Michael Saylor’s MicroStrategy has made its largest Bitcoin purchase to date, acquiring 51,780 BTC for $4.6 billion at an average purchase price of $88,627 per coin, according to a November 18 report submit with the US Securities and Exchange Commission (SEC).

The move comes just a week after the company bought 27,200 BTC for $2.03 billion. Combined, the transactions bring the company’s total Bitcoin purchases for November to nearly 80,000 BTC, worth more than $6.6 billion.

These aggressive BTC purchases have increased its total Bitcoin holdings to 3331,200 BTC, which it acquired for $16.5 billion at an average price of $49,875 per coin. At current prices, these assets are worth approximately $30 billion.

The company stated that its latest purchase pushed the BTC return to 41.8% according to the year-to-date measure. Bitcoin return is a key performance indicator that the company uses to measure how its BTC investment strategy impacts its shareholders.

However, despite the size of this acquisition, MicroStrategy’s stock price saw minimal movement. Pre-market trading data from Google Finance shows a slight increase of 0.23%.

MicroStrategy vs Bitcoin ETFs

Meanwhile, the latest Bitcoin purchase means MicroStrategy has bought more of the top cryptocurrencies this month than all the Bitcoin funds traded on the US spot market.

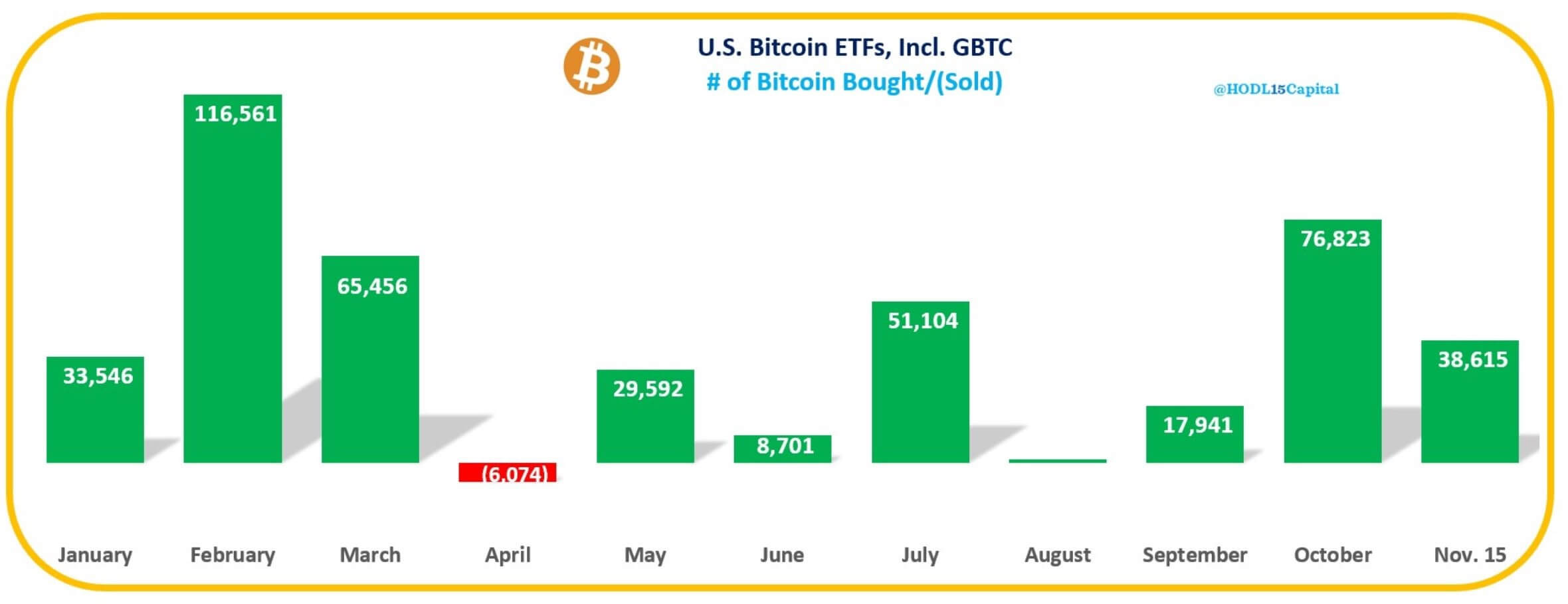

Facts A compilation from HODL15Capital shows that these high-flying BTC-related financial instruments acquired 38,615 BTC on November 15. BlackRock’s IBIT led the acquisitions during this period, purchasing over 37,000 BTC.

Not surprisingly, MicroStrategy’s BTC purchasing strategy has attracted significant market attention for changing the software company’s financial structure and positioning it as a prominent advocate for digital asset adoption.

Market observers have pointed out that the company’s corporate reserves now exceed all but fourteen S&P 500 companies, such as iPhone maker Apple and Google’s parent company Alphabet.

Bitcoin Market Data

At the time of printing 12:28 UTC on November 19, 2024Bitcoin is number 1 in terms of market capitalization and so is its price upwards 0.96% in the last 24 hours. Bitcoin has a market capitalization of $1.79 trillion with a 24-hour trading volume of $75.75 billion. Learn more about Bitcoin ›

Summary of the crypto market

At the time of printing 12:28 UTC on November 19, 2024the total crypto market is valued at € $3.07 trillion with a 24 hour volume of $199.59 billion. Bitcoin’s dominance currently stands at 58.51%. Learn more about the crypto market ›

Leave a Reply