- MANA and AXS shared similar price trajectories over the last few weeks

- Investigation of other metrics revealed who the crowds favoured more

A recent Santiment post on X (formerly Twitter) highlighted the vast gulf between Decentraland [MANA] and Axie Infinity [AXS] in terms of development activity. This is worth looking at because these two were among the most popular tokens in 2020 in the virtual reality and gaming sector.

The development activity behind MANA far outpaced that of Axie Infinity. In fact, according to Santiment, the 30-day Dev activity for Decentraland was at 168.33, compared to a paltry 19 for Axie Infinity. Ergo, AMBCrypto decided to dig deeper and investigate if the latter has been lagging in other metrics as well.

Development activity lead for MANA isn’t something new

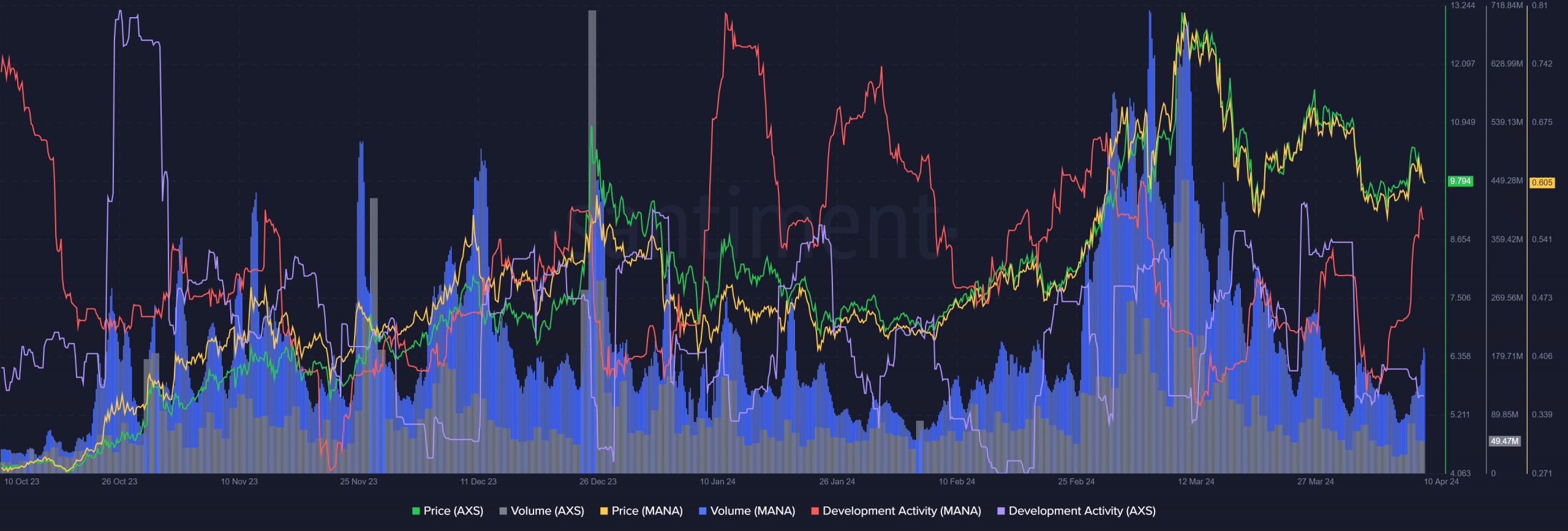

The price action for both tokens has been pretty similar in recent months. Especially since late February as both have walked hand in hand on the charts. Hence, it can be argued that the same market factors moved both tokens’ prices.

And yet, the trading volume was vastly different too. MANA has consistently had a higher trading volume than AXS. Similarly, the development activity lead of MANA is not pertinent solely to the past month.

In fact, Santiment data revealed that the dev activity of MANA has been higher than AXS since mid-December. This difference was particularly noteworthy back in late January.

Investor sentiment also in favor of Decentraland

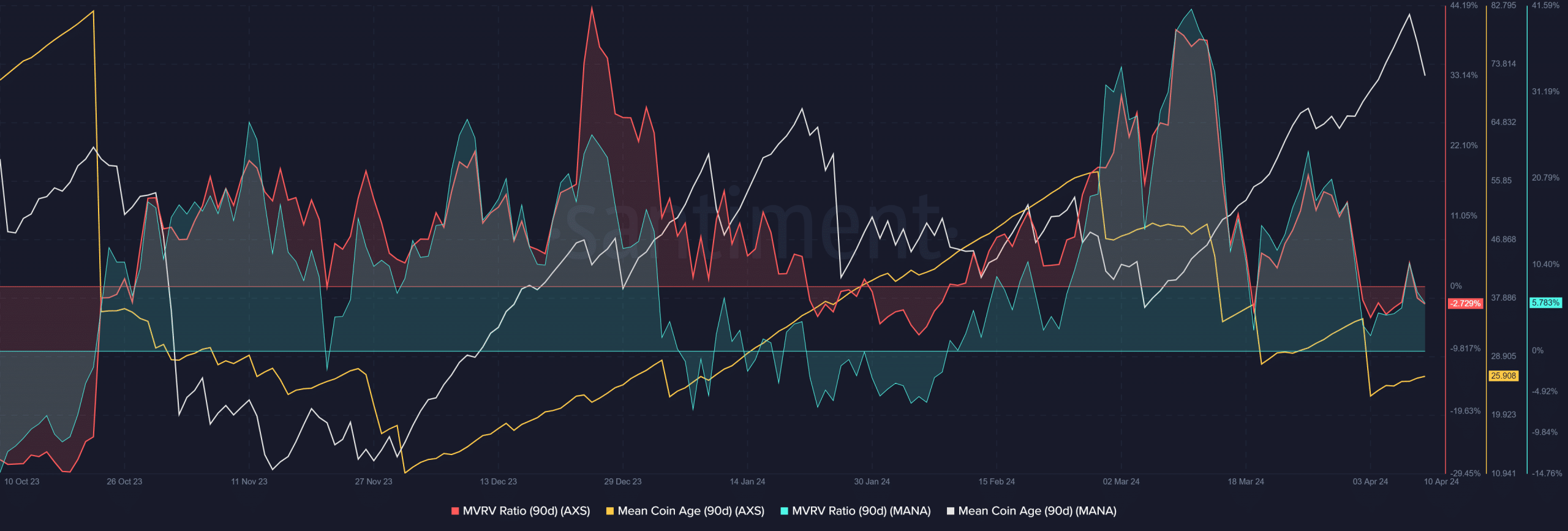

A higher development activity means that the project is shipping more features, issue resolution, and is less likely to be a scam. It buoys investor confidence greatly. The belief in MANA was underlined by its 90-day mean coin age too. This metric has trended upwards for the token since late November.

Meanwhile, AXS’s mean coin age has been falling since early March. The MVRV ratio for AXS also implied a slightly undervalued asset.

Is your portfolio green? Check the Decentraland Profit Calculator

Finally, MANA holders were accruing a small profit at press time, in contrary to AXS holders.

While their price actions were so similar, on-chain metrics highlighted a key difference in how users viewed both projects. Simply put, MANA and Decentraland have the advantage over AXS right now.

Leave a Reply