- Percentage of miner revenue derived from fees hit an ATH on the halving day.

- Miners have been selling their holdings post halving after HODLing for more than a month.

Bitcoin’s [BTC] halving events have been to the crypto space what Olympics means for the sports fraternity, and Academy Awards for movie aficionados. A keenly awaited and celebrated event, halving tends to boost the economic value of the biggest digital asset on the planet by squeezing the supply.

However, regardless of the perceived bullishness, these events have had an adverse impact on the economics of Bitcoin mining, forcing miners to adopt new methods to improve their profit margins.

Halvings – A pain for Bitcoin miners

As is well known, miners validate and add transactions on the Bitcoin ledger, thus acting as a vital cog in the everyday operations of the chain. On their part, miners make huge investments in setting up mining infrastructure to carry out this task.

In return, they are compensated with a fixed subsidy from every block they mine along with transaction fees from users.

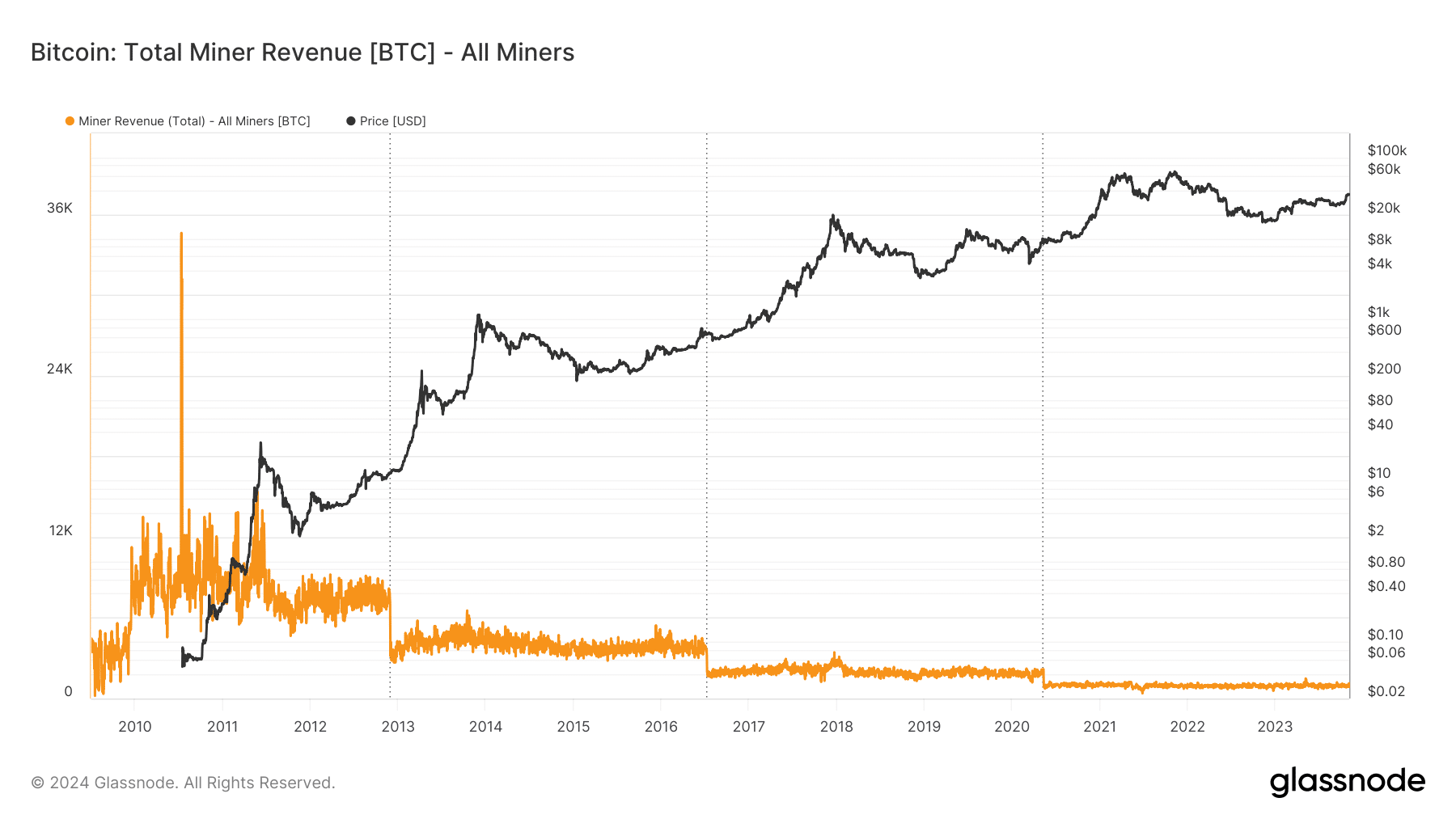

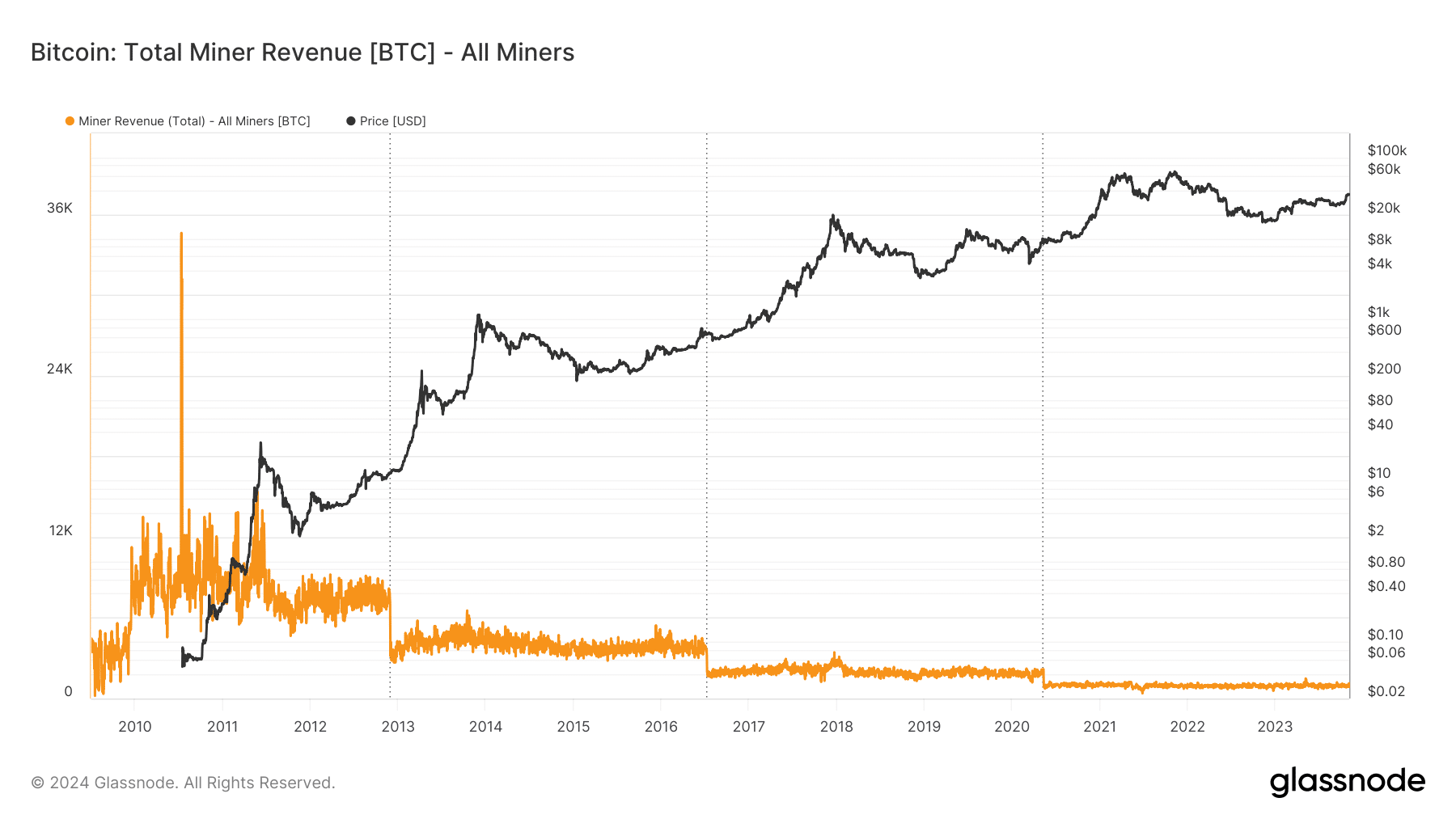

