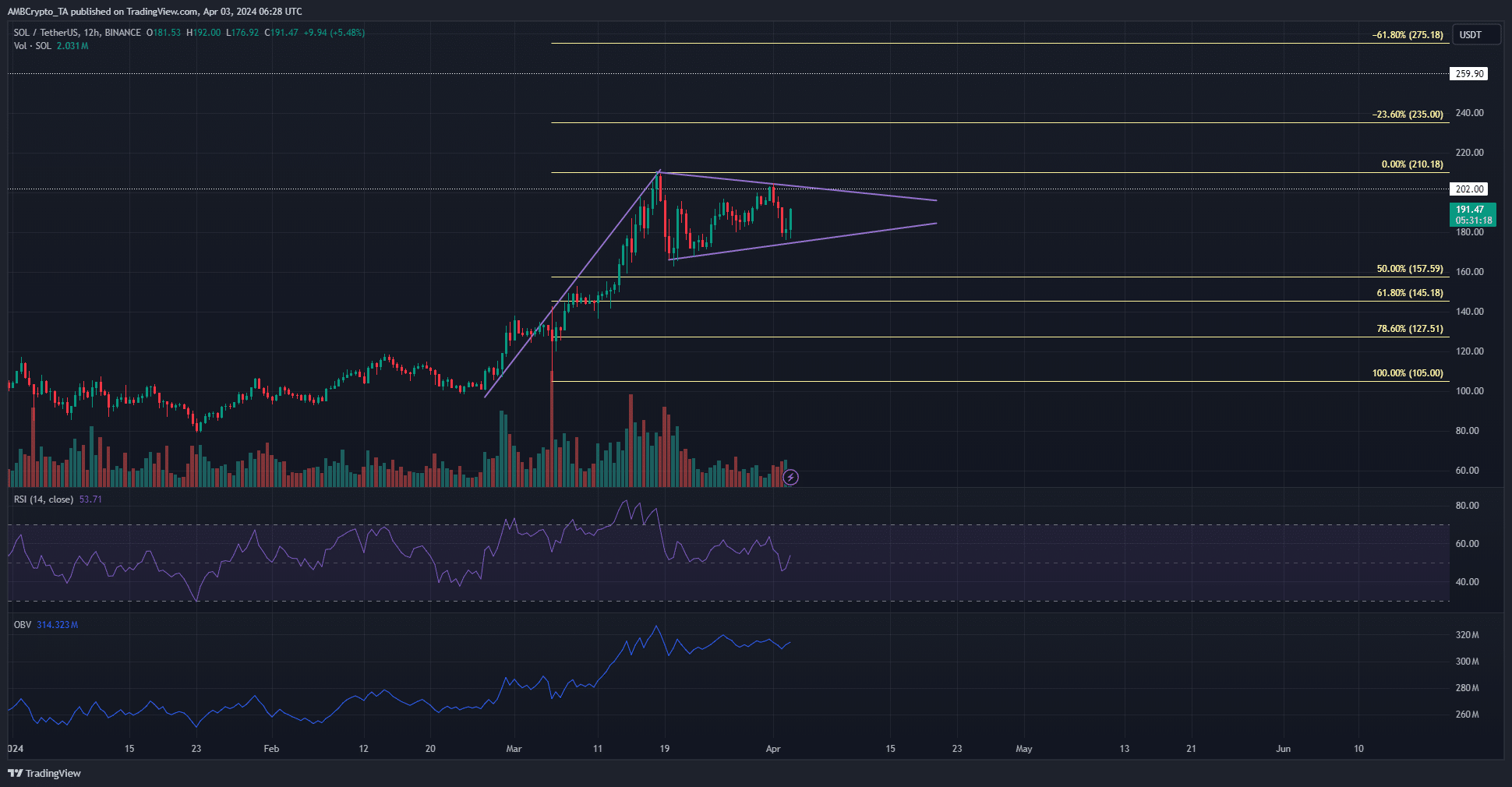

Source: SOL/USDT on TradingView

The swing low that SOL needs to fall below to flip the H12 market structure bearishly was at $162.45. The past month saw SOL form a bullish pennant pattern, highlighted in purple.

When the upper trendline is broken and retested, a breakout will be confirmed.

The trading volume within the pennant has trended downward and the OBV moved sideways as a result. Meanwhile, the RSI was meandering about the neutral 50 mark.

It showed momentum favored neither bulls nor bears at press time.

Based on the flagpole length, a breakout could take Solana prices to $240. This has confluence with the 23.6% Fibonacci extension level.

