- Ethereum leads in social dominance and development activity, maintaining a stronger developer presence.

- Both Ethereum and Solana show similar whale interest, while Solana has lower liquidation volumes.

With bullish sentiment from both crowd and smart money indicators, Solana [SOL] shows significant upward momentum, sparking interest in whether it can rival Ethereum [ETH] as a leading platform for decentralized applications (dApps).

At press time, Ethereum trades at $2,680.82, marking a 2.17% increase over the past 24 hours.

Meanwhile, Solana was priced at $178.27, reflecting a 1.43% decline within the same period. Examining key metrics—social dominance, development activity, whale activity, and liquidation data—highlights each network’s distinct position and strengths.

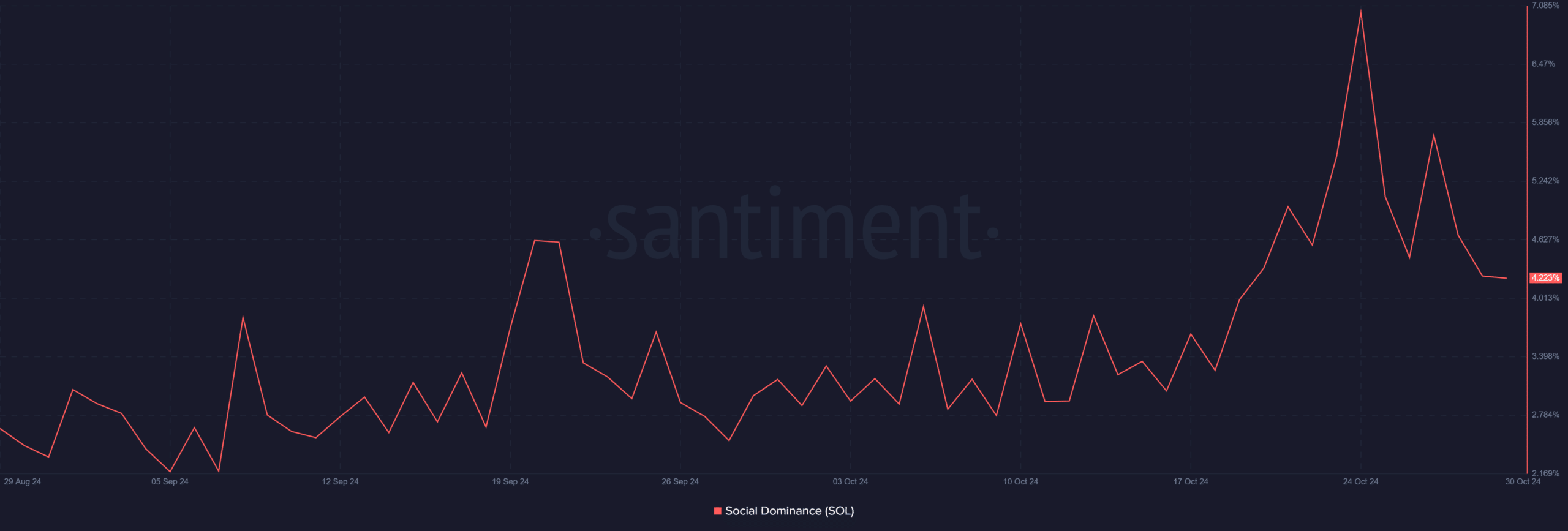

Social dominance: Does Ethereum still lead the conversation?

Ethereum commands higher social dominance than Solana. Over the past month, Ethereum’s social presence consistently peaked above 6%, while Solana’s highest point reached around 4.22%.

This metric measures the share of discussions and mentions on social platforms, reflecting the community’s interest levels.

Consequently, Ethereum dominates online conversations more than Solana. However, Solana’s growing user base indicates upward momentum in its social presence, showing rising attention around the network.

