- Cardano sees surge in social activity, but could this be a precursor to a major price move?

- ADA’s wedge pattern, and assessing the current state of demand.

Cardano [ADA] was one of the top trending blockchain network in the last 24 hours. A potential reason for this could be a reaction to recent comments by its founder Charles Hoskinson, who stated that it Cardano will flip Bitcoin.

Hoskinson’s bold statement may build on the social traction that Cardano was already enjoying since the start of October. According to Messari, Cardano’s followers on X dropped considerably from March to September. However, it is currently enjoying its largest recovery so far.

The network’s number of followers on X peaked above 836,000 in March. It then dropped over the consequent months and recently bottomed out just below 822,000 followers at the end of September. This means it lost over 14,000 followers.

Cardano had 823,870 followers at press time, which means it added over 2,000 new followers since the start of the month. This indicates renewed interest in the project as there is historical correlation between the followers and price.

It could further cement the idea that Cardano’s ADA may enjoy weeks or months of bullish recovery ahead.

Are ADA bulls preparing for a big move?

The surge in the number of users suggests a changing sentiment which may favor ADA bulls.

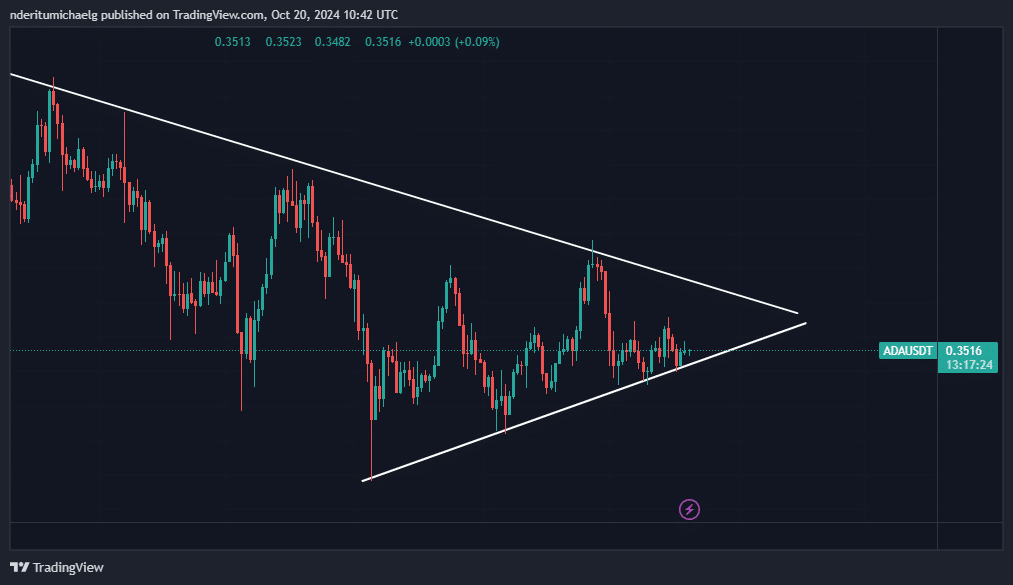

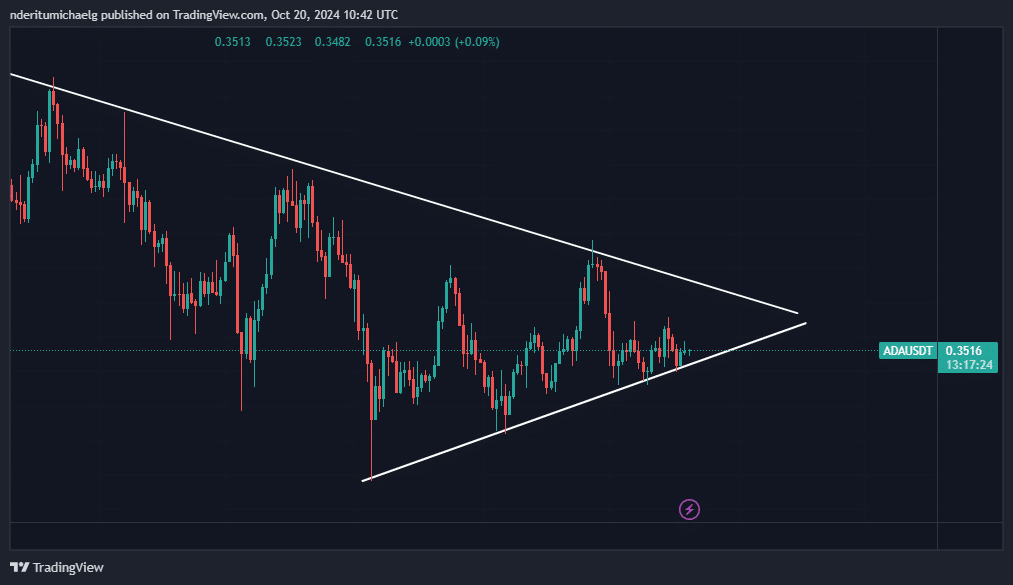

The price action has been stuck in a wedge pattern for the last few months and is currently converging, suggesting that a pattern break is imminent. ADA exchanged hands at $0.351 at press time.

