- Development activity on Chainlink increased materially in the last few days.

- Price of LINK continued to fall as network growth declined.

Chainlink [LINK] has been one of the most prominent infrastructure protocols in the crypto space for quite some time.

One reason for the same would be the rising development activity on the Chainlink network.

A spike in activity

Recent data revealed that Chainlink is at the forefront of GitHub activity in the Real World Assets (RWA) sector, underscoring its dedication to pioneering blockchain solutions for real-world assets.

The surge in development activity for Chainlink could help the protocol improve upon its products and offerings. This, in turn, could improve sentiment towards the network and attract more users.

Source: X

However, overall activity on the network had declined significantly.

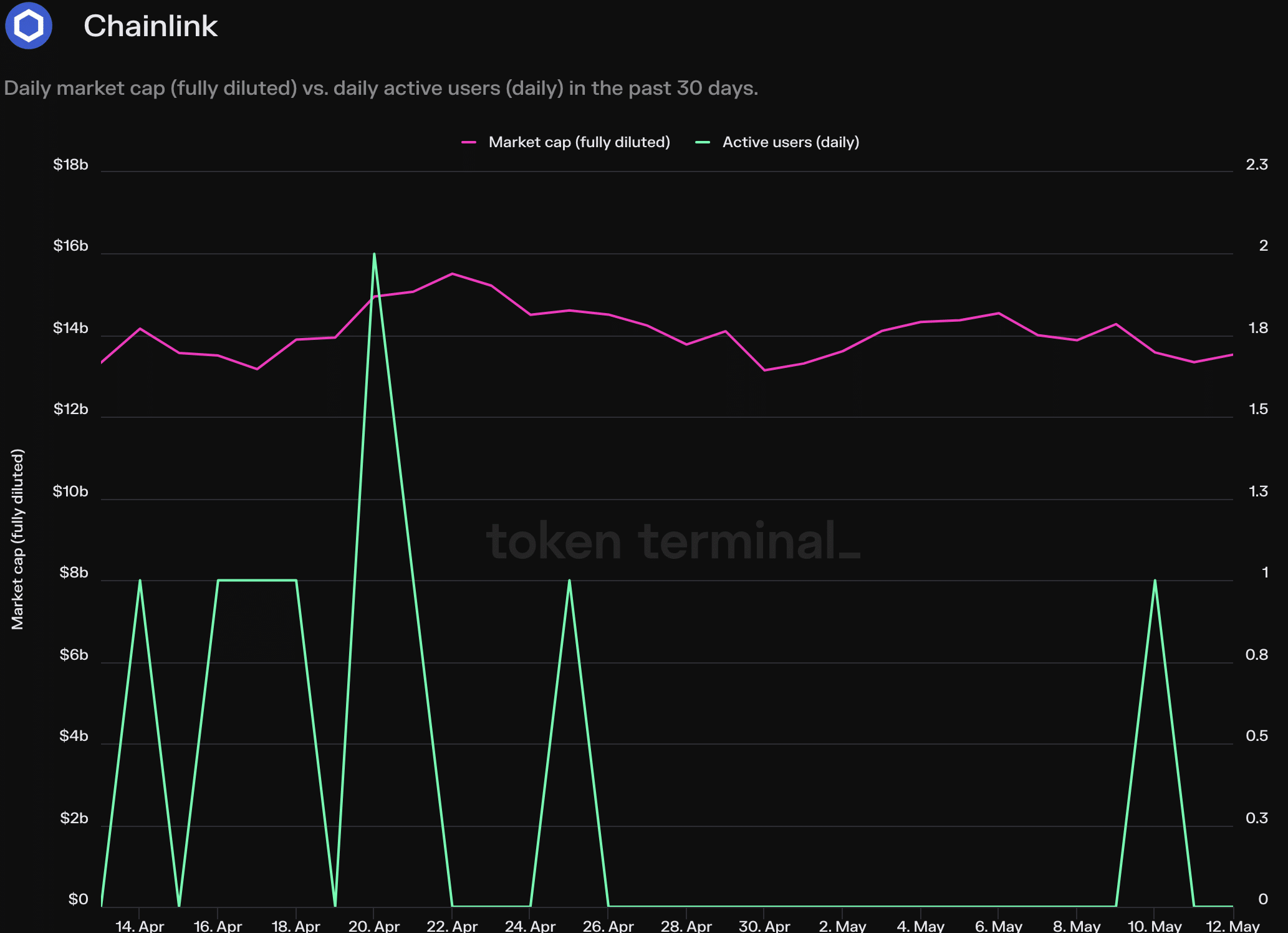

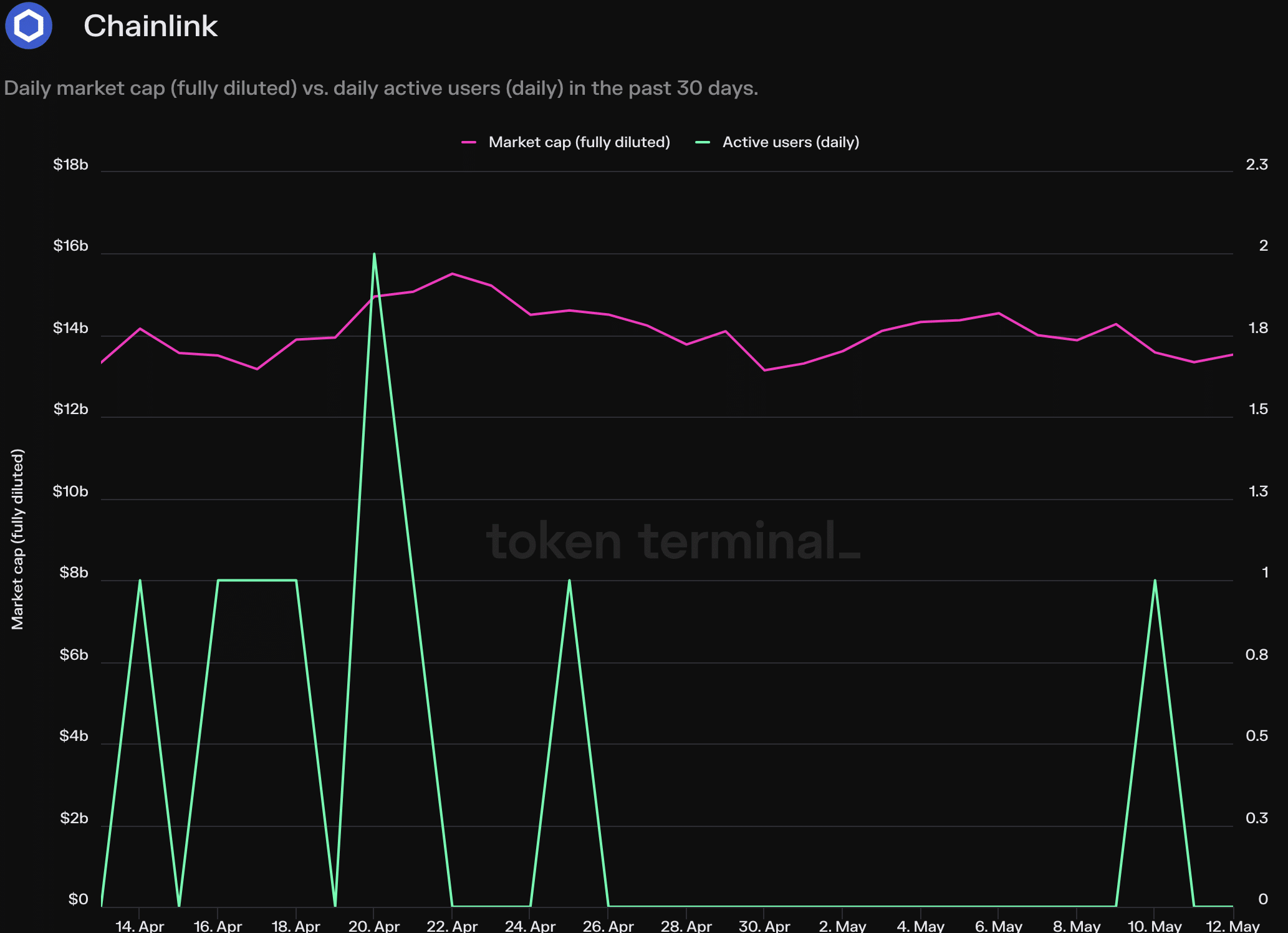

AMBCrypto’s analysis of Token Terminal’s data revealed that the number of active daily users on the network fell by 66% over the past month.

Coupled with that, the revenue generated by Chainlink dimished by a whopping 90%.

