- BTC’s recent price surge has led to a notable change in market sentiment.

- LTHs have started distributing their holdings for profit.

Bitcoin’s [BTC] recent rally above the $72,000 price region has pushed market sentiments into the ‘Euphoria Zone,’ Glassnode found in a new report.

Historically, this phase has been accompanied by new highs in the coin’s value and realized price and a shift in investor behavior.

At press time, the leading crypto asset exchanged hands at $72,970. In the last week, its value has rallied by 10%, according to CoinMarket’s data.

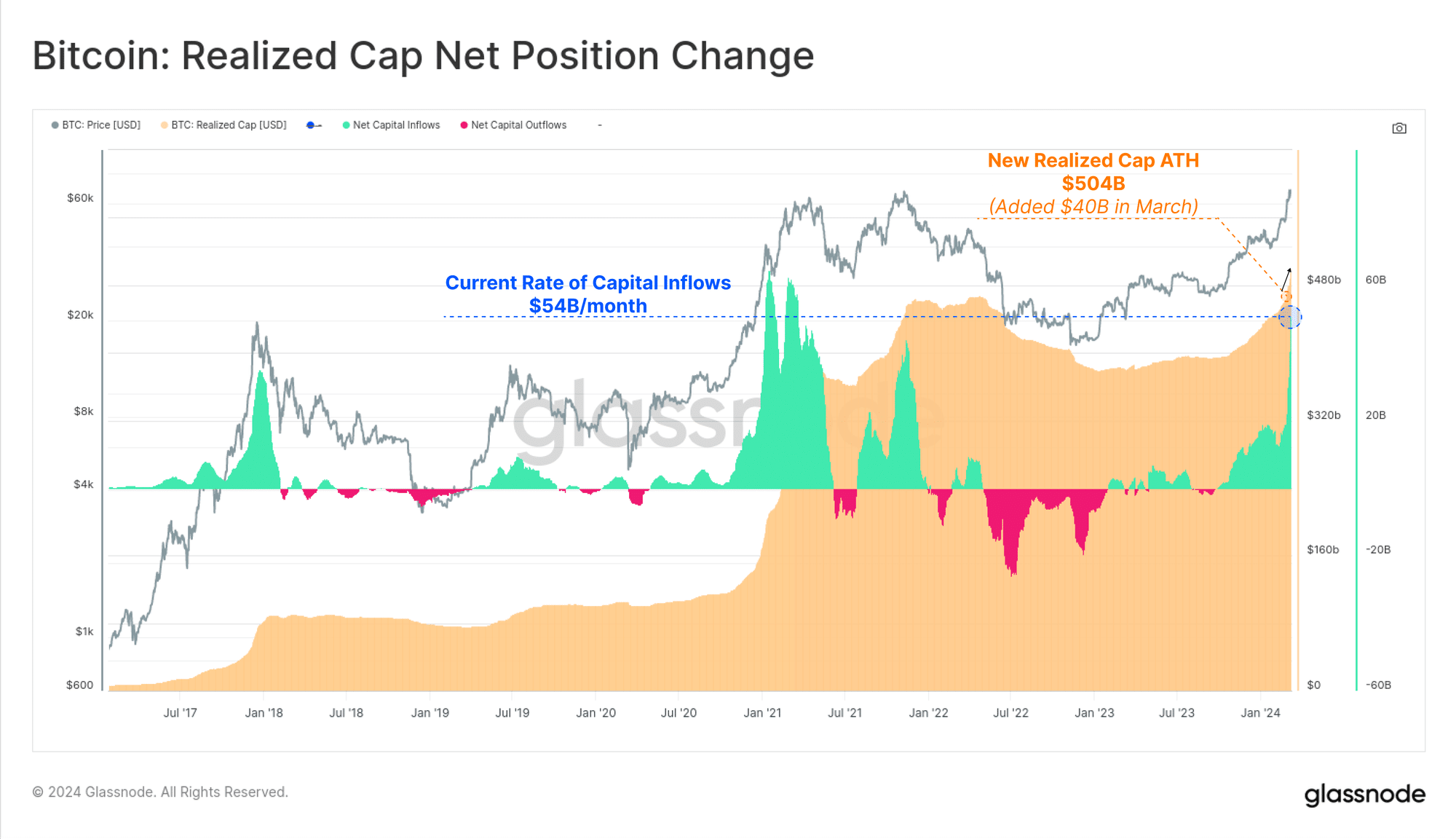

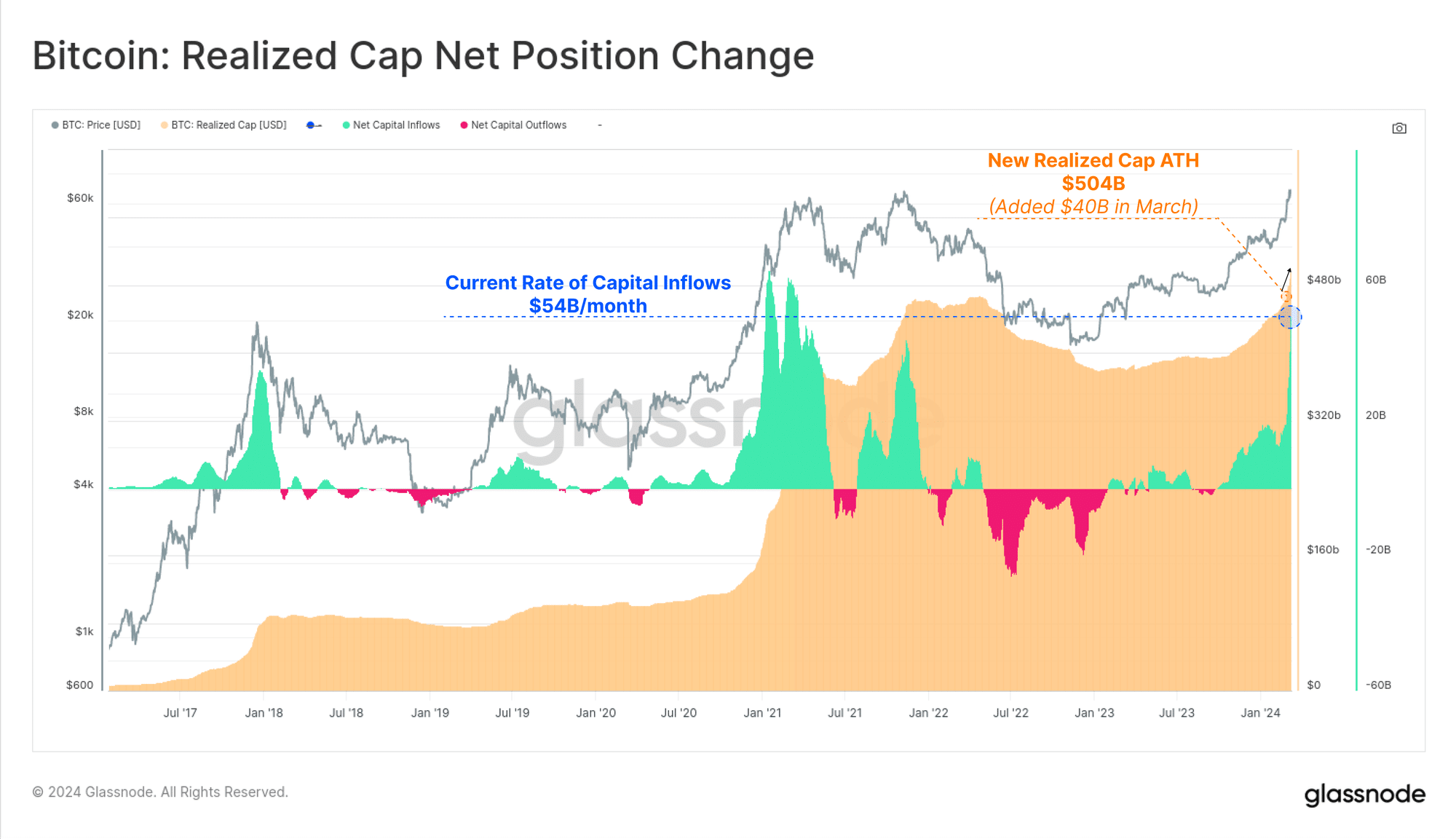

Glassnode also took a look at the coin’s realized price, which tracks the average price at which all coins in circulation were last bought or sold.

Notably, the realized price has been growing by $54 billion per month.

