- Maker explained that it would reform DAI and MKR.

- DAI might not be able to compete with USDT despite plans to drive its supply up.

If the plan of MakerDAO’s [MKR] co-founder Rune Christensen comes to pass, then the project might upgrade its governance token and decentralized stablecoin DAI. AMBCrypto went through the memo Christensen wrote to the Maker community on the 12th of March.

Most of it was centered around the Endgame, which aims to scale the supply of DAI to 100 billion and more. For the unfamiliar, DAI’s current supply was 5.35 billion.

An upgraded version does not seem like the solution

In May 2023, the Maker team introduced the Endgame as a way to support DAI. One of its mission was to make it compete with stablecoins like USDT. But since that time, the development had failed to impact the stablecoin.

This time, Maker is saying that an upgraded MKR and DAI would get it closer to its objectives. Should this happen and DAI gets a 100 billion supply, the market cap of the stablecoin might jump from the 27th position.

However, this forecast does not mean that other stablecoins like USDT and USDC which are far above it, would remain stagnant. At press time, MakerDAO’s Total Value Locked (TVL) had increased by 20.32% in the last 30 days.

The TVL assesses the overall health of a particular protocol. Therefore, the increase above suggest that market participants believe their deposits would get a better yield.

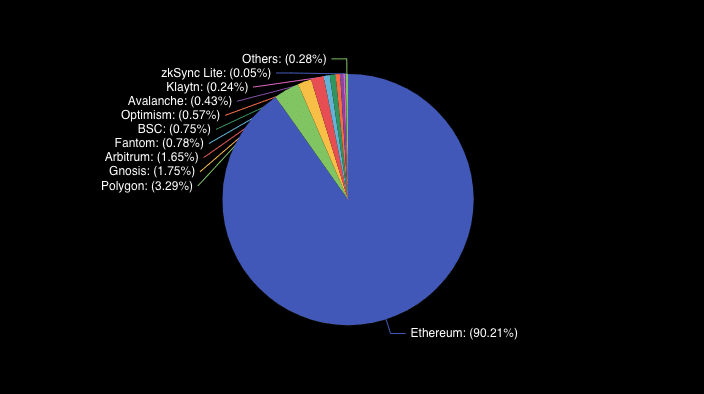

But in terms of the stablecoin volume, DAI has been lagging. Using data from DeFiLlama, AMBCrypto noticed that participants bridged the stablecoin from Ethereum [ETH], Arbitrum [ARB], and the likes.

However, the changes in the last seven days has been unimpressive, indicating that instability in participants’ interest. Should DAI’s volume fail to rise higher, the stablecoin might only remain “king” in the decentralized arena, and not in the broader market.

Development drops, same as traction

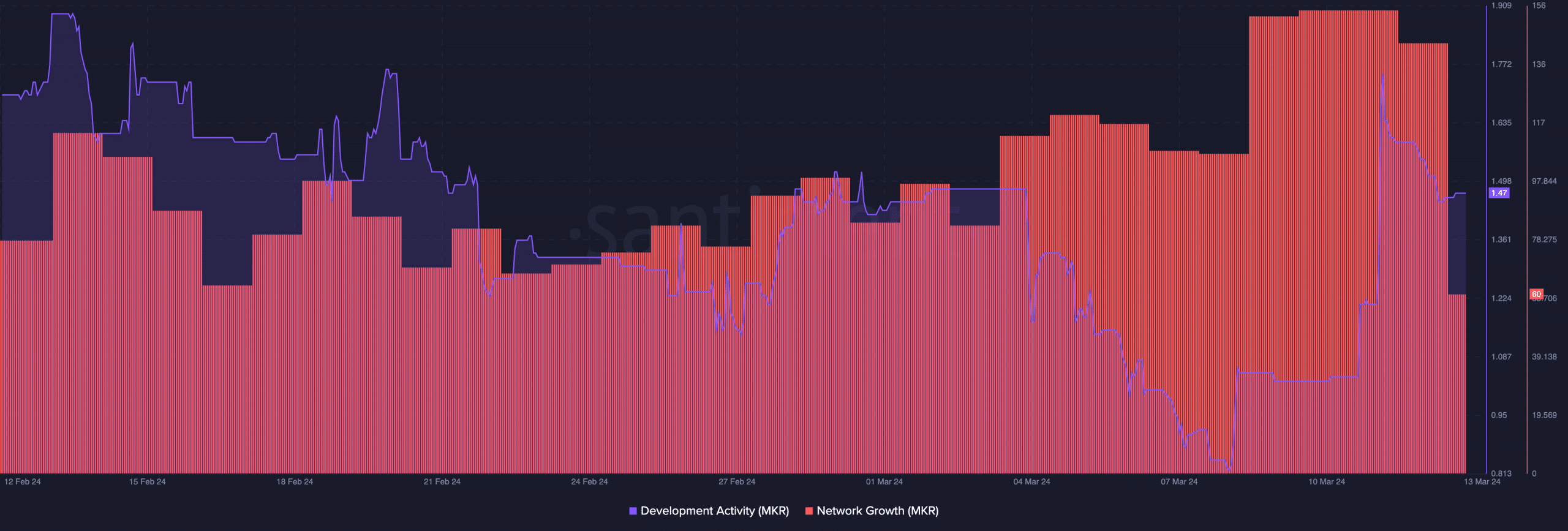

Furthermore, we checked if MakerDAO has been making efforts in terms of development activity. According to Santiment, the development activity jumped on the 11th of March.

When this metric increases, it means developers are shipping new features. But at press time, development had decreased, suggesting that code commits in upgrading the network had slowed down. The decrease also implied that it might not be time to go bullish on MKR.

One other metric AMBCrypto looked at was the network growth. The network growth illustrates user adoption by tracking the number of new addresses involved in first time transfers.

Source: Santiment

Realistic or not, here’s DAI’s market cap in MKR terms

If the metric had increased, it would have indicated a surging interest in the Maker ecosystem. However, the decrease here implies that traction on the network had fallen.

Going forward, market players can keep an eye on DAI and MKR to see if the proposal or potential approval would have any effect on the cryptocurrencies.

Leave a Reply