- Network activity decreased, indicating low demand for TON.

- A notable announcement did not affect Toncoin’s development activity in a good way.

Toncoin’s [TON] native token was one of the cryptocurrencies with an eye-catching performance this week. At press time, the price of TON was $4.82, which constituted an 8.34% increase.

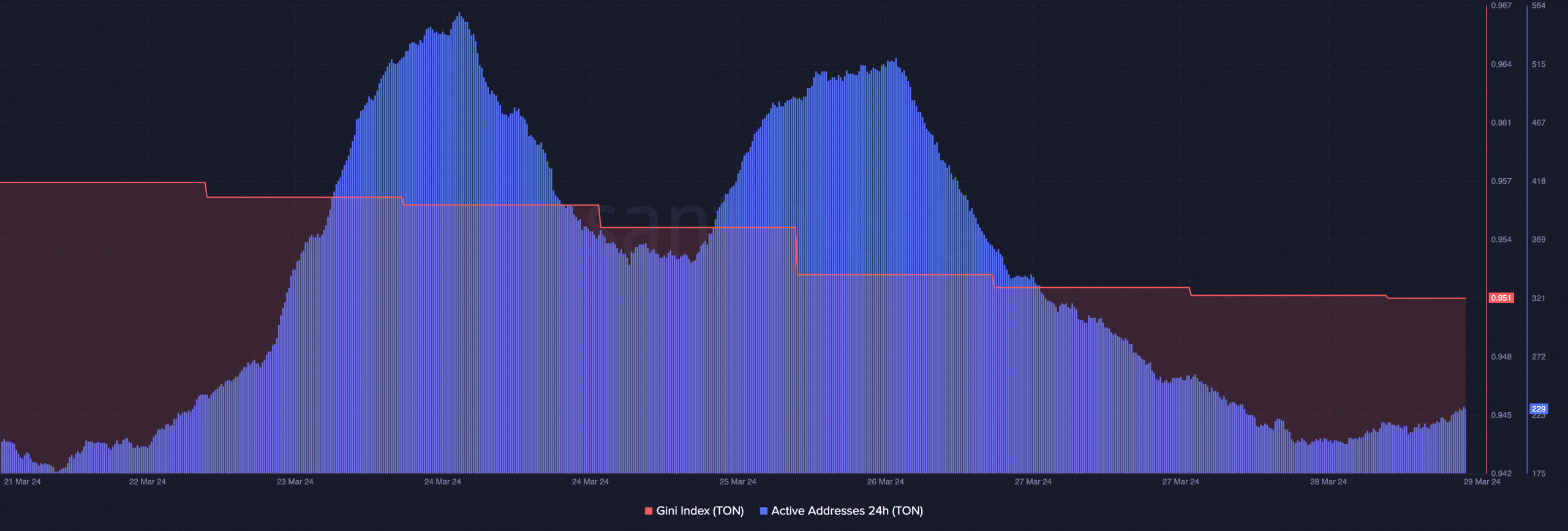

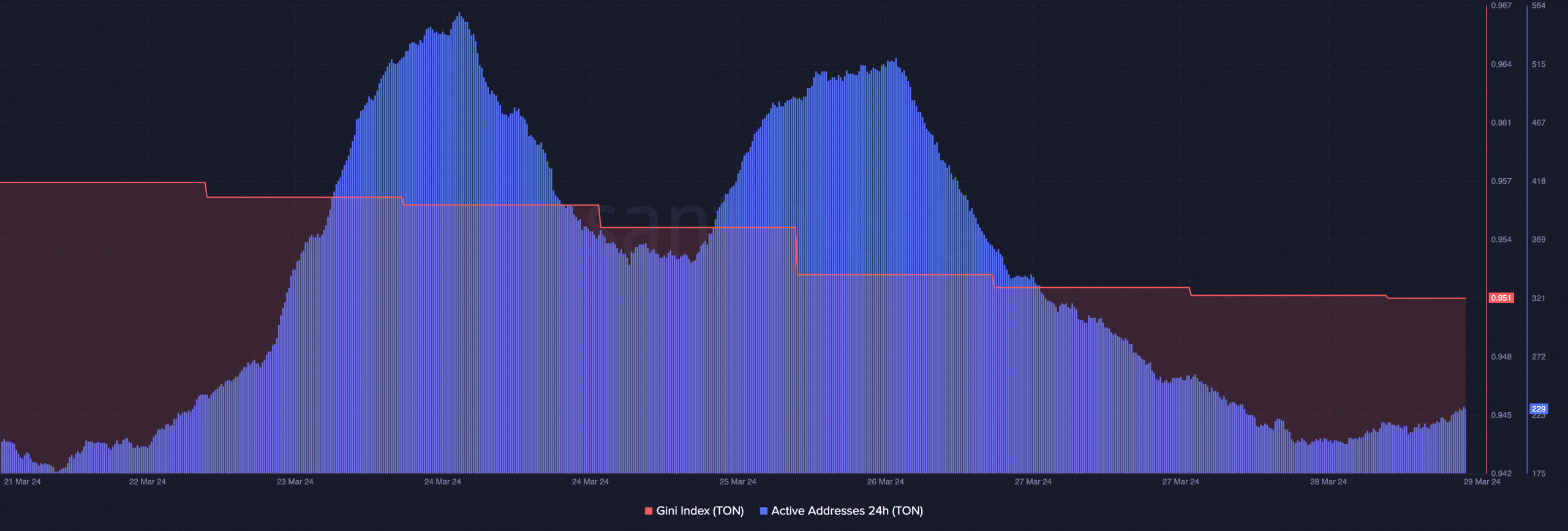

However, AMBCrypto’s analysis showed that the upward trajectory could break off. Findings showed that activity on the Toncoin blockchain was at impeccable heights on the 26th of March.

TON is stuck in a rut

But when we checked the data at press time, things had changed. As of this writing, the 24-hour active addresses on the network were nowhere near the peak mentioned above.

Active addresses indicate the daily level of interaction users have with a project. If the metric increases, then there is a high number of unique addresses involved in transactions.

Therefore, the decrease in network activity suggests that demand for TON had reduced. Price-wise, a decrease in demand is a bearish signal. Hence, if the activity remains low, Toncoin’s price action could be affected negatively.

One other metric fueling the bearish thesis was the Gini Index. For the uninitiated, the index measures the distribution of coins across addresses.

Source: Santiment

Typically, a decreasing Gini Index is a sign that token holders are cashing out. On the other hand, an increase suggests accumulation.

At press time, TON’s index had decreased from the point it was on the 24th of March. If we go by the definition above, it implies that participants’ perception of the token was no longer optimistic.

If this lack of confidence continues, TON’s price might undergo a correction. However, bullish sentiment still exists due to a recent development centered around the project.

It’s open season on the network

On the 27th of March, 21 Shares, the world’s largest issuer of ETPs, announced that it had launched a Toncoin Staking ETP. ETP stands for Exchange Traded Products, and they represent financial instruments pooled into an exchange.

According to the official statement, the firm noted that Toncoin’s decentralized and open network nature made it a suitable option. It said,

“With our ETP, investors can now enjoy the benefits of staking Toncoin while leveraging the liquidity and convenience of traditional financial markets.”

