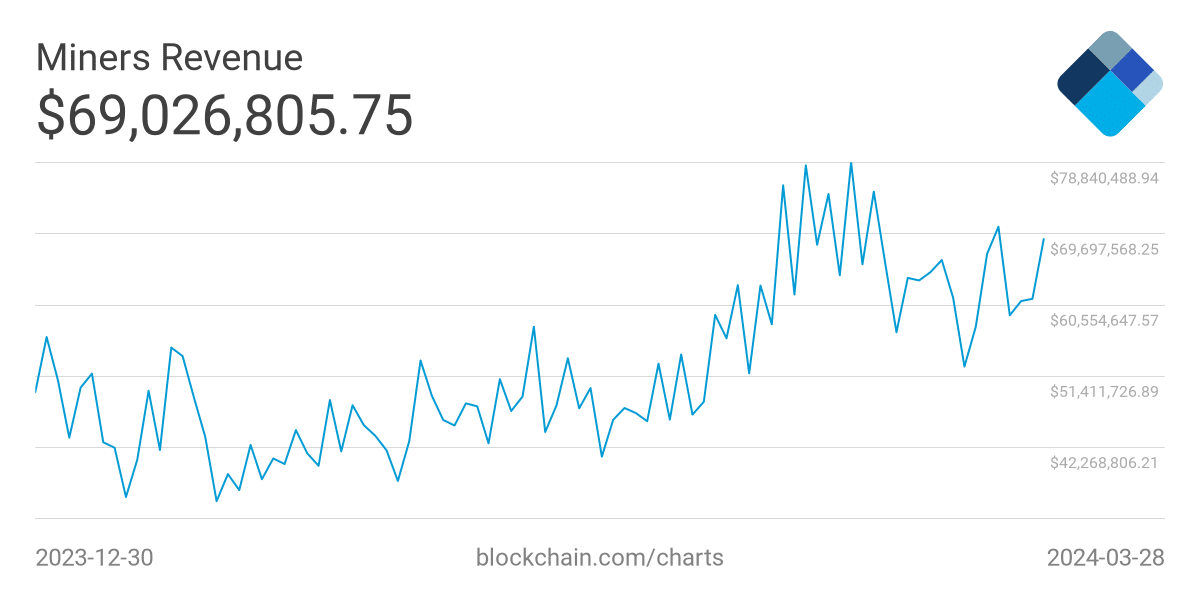

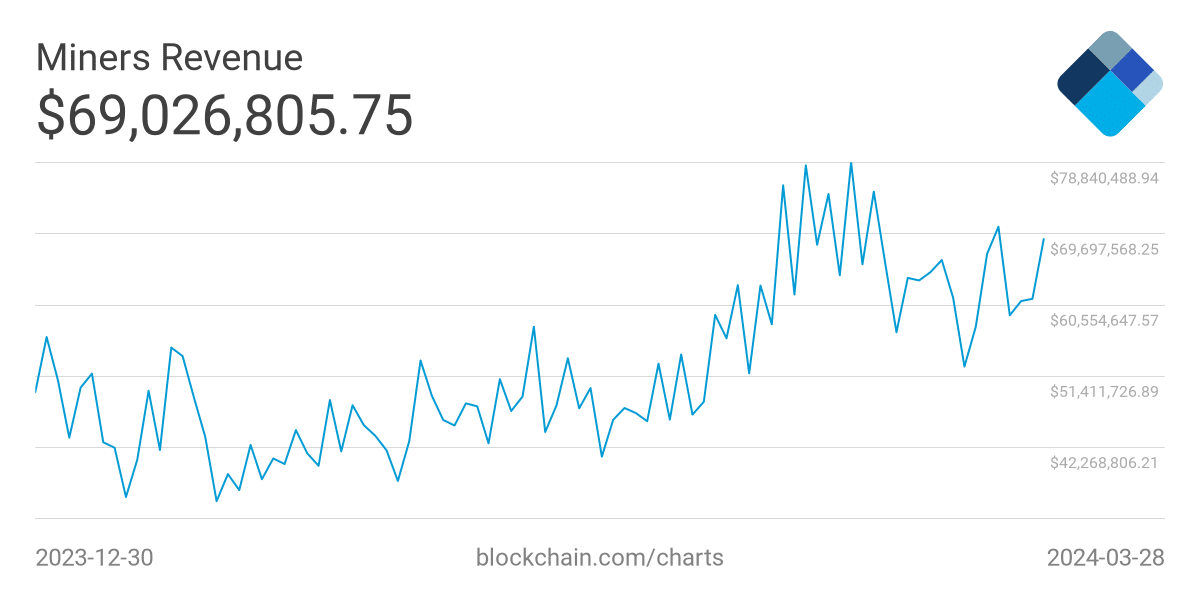

- Inflows for Bitcoin ETFs grew suggesting a rising interest showcased in BTC.

