- Dormant Bitcoin whales have awakened, with decade-old addresses reactivating.

- Now, FOMO could spark a push to $73K, but there’s a catch!

A perfect storm of macro factors – ranging from the post-halving surge, the “Uptober” frenzy, the approaching end of the election cycle, and Fed rate cuts – has fueled a parabolic rally, driving Bitcoin [BTC] to $69K in just 10 trading days.

However, unlike previous rallies, the bulls this time have been actively defying bearish pressure, with daily lows barely exceeding 1%.

While this rapid ascent could spark fear among traders, leading them to lock in gains and exit positions, the market now needs a key catalyst – likely the conviction of whales – to view the current price as a prime entry point.

A long-dormant Bitcoin whale resurfaces

A post on X (formerly Twitter) revealed that a dormant Bitcoin wallet, inactive for over a decade, was recently reactivated. This wallet contains 25 BTC, valued at around $1.7 million.

It’s important to look at the timeline of this movement. The reactivated wallet has held its 25 BTC since 2013, when Bitcoin’s price ranged from $100 to $266.

With Bitcoin’s recent meteoric rise, the owner of this wallet now possesses a valuable asset. Notably, this marks the second time in just two days that an old whale has resurfaced.

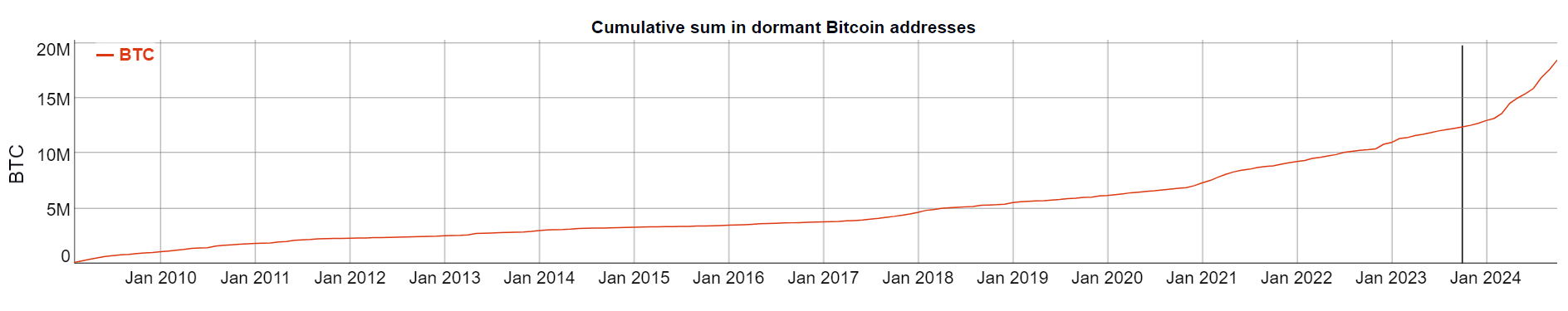

Source : BitInfoCharts

Over the past decade, the amount of BTC stored in dormant wallets has reached an ATH of 19 million BTC. At a price of $69K, this translates to approximately $1.311 trillion.

A rising sum in dormant wallets usually signals a bullish trend, showing that holders choose to wait for potential price appreciation rather than cashing out. However, it also means there’s a large supply of Bitcoin that could flood the market if these dormant holders decide to sell.

With these wallets becoming active again, it’s crucial to monitor their activity. If the owners view the current price as a chance to cash in, it could draw in more buyers and spark FOMO in the market. On the flip side, if they think there’s little room for growth, we might see a significant pullback.