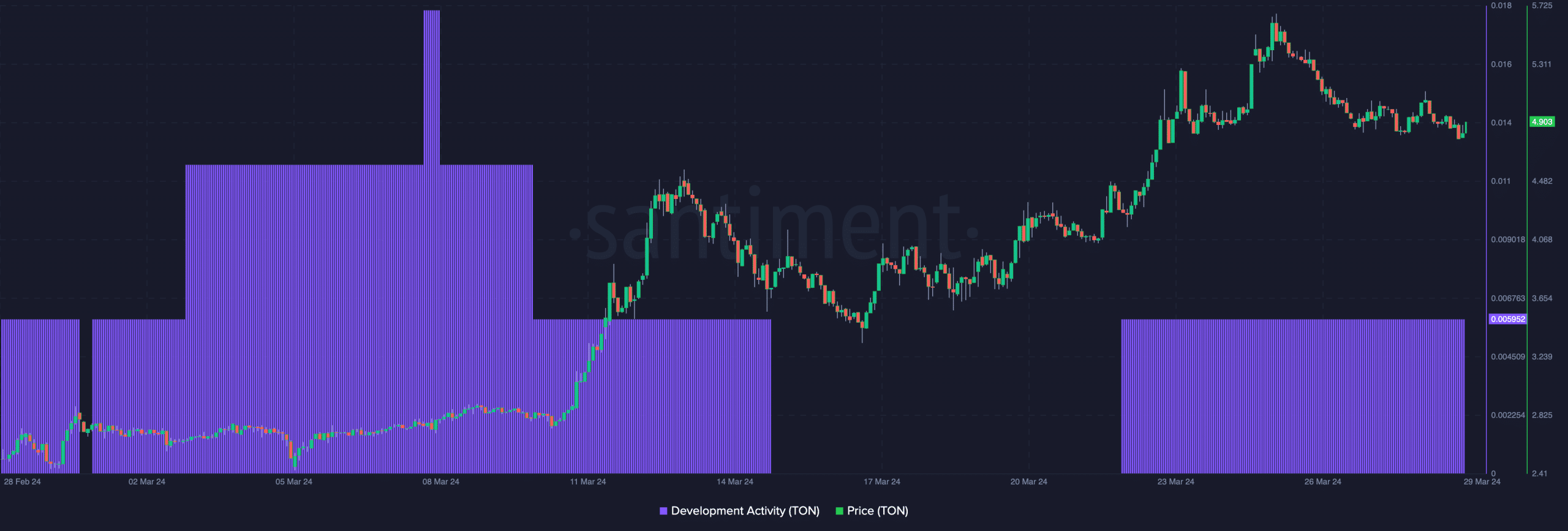

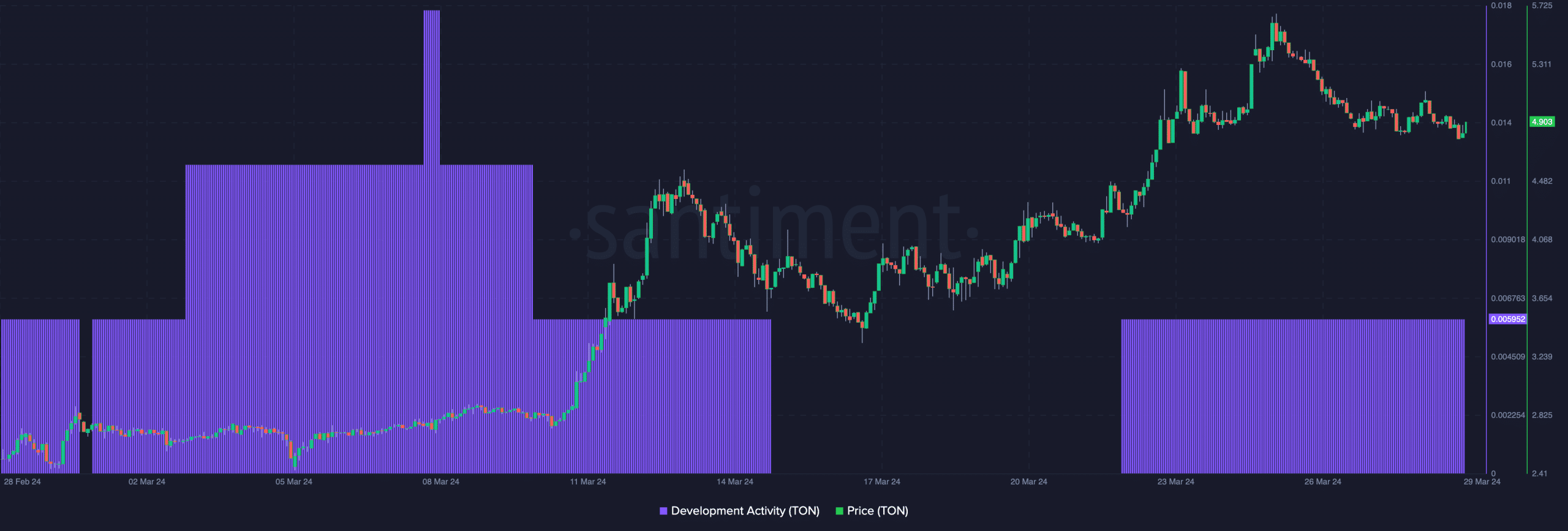

Despite the launch, development activity on the network stalled. As of this writing, Santiment showed that the development activity metric was flatlined at 0.0059. This was proof that Toncoin had not made a significant upgrade of late.

Source: Santiment

Is your portfolio green? Check the Toncoin Profit Calculator

Should this stay the same, TON’s price could fail to hit $5.61 as it did a few days ago. In the meantime, traders were at loggerheads about the price potential.

For some, TON might experience a short-term downtrend. However, the bullish side believes that the development team would be able to attract more users and help TON’s adoption scale.

Leave a Reply