Some in the Bitcoin space claim to only be in it for the tech, maintaining that bitcoin’s price doesn’t matter much to them.

Whether they’re just posturing or whether they really mean it, they’re overlooking a major factor that keeps the Bitcoin network secure and healthy — the price of bitcoin.

Lyn Alden did an exemplary job describing why bitcoin’s price matters in the follow post:

Because money is a network good.

Liquidity feeds more liquidity. And eventually broad enough liquidity feeds stability, which makes it more usable. Which then feeds more liquidity.

It is similar to why we are here on this platform whether or not we like the recent owner.…

— Lyn Alden (@LynAldenContact) October 24, 2023

Her main points included:

- The more liquid bitcoin becomes, the less volatile and more usable as money it becomes.

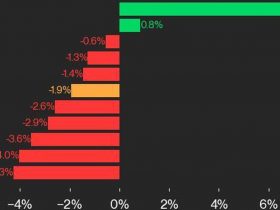

- Price is a market signal: five years of stagnant price action would send a negative signal to the market about bitcoin’s value.

- If bitcoin (a finite asset) was designed as a counter to fiat (an infinite asset), its price should increase as more liquidity is injected into the system (i.e., as more fiat is printed or more debt is created).

I’d like to help further Lyn’s argument by including the following points:

- The security of the Bitcoin network depends in large part on the amount of people or institutions that mine bitcoin. As the block subsidy decreases every four years, bitcoin has to continually increase in price for miners to remain incentivized to mine the asset.

- Bitcoin’s price adds to its legitimacy: the closer bitcoin’s market cap gets to the market cap of gold, the more investors view the assets as comparable.

- An increase in bitcoin’s price incentivizes holders to continue to do things to keep the network healthy, like running nodes, and to defend the network against its detractors. After all, as Jeff Booth says, “We Are Bitcoin,” and its success depends on us.

So, if you were pumped when bitcoin’s price hit a new all-time high this week, good for you.

Even if you weren’t necessarily thinking about the points made above as bitcoin’s price reached new highs, it’s also okay to simply be happy about having greater purchasing power.

Leave a Reply