- Tron made massive progress in the DeFi sector in Q1, but failed to do the same in Q2

- Activity on Tron rose compared to the previous quarter though

According to recent data, Tron [TRX] managed to do extremely well in the first quarter of 2024, despite facing stiff competition from other layer 1 networks.

The DeFi scene

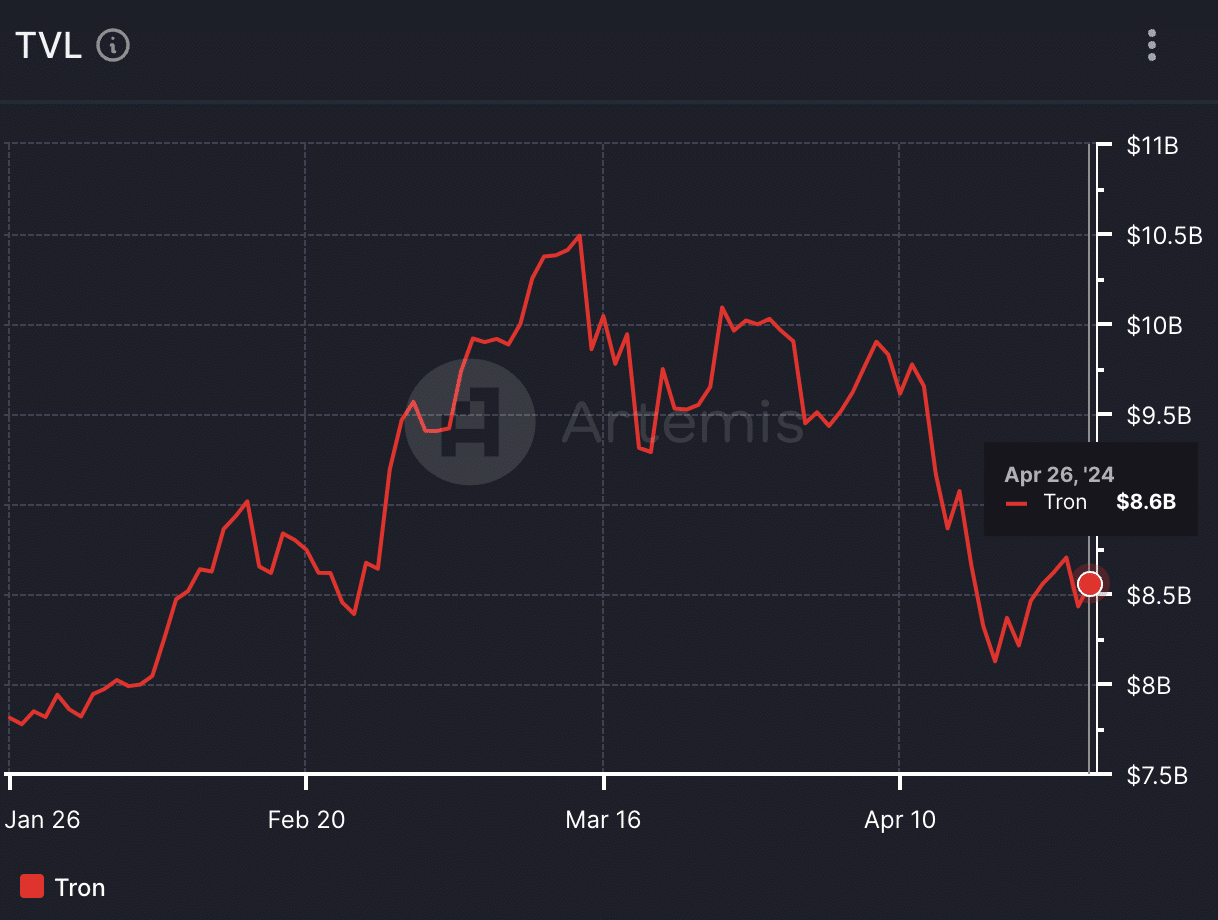

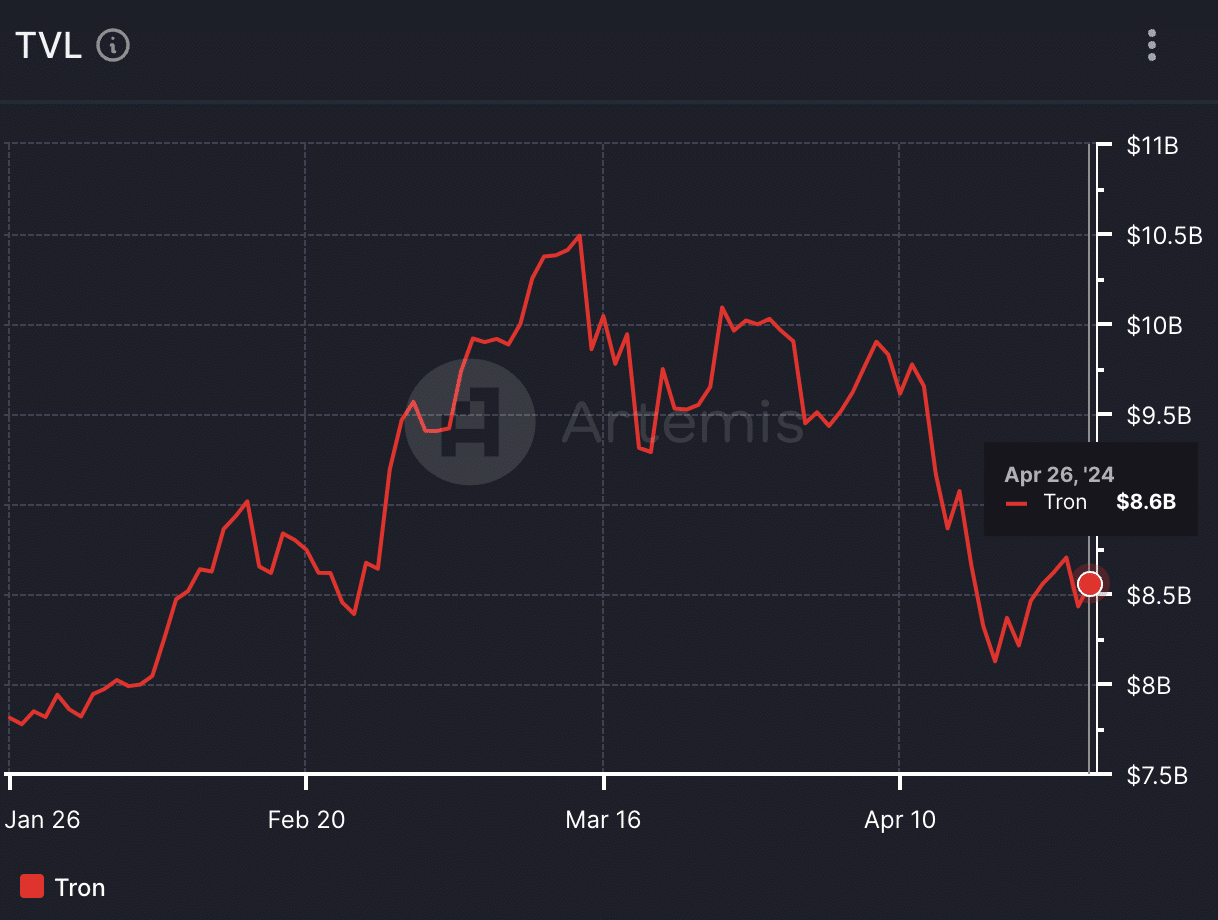

One of the most important areas where Tron did well was the DeFi sector. In fact, data revealed that Total Value Locked (TVL) on TRON surged past the eleven-figure mark during Q1, climbing by 25% quarter-over-quarter from $8.1 billion to $10.1 billion. As Q1 drew to a close, TRON maintained its position as the second-highest network by TVL, surpassing BNB Chain ($7.2 billion) by nearly $3 billion.