Source: Santiment

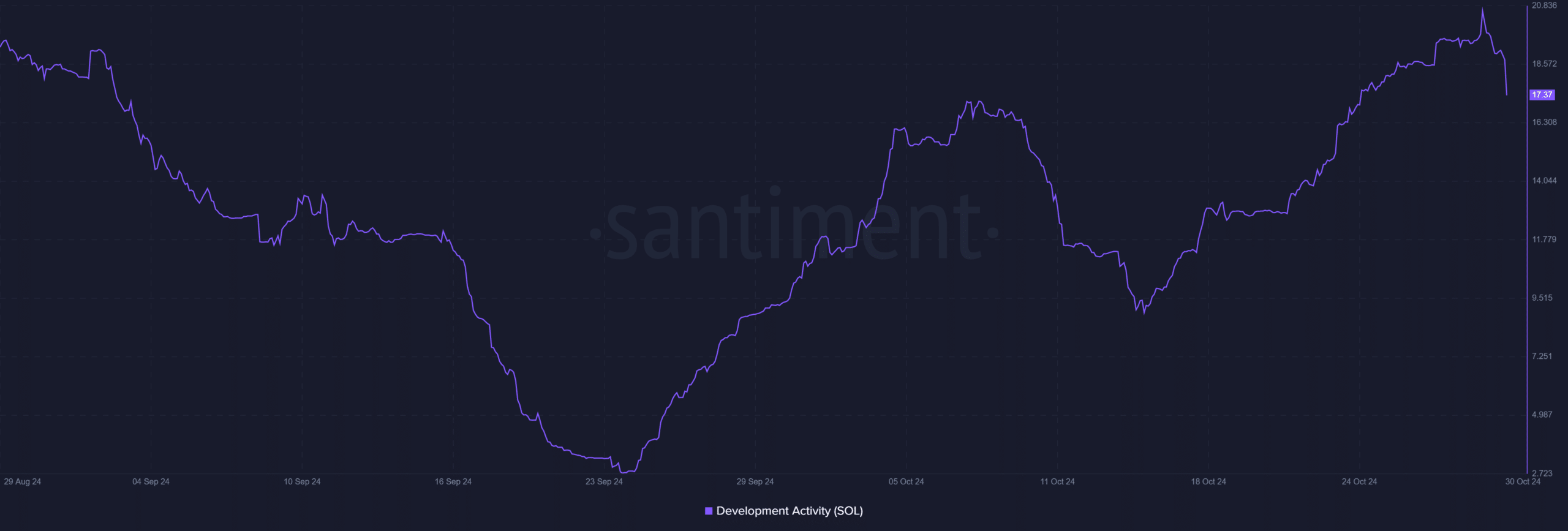

Development activity: Is SOL innovation growing faster?

Ethereum currently leads in development activity, with a score of 25.5 compared to Solana’s 17.37. Development activity reflects code updates, project contributions, and ongoing maintenance, showing the health and growth of each ecosystem.

Therefore, Ethereum benefits from a highly active developer community focused on innovation and improvements.

Additionally, Solana’s development activity shows a positive trend, indicating increasing developer engagement. However, it still trails Ethereum in absolute terms, underscoring Ethereum’s longstanding developer dominance.