Source: Token Terminal

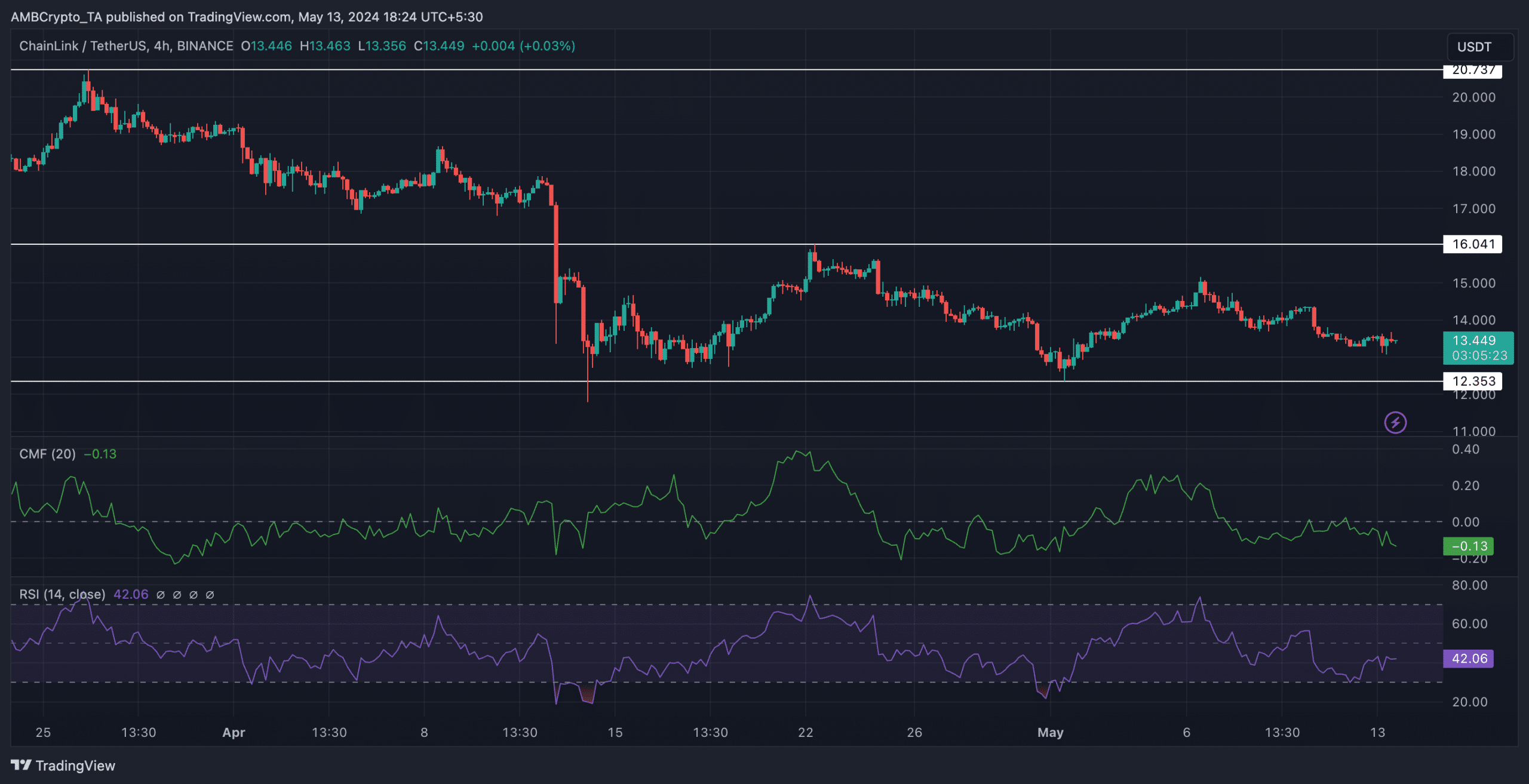

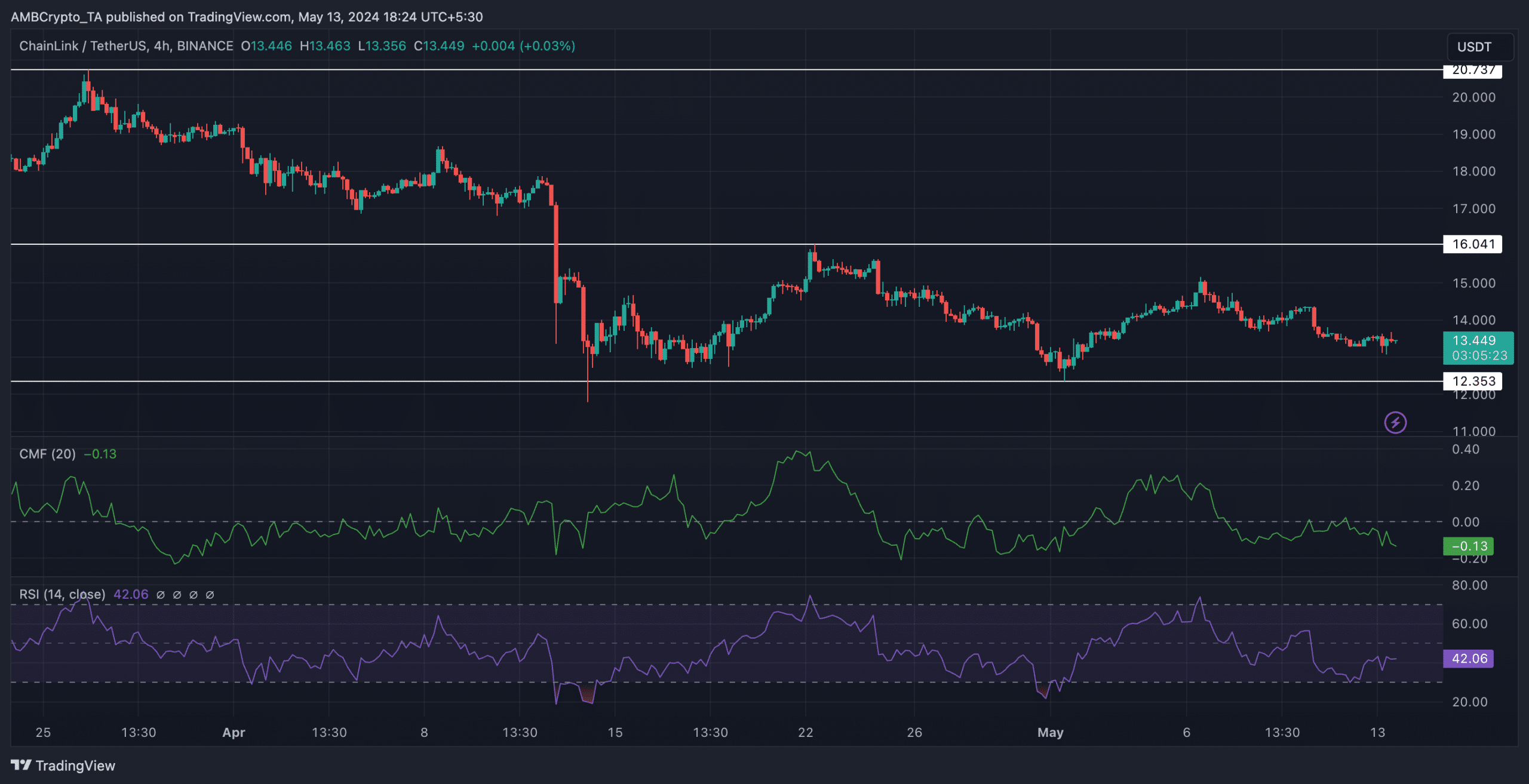

The price of LINK wasn’t doing that well either. Since the 26th of March, the price of LINK began to see its downfall.

It plummeted from the $20.737 price and began to indicate lower lows and lower highs, which are signs of a bearish trend.

There was no sign of significant positive price action in all of April or May, as LINK’s price failed to push past the $16.041 mark.

LINK would need to test this level multiple times and weaken the resistance before it could possibly aim at a price reversal in the future.

The CMF (Chaikin Money Flow) showcased a negative picture as well, as it had declined to -0.13. A falling CMF indicated that the money flowing into LINK had declined materially in the last few days.

Moreover, the RSI (Relative Strength Index) for LINK had also fallen to 42.06 implying that the bullish momentum around the LINK token had waned.

Source: Trading View

Is your portfolio green? Check out the LINK Profit Calculator

Chainlink’s Network Growth had also declined materially over the last few days, implying that new addresses were losing interest in the token. This could further increase selling pressure.

However, the velocity around LINK continued to surge, which meant that the frequency of LINK trades had grown significantly high over the last few days.

Source: Santiment

Leave a Reply