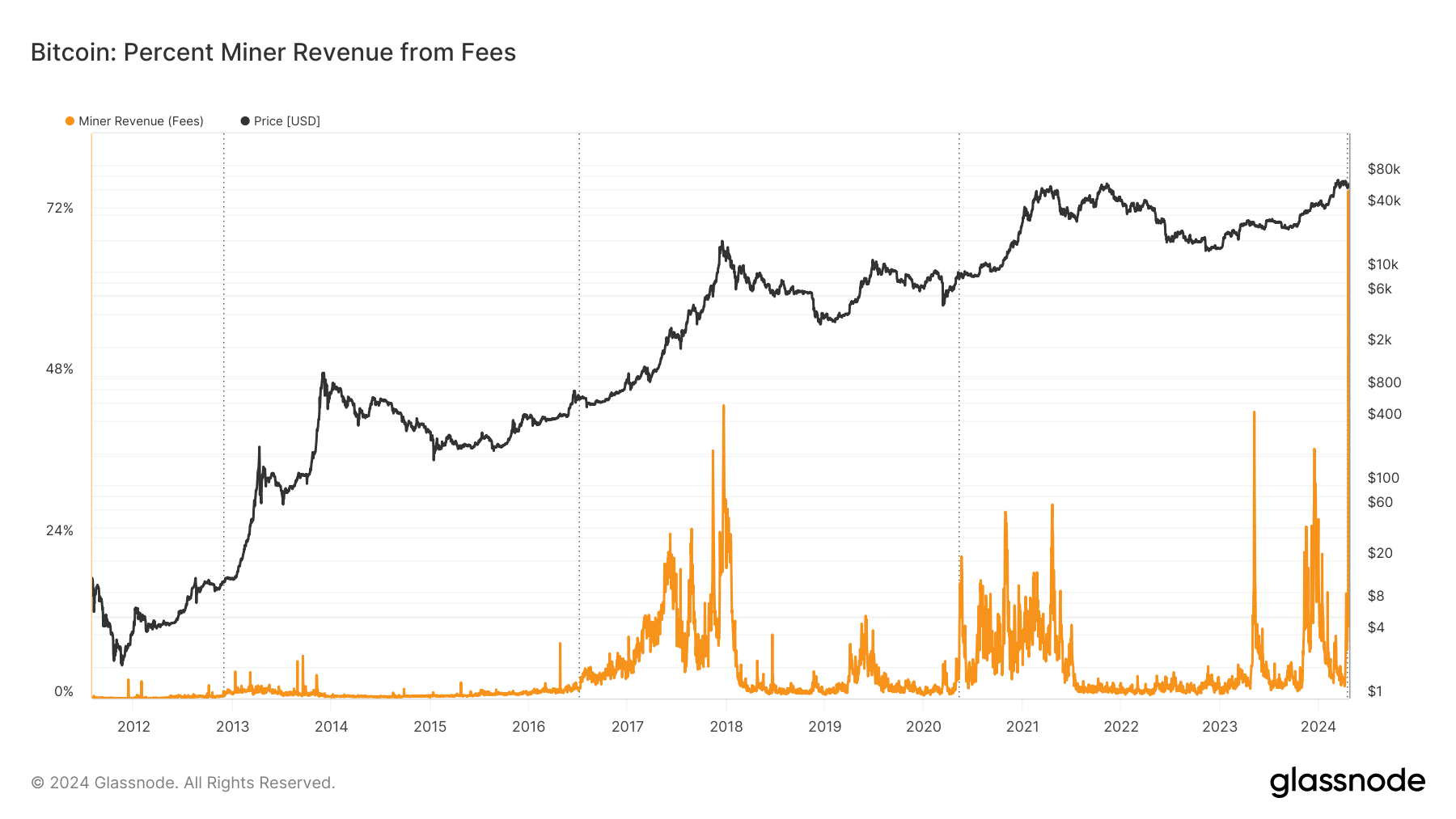

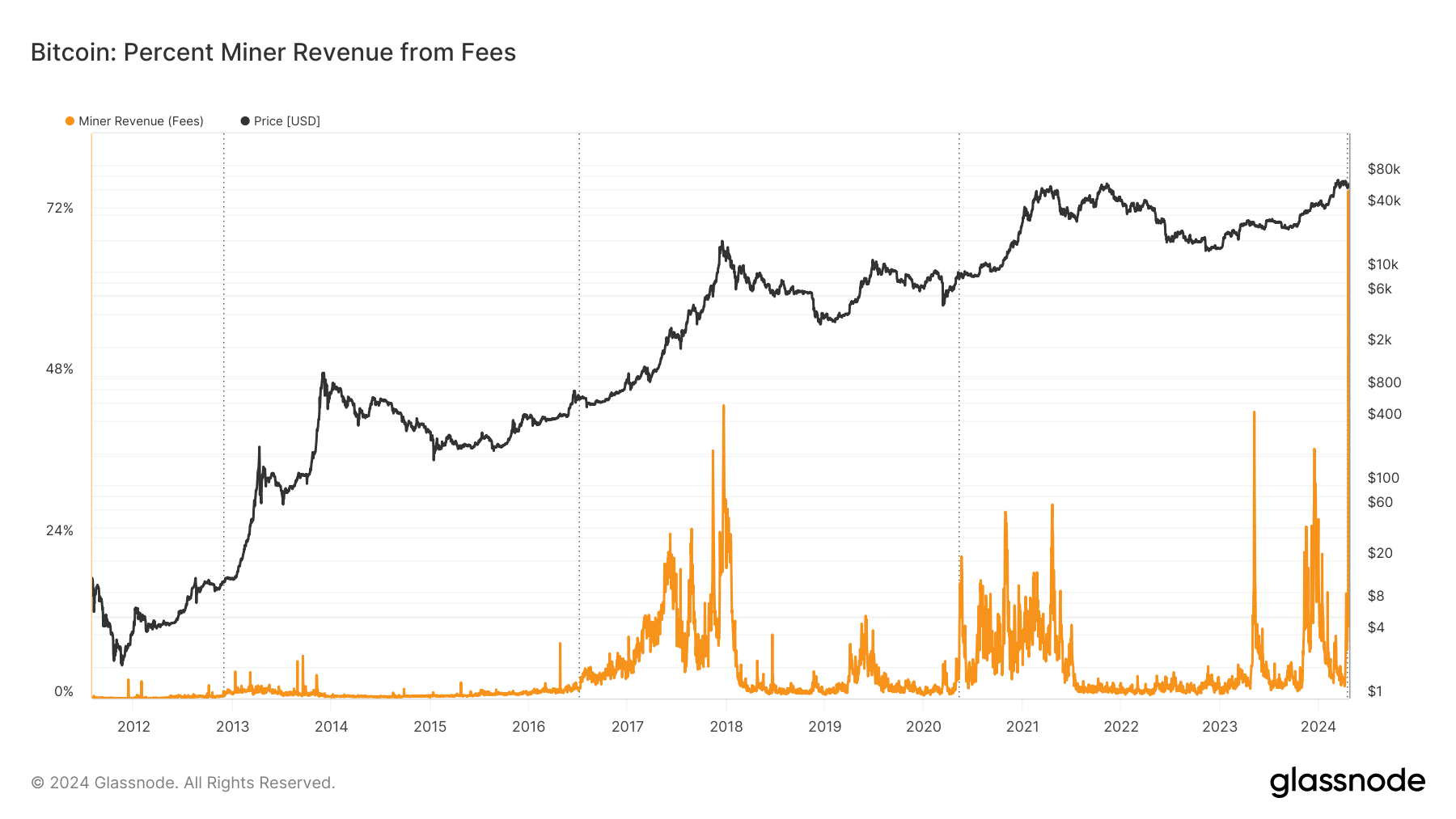

Halvings attack the vital component of their revenue – block rewards. Each of the four such events in Bitcoin’s short history have slashed rewards by half, with the latest one reducing it from 6.25 BTC to 3.125 BTC. The progressive drop was examined by AMBCrypto using Glassnode’s data.