Source: Santiment

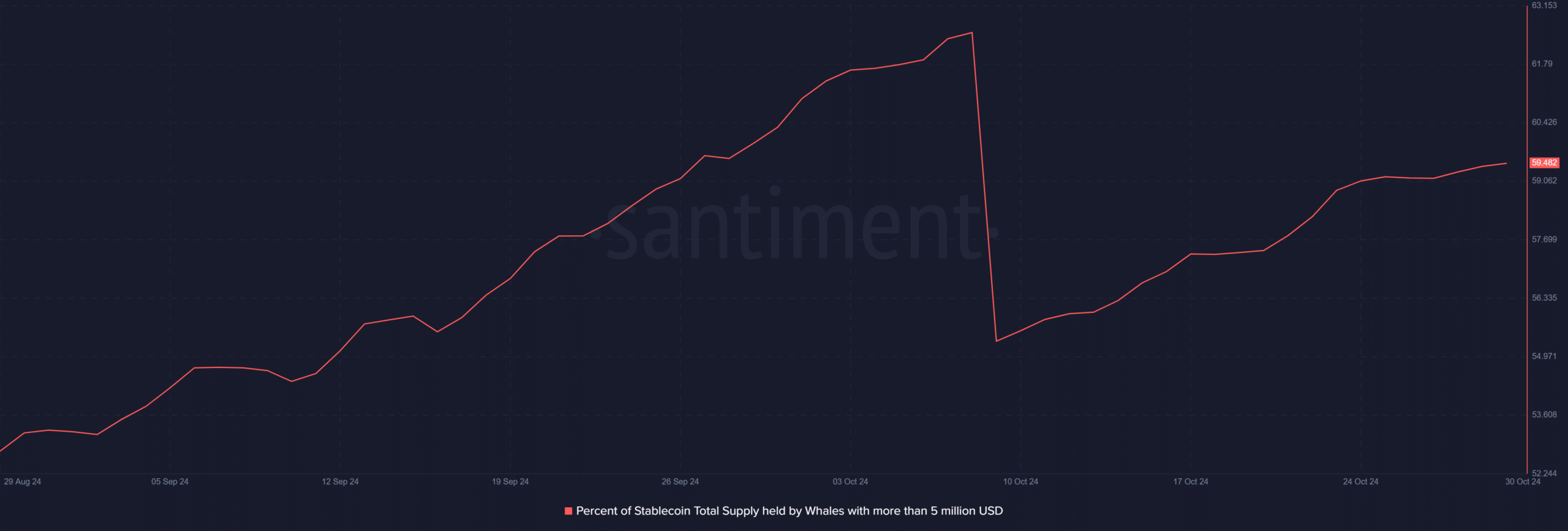

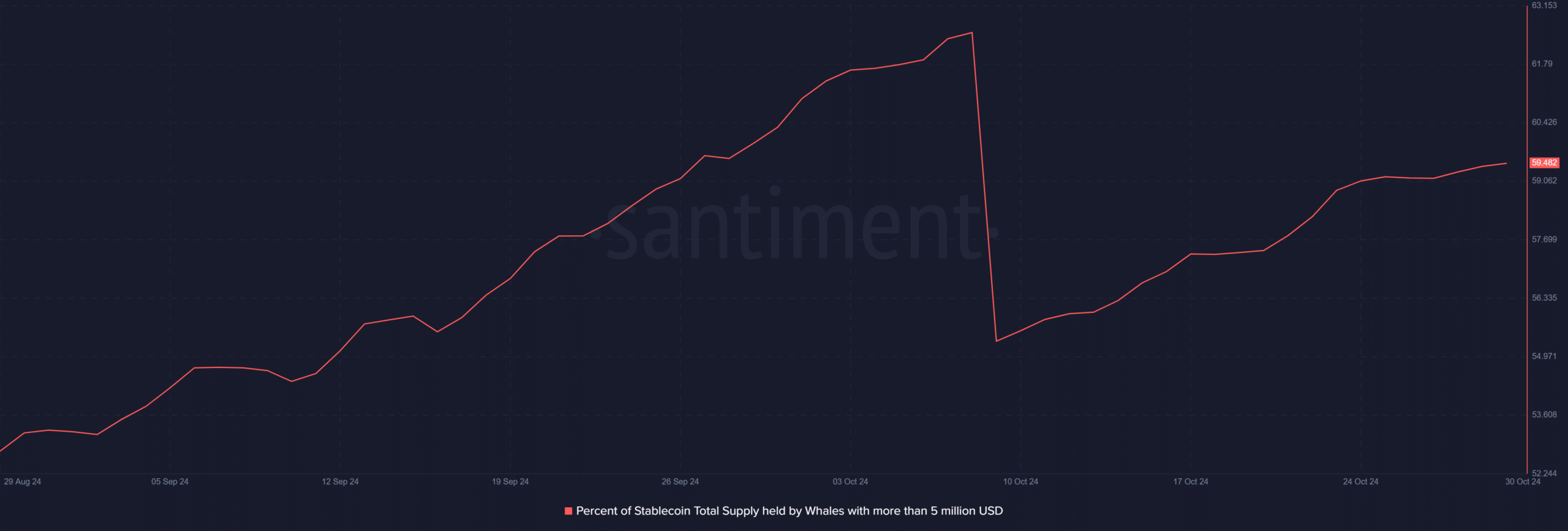

Whale activity: Does SOL attract the bigger investors?

Both Ethereum and Solana show significant whale activity, with each network’s top holders controlling approximately 59.48% of their stablecoin supply.

This high concentration among large holders reflects strong interest from major investors across both ecosystems.

Consequently, whale interest is equally prominent in Ethereum and Solana, suggesting that large-scale investors view both networks as valuable assets within the blockchain landscape.