The resistance levels above $200 were sparse, and a breakout could fuel a move to $260.

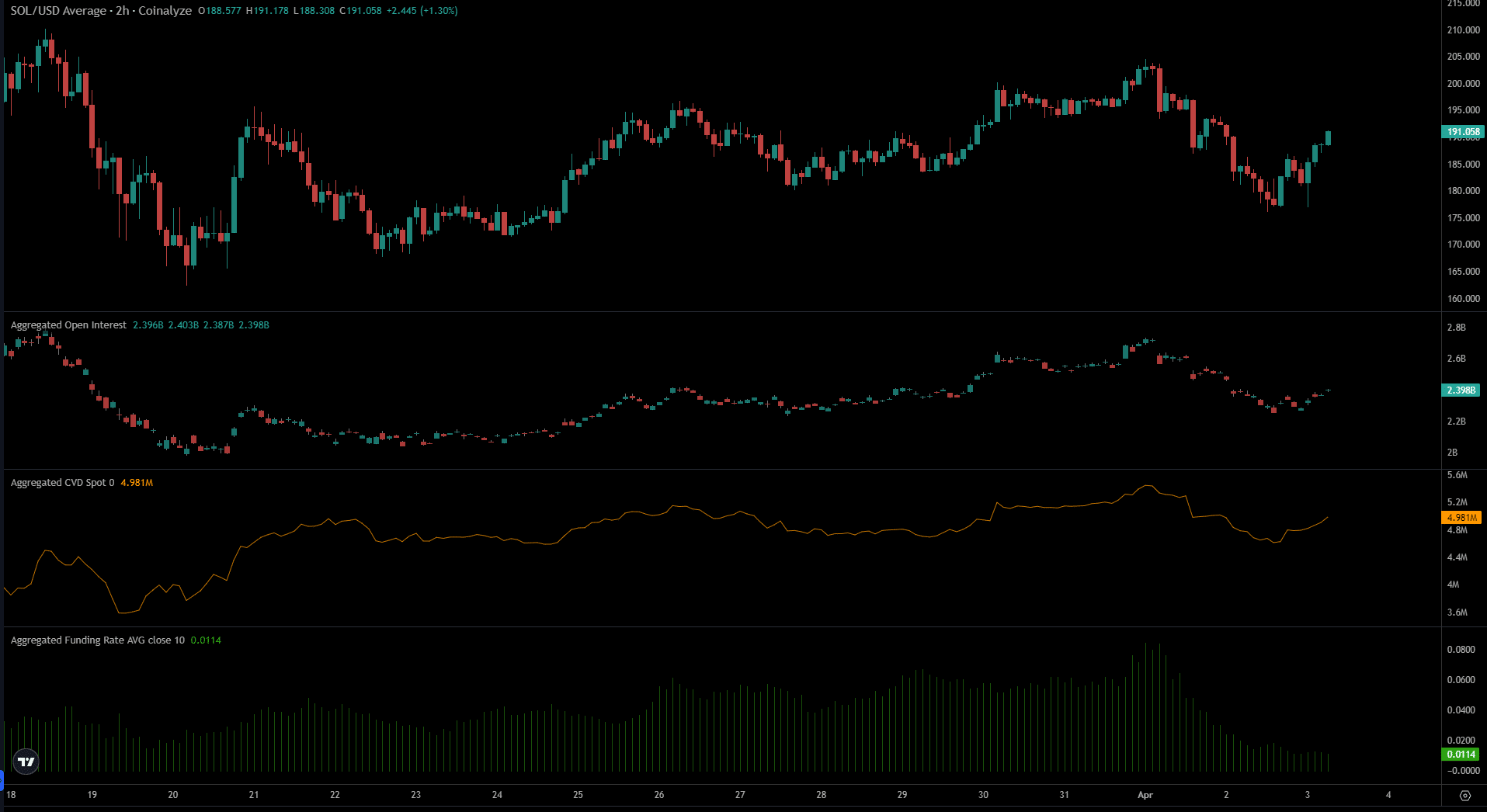

The short-term sentiment was bearish

The Open Interest and the funding rate declined since the 1st of April as prices fell from $204 to $177.

Read Solana’s [SOL] Price Prediction 2024-25

Despite Solana bouncing to $191 since then, the futures market participants were unwilling to go long on the asset.

The spot CVD also saw a blip over the past two days but began to recover in recent hours. This pointed toward demand in the spot markets and supported the idea of a Solana breakout.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

Leave a Reply