- A crypto influencer questioned Cardano’s high market value despite lower network utilization.

- Cardano’s market cap to TVL ratio was one of the highest in the space.

A crypto influencer enraged the supporters of popular smart contracts chain Cardano [ADA], sparking a heated debate on the network’s fundamentals.

What happened?

In a controversial X (formerly Twitter) post that went viral, MartyParty questioned the rationale behind the ADA token commanding a $23 billion-plus market valuation despite having much less network utilization.

The influencer went one step further by advising his followers to dump the token and shift to a “performing” blockchain token.

These remarks weren’t taken well by the Cardano community, who jumped to counter Marty’s arguments.

Some of them even called the transaction per second (TPS) data highlighted by him as outdated, adding a community note under his post with a link to the updated source.

Not the first time

Over the years, many prominent market observers have trained their guns on Cardano’s network capabilities and the justification behind it having a disproportionately larger market cap.

Just last month, Bitcoin [BTC] advocate and BitMeX co-founder Arthur Hayes threw shades at the network.

The Cardano community has energetically countered these arguments every time, with some questioning the use of TPS metric to gauge the network’s performance.

Others have drawn attention to the technical intricacies of a single transaction on Cardano.

Does the argument hold merit?

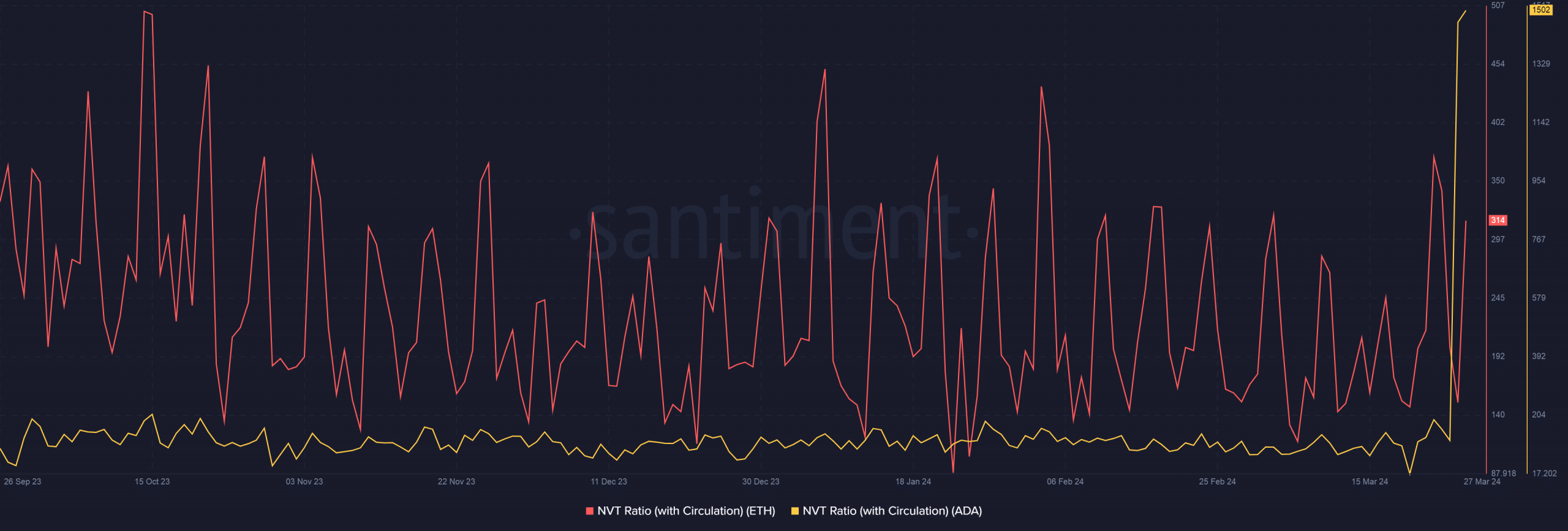

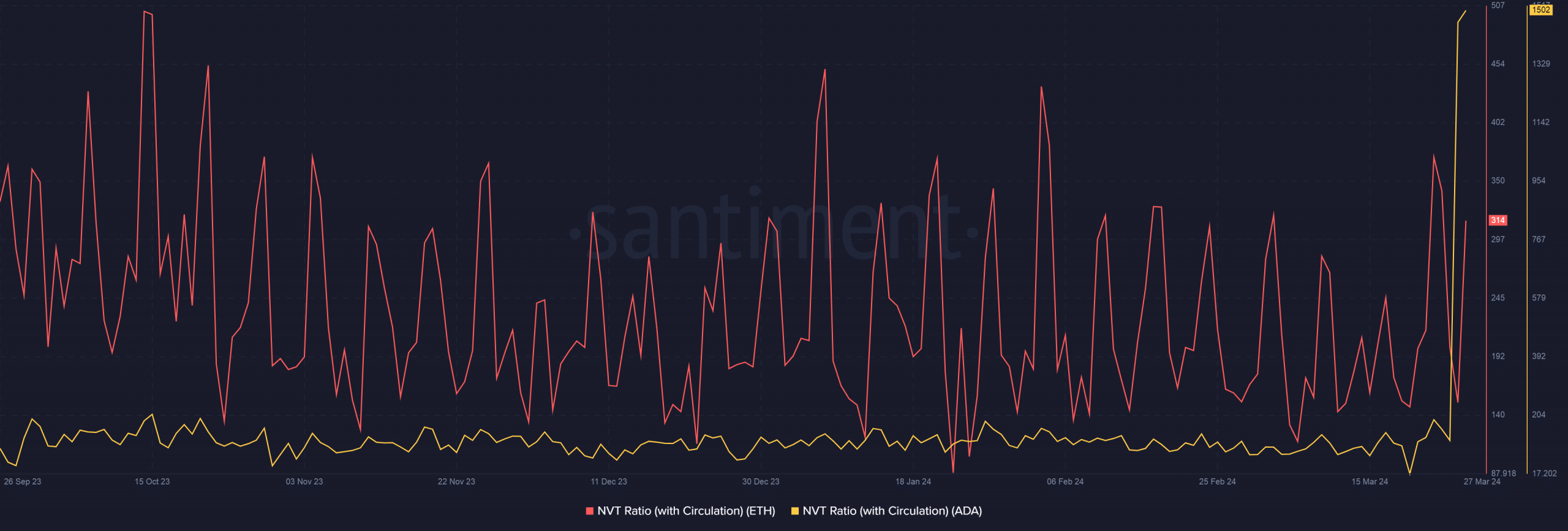

AMBCrypto assessed Cardano network through Santiment’s asset valuation metric, NVT Ratio. When compared to Ethereum [ETH], Cardano’s NVT Ratio has been on the lower side in recent months.

This meant that its market valuation was lower than the value being transmitted on the network, in other words an undervalued asset.

Source: Santiment

That being said, Cardano’s DeFi growth has lagged well behind its market cap increase.

As of this writing, its total value locked (TVL) was just $418 million according to DeFiLlama, significantly lower than chains with similar market caps.

Read Cardano’s [ADA] Price Prediction 2024-25

These findings have led critics to question the network’s potential in building effective decentralized apps (dApps).

Meanwhile, ADA fell 4.5% in the last 24 hours, trading at $0.65 as of this writing, according to CoinMarketCap.

Leave a Reply