Source: Santiment

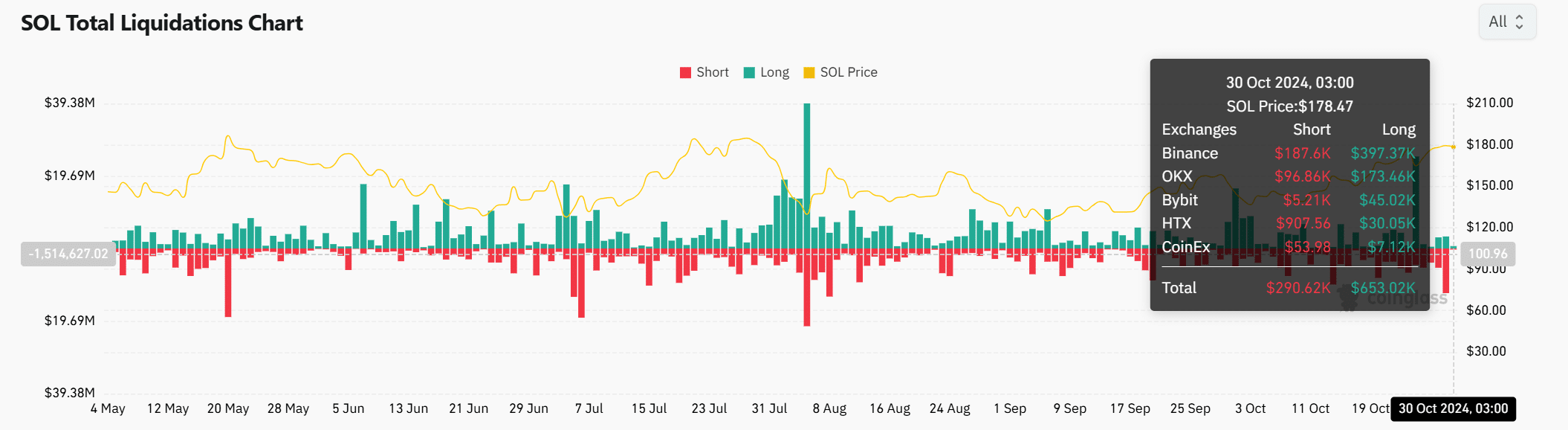

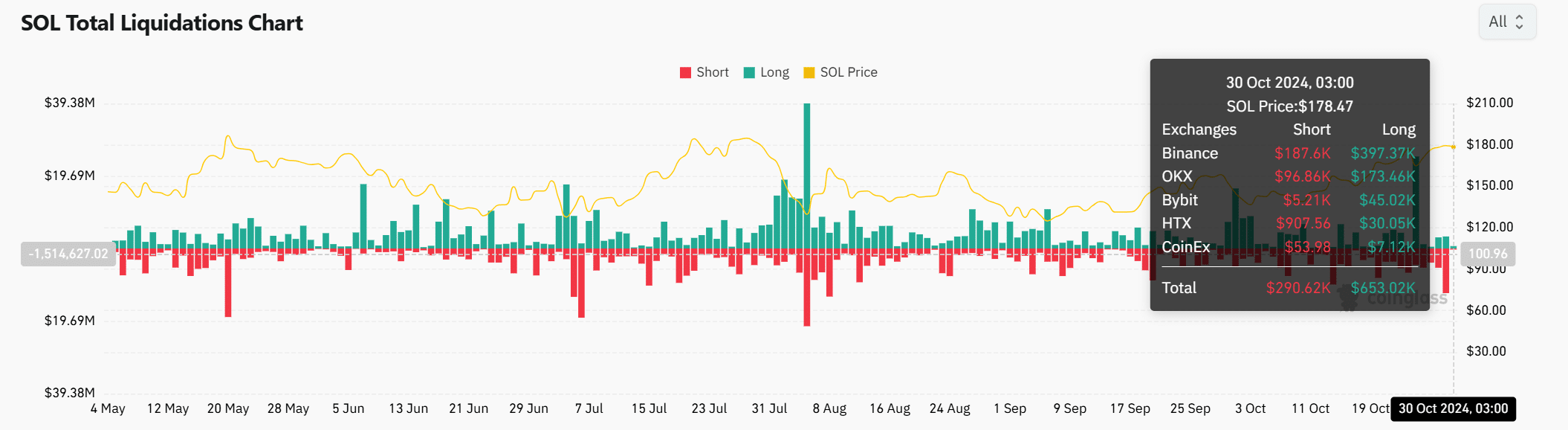

Liquidation data: Which network faces more volatility?

Liquidation data provides insight into leverage-driven activity. Currently, Solana has experienced $653K in long liquidations and $290K in shorts. By comparison, Ethereum saw higher liquidation volumes, with $1.93M in long liquidations and $3.94M in shorts.

Therefore, Ethereum’s higher leveraged trading activity suggests it may encounter more frequent price swings, while Solana’s lower liquidation levels imply comparatively less volatility under certain conditions.

Source: Coinglass

Is your portfolio green? Check out the SOL Profit Calculator

Conclusion

Across social dominance, development activity, whale involvement, and liquidation data, Ethereum maintains an edge in several metrics. However, Solana shows concentrated investment from large holders and increasing developer interest, signaling potential growth.

While Ethereum’s broader user and developer base currently reinforces its dominance, Solana’s upward trajectory makes it a competitive force in the blockchain space.

Leave a Reply