Source: TradingView

ADA retested its support on Friday, 18th October, which suggests that a bullish recovery could be building up momentum.

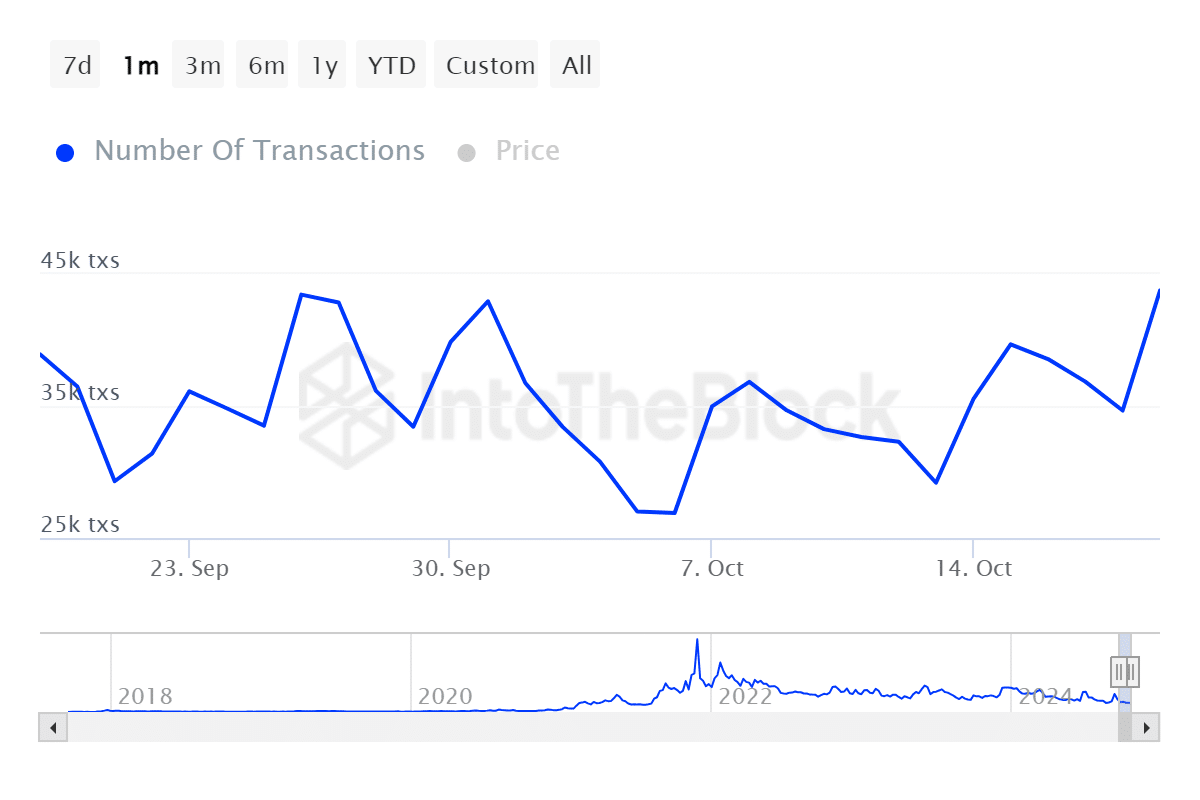

Speaking of momentum, the number of transactions on the Cardano network has been on the rise since the second week of October. The network recorded its lowest transactions this month at 26,900 transactions on 6th October. It had 43,750 transactions on 19th October.