Source: Glassnode

Similarly, rewards would drop to 1.5625 coins per block after next halving, and once all the Bitcoins have been mined, estimated to be around 2140, miners will earn income only from transaction fees.

This meant that miners would have to double their mining investments to achieve the same output after halving, in other words to break even.

So where does the solution lie?

The significance of transaction fees

As mentioned earlier, transaction fees paid by users was emerging as a strong revenue stream for miners with each halving. This meant there was a strong case to look for avenues which could increase Bitcoin network utilization and generate more fees for the miners.

In comes innovative token protocols like Ordinals and Runes.

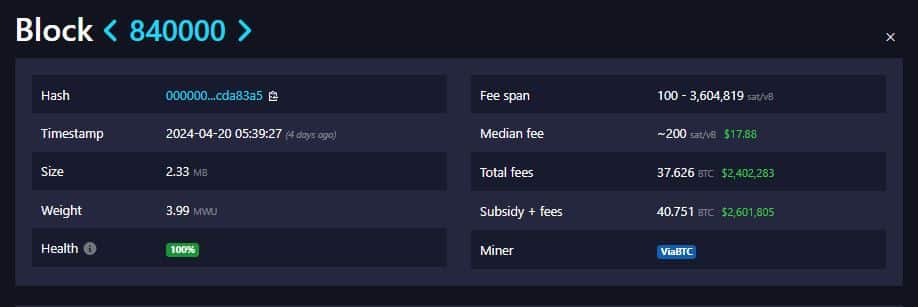

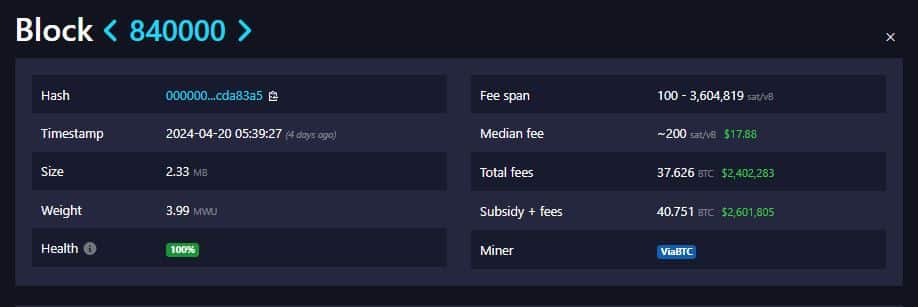

We recently saw Rune protocol going live with the halving block – 840,000. Developed by Casey Rodmarmor who also introduced the Ordinals concept last year, Runes also allows users to mint tokens on the Bitcoin chain.

The results were immediate. The halving block saw a whopping 37.62 BTCs in fees collected by miners, worth nearly $2.4 million at prevailing market prices.

Combined with the slashed block subsidy of 3.12 BTCs, miners earned more than $2.6 million from the block, AMBCrypto spotted using Mempool data.

Source: Mempool

In fact, the percentage of miner revenue derived from fees hit an all-time high (ATH) of 75% on the halving day. Interestingly, the previous spikes in transaction fees was during the Ordinals frenzy in December and May of last year.

Source: Glassnode

The way forward

Though the frenzy has subsided since the halving day, there’s no disputing that protocols like Runes and Ordinals fuel speculative activity to create new coins, particularly among crypto degens.

This has helped in unlocking a new use case for the first generation network. Up until 2023, Bitcoin’s reputation was restricted to being a peer-to-peer (P2P) payments network with not much real-world utility.

However, with Ordinals and Runes, it has started to position itself like other conventional layer-1 blockchains, enabling minting of NFTs and other fungible tokens.

All of this works well in Bitcoin miners’ favor. The more the blockchain is used for the aforementioned activities, the more money they would make, and offset the losses from halvening.