According to Glassnode, the recent growth in BTC’s realized price mirrors the surge observed during the general market rally in early 2021. It depicts a considerable inflow of liquidity into the current market.

Glassnode said,

“The Realized Cap is currently increasing at a rate of $54B/month, approaching levels last seen during the run-up in early 2021. This highlights just how significant the capital inflows have been for Bitcoin, driven in part by the tremendous success and demand for the new US ETF products.”

BTC Realized Price

Change in investor behavior

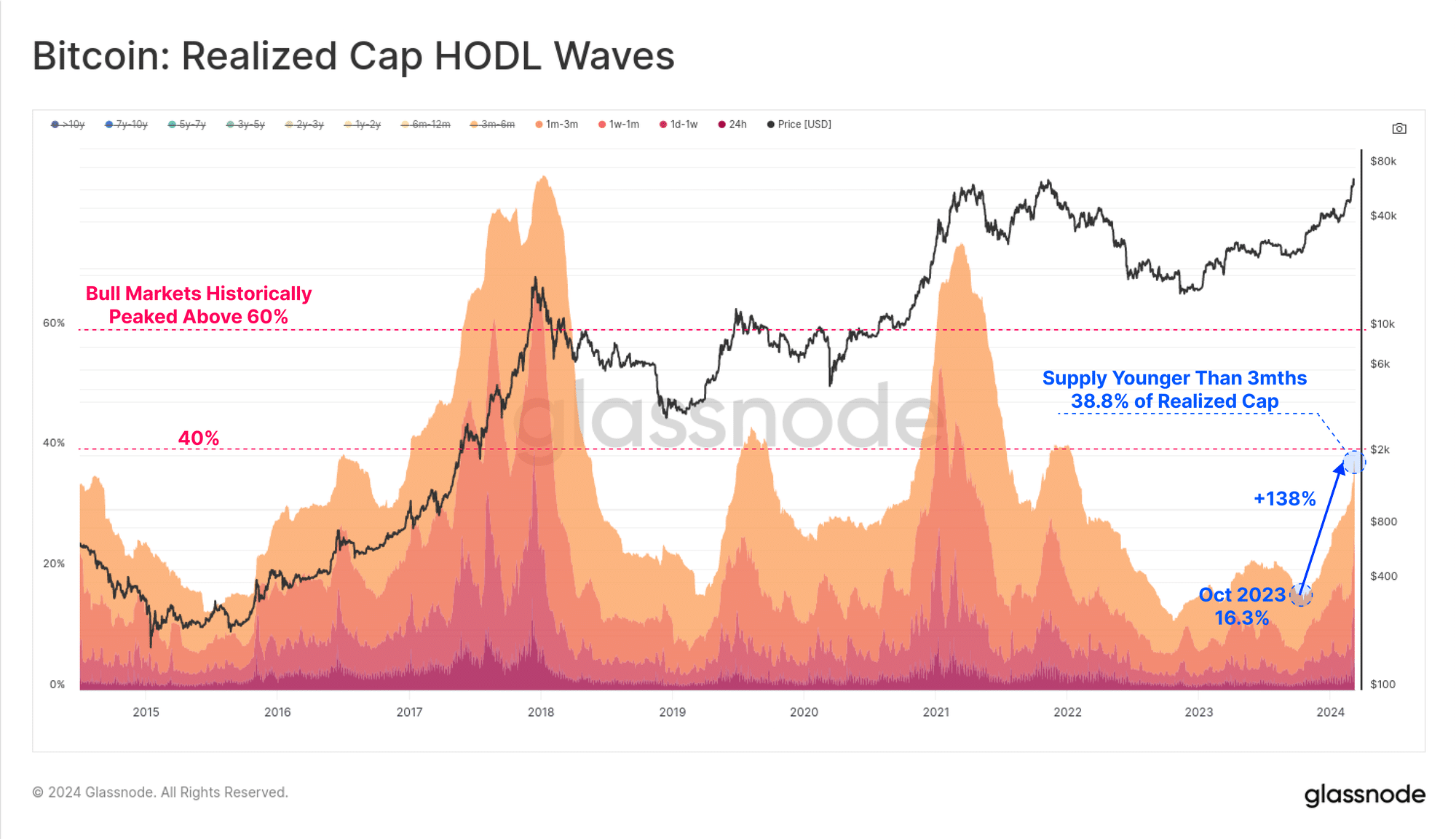

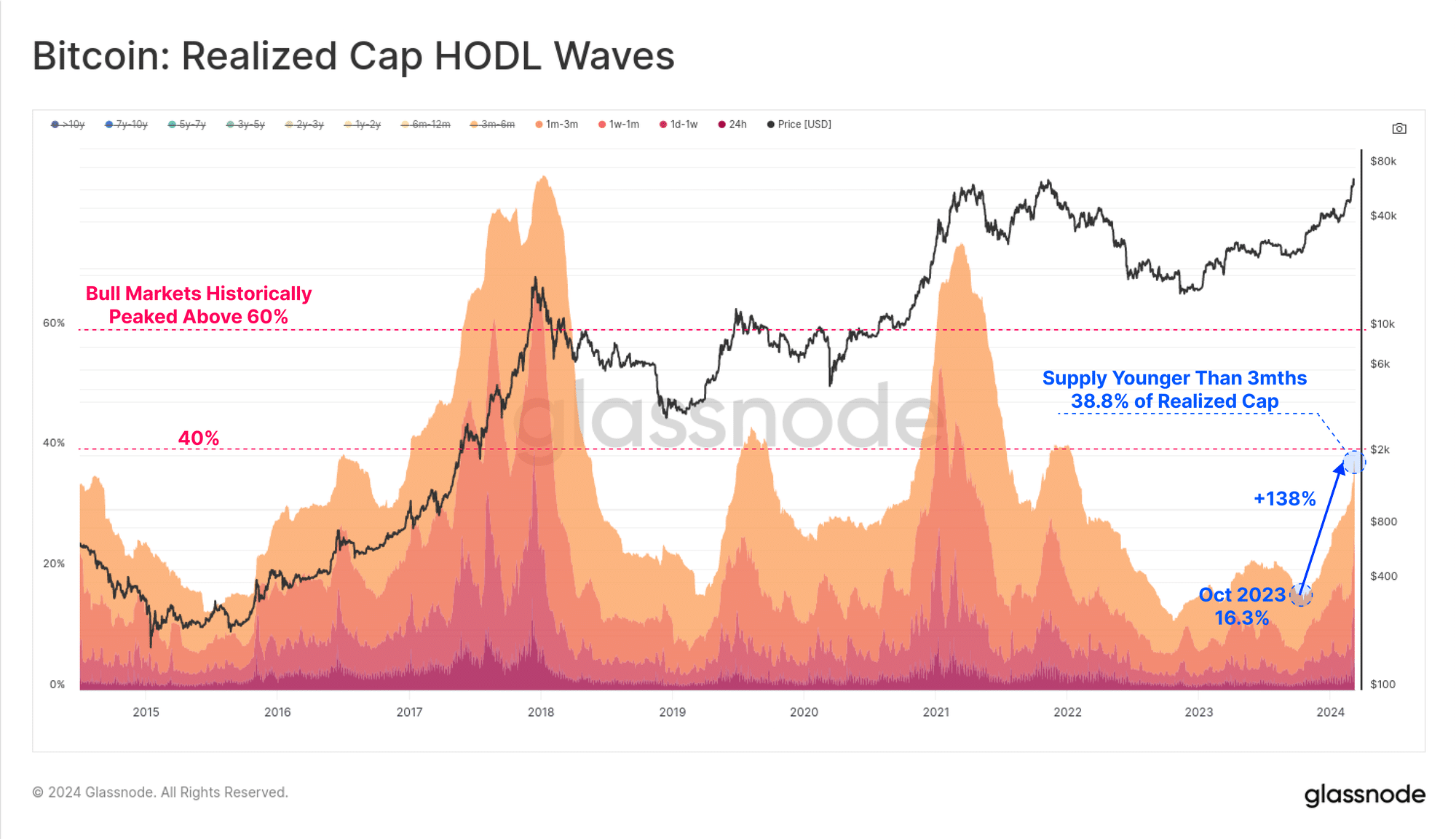

BTC is now trading at its fourth cycle all-time high. Inasmuch, there was an uptick in the amount of wealth that the ‘young coins’ held.

For the uninitiated, these are coins that have changed hands within the last three months.

According to Glassnode, BTC bull cycles are typically marked by a “transfer of wealth from old to young.”

This occurs as investors who acquired their coins at lower prices several months or years ago see the new highs as an opportune moment to distribute for profit.