Additionally, TVL denominated in TRX also recorded a quarterly hike, rising by 8% from 76.4 billion to 82.5 billion. This growth seemed to highlight TRON’s sustained dominance and resilience within the DeFi landscape.

That being said, even though TRON managed to note an uptick in Q1, the same couldn’t be said for Q2. Over the last few weeks, for instance, the TVL for TRON fell significantly and dropped below the $9 billion-mark.

Source: Artemis

Activity on the network

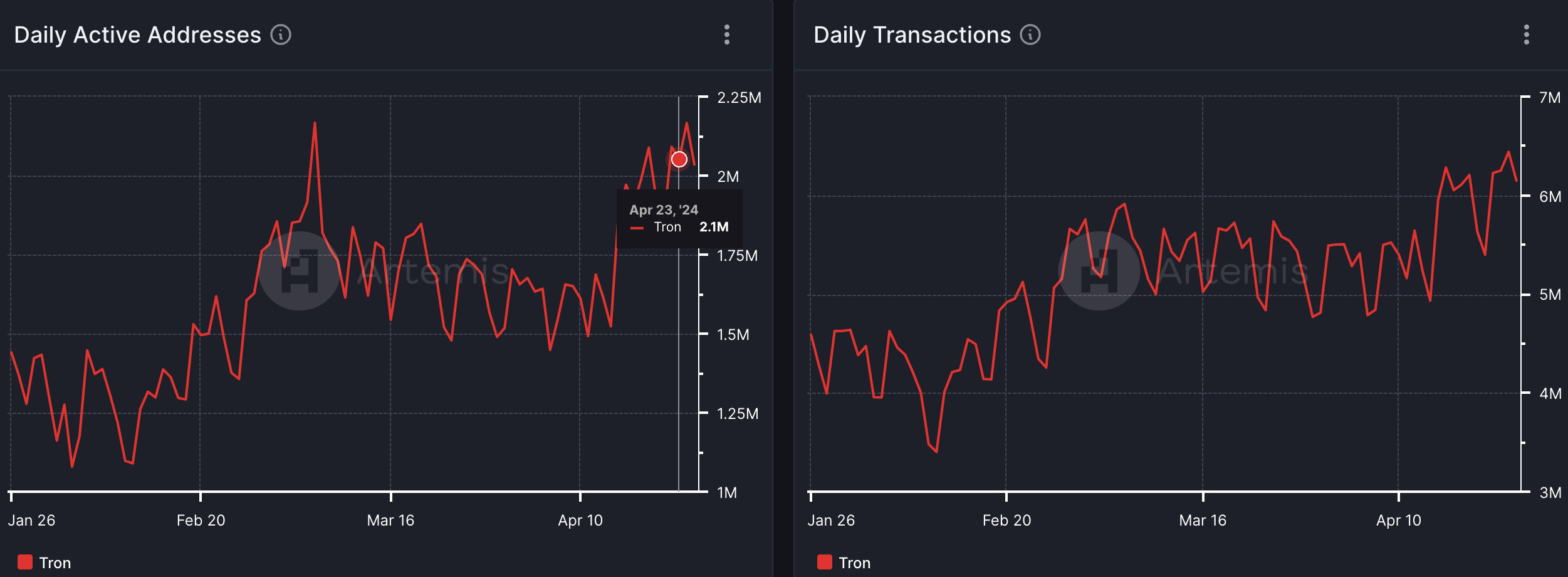

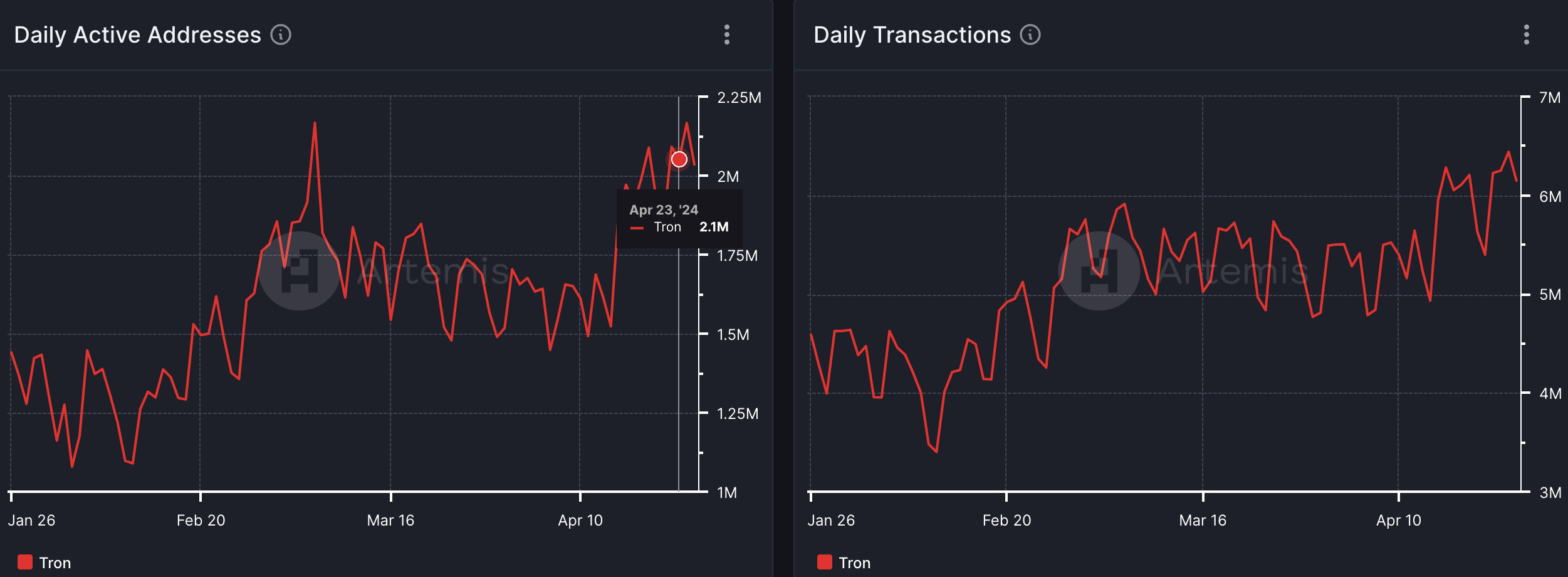

In Q1, average daily transactions on TRON remained relatively stable, registering a modest 1% quarter-over-quarter decrease from 4.9 million to 4.8 million. Notably, this figure remained below the levels observed over the same period last year, with Q1 ’23 registering an average of 7.1 million daily transactions.

Moreover, average daily active address activity showed little change over both the past year and quarter, with Q1 maintaining an average of 1.5 million active addresses daily, representing a marginal 4% quarter-over-quarter hike.

Following two consecutive quarters of decline, average daily new addresses saw a modest 2% quarter-over-quarter uptick in Q1, rising from 184,500 to 187,800. Approximately 12% of all active addresses in Q1 were newly created, a figure that remained stable quarter-over-quarter. Over the past year, TRON has consistently seen around 195,000 new addresses added daily.

However, things took a turn for the better in Q2 with daily active addresses on the network and transaction activity climbing. If TRON manages to sustain this momentum, it would be beneficial for both the protocol and the token’s price movement.

Realistic or not, here’s TRX market cap in BTC‘s terms

Source: Artemis

Leave a Reply