Hash rate continues to increase

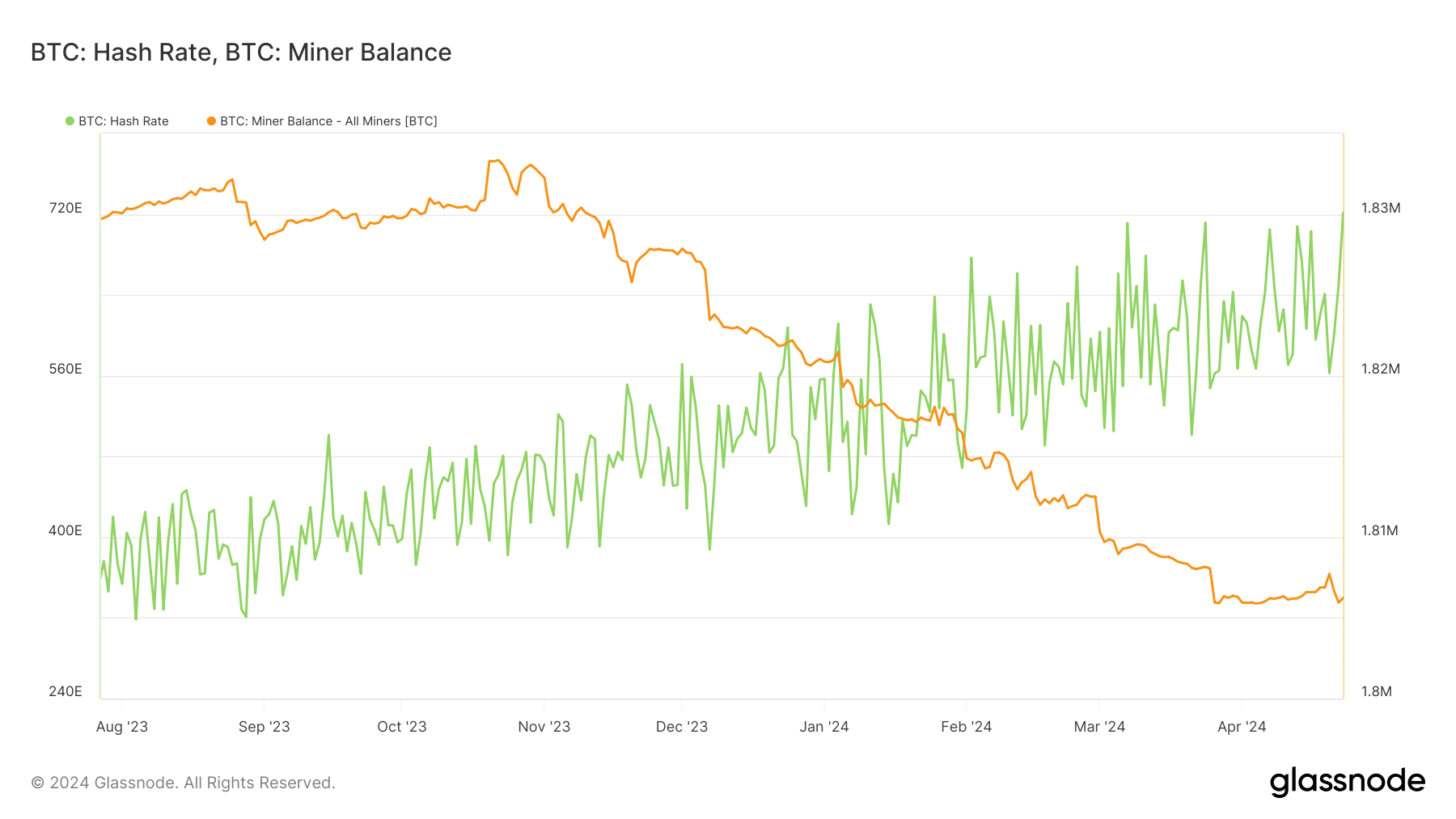

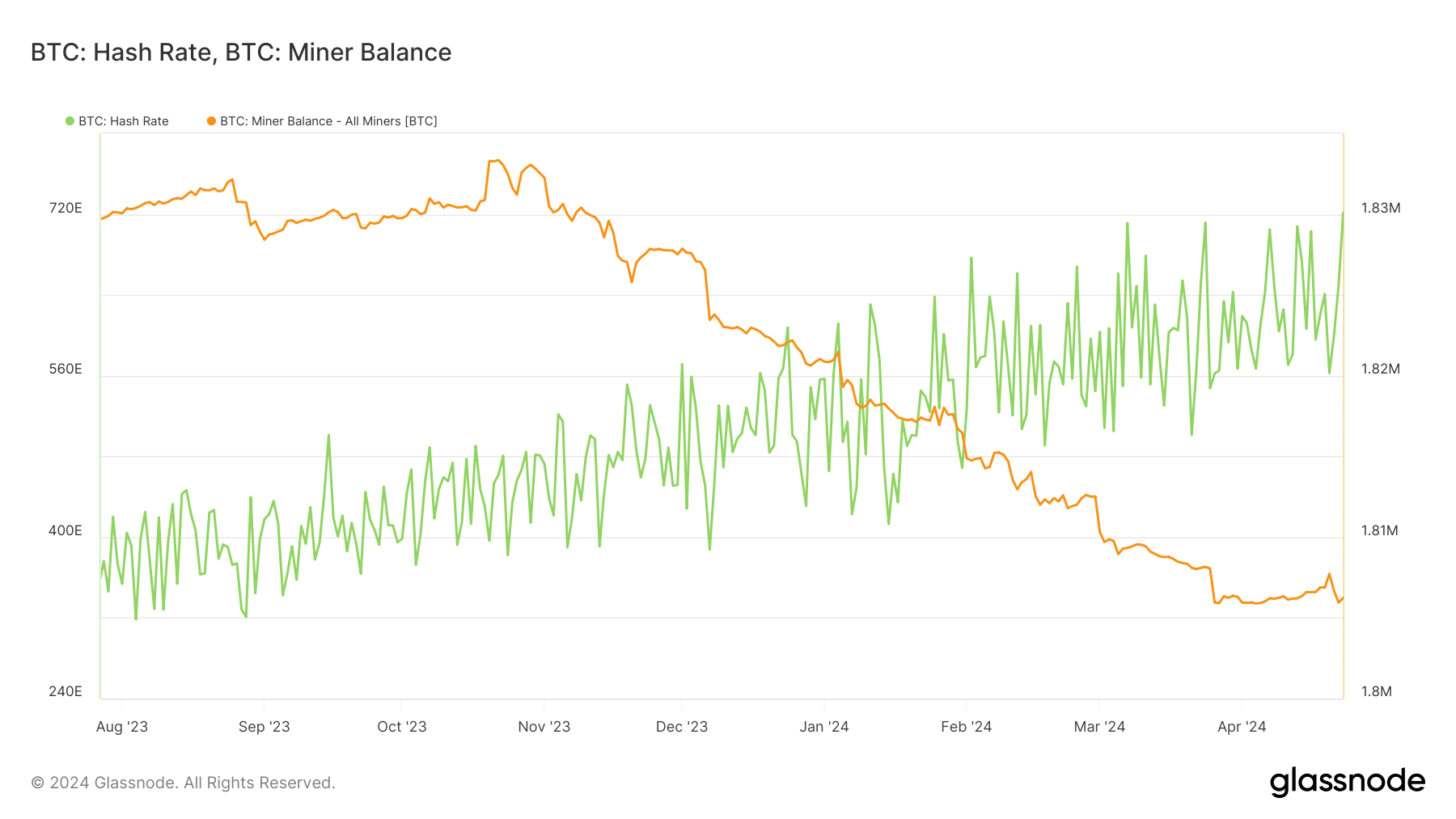

The hash rate, or the computational power dedicated by miners, has been on an ascending curve over the years.

With the prospect of more players entering the industry, and difficulty rising, there was a greater need to look for efficient Bitcoin mining machines that generate more hash rate per unit of electricity consumed.

Source: Glassnode

Is your portfolio green? Check out the BTC Profit Calculator

Interestingly, after HODLing for more than a month, miners immediately offloaded their bags on the halving day. This increased earnings due to the fee spike might have motivated them to sell off.

The proceeds from these sales would be likely used to make investments in more cost-effective equipments.

Leave a Reply