Source: Glassnode

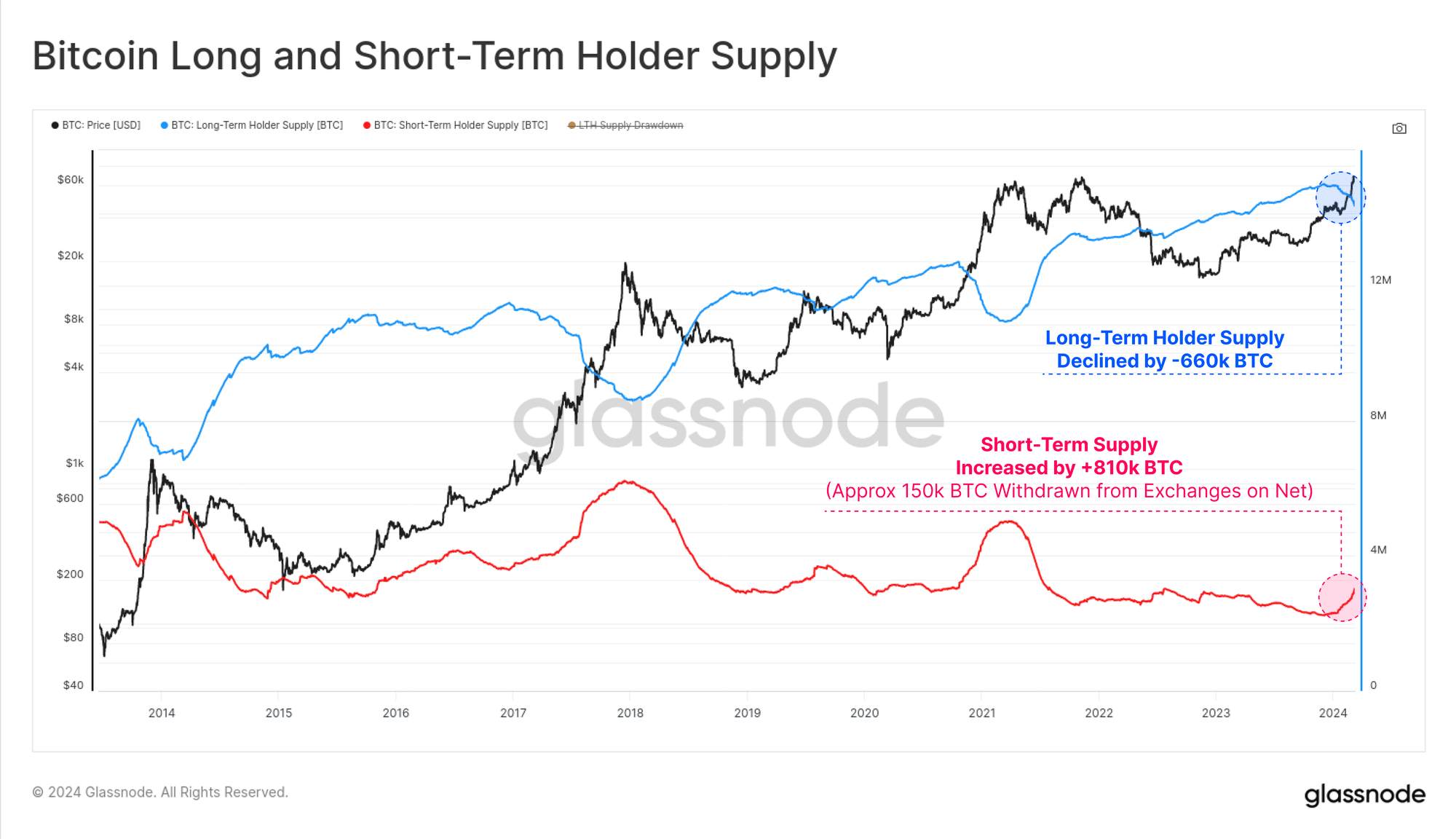

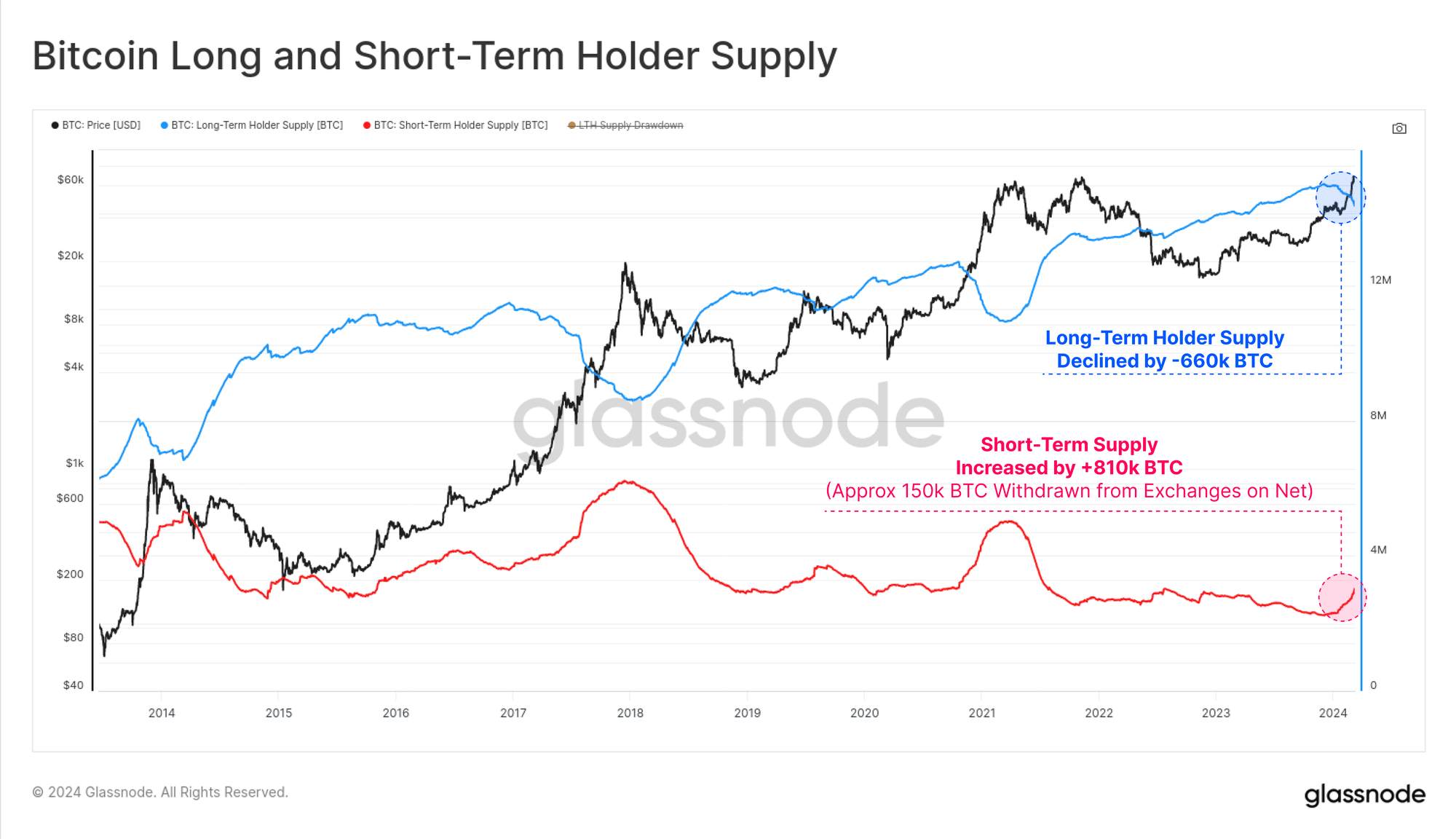

We can assess this shift in accumulation/distribution patterns by observing the coin supply held by its LTHs and STHs. Per Glassnode, LTH supply has decreased by 660k BTC since its peak in November 2023.

Read Bitcoin’s [BTC] Price Prediction 2024-25

In contrast, STH supply has surged by 810k BTC during the same period.

This cohort of investors has gotten their coins from two primary sources: 660k BTC transferred from LTHs and 150k BTC withdrawn from exchange balances tracked by Glassnode.

Source: Glassnode

Talking about this transfer of wealth from an investor class that has held on to their coins for years to new investors, Glassnode concludes that it,

“Reflects a healthy balance between distribution pressure and new demand.”

Leave a Reply