Trust from big players is vital

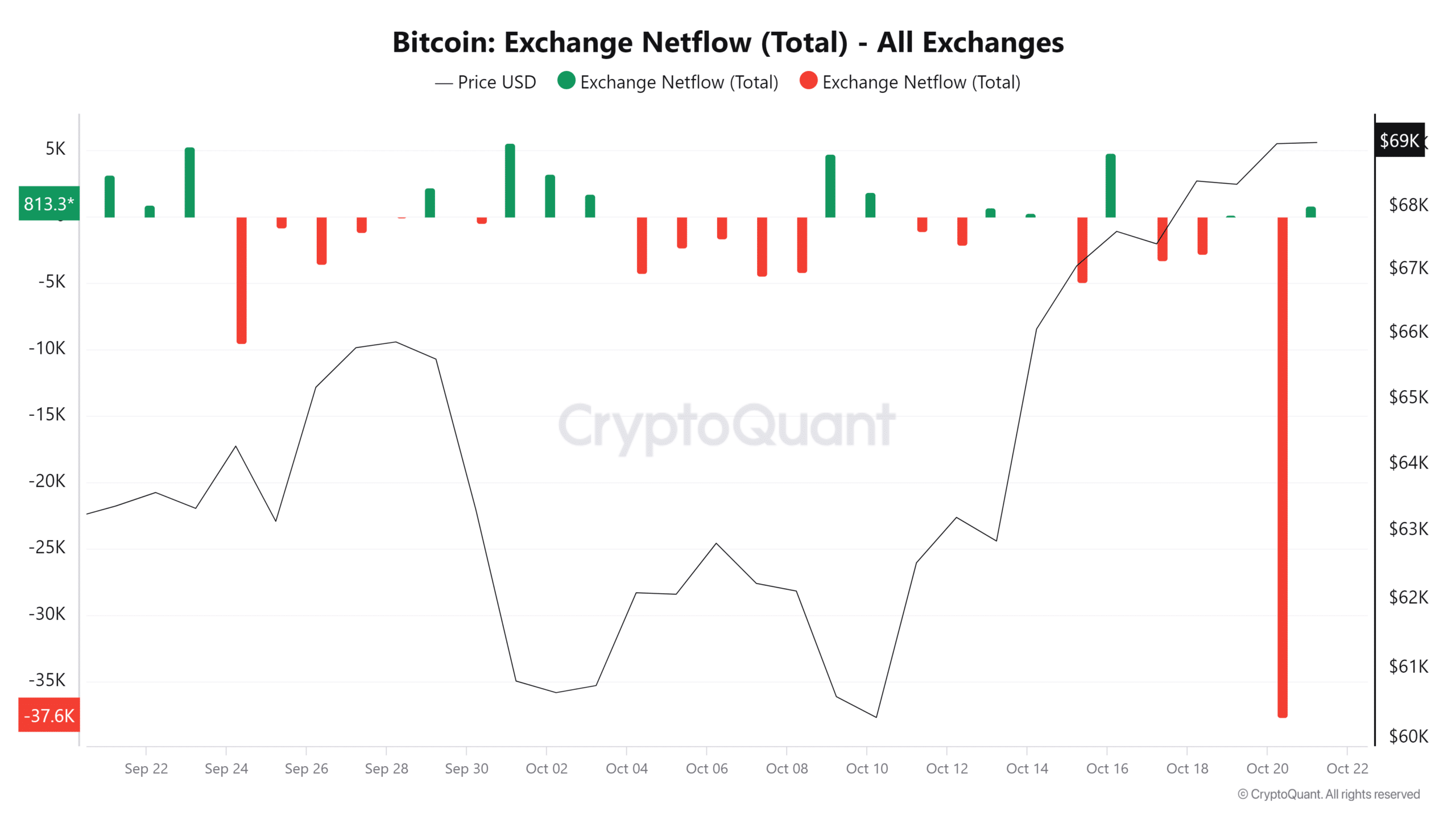

Interestingly, AMBCrypto has uncovered a compelling pattern that could signal rising volatility in the market.

Just a day ago, a massive long red candle appeared on the chart below, showing that nearly 38,000 BTC moved into exchanges. This influx led to a noticeable spike in exchange reserves.

Source : CryptoQuant

However, despite this aggressive sell-off, Bitcoin’s price action remained relatively stable, closing above $69K – a level it hadn’t reached in four months.

This anomaly can likely be attributed to whale intervention, which absorbed much of the selling pressure. In fact, this isn’t just speculation; it’s backed by real data. As shown in the chart, nearly 40,000 BTC were purchased by large holders on the same day.

Is your portfolio green? Check out the BTC Profit Calculator

Overall, whales play a critical role in this cycle. Their support is essential to prevent the market from overheating, which could otherwise signal a potential top and trigger mass capitulation.

However, if their confidence wavers, a retracement could be imminent.

Leave a Reply