CCData, a global leader in digital asset data recognized for providing institutional and retail investors with high-quality real-time and historical data, has recently published its February 2024 Exchange Review. According to CCData, the report aims to capture the key developments within the cryptocurrency exchange market, focusing on exchange volumes, market segmentation, and analysis of Bitcoin trading into various fiats and stablecoins. This report offers a comprehensive overview, serving the interests of crypto enthusiasts and professionals alike by providing objective insights into the digital asset industry.

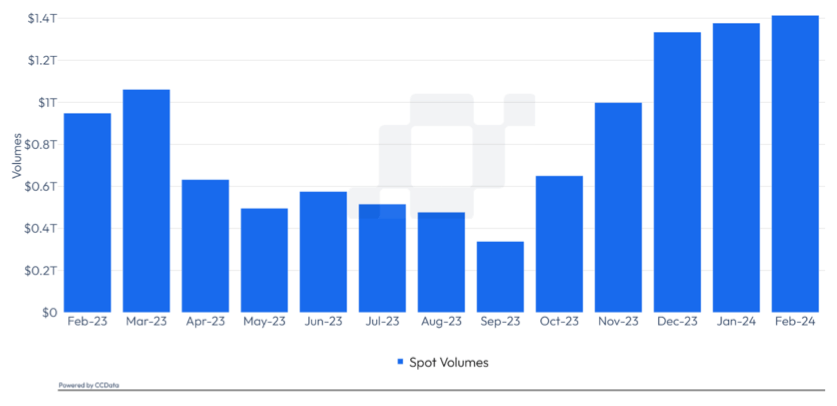

In the latest findings by CCData for February 2024, there was a notable increase in trading activity across centralized exchanges. Specifically, the report indicates that the combined spot and derivatives trading volume on these platforms rose by 2.28% to $4.73 trillion. This growth reflects a continued interest in trading, with Bitcoin’s price nearing new all-time highs contributing to the fifth consecutive month of increased trading volumes. CCData highlights that spot trading volumes on centralized exchanges climbed by 2.65% to $1.41 trillion, while derivatives trading volumes experienced a 2.12% increase to $3.32 trillion.

Source: CCData’s Exchange Review Report (February 2024 Edition)

One of the key insights from CCData’s February review is the remarkable performance of Binance in the spot trading market. The exchange saw its spot trading volumes jump by 15.5% to $505 billion, marking its highest trading volume since March 2023. This surge propelled Binance’s market share from 31.8% to 35.7%, the highest since August 2023. According to CCData, Binance’s growth in the derivatives market was also notable, with a 2.07% increase to $1.53 trillion in trading volume, reaffirming its dominance with a 46.2% market share.

CCData’s report also sheds light on Bybit’s ascension in the crypto exchange landscape. The exchange witnessed a 17.5% increase in its spot trading volume, reaching $95.7 billion in February and setting a new record. This achievement allowed Bybit to become the second-largest spot trading exchange, surpassing competitors such as OKX and Coinbase for the first time. CCData also notes Bybit’s derivatives trading volume rose by 6.78% to $444 billion, further cementing its position as a leading exchange with a 13.4% market share.

Further analysis by CCData reveals significant trends in open interest and funding rates on centralized exchanges. Open interest hit new highs, soaring by 54.9% to $49.3 billion, as traders leveraged up amid strong price action in crypto assets. The report highlights that the top three derivatives exchanges by volume—Binance, OKX, and Bybit—saw substantial increases in their open interest. Additionally, CCData points out the significant rise in open interest on CME, indicating a surge in institutional interest in the crypto markets.

Lastly, CCData cautions that the heightened open interest and funding rates for BTC trading pairs often precede market adjustments. This was exemplified on 5 March when Bitcoin experienced a 14.6% drop after achieving a new all-time high, illustrating the market’s volatility and the speculative nature of current trading activities.

Leave a Reply