- Revenues generated by miners remained positive before the upcoming halving.

Bitcoin[BTC] climbed past the $70,000 mark after staying stagnant at those levels for quite some time. However, recent interest in Bitcoin ETFs may help BTC see green yet again.

A tale of outflows and inflows

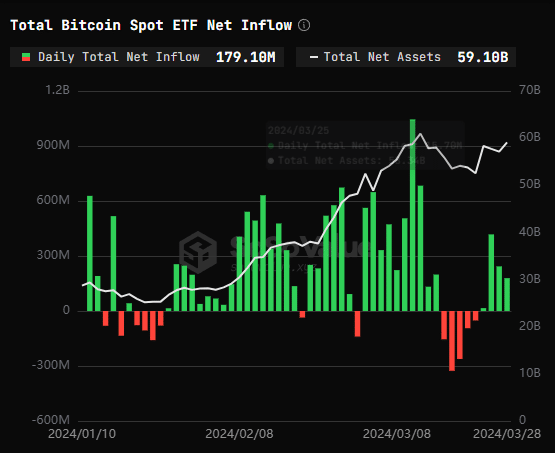

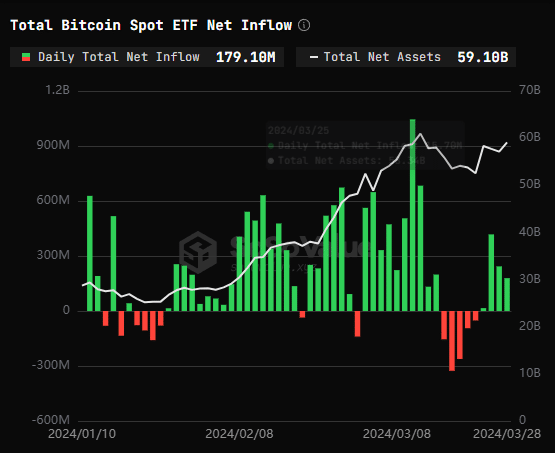

As per data from SoSoValue, the aggregate net inflows into Bitcoin spot ETFs stood at $179 million on 28th March.

Specifically, the Grayscale ETF GBTC witnessed an outflow of $104 million, whereas the BlackRock ETF IBIT experienced an inflow of $95.12 million and the Fidelity ETF FBTC saw an inflow of $68.09 million.

Consequently, the cumulative historical net inflow of these ETFs currently stood at $12.12 billion.

Source: SoSoValue

This surge in inflow could imply that retail interest in ETFs in traditional markets is on the rise. High inflows could potentially result in a positive price movement for BTC in the future.

At press time, BTC was trading at $69,864.20 and its price had declined by 0.81% in the last 24 hours.