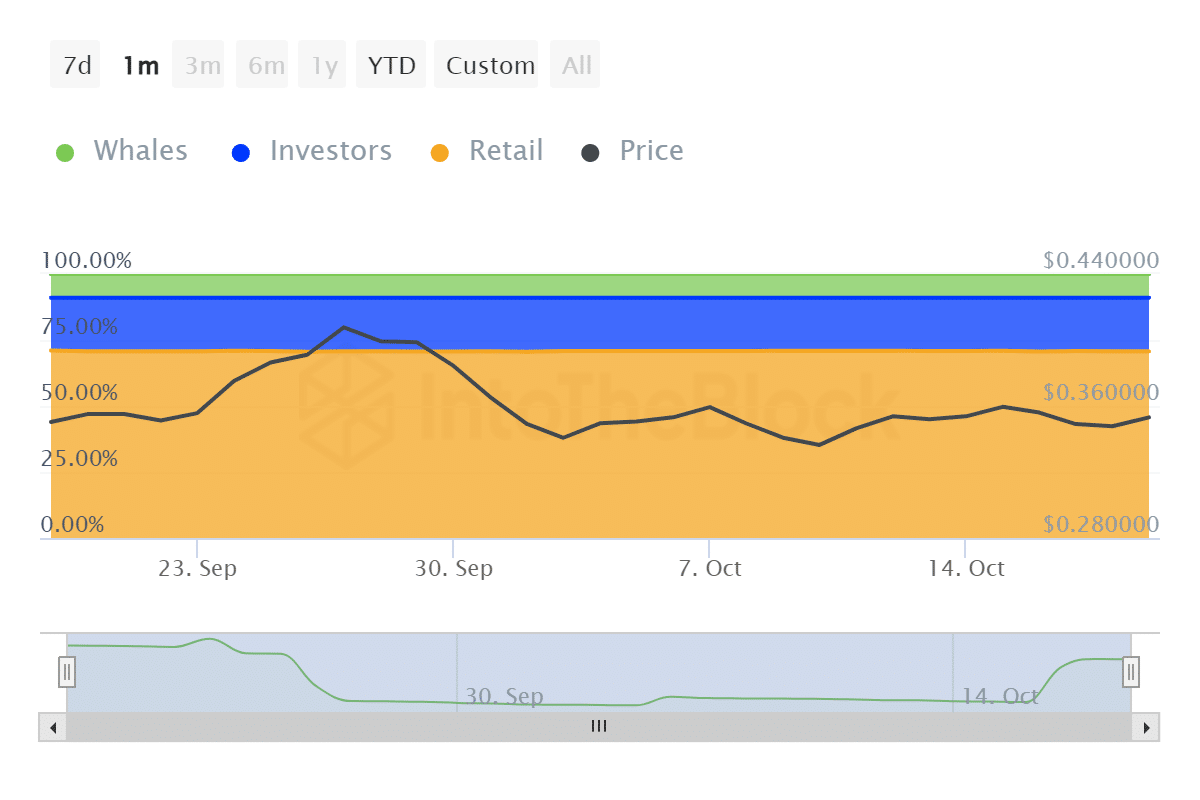

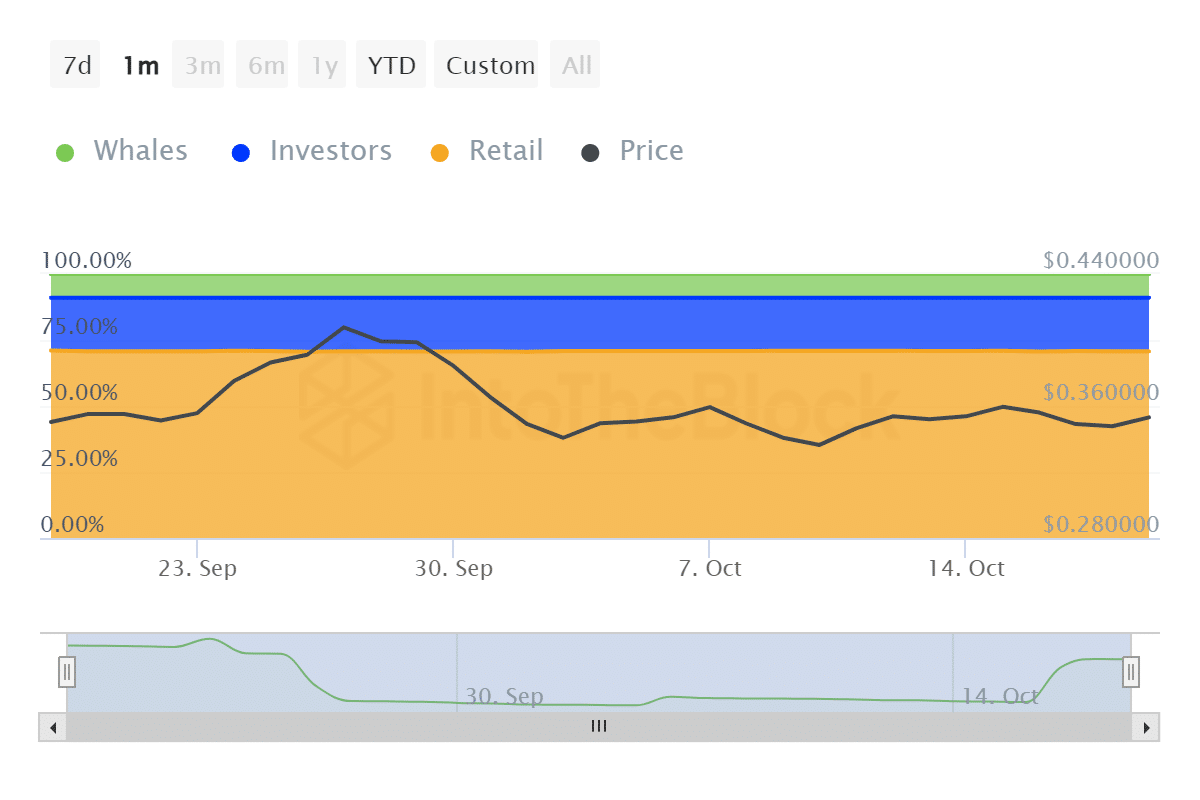

Source: IntoTheBlock

The surge in transaction activity may indicate that demand for ADA in the Cardano ecosystem has been rising. However, it may not necessarily be an indication of a strong demand build-up in the market.

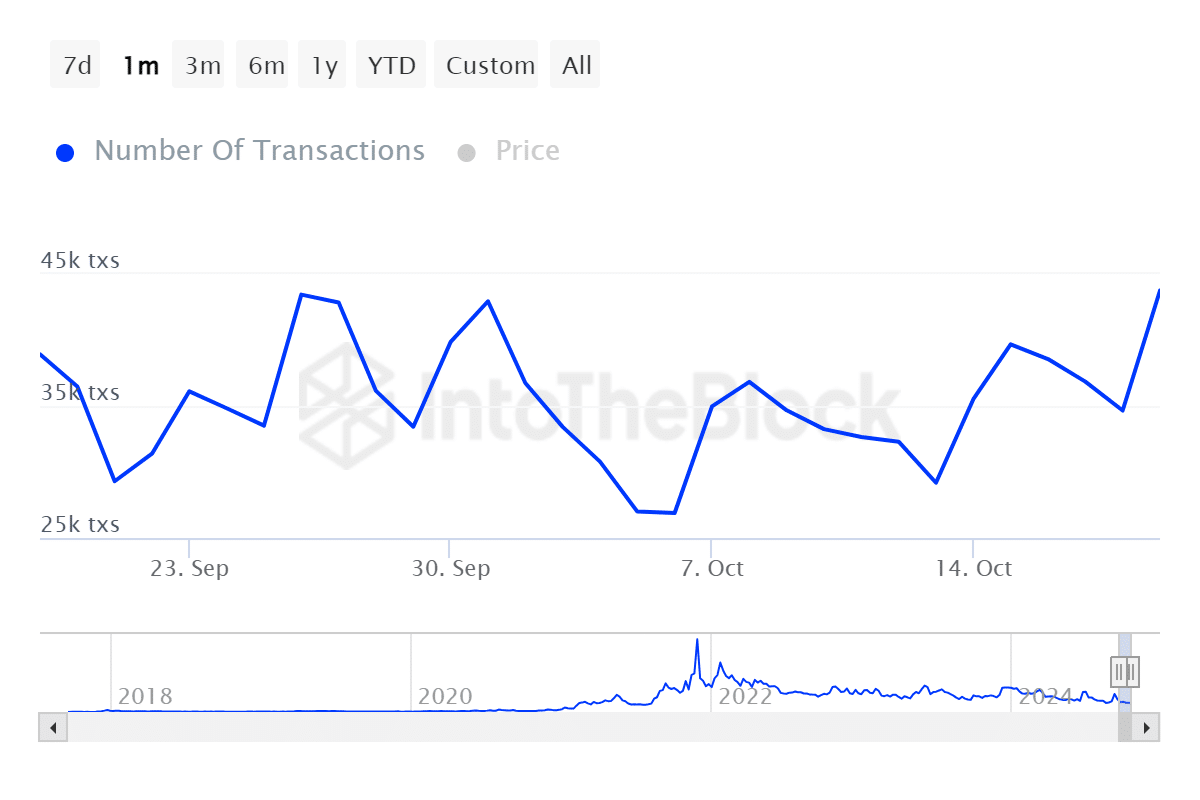

ADA’s historical concentration data reveals that whale held 3.19 billion coins or 8.95% of its supply on 1st October. The same whale category controlled 3.2 billion ADA or 8.98% of its supply.

Source: IntoTheBlock

Read Cardano’s [ADA] Price Prediction 2024–2025

Investor balances dropped from 7.25 billion ADA to 7.24 billion ADA during the same 3 week period. Retail balances were up from 25.18 billion coins to 25.19 billion coins.

Higher demand from whales is a healthy sign but may be lessened by the sell pressure from the investor class. These findings suggest that demand for ADA has been modest so far.

Leave a Reply