- Metrics revealed that selling pressure on PORK increased.

- Most indicators hinted at a further price drop.

Pepe’s [PEPE] forked token, PepeFork [PORK], gained much traction in the crypto community as its social metrics soared. While PORK’s popularity rose, its price action moved the other way around.

Therefore, AMBCrypto planned to check PEPE and PORK’s current states to see how they are faring against each other.

PORK’s latest bloodbath

LunarCrush’s latest tweet highlighted an interesting development related to PORK, as its social metrics soared.

A possible reason behind this increase in popularity could be the meme coin’s weekly rally of over 12%.

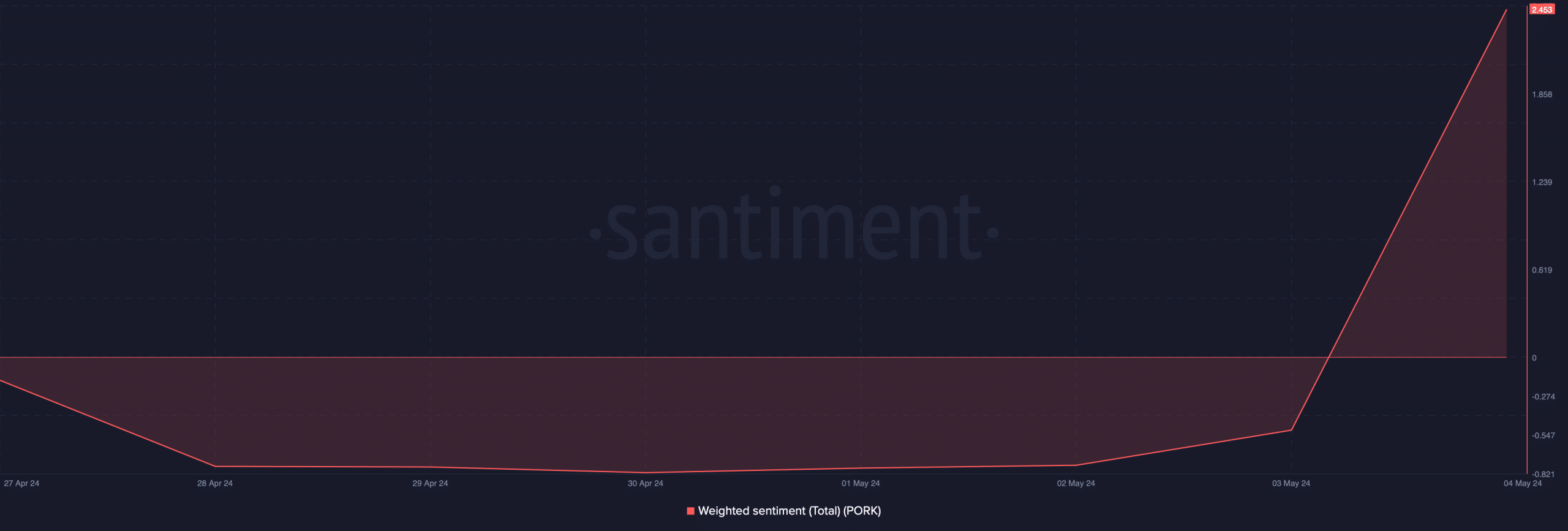

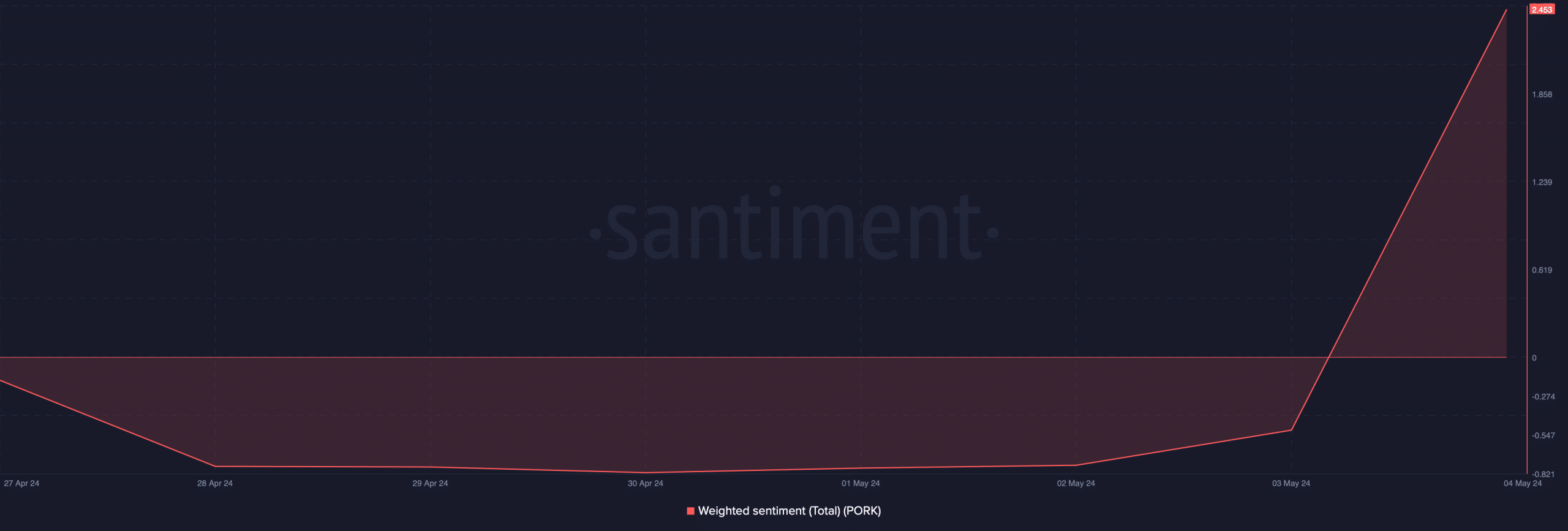

Thanks to the price uptick, sentiment around the meme coin remained bullish, as evident from its high Weighted Sentiment.

Source: Santiment

However, the bull trend didn’t last long, as the meme coin witnessed a major price correction. According to CoinMarketCap, the meme coin was down by more than 10% in the last 24 hours alone.

At press time, it was trading at $0.0000002431 with a market capitalization of over $102 million.