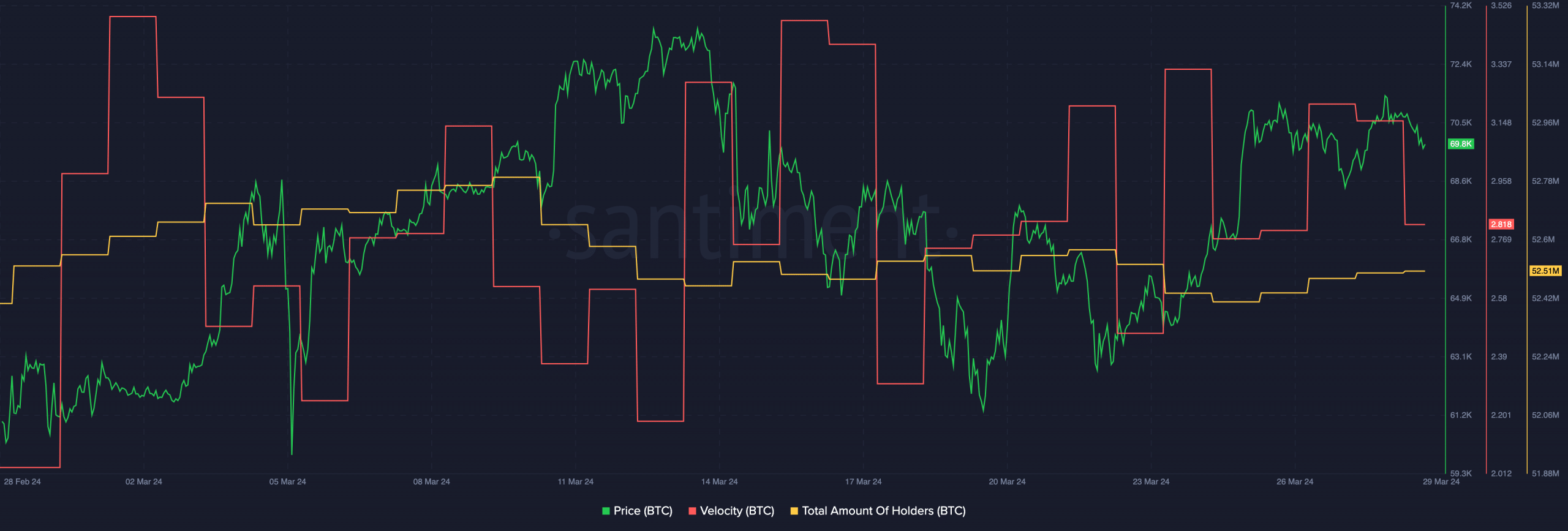

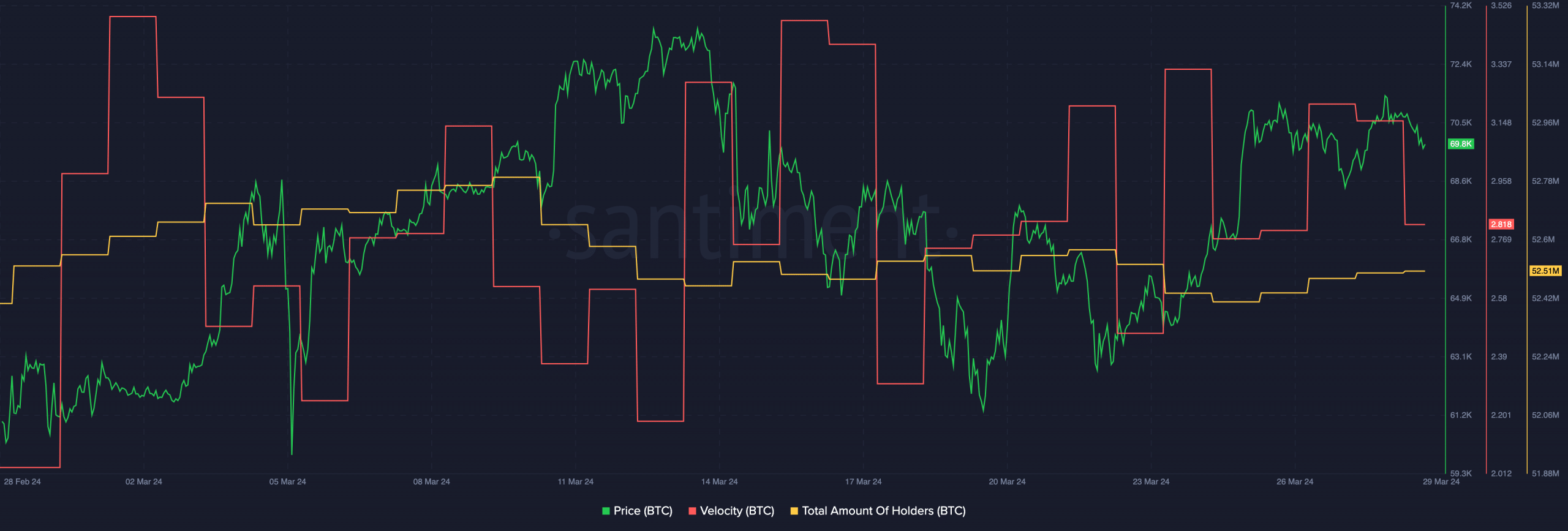

Even though interest in Bitcoin was rising in the Traditional Finance sector, the same couldn’t be said in terms of the crypto space. The velocity at which BTC was trading had also fallen during this period. This meant that the frequency at which the king coin was trading at had declined. The decline in velocity may indicate that current addresses may be losing interest in BTC.

Additionally, the total number of holders accumulating BTC had also declined. These factors could impact BTC’s price going forward.

Source: Santiment

State of miners

Another factor that could influence the price of Bitcoin would be the state of miners on the network. AMBCrypto’s analysis of Blockhain.com’s data revealed that the revenue collected by miners had surged.

The surge in revenue means that miners won’t have to sell their BTC holdings to remain profitable.

Read Bitcoin’s [BTC] Price Prediction 2024-25

The overall selling pressure for BTC could also be reduced. However, the upcoming halving could change the course for miners as the reward generated by miners would decrease.

This could result in many miners opting to sell their holdings. Even though halvings have historically been a bullish event for Bitcoin, many holders would have to absorb the short-term sell-offs that could occur due to the halving on the network.

Source: Blockchain

Leave a Reply