- BTC’s supply absorption by spot ETFs has turned negative.

- This suggested a temporary decline in interest in BTC spot ETFs.

The recent decline in Bitcoin’s [BTC] supply absorption by spot Bitcoin exchange-traded fund (ETF) has indicated a drop in interest in this asset class.

This was noted by pseudonymous CryptoQuant analyst Oinonen_t in a new report.

The BTC spot ETF market witnesses a slight decline

BTC’s supply absorption by BTC ETFs tracks the rate at which newly mined coins are acquired or absorbed by these funds.

This metric is important because increased supply absorption from spot ETFs could potentially lead to upward price pressure on BTC.

Conversely, a decreased demand can signal a potential decline in the leading coin’s value.

Oininen_t found that the coin’s supply absorption recently turned negative and dropped to a low of -0.38. Confirming the position above, the analyst opined,

“Despite the hype around upcoming halving in 21 days, bitcoin’s spot price hasn’t moved dramatically within the past 30 days. One explanation for the stagnant price action is the negative supply absorption of the ETFs.”

The analyst added that when spot ETFs cannot absorb the newly mined coins,

“The demand for the approximately 900 bitcoins issued daily must come from other sources.”

However, in the current market, the retail investors who usually accumulate these coins have shifted their attention towards meme coins.

In the past few weeks, the values of some Solana [SOL]-based meme coins have grown by triple-digits, leading to a significant uptick in the meme coin market capitalization.

Read Bitcoin’s [BTC] Price Prediction 2024-25

According to Oininen_t,

“Although retail investors have shown growing interest towards bitcoin, their focus might be on the new Solana-based tokens and “meme coins.”

Concluding that the negative supply absorption is a temporary drawback in the spot ETF market, the analyst said,

“The bigger picture still looks promising. In a multi-year scenario, I see bitcoin trying to reach market capitalization parity with gold, which would mean a 1000 percent upside to the current spot price.”

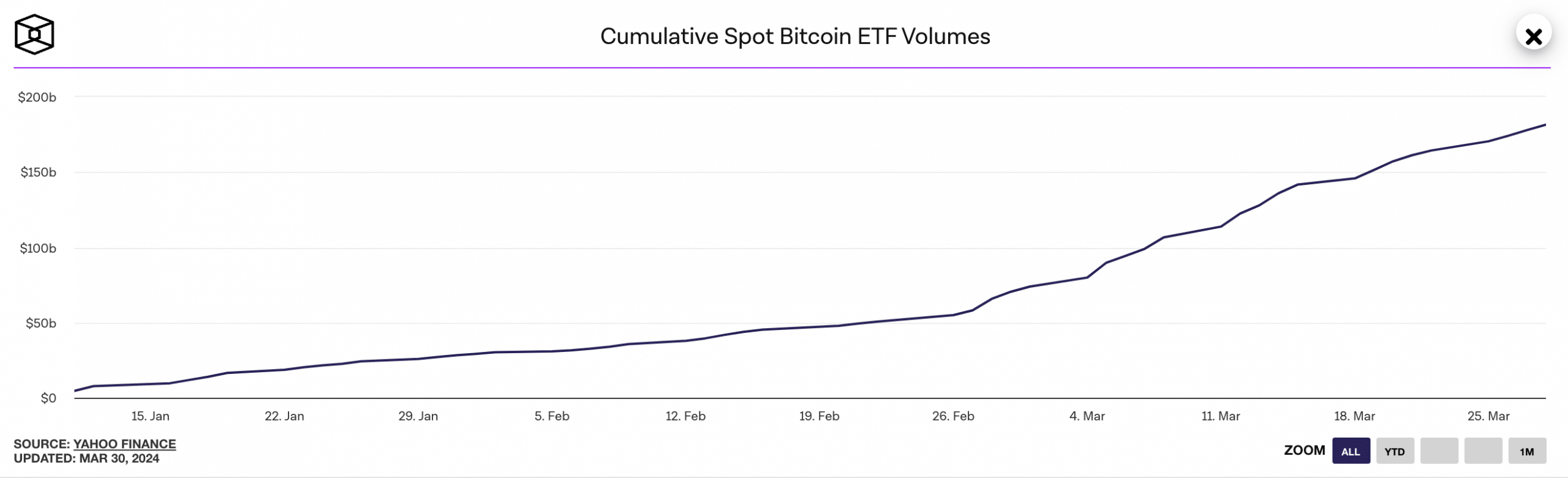

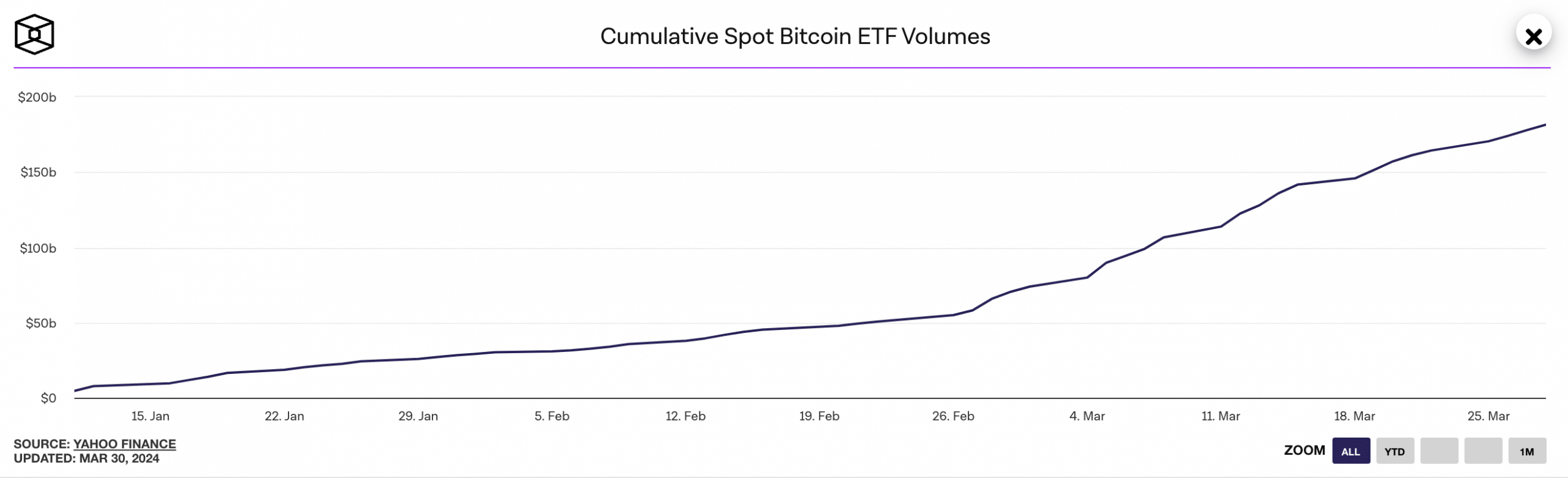

Since its launch, the volume of Bitcoin spot ETFs have grown significantly. Sitting at $182 billion at press time, the daily cumulative volume for this asset category has climbed by over 3500%.

Source: The Block

With an asset under management (AUM) value of $24 billion, the Grayscale Bitcoin Trust (GBTC) currently holds the largest market share in the BTC spot ETF market.

Leave a Reply