Last week, digital asset investment products saw inflows of $2.2 billion, reflecting a broader uptrend in the market driven by Donald Trump’s recent victory in the just-concluded US presidential election.

In the first half of the week, inflows peaked at $3 billion, bringing total assets under management (AUM) to a record high of $138 billion. However, Bitcoin’s record price performance during the period saw outflows of approximately $866 million, resulting in net inflows of $2.2 billion.

According to Coin sharesThese inflows pushed totals since September’s rate cut to $11.7 billion, bringing the year-to-date total to $33.5 billion.

James Butterfill, head of research at CoinShares, explained that:

“This recent uptick in activity appears to be driven by a combination of looser monetary policy and the Republican Party’s cleanliness in the recent US elections.”

US-Bitcoin ETFs Continue to Dominate

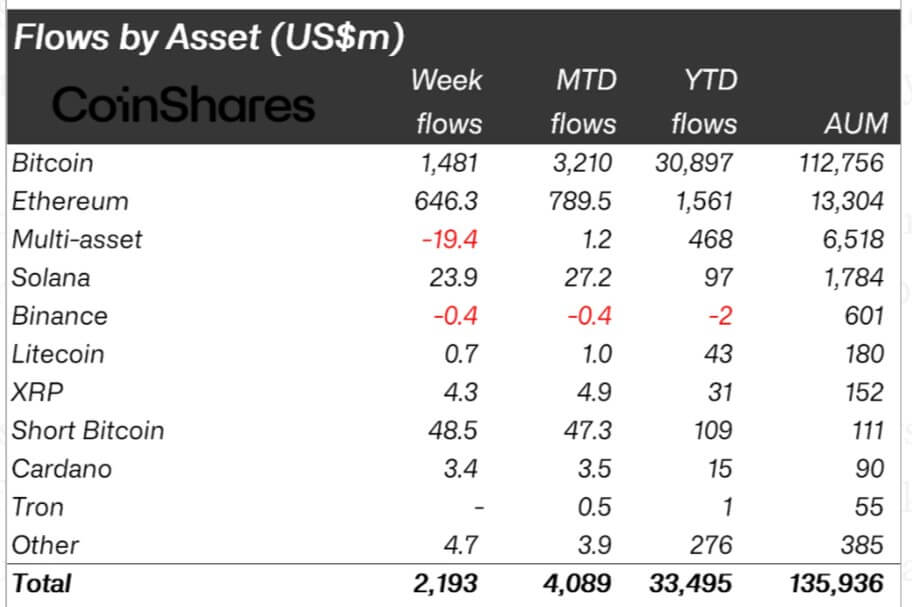

Bitcoin’s dominance remained strong, with inflows reaching $1.48 billion. The substantial flows can be linked to the impressive performance of US-based spot exchange-traded fund (ETF) products, which continue to attract significant attention from retail and institutional traders.

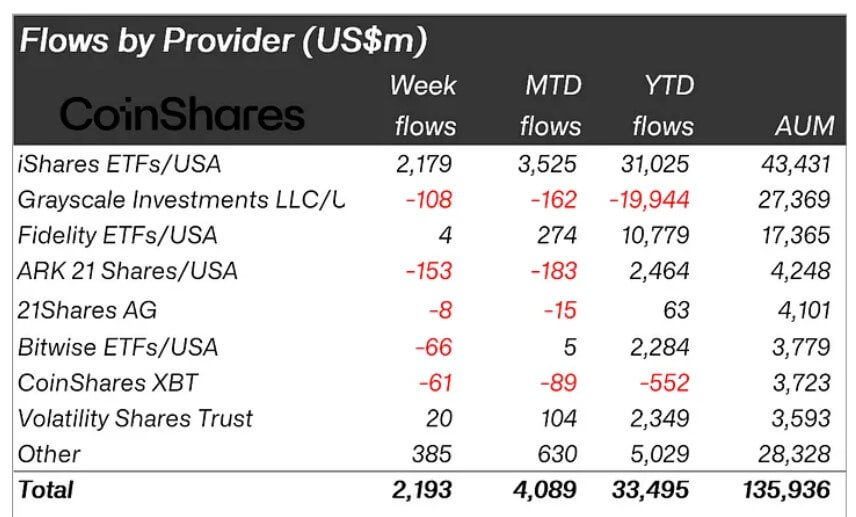

According to data from CoinShares, BlackRock’s IBIT and Fidelity’s FBTC saw inflows of $2.1 billion and $4 million, respectively. On the other hand, the Ark 21 Shares fund’s $153 million outflow surpassed Grayscale’s, which stood at $108 million this week.

Meanwhile, Bitcoin’s record-breaking price performance above $90,000 has attracted bearish traders, who invested $49 million in short Bitcoin products.

Furthermore, bullish market sentiment seemed to influence interest in Ethereum, which also attracted significant inflows of $646 million (equivalent to 5% of assets under management). Butterfill linked this influx to election results and a proposed upgrade to the Beam Chain network.

Other assets, including Solana, XRP and Cardano, saw more modest inflows of $24 million, $4.3 million and $3.4 million, respectively.

Leave a Reply