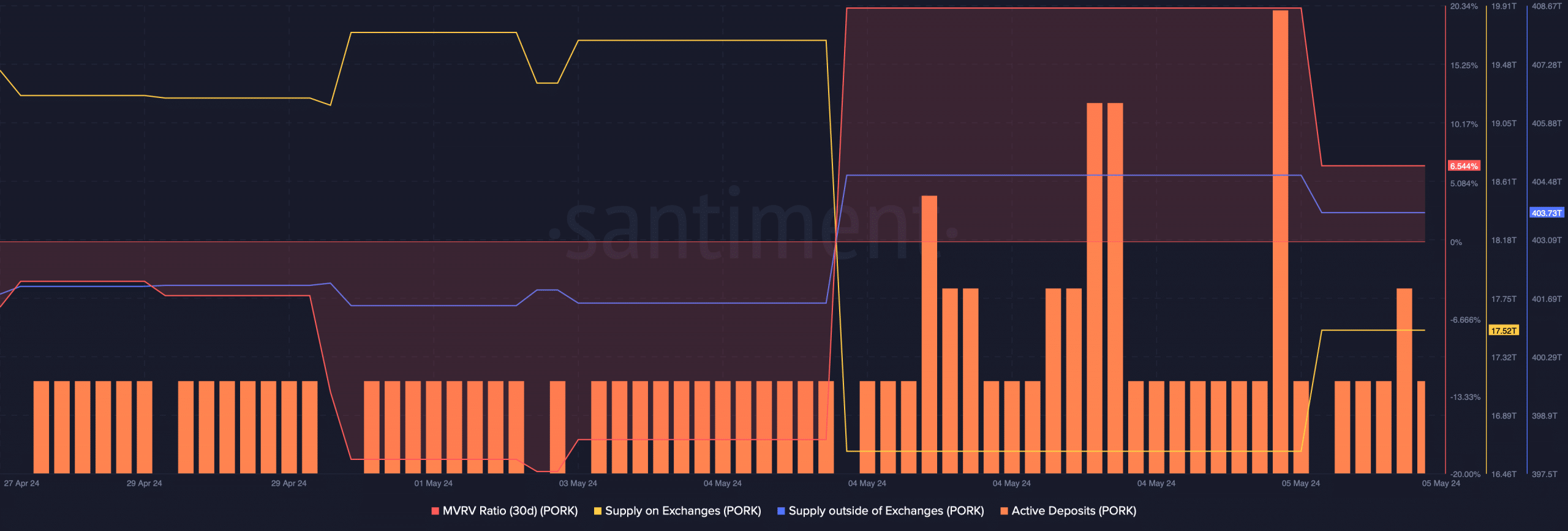

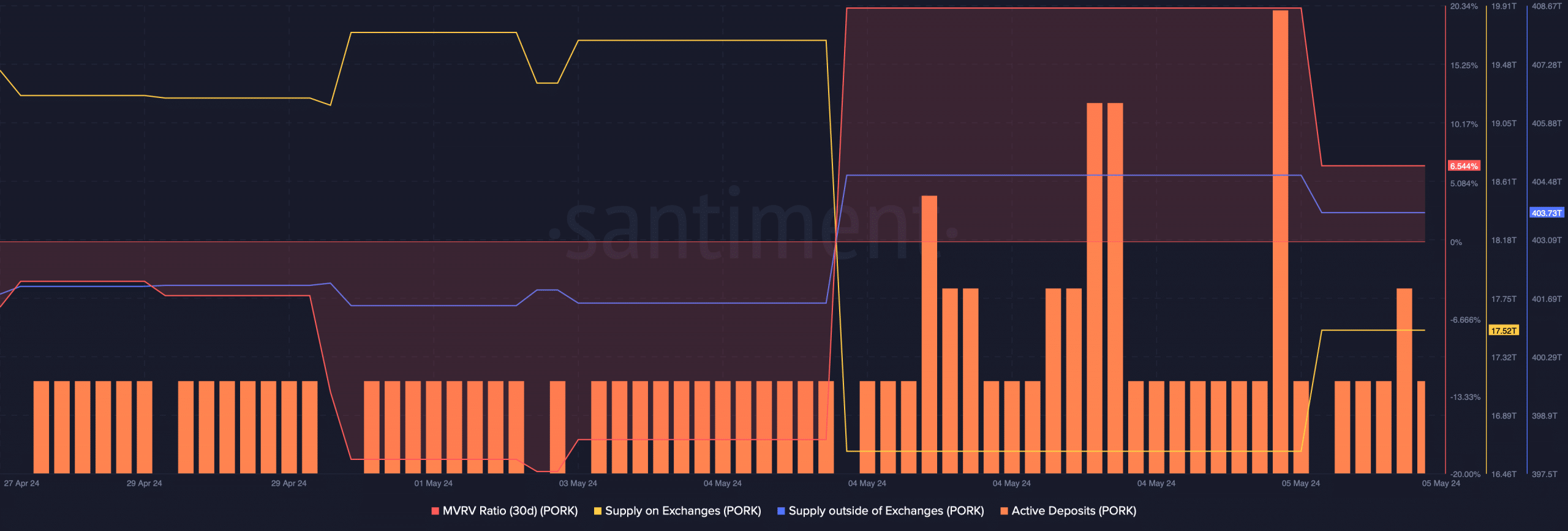

AMBCrypto’s analysis of Santiment’s data revealed that PORK’s MVRV ratio dropped on the 5th of May, hinting that fewer investors were in profit.

As the meme coin’s price turned bearish, investors chose to sell. This was the case as the meme coin’s active deposits increased.

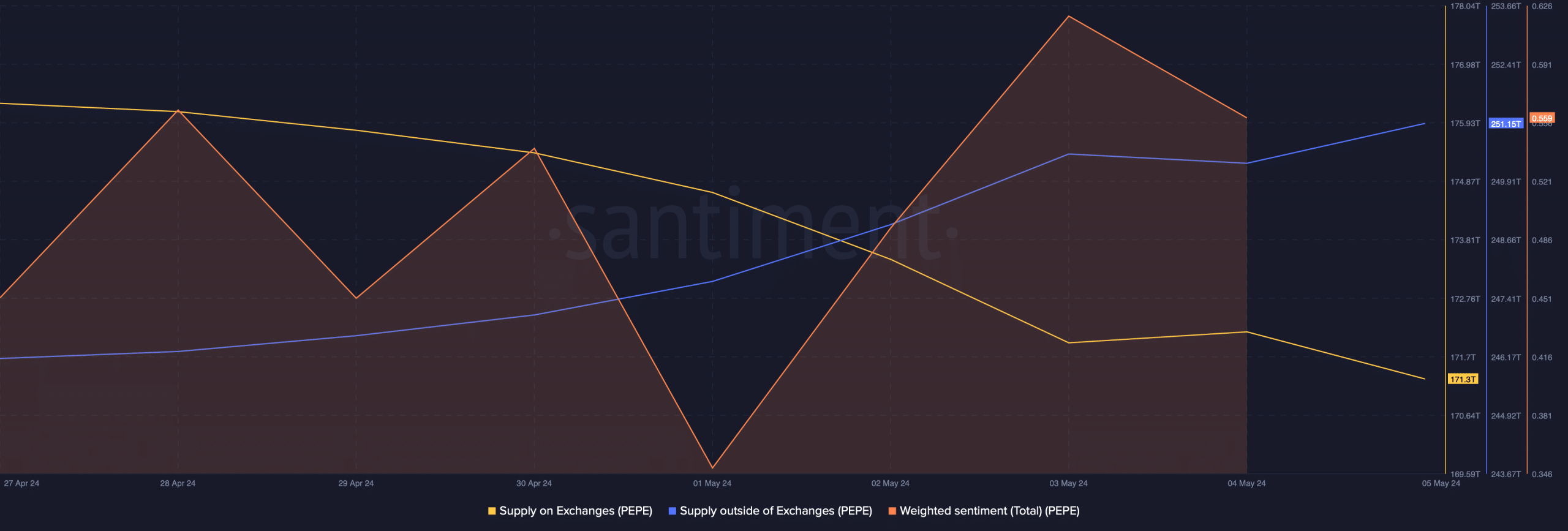

Additionally, its Supply on Exchanges increased, while its Supply outside of Exchanges dropped on the 5th of May. This meant that selling pressure was high at press time.

Source: Santiment

PEPE is in a better position

PEPE, on the other hand, acted differently. According to CoinMarketCap, its price only dropped 1.5% in the last 24 hours.

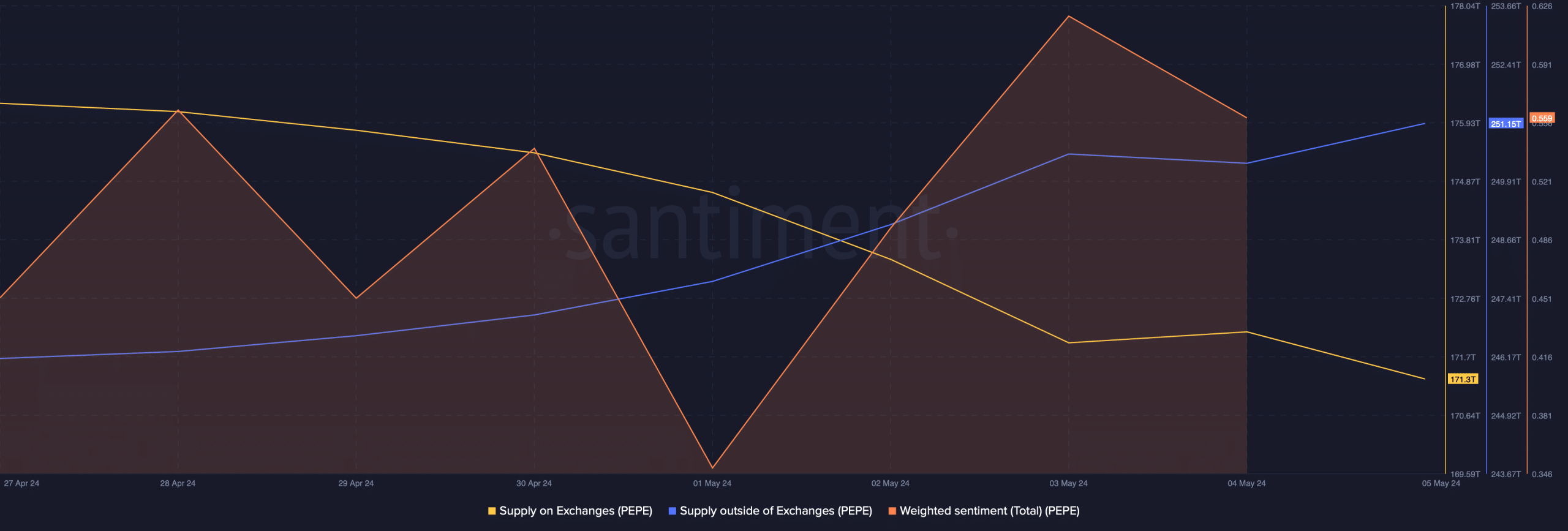

At press time, it was trading at $0.000008569 with a market cap of $3.6 billion. Market sentiment around PEPE remained bullish as its Weighted Sentiment graph was up.

Unlike PORK, PEPE remained under high buying pressure. The meme coin’s Supply on Exchanges dropped, while its Supply outside of Exchanges increased over the last week.

In fact, AMBCrypto reported earlier about the possibility of PEPE touching $0.00001 in the coming days.

Source: Santiment

What to expect from PORK

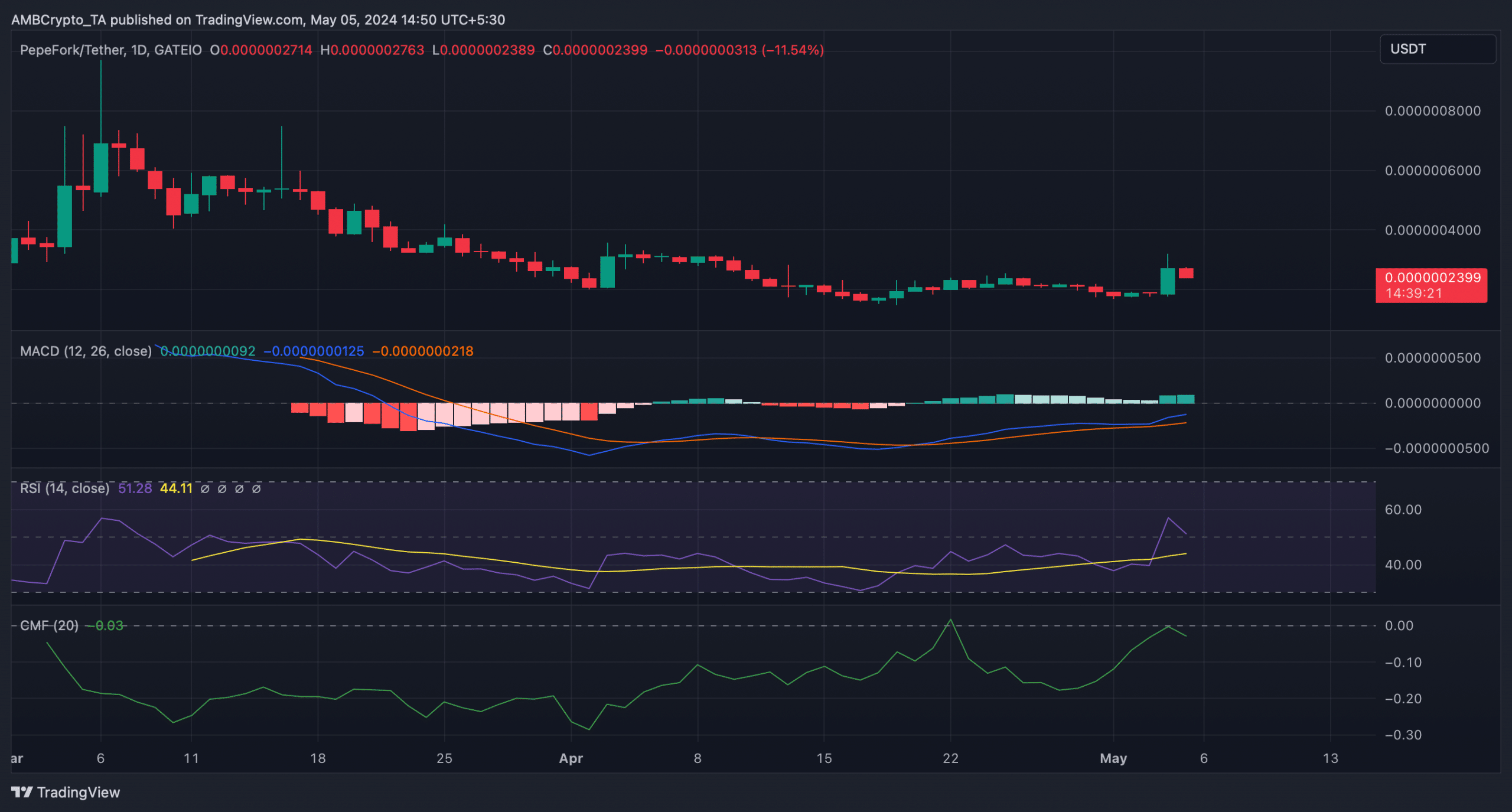

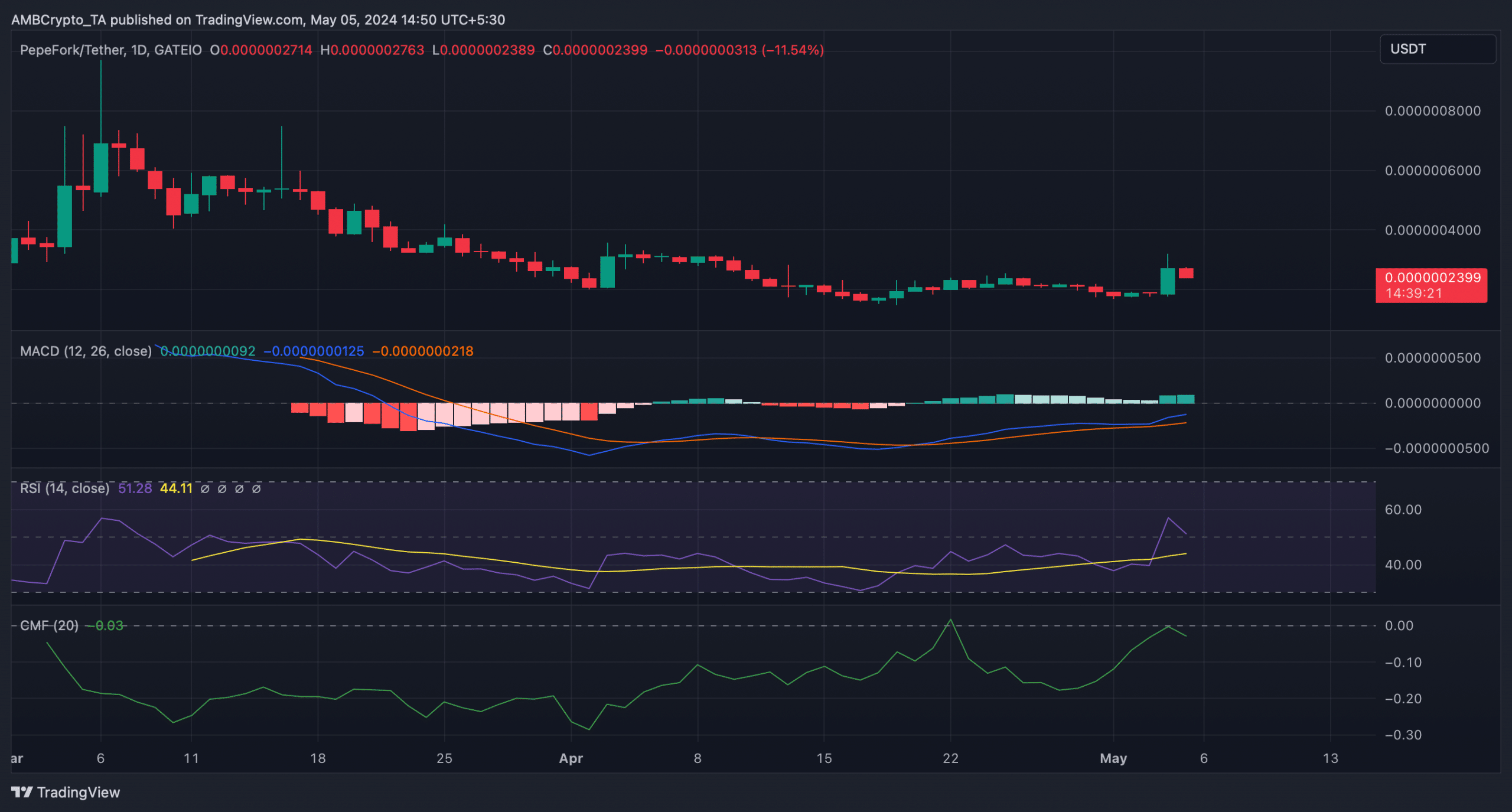

Since PORK was in a concerning state, AMBCrypto planned to check its daily chart to better understand whether it could change the bearish trend.

We found that its Relative Strength Index (RSI) registered a sharp downtick.

Realistic or not, here’s PORK’s market cap in DOGE’s terms

The Chaikin Money Flow (CMF) also followed a similar declining trend. These suggested that the chances of a continued price decline were high.

Nonetheless, the MACD remained in buyers’ favor as it displayed a bullish advantage in the market.

Source: TradingView